Comparison Data

1Performance

| 1 month | 3 month | 1 year | 3 year | 5 year | Since Inception | Inception Date |

|---|---|---|---|---|---|---|

| 0.4% | 5.68% | 18.8% | 20.33% | 17.12% | 8.88% | 31 May 2005 |

Fees

| Management Fee | Performance Fee | Morningstar Total Cost Ratio |

|---|---|---|

| 0.98% | - | 0.98% |

The Acadian Global Equity Fund offers investors the opportunity to invest in a globally diversified portfolio that aligns with sustainable values.

By focusing on companies with strong environmental, social, and governance (ESG) practices, the fund aims to deliver competitive long-term returns while contributing to a more sustainable future.

With a rigorous investment process that incorporates ESG factors alongside traditional financial analysis, the fund seeks to identify companies that are well-positioned for long-term growth while also making a positive impact on the world.

This strategy aims to deliver superior long-term returns by actively investing in a diversified portfolio of global companies whilst promoting sustainable characteristics including a Net Zero inspired decarbonisation target.

Objective

To maximise risk-adjusted, long term active returns from a diversified portfolio of global securities while actively incorporating a range of Environmental, Social and Governance (ESG) investment criteria and reducing exposure to carbon intensive companies relative to the benchmark. The fund aims to outperform the MSCI World (ex Australia) Index over rolling four-year periods before fees and taxes.

Strategy

Acadian utilises a systematic multi-factor investment approach, while integrating a range of ESG criteria, to select stocks. This includes having no exposure to stocks that derive any revenue from the production or manufacturing of tobacco and controversial weapons (including the manufacture, delivery or provision of critical components of cluster munitions, landmines, biological & chemical weapons, blinding laser weapons, depleted uranium weapons, incendiary/white phosphorus weapons, non-detectable fragments weapons or nuclear weapons); or more than 10% of gross revenue1 from the production or manufacture of products in alcohol, gambling and adult entertainment; derive more than 20% of gross revenue1 from thermal coal mining or extraction of unconventional oil & gas (such as oil sands, shale oil, shale gas and tar sands); and stocks considered to have business practices that violate the UN Global Compact (as assessed by a third party provider, MSCI), for example those involved in very severe ESG controversies such as human rights abuses or corruption (e.g. extortion or bribery). Acadian will target a reduction in weighted average carbon intensity (WACI) of the portfolio relative to the MSCI World ex Australia index of at least 20%. The fund will also target a positive (at least 10% above the index)rating to companies providing environmental solutions such as clean technologies and renewable energy (as assessed by a third party provider, MSCI). The fund does not hedge currency risk.

Investment Universe

40,000+ stocks in developed and emerging markets (includes ex-index stocks to maximise the opportunity set).

Return Forecast

Daily analysis at stock-specific, peer group, and macro level results in objective risk and return forecast

Portfolio Construction & Trading

Forecasts enter proprietary portfolio optimisation system, weighing expected return against risk, liquidity and T-costs

1 As supplied by MSCI. Revenue is the latest available year percent of revenue, or maximum estimated percent, a company has derived from the stated activity. MSCI uses total or gross revenue. However, in absence of such, MSCI considers net sales or operating revenue as reported by the company in its financial statements for the purpose of revenue estimations. When companies do not report exact revenue figures for a covered business activity, MSCI provides an estimate of companies’ involvement in the subject activity. Revenue estimates do not cover indirect involvement to a business activity, either through a parent company or subsidiary.

- Top-performing companies display many qualities. Their success is multi-faceted and cannot be attributed to any single factor. Acadian’s systematic process incorporates over 70 predictive factors including a range of ESG signals.

- Active management can exploit market inefficiencies such as undervalued companies, arising from changing market conditions and behavioural errors.

- Using technology, including AI and machine learning, financial data can be collected, analysed and monitored with greater efficiency across a broader investment universe. A disciplined approach also avoids qualitative bias and subjective inputs.

- Systematic strategies cover a broader and deeper investment universe, therefore, portfolios can be customised to exclude certain companies, with minimal impact on a portfolio’s risk and return profile.

Click here to view our latest Fund Performance.

Acadian LLC is a Boston based investment adviser registered with the United States Securities and Exchange Commission. Acadian LLC has four wholly-owned investment advisory affiliates. Acadian Asset Management (Singapore) Pte Ltd is located in Singapore and is registered with the Monetary Authority of Singapore. Acadian Asset Management (Japan) is located in Tokyo and is registered with the Kanto Local Financial Bureau. Acadian Asset Management (UK) Limited is located in London and is authorised and regulated by the Financial Conduct Authority. Acadian Asset Management (Australia) Limited is located in Sydney and is the holder of Australian financial services license number (AFSL) 291872. All Acadian entities specialise in active equity strategies.

Acadian LLC evolved from a non-US all-cap equity manager to a global manager with the launch of Acadian LLC’s global strategy in 1992. In 2002, Acadian LLC began to apply its stock selection process to attempt to find the poorest performing companies as well as the strongest, opening the doors for Acadian’s long/short strategies. In 2006, based on research showing that a portfolio of low-risk stocks has the potential to offer market-like returns at lower risk than the overall equity market, Acadian launched its managed volatility strategy. Acadian’s commitment to research, the flexibility of its process and the collaborative nature of its client relationships suggests that Acadian’s suite of strategies will have the potential to continue to grow and evolve in an effort to meet the needs of its clients.

For further information go to Acadian’s website www.acadian-asset.com

Katrina joined Acadian Asset Management (Australia) Limited in 2009 and is a Portfolio Manager, focusing on Australian equity strategies.

Prior to joining Acadian, Katrina was a senior quantitative analyst at ING. Previous to that, she held various quantitative roles at IFS Equities, BT Funds Management, Country Investment Management, and Mercantile Mutual Investment Management.

Katrina holds a Graduate Diploma in applied finance and investments from Securities Institute of Australia and a Bachelor’s in mathematics and finance (Hons) from University of Technology, Sydney. Katrina is a CFA charterholder.

Zhe joined Acadian Asset Management (Australia) Limited in 2017 and is a Portfolio Manager, focusing on Australian equity strategies.

Prior to joining Acadian, Zhe was an analyst on the quantitative research team at Macquarie Securities.

Zhe holds a Ph.D. in empirical finance from Macquarie University, a Bachelor of Engineering in bioinformatics with First Class Honours and the University Medal from the University of New South Wales, and a Bachelor of Commerce in finance from the University of New South Wales. Zhe is a CFA charterholder.

Click here to view our latest Monthly Factsheet.

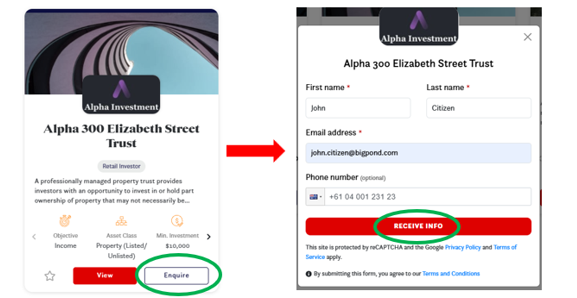

- By clicking the enquire button on the card view

Or

- By selecting “Receive Info” when viewing the listing

We will respond using your preferred communication method (i.e., email or phone).

Statutory Statement

The issuer of this product is identified at the top of this page. The PDS and target market determination for the product are available in the Documents section of this listing. Prospective investors should consider the PDS before deciding to acquire the product. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

1 For use in Australia: © 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its affiliates or content providers; (2) may not be copied, adapted or distributed; (3) is not warranted to be accurate, complete or timely and 4) has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), subsidiary of Morningstar. Neither Morningstar nor its content providers are responsible for any damages arising from the use and distribution of this information. Past performance is no guarantee of future results.

Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at http://www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar's publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar's full research reports are the source of any Morningstar Ratings and are available from Morningstar or your advisor. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a financial advisor. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.