Exploring Global Equity Funds for Australian Investors

Looking to diversify beyond the ASX? Global equity funds offer access to international markets and new opportunities - but not all funds are created equal. This guide helps you cut through the noise and compare the best options.

Table Of Contents

What Are Global Equity Funds?

Global equity funds invest in international companies across regions like the US, Europe, and emerging markets. They’re ideal for investors seeking long-term growth and diversification beyond Australia.

Global equity funds are investment funds that pool investor money to buy shares in companies across multiple countries. Unlike domestic funds that focus on Australian equities, global equity funds spread their holdings across developed and emerging markets.

They are typically categorised by:

- Market capitalisation: Large-cap, mid-cap, small-cap, micro-cap;

- Regions: US, Europe, Asia, Emerging Markets;

- Management style: Active or passive;

- Strategy: Growth, income, long/short equity, index-based.

By including global equity funds in your portfolio, you can gain exposure to world-leading companies like Microsoft, Apple, Nestlé, Samsung, and LVMH, depending on the fund’s focus.

Why Invest in Global Equity Funds?

If you’re looking to diversify beyond the Australian market, global equity funds can play a crucial role in achieving a more balanced and growth-oriented portfolio.

These funds offer a powerful way to diversify your investments across geographies, sectors, and currencies - giving you access to industries and innovations that may not be available locally.

In particular, there are five benefits of investing in global equity funds worth focusing on:

5 Benefits of Investing in Global Equity Funds

Diversification

Investing globally helps local investors reduce overexposure to domestic risks. A downturn in the Australian economy, for example, may not affect markets in the US or Europe to the same extent. Diversified portfolios tend to generate smoother, more consistent long-term returns.

Access to high-growth sectors

Global equities offer exposure to the world’s fast growing companies. In fact, many of the world’s most dynamic companies are listed outside of Australia. Think tech in the US, luxury goods in Europe, and ecommerce in Asia.

Currency exposure

Foreign currency returns can enhance fund returns when managed strategically. Global equity funds offer this potential.

Professionally managed

Global equity funds are professionally managed. They have the scale and insights to research, select, and monitor hundreds of international companies.

Liquidity

Global equity funds are able to access liquid investment opportunities from all around the world, which ensures fund liquidity risk is on the low side.

Bottom line: Global equity funds allow you to participate in global growth stories while reducing the concentration risk of an Australia only portfolio. In the words of global equity manager Magellan:

‘Investing in global equities can provide exposure to some of the world’s best companies, diversification, and the potential for long-term growth.’

What are the Risks with Global Equity Funds?

All investments come with risks, and global equity funds are no exception. While they broaden investors’ exposure, they also introduce specific risks to consider.

Here are the main risks to be aware of:

Market Risk

International markets can be just as volatile as domestic ones, especially during geopolitical tensions or global economic slowdowns. The resulting fluctuations in stock markets worldwide can lead to declines in fund values which are influenced by investor sentiment.

Currency Risk

Since global equity funds invest in assets denominated in various currencies, fluctuations in exchange rates can impact returns positively or negatively. For this reason, some global equity funds are hedged to ensure their returns aren’t impacted by currency movements.

Liquidity Risk

Some international markets may have low trading volumes, making it harder for fund managers to buy or sell their funds’ securities without impacting price.

Country & Region Risk

Economic or political issues in particular countries or regions can disproportionately affect investments in those areas. For example, the risk of investing in U.S. equities rose in response to Trump’s tariff policy.

Economic Risk

Global economic downturns, inflation, or changes in interest rates can negatively impact corporate profits and stock prices worldwide.

Political and Regulatory Risk

Changes in government policies, regulations, or political stability in different countries can affect markets and specific companies within those markets.

A Common Mistake

Thinking that global automatically means a portfolio is diversified is a common mistake investors make. For example, some global funds heavily favour US tech stocks, which can create unintentional sector concentration.

