Exclusive property investment opportunities for wholesale investors, offering from 12% per annum paid monthly.

Providing sophisticated investors monthly income distributions by investing in asset backed securities. (For Wholesale Investors Only)

The Fund aims to outperform the S&P / ASX 300 Accumulation Index (Benchmark) on a net of fees basis, by investing in companies that operate ethically, responsibly and sustainably. (For Wholesale Investors Only)

The NextGen Resources Fund provides investors with exposure to a range of commodities such as lithium, the rare earth elements, graphite, nickel, gold, copper, oil, coking coal and gas. (For Wholesale Investors Only)

The TT Global Environmental Impact Fund aims to generate strong long-term returns by investing in the leading global structural growth theme – the green transition.

The Fund is highly focussed on investing in long-term winners in attractive transforming markets when they are undervalued and offer outsized return potential.

The Fund’s objective is long-term capital growth and to outperform the MSCI All Country World Index focusing on mid- and large-capitalisation companies across global equity markets.

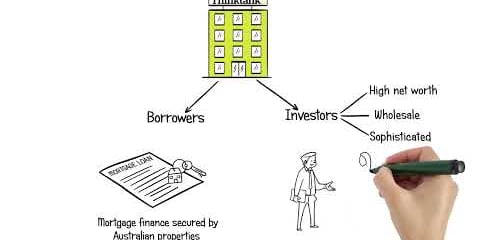

The Trust invests in domestic commercial and residential Mortgage Backed Securities (For Wholesale Investors Only)

The Fund provides secured debt facilities to non-bank lenders and corporates with physical and/or financial assets that can provide asset backing. (For Wholesale Investors Only)

The Firetrail Absolute Return Fund is a market-neutral, uncorrelated alternative of Firetrail’s best ideas.

The Fund’s current indicative distribution rate is 6.55%p.a., paid monthly.

The Fund aims to generate long-term uncorrelated returns in excess of the RBA Total Return Index after fees. (For Wholesale Investors Only)

The Burrell 20 aims to achieve capital growth over the long term with correlation to the S&P/ASX20 Accumulation Index also providing income through the receipt of franked dividends.

The Fund provides an opportunity for Wealth Managers to access cash-based products designed with specific considerations to their core needs across returns, liquidity, administration, and reporting. (For Wholesale Investors Only)

A long only small-cap fund targeting future-facing emerging companies on the ASX.