Investment Highlights

The Core Services Opportunity Fund 1 (Delawney) is acquiring a premier industrial property in Balcatta, WA, to provide regular income and forecasted capital growth.

The asset, a specialised pharmaceutical manufacturing facility on an 8,594 sqm site, is underpinned by a 20-year triple net lease to the high-calibre tenant, Evaris Pharma, an Australian company operating for over 40 years.

The fund is raising $10.75 million from wholesale and sophisticated investors to complete the $21.5 million purchase. The investment objective is long-term income, with a minimum investment term of five years and a forecast average total return of 12–14% per annum.

Core Services Opportunity Fund 1 (Delawney) (“the Fund”) is acquiring 25-29 Delawney Street, Balcatta WA. The Fund aims to provide regular income, underpinned by a long-term lease to a high calibre tenant in the healthcare industry - Australian owned pharmaceutical manufacturing company, Evaris Pharma. Evaris Pharma boasts over 40 years of operation, and have invested significant capital into the asset to deliver a unique, specialist facility. An underlying land component of 8,594 sqm in the Balcatta industrial and commercial area benefits from impressive connectivity - just 10km from Perth CBD and less than 1km from both Mitchell Freeway and Reid Highway.

Key Details

The Offer

The Offer under this IM is to raise $10.75 million, through the issue of up to 10.75 million units in the Fund at a price of $1.00 per unit to facilitate the purchased of 25-29 Delawney Street. Investment in the Fund is restricted to applicants that qualify as “wholesale clients” under Section 761G (7) of the Corporations Act or as “sophisticated investors” under Section 761GA of the Corporations Act.

The Fund

A special purpose unlisted unit trust established with the sole purpose to acquire 25-29 Delawney St, Balcatta. This Fund will not acquire any other property. The Trustee of the Fund is AGEM PG 55 Pty Ltd (ACN 660 829 809), a wholly owned entity of AGEM.

The Property

A premier industrial property, purpose-built and equipped for pharmaceutical manufacturing.

- Address: 25-29 Delawney Street, Balcatta WA

- Site Area: 8,594 sqm

- Net Lettable Area: 3,826 sqm

- Tenant: Orion Laboratories Pty Ltd trading as Evaris Pharma, a privately owned company established in 1985.

- Lease: 20 year (+ 2 x 10 year options) triple net lease, where all variable and capital outgoings are the responsibility of the tenant.

- Purchase Price: $21.5 million

- LVR/Debt: Maximum LVR of 60%

- Investment Objective: Long-term income with forecasted capital growth.

Investment Term

The minimum Investment Term is 5 years (unless varied by the Trustee).

The Trustee will offer the option to exit and retrieve capital on a rolling 5 year basis.

Minimum Investment $250,000 minimum and $25,000 increments thereafter.

Offer Close

Offer will close upon full subscription. Investor funds are due immediately in preparation for settlement.

Investor Reporting

The Trustee will provide regular updates to investors in relation to the performance of their investment in the Fund, comprising quarterly newsletters and an annual tax statement and financial statements.

25-29 Delawney Street, Balcatta, is a substantial industrial asset, purpose-built and equipped for pharmaceutical manufacturing. Its inherent value is significantly amplified by its specialised nature, critical certifications and strategic location.

Originally constructed circa 1994, the asset is a modern pharmaceutical manufacturing facility comprised of four individual buildings, interlinked to provide a single occupancy, which includes laboratories, manufacturing, ancillary office and warehouse space. The property has a gross lettable area of 3,826m² on a substantial 8,594m² site. The generous land-to-building ratio allows for potential future expansion or site optimisation, subject to approvals. Recognised as one of Perth’s most significant pharmaceutical production sites, this facility was purpose-built and is not a retrofit of a generic warehouse.

Evaris Pharma currently manufactures liquids, creams, ointments, and gels here, confirming that it is equipped with the necessary controlled environments for mainstream pharmaceutical production. The asset holds pharmaceutical manufacturing approvals, including Therapeutic Goods Administration (TGA) certification and Good Manufacturing Practice (GMP) approval.

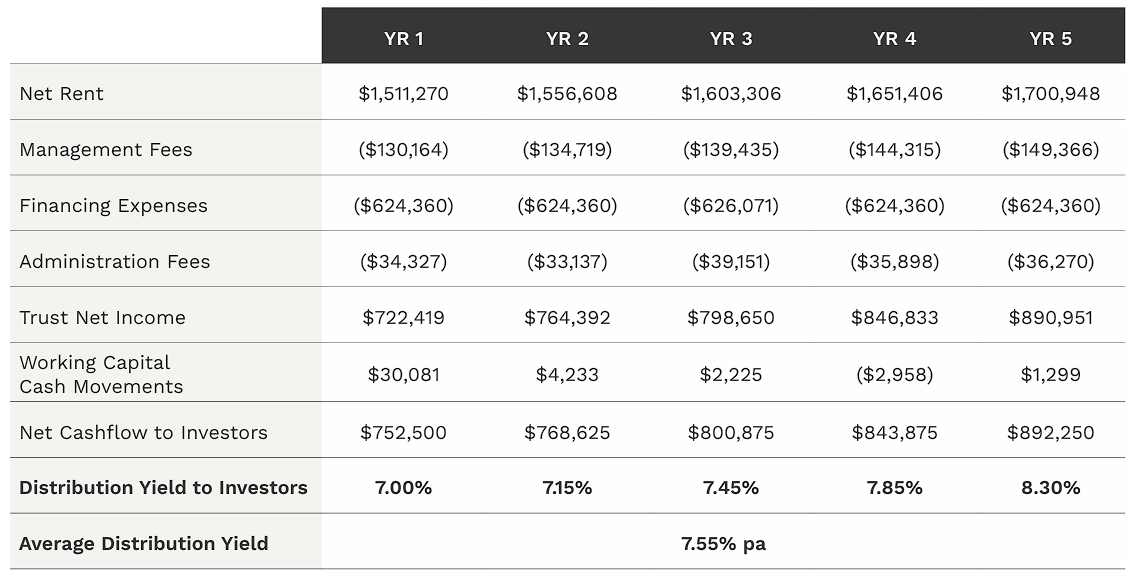

Key assumptions included in the above forecasts are as follows:

- Total equity of $10.75 million is raised.