Tip: Don’t just look at the word ‘global’ in the title - review a fund’s underlying holdings and strategy to understand its exposure and diversification.

Alternative Investment Strategies for Global Equity Fund Investors

There are eight main global equity fund strategies to be aware of:

1. Global Equity Income Funds

- Purpose: Generate consistent dividend income from global blue-chip stocks.

- Why It’s a Popular Alternative: For investors nearing or in retirement, income-yielding strategies can help them fund their living costs.

- Example: Plato Global Shares Income Fund—focuses on high-conviction, dividend-paying stocks.

2. Global Equity Exchange-Traded Funds (ETFs)

- Purpose: Provides passive, convenient access to portfolios of international stocks that replicate an index.

- Why It’s a Popular Alternative: ETFs provide easy, convenient assess for investors seeking low cost funds which replicate the performance of a global benchmark.

- Example: JPMorgan Equity Premium Income Active ETF (Hedged) (ASX: JHPI)—invests in global equities with the objective of seeking current income while maintaining prospects for capital appreciation.

3. Global Long/Short Equity Funds

- Purpose: Reduce volatility and pursue absolute returns by taking both long and short positions.

- Why It’s Popular: Offers downside protection in volatile or overvalued markets.

- Typical Investors: Sophisticated investors or SMSFs wanting equity exposure with a hedging mechanism.

- Example: Aim Precision Capital Global Quant Fund—invests in global equities with the objective of using quantitative analysis and AI/machine learning methodologies to generate alpha.

4. International Small-Cap or Emerging Market Funds

- Purpose: Tap into higher-growth opportunities in under-researched segments of global markets.

- Why It’s Used: Complements a core global fund by adding alpha potential from niche markets.

- Risk: Higher volatility and liquidity risk, but potentially outsized returns over long horizons.

- Example: Pengana Global Small Companies Fund is an actively managed portfolio of global small-cap stocks.

5. Global Thematic Funds

- Purpose: Invest in global megatrends such as AI, clean energy, healthcare innovation, or cybersecurity.

- Why It’s Popular: Aligns with investors’ beliefs, values, or long-term sector bets.

- Example: Global X ROBO Global Robotics & Automation ETF invests in global companies that potentially benefit from increased adoption and utilisation of robotics and artificial intelligence.

6. International Real Assets (REITs & Infrastructure Funds)

- Purpose: Provide exposure to physical assets (e.g. real estate, toll roads, utilities) with inflation-protected cash flows.

- Why It’s Complementary: Offers diversification benefits as these assets are often less correlated with global equities.

- Example: Magellan Infrastructure Fund (Currency Hedged) - Active ETF invests in globally listed infrastructure companies with predictable cash flows.

7. Unlisted Global Private Equity or Venture Funds

- Purpose: Gain exposure to private global companies before they list or mature.

- Why It’s Used: For long-term capital growth and access to innovation before it reaches public markets.

- Caveats: Illiquid, long lock-in periods, high minimum investments mean these funds are suited to experienced investors only.

- Example: Pengana Private Equity Trust invests in global private companies with the objective of generating strong long-term returns.

8. Currency Hedged Strategies

- Purpose: Reduce the impact of AUD/USD or AUD/EUR fluctuations on portfolio performance.

- Why It’s Used: Offers a way to isolate market returns from FX noise.

- Tip: Some investors split exposure between hedged and unhedged versions of the same fund to smooth their returns.

- Example: Claremont Global Fund (Hedged) invests in global markets with a hedged portfolio.

How These Funds Fit into a Broader Investment Strategy

For a typical high-net-worth investor in Australia:

- Global equity funds provide convenient access to growth assets positioned to generate solid long-term returns.

- Equity income and infrastructure funds are ideal for providing regular cash flow in retirement.

- Long/short and thematic funds are ideal for sophisticated investors aiming for tactical tilts or market protection.

