Investment Highlights

This Fund provides an opportunity to invest in commercial property trusts targeting a total annual return of 12-14%, post-establishment. This includes stable, tax-efficient income distributions forecast to average 7-8% per annum, paid quarterly.

The strategy focuses on acquiring high-quality assets in Perth’s growth corridors, tenanted by businesses in non-discretionary sectors such as healthcare, childcare and industrial. With a minimum lease expiry of five years and a focus on significant depreciation benefits, the assets are structured for income security and long-term capital growth. To ensure alignment, management intends to co-invest up to 30% in each trust. The investment is designed to deliver strong risk-adjusted performance by balancing predictable cash flow with strategic upside in resilient markets.

The Fund aims to deliver strong returns through long-term capital growth and stable quarterly income distributions. Post the Establishment Phase (~3-12 months), a total forecast return of 12-14% pa will be targeted, including tax-efficient income distributions averaging 7-8% pa.

Target Acquisitions

The Trust(s) will target commercial assets underpinned by a core set of fundamentals outlined below:

- Buildings with design flexibility that can accommodate a range of tenants

- High underlying land value

- Existing or potential occupancy by businesses with:

- Operations primarily supported by non-discretionary spend

- Lease expiries of 5+ years

- Leases backed by financial assurity (Bank Guarantees, Director Guarantees and/or landlord rights over fit-out etc)

Key Details

| Tenants | Existing or prospective tenants primarily operating in non-discretionary sectors such as allied health, education, childcare and/or certain areas of the industrial market. |

| Target Returns |

During the Establishment Phase, all investor deposits will be held in a high interest account with income accrued monthly. The interest rate payable during this period will be subject to the available rate provided through the nominated bank, but is forecast at ~3-4%. Post Fund establishment, forecasted total return of 12-14% pa including income distributions averaging 7-8% pa. |

| Establishment Phase | The period between initial deposits being paid by investors and settlement of each property (3-12 months). The acquisition of the first asset is expected to occur within 3-6 months. |

| WALE | Minimum 5 years |

| Investment Term | The minimum Investment Term is 5 years, commencing post Establishment Phase. The investment should be considered illiquid. |

| Minimum Investment | $250,000 minimum and $25,000 increments thereafter. |

| Funds Due | 5% deposit required to secure commitment. Remaining funds will be due prior to settlement - details to be confirmed. |

| Number of Assets | Each Trust will be comprised of one asset valued at $6-18m. Up to 3 Trusts will be established from the Fund. |

| LVR/Debt | 45-60% |

| Co-Invest with AGEM | AGEM management and family intend to subscribe to up to 30% of Units in each Trust. |

