IAM provides wholesale clients with alternative debt investment options, allowing investors to gain exposure to a broad range of issuers and industries.

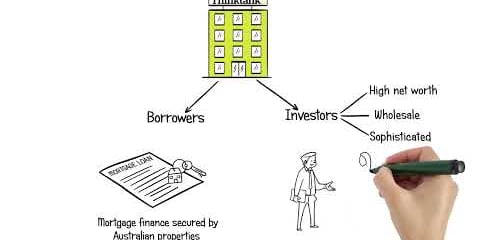

Thinktank Income Trust offers investors first mortgage exposure to domestic, established commercial and residential property (for Wholesale Investors only)

The Fund’s objective is to provide investors with regular income via monthly distributions from investing in Notes.

The Fund is an opportunistic high-yield, non-property private credit strategy focused on delivering a Target Return of 10% + RBA Cash Rate

The Trust invests in domestic commercial and residential Mortgage Backed Securities (For Wholesale Investors Only)

The Fund’s strategy is to provide strong risk adjusted returns by providing loan facilities for property investment & development in major cities with a primary focus on residential & commercial projects throughout Australia -For Wholesale Investors Only

The Supra Capital First Mortgage Class Fund consists of a diversified pool of first mortgage loans which are used for the purchase, refinancing, investment or development of real estate in Australia.

We help wholesale investors generate targeted returns of up to 15% p.a. on real estate secured investments.

The objective of the Fund is to provide monthly income through a selection of investments in short-to-medium term registered first mortgage loans.

The Fund provides secured debt facilities to non-bank lenders and corporates with physical and/or financial assets that can provide asset backing. (For Wholesale Investors Only)

The Fund aims to provide investors with an attractive rate of return and regular, risk-adjusted income by investing in a specifically curated portfolio of credit-vetted, mortgage-secured loans. (For Wholesale Investors Only)

Attractive predictable income. Disciplined real estate investment. (For Wholesale Investors Only)

IAM offers direct ownership of a curated portfolio combining investment grade bonds with syndicated term loans.

The Invesco Wholesale Senior Secured Income Fund invests in Senior Secured Loans to around 350 global companies, many household names, diversified across 20 or more sectors.

A contributory mortgage fund offering investors the opportunity to invest directly in selected registered First Mortgages over predominately residential but also limited non-residential property in South East Queensland.