- Private equity is an increasingly mainstream asset class focused on generating equity-like returns without the volatility of listed stocks.

⚠️ Always review the PDS and understand the risk profile before investing.

How to Choose the Right Global Equity Fund?

With dozens of global equity funds available to Australian investors, how do you pick the one that fits your needs?

The answer lies in understanding your objectives and knowing what to look for under the hood.

Performance Track Record

- Look at consistent long-term returns, not just the last 12 months.

- Pay attention to volatility and drawdowns - the smoothness of returns matters, especially in retirement.

Management Style: Active vs Passive

- Passive (ETFs): Tracks an index like MSCI World or FTSE Global All Cap. These funds charge lower fees for broad exposure.

- Active: Aims to outperform its benchmark index via research and stock picking. These funds charge higher fees for potentially higher returns.

Fees and Expenses

- Compare management fees and the MER (Management Expense Ratio) for a measure of total costs. Index funds may charge total costs of <0.2% p.a., while active funds can exceed 1%.

- Watch out for performance fees or hidden costs.

Currency Hedging Options

- Some funds offer AUD-hedged and unhedged versions.

- Hedging can reduce currency-driven volatility but may limit upside in some market conditions. For example, during periods of AUD weakness, unhedged global funds will generally outperform their hedged peers.

Fund Size and Liquidity

- Larger funds typically have more daily trading volume and lower bid-ask spreads than their smaller peers. In addition, larger funds are generally more sustainable as their managers are more likely to be profitable.

Fund Selection Tips

In summary, there’s no universal ‘best’ global equity fund for all investors.

Global equity funds can be a useful investment tool - but only when matched to the right strategy.

Some investors prefer low-cost global ETFs for broad market exposure, while some seek actively managed global equity funds for the potential outperformance on offer.

And others opt for a mix of both active and passive global equity funds to blend lower costs with targeted exposure.

What matters most is clarity around your investment goals and a willingness to compare the options carefully.

Always read a fund’s Product Disclosure Statement (PDS) and consider seeking financial advice from a licensed professional.

Tip: Use fund analysis tools like InvestmentMarkets and Morningstar to research equity funds based upon their performance, risk, and fees.

Strategy Match Table: What to Invest in Based on Your Goals

This table is intended as a quick-reference guide to help match your personal investment goals with the most suitable global equity fund or alternative strategy.

Start by clarifying what matters most to you—whether it’s growth, income, diversification, or downside protection - then use the checklist to evaluate fund features that align with those priorities. From there, explore the table to identify other investment options that may complement or enhance your portfolio. This approach helps ensure every allocation decision supports your broader financial objectives with clarity and confidence.

Best Global Equity Funds for Australian Investors

| If your priority is... | Consider... | Why? |

| Long-term capital growth | Global equity growth funds | Exposure to global innovation and growth sectors such as tech |

| Reliable income or dividends | Global equity income funds | Designed to pay consistent yields from global blue-chip stocks |

| Downside protection / volatility control | Global long/short equity funds | Aims to profit in rising and falling markets; adds portfolio resilience |

| Thematic trends | Thematic global equity funds (e.g. tech, ESG) | Lets you express convictions or align with investment megatrends |

| Higher return potential from under-researched areas | International small-cap or emerging market funds | Higher risk, but greater potential for alpha in less efficient markets |

| Inflation-hedged real asset exposure | Global infrastructure funds or international REITs | Cash flow plus potential price appreciation tied to real assets |

| High-growth, long-term capital growth | Global private equity or venture capital funds | Illiquid, private market opportunities with potential for substantial returns |

| Reducing foreign currency risk | AUD-hedged versions of global funds | Minimises return volatility caused by FX movements |

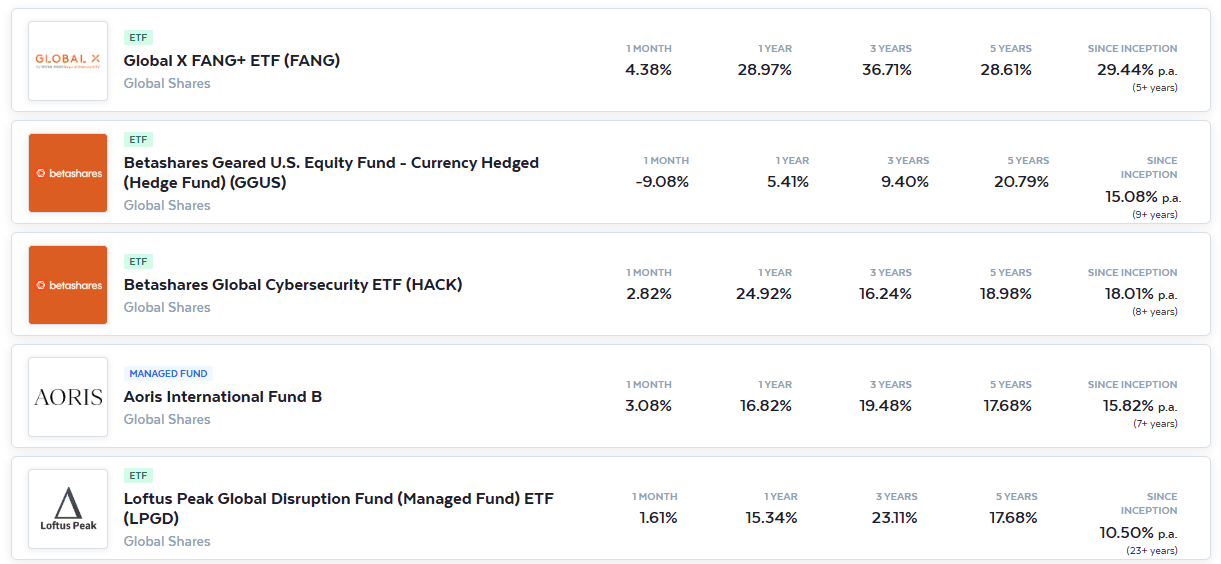

By way of example, here are the top performing global equity funds available to Australian investors based on 5-year returns:

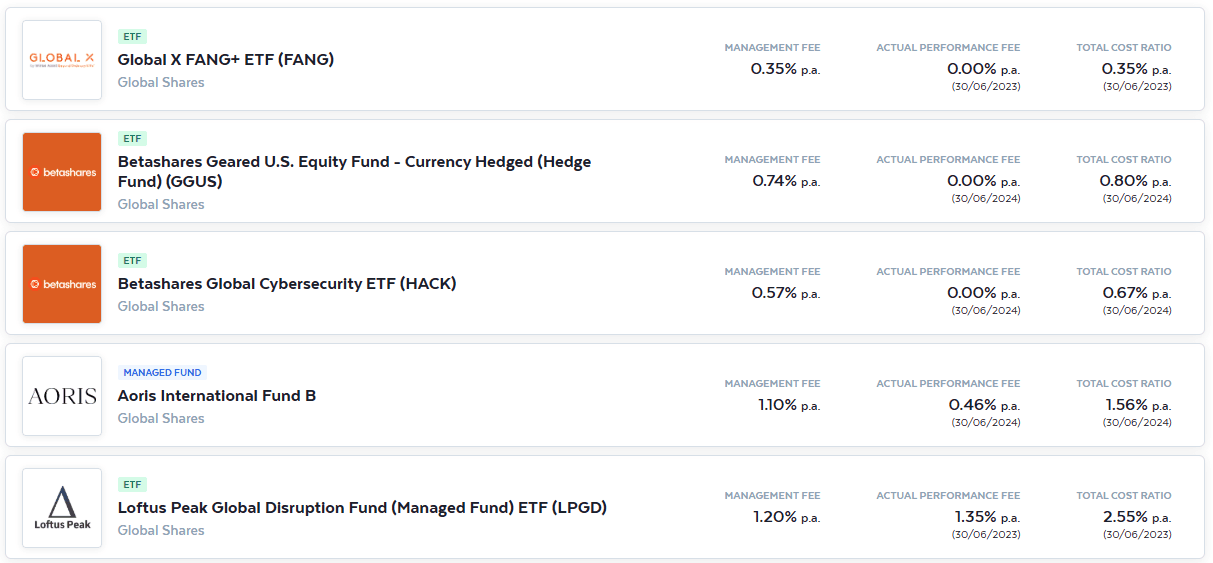

Here are the costs of investing in these same top-performing funds:

Tip: focus on each fund’s total cost ratio rather than its management fee to ensure fund expenses are included.

⚠️Always review a fund’s PDS and understand its risk profile before investing.

Deciding whether to Invest in Global Equity Funds

Global equity funds aren’t just for market veterans - they’re a smart, scalable way for Australian investors to access the best international growth opportunities, diversify away from local risks, and tap into world-leading industries. But they’re not a one-size-fits-all solution.

Ask yourself:

- Am I comfortable with exposure to overseas markets and currencies?

- Do I want to reduce my reliance on the Australian economy?

- Is my investment horizon 5+ years?

- Am I looking to capture growth, income, or both — globally?

- Do I prefer a professionally managed portfolio over picking foreign shares myself?

If you answered ‘yes’ to most of these questions, global equity funds may be a valuable addition to your investment portfolio - particularly if you’re aiming for long-term growth and broader market exposure.

Whether you’re a retiree seeking international dividend income, or a self-directed investor building a future-focused portfolio with exposure to international companies, there’s a global equity fund that will align with your goals.

Global equity funds open the door to global opportunity - but the key is aligning them with your personal goals.

Final tip Take your time. Compare global equity fund strategies, fees, regional exposure, and risk profiles. And when in doubt, consult a licensed financial adviser.

Global Equity Funds FAQs

Global equity funds invest in companies worldwide — including Australia — while international equity funds exclude your home country. For Australian investors, that means international funds avoid ASX-listed stocks, whereas global funds may include them as part of a broader strategy.

If a global fund is unhedged, its returns will be affected by movements between the Australian dollar and the currencies of the countries where the fund invests. A strong AUD can reduce overseas returns when converted back, while a weaker AUD can enhance them. Hedged funds aim to smooth this out by hedging out their currency exposure.

Yes, many global equity funds are designed to generate reliable dividend income. These funds invest in established international companies with strong balance sheets and consistent pay-out histories. Look for funds specifically labelled as ‘global equity income’, such as Plato Global Shares Income Fund.

Management fees vary based on a fund’s strategy. Passive index funds may charge as little as 0.18% p.a., while actively managed funds can charge 1% p.a. or more.

In addition to management fees, check the MER (Management Expense Ratio), which represents a fund’s annual operating expenses, and evaluate whether its performance justifies its total costs over time.

Generally, yes — but it depends on the fund. While global equity funds provide geographic diversification, many are still heavily weighted toward the US market or specific sectors (like tech). Always review a fund’s top holdings and regional breakdown to ensure it matches your diversification goals.

Absolutely. Global equity funds, whether they be managed funds or ETFs, are commonly held within Self-Managed Super Funds (SMSFs). Just ensure that any investment aligns with your SMSF’s investment strategy, complies with ATO regulations, and is documented in your fund’s records. As always, please seek financial advice before you make specific investment decisions.

Start with comparing funds’ 3- and 5-year annualised returns, but also look at risk-adjusted metrics like the Sharpe ratio and volatility. Compare each fund against its relevant benchmarks such as the MSCI World Index. Use the fund's fact sheet and independent platforms like InvestmentMarkets and Morningstar to assess performance consistency and manager track record.