- The loan will have a facility limit of 60% LVR, which will be fully drawn at settlement. The LVR covenant will be 60%. The Trustee expects the LVR to reduce over the investment term through re-valuation increases.

- The property is to remain fully leased with fixed annual rent reviews at 3.0% in accordance with the lease agreement (subject to final negotiations).

- Management fees payable to the Trustee are outlined on page 26 of IM. The Trustee may elect to defer some or all of its fees and/or receive fee(s) in cash or in the form of units in the Fund.

- Property is sold on a valuation capitalisation rate at the end of year 5 at 6.35% (refer total return sensitivity detailed in IM).

- Interest rates are based on an average of current available market evidence and assume an initial base rate of 3.35% plus margin of 1.49%.

The Trustee will offer liquidity events on a rolling 5 year basis where all investors will have the opportunity to sell or transfer Units should they elect to do so at the prevailing valuation as determined by an independent valuer. The transfer or sale of units will be subject to costs, which may include stamp duty and other Trust related fees.

Limited Withdrawal Facility

Investors should treat the Fund with a medium-term horizon of no less than five years. While the investment is illiquid and there is no secondary market for investor’s units, the Trustee intends to offer investors the opportunity to withdraw their investment on a limited basis. The amount available to meet a withdrawal request will be determined by the Trustee and subject to available funds.

AGEM is an investment manager specialising in providing investors with access to stable, low-risk commercial property investments delivering above market returns in the form of both ongoing passive income and long-term growth.

Since inception in 2012, we have established over 30 unlisted property funds. Our current passive portfolio is delivering an average total return of 15.1% pa.

As co-investors in every Fund, our experienced and dedicated team is committed to the success of every asset.

How we’re different

Co-investment

First and foremost, our co-investment model sets us apart from other property investment groups. AGEM management, family and close friends always hold a significant portion of units in each of our assets, aligning our financial interests and fostering a genuine community and partnership with our clients. Currently, AGEM management, family and close friends hold an average of 54% ownership across our Funds.

De-risking and value creation – upfront

We focus on risk mitigation and value creation right from the start – adhering to a strict mandate that ensures the income of any investment is sufficiently underpinned before proceeding.

Relationship-focused

Building strong relationships is at the core of our approach. We know each of our investors and partners personally, and prioritise open communication, trust, and collaboration.

Active asset management

As active asset managers, we proactively manage and enhance the value of your investments, ensuring optimal performance and returns.

Comprehensive control

We control every step of the property investment life cycle, from site selection to acquisition, management, and beyond, ensuring a seamless and efficient process. A key component of this is rigorous site review and due diligence - we conduct thorough evaluations, reviewing over 300 potential sites each year to identify properties with the greatest potential for value and growth.

Our people

AGEM’s team consists of experienced professionals who bring a wealth of expertise and knowledge to the table, making strategic investment decisions tailored to your financial goals.

Adrian founded AGEM Property Group in 2012 and has since led AGEM’s team of property specialists, spearheading the company’s long-term strategy and growing portfolio of commercial property investments.

Adrian is a respected figure in the real estate industry, known for his extensive industry network and expertise in deal origination and negotiation. He holds a Bachelor of Commerce (Accounting & Information Systems) from Edith Cowan University in addition to being a registered builder, qualified real estate agent and the licensee/authorised representative of the AFSL held by APG Finance Services Pty Ltd. Adrian brings a wealth of knowledge and experience to AGEM Property Group spanning all elements of property investment including acquisitions, leasing, development, divestment, structuring and project funding.

The importance Adrian places on quality relationships lies at the heart of AGEM’s success. He nurtures enduring partnerships and always strives to align objectives and generate mutual value and trust.

Robert works closely with our co-investors to provide insights, education, and consistent communication, fostering relationships that support informed decision-making and long-term confidence.

He has over 30 years of experience in investment and finance, spanning roles in accounting, investment banking, corporate finance and funds management domestically and overseas.

Robert holds a Bachelor of Commerce and Graduate Diploma of Applied Finance and is also a member of the Chartered Accountants Australia and New Zealand.

Ben leads the management of AGEM’s property portfolio, ensuring our assets perform well and our tenants are supported to succeed.

Ben brings over 15 years of experience in asset management, development, leasing and disposal across both public and private sectors. He’s equally analytical and practical and highly valued by our diverse network of partners for his collaborative and transparent approach.

Ben has a Bachelor of Commerce from Curtin University, a Diploma of Financial Planning from Kaplan Professional and attained his GAICD certification upon successful completion of the Company Directors Course with the Australian Institute of Company Directors (AICD).

Click here to view our latest News, knowledge and resources to support your passive income and investment journey.

Statutory Statement

This offer of scheme interests is available to wholesale clients only. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.