Private credit funding for family farms & agriculture across Australia.

The Metrics Real Estate Multi-Strategy Fund (Fund) is a stapled structure consisting of the Metrics Real Estate Multi-Strategy Passive Trust ARSN 679 413 293 (Passive Trust) and the Metrics Real Estate Multi-Strategy Active Trust ARSN 679 413 695 (Active Trust) jointly quoted on the ASX as stapled securities

The 360 Capital Mortgage REIT (ASX:TCF) provides investors access to credit opportunities secured by Australian real estate assets. TCF aims to deliver regular monthly income to investors through disciplined asset selection and risk analysis.

The Fund’s strategy is to provide strong risk adjusted returns by providing loan facilities for property investment & development in major cities with a primary focus on residential & commercial projects throughout Australia -For Wholesale Investors Only

The Qualitas Real Estate Income Fund seeks to provide monthly income and capital preservation by investing in a portfolio of investments that offers exposure to real estate loans secured by first and second mortgages, located in Australia.

Earn up to 11% p.a. through an exposure to Australian first mortgage loans (wholesale investors only)

The objective of the Fund is to provide monthly income through a selection of investments in short-term registered first mortgage loans.

The objective of the Fund is to provide monthly income through a selection of investments in short-to-medium term registered first mortgage loans.

Investors gain immediate exposure to an established and diversified portfolio of high-quality CRED exposures, and the monthly income distributions these generate.

The Fund offers investors the opportunity to invest directly in a range of Registered First Mortgages over predominately residential but also limited non-residential property.

A contributory mortgage fund offering wholesale investors the opportunity to invest directly in selected registered First Mortgages over predominately residential but also limited non-residential property in South East Queensland.

Diversify your portfolio with private credit backed by Australian real estate and generate a regular income stream.

HoldenCAPITAL Partners provides sophisticated investors with the opportunity to invest in standalone, development related, secured mortgage investments. (For Wholesale Investors Only)

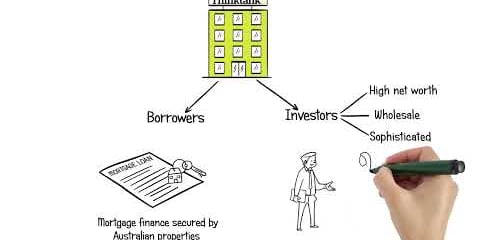

Thinktank Income Trust offers investors first mortgage exposure to domestic, established commercial and residential property (for Wholesale Investors only)

This CFMG First Mortgage & Income Fund product provides our investors with a regular income stream, as the fund will distribute returns on a quarterly basis.