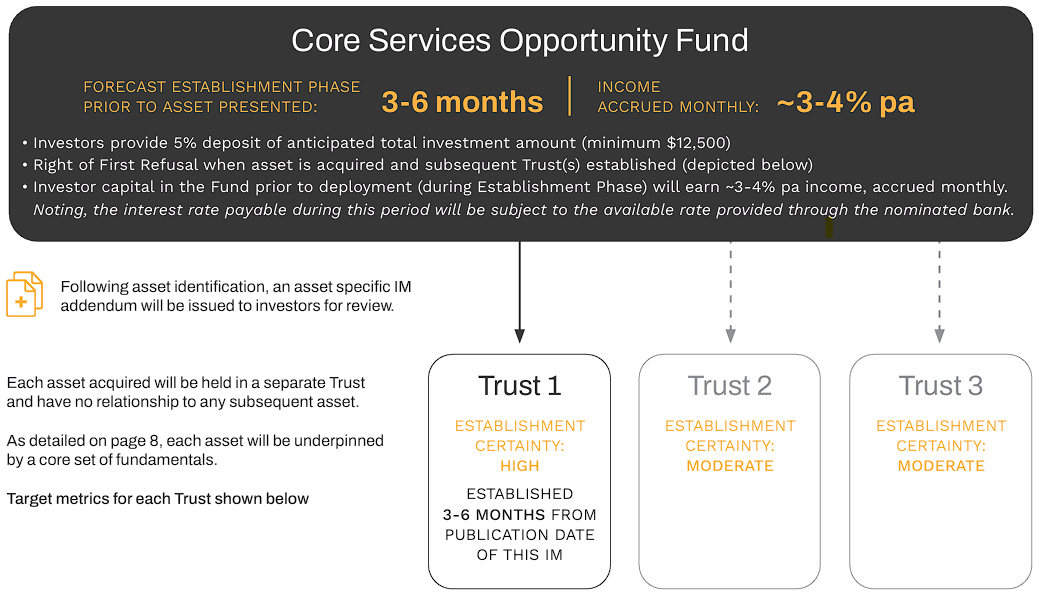

As shown above, following each asset acquisition, a new Trust will be established.

We expect up to three suitable assets to be acquired within a 12 month period.

In each instance, an asset specific IM addendum will be issued to investors for review. Investors can then elect to:

- Deploy their deposit and transfer remaining amount to participate in Trust

- Pass on Trust, keeping their deposit in the Fund in anticipation of a future Trust

- Retrieve their deposit and exit Fund

Investors can participate in one or more Trusts and will have Right of First Refusal when each asset is acquired. An investor may choose to pass on a Trust due to personal preferences or circumstances. However, as specified, forecasted performance and fundamentals will be consistent across Trusts.

12-14%pa Forecast Average Total Return

Trust(s) to be established will target an average total return of 12-14% pa, combining secure rents with long-term capital growth potential. This return profile is designed to align with dual investor priorities - balancing predictable cash flow with strategic upside.

Cash distributions are forecast to average 7-8% per annum, paid quarterly, offering investors consistent income following settlement. The balance of the forecast return is expected to be delivered through capital appreciation over the investment term, driven by the asset’s strategic location, quality of tenancy profile, and demand resilience in the underlying sector. The combination of steady income and capital growth positions the Trust(s) to deliver strong risk-adjusted performance, with a focus on long-term value creation.

High Calibre Tenants + Long-Term Leases

The asset(s) will be curated to attract and retain essential-service tenants with a core set of fundamentals - businesses that operate in sectors with consistent, non-discretionary demand such as childcare, medical, allied health, supermarkets and certain industrial markets. These tenants are integral to daily life and community function, making them less vulnerable to consumer sentiment cycles and market volatility.

Existing or prospective tenants will be established, experienced operators with proven track records and solid financial profiles. The target tenant profile includes national brands, multi-site operators, and independent providers with strong local presence. Lease terms will be structured to reflect a Weighted Average Lease Expiry (WALE) of at least five years, backed by financial surety i.e. Bank Guarantees, Director Guarantees and/or landlord rights over fit-out etc.

This alignment of tenant quality and lease structure ensures a stable, risk-adjusted investment profile and enhanced income security.

Strategic Location

The asset(s) will be located within strategically selected growth corridors, within 50km of the Perth CBD. Location selection is underpinned by a data-led approach, prioritising suburbs demonstrating strong population growth, infrastructure investment, and increasing demand for essential services - indicators that historically align with above-average long-term capital growth and rental performance.

The Trust(s) will be structured to deliver stable returns by anchoring in areas where demand for non-discretionary services, such as healthcare, childcare remains resilient regardless of broader economic cycles. These service-driven tenancies are embedded in the daily lives of high-growth communities, providing an in-built layer of income security and ongoing occupancy demand. By targeting well-connected, demographically expanding suburbs, the strategy supports both income stability and asset appreciation, aligning with long-term investment objectives.

Significant Depreciation Benefits

The acquisition of a newly developed or purpose-refurbished asset offers the potential for substantial depreciation benefits, enhancing after-tax returns for investors through legally recognised tax deductions. In line with Australian Taxation Office (ATO) guidelines, capital works deductions and plant and equipment depreciation can be applied to eligible components of the property - with deductions typically spanning 40 years for structural improvements and shorter effective lives for fixtures, fittings, and mechanical inclusions.

These allowances not only deliver immediate cash flow advantages, particularly in the early years of ownership, but also serve to improve net yield performance without altering tenancy conditions or operational costs.

The Trustee will offer liquidity events on a rolling 5 year basis where all investors will have the opportunity to sell or transfer Units should they elect to do so. The transfer or sale of Units will be subject to costs, which may include stamp duty and other Trust related fees.

Investors should treat the Trust(s) with a medium-term horizon of no less than five years. While the investment is illiquid and there is no secondary market for investor’s units, the Trustee intends to offer investors the opportunity to withdraw their investment on a limited basis. The amount available to meet a withdrawal request will be determined by the Trustee and subject to available funds.

AGEM is an investment manager specialising in providing investors with access to stable, low-risk commercial property investments delivering above market returns in the form of both ongoing passive income and long-term growth.

Since inception, we have established 38 unlisted property funds. Our current passive portfolio is delivering an average total return of 14.5% pa.

As co-investors in every Fund, our experienced and dedicated team is committed to the success of every asset.

How we’re different

Co-investment

First and foremost, our co-investment model sets us apart from other property investment groups. AGEM management and family always hold a significant portion of units in each of our assets, aligning our financial interests and fostering a genuine partnership with our clients. Currently, AGEM management and family hold an average of 44% ownership across our Funds.

De-risking and value creation – upfront

We focus on risk mitigation and value creation right from start – adhering to a strict mandate that ensures the income of any investment is sufficiently underpinned before proceeding.

Relationship-focused

Building strong relationships is at the core of our approach. We know each of our investors and partners personally, and prioritise open communication, trust, and collaboration.

Active asset management

As active asset managers, we proactively manage and enhance the value of your investments, ensuring optimal performance and returns.

Comprehensive control

We control every step of the property investment life cycle, from site selection to acquisition, management, and beyond, ensuring a seamless and efficient process. A key component of this is rigorous site review and due diligence - we conduct thorough evaluations, reviewing over 300 potential sites each year to identify properties with the greatest potential for value and growth.

Our people

AGEM’s team consists of experienced professionals who bring a wealth of expertise and knowledge to the table, making strategic investment decisions tailored to your financial goals.

Adrian founded AGEM Property Group in 2012 and has since led AGEM’s team of property specialists, spearheading the company’s long-term strategy and growing portfolio of commercial property investments.

Adrian is a respected figure in the real estate industry, known for his extensive industry network and expertise in deal origination and negotiation. He holds a Bachelor of Commerce (Accounting & Information Systems) from Edith Cowan University in addition to being a registered builder, qualified real estate agent and the licensee/authorised representative of the AFSL held by APG Finance Services Pty Ltd. Adrian brings a wealth of knowledge and experience to AGEM Property Group spanning all elements of property investment including acquisitions, leasing, development, divestment, structuring and project funding.

The importance Adrian places on quality relationships lies at the heart of AGEM’s success. He nurtures enduring partnerships and always strives to align objectives and generate mutual value and trust.

Ben leads the management of AGEM’s property portfolio, ensuring our assets perform well and our tenants are supported to succeed.

Ben brings over 15 years of experience in asset management, development, leasing and disposal across both public and private sectors. He’s equally analytical and practical and highly valued by our diverse network of partners for his collaborative and transparent approach.

Ben has a Bachelor of Commerce from Curtin University, a Diploma of Financial Planning from Kaplan Professional and attained his GAICD certification upon successful completion of the Company Directors Course with the Australian Institute of Company Directors (AICD).

News, knowledge and resources to support your passive income and investment journey. Click here to read more.

Yes, investors will accrue interest on their deposit. Funds will be held in an interest bearing account and all interest earned will be paid out, as a single distribution, when the balance of an investors funds are transferred (i.e. when an asset is acquired). Should investors elect not to proceed with their investment, interest will be returned alongside their original deposit.

The forecast interest rate during this Establishment Phase is approximately 3-4% pa but will vary subject to rates available through the nominated bank. Post Establishment Phase (i.e. following asset acquisition), distributions are paid quarterly within 15 days post quarter-end. For example, distributions for January–March (FYQ3) will be paid by the 15th day of April. If the 15th falls on a weekend or public holiday, distributions will be paid on the next business day.

No. At the time a target asset is placed under offer for purchase, a supplementary IM will be provided to each investor, which will provide details specific to the asset. Whilst an asset will only be placed under offer if it meets the core fundamentals outlined in this IM, investors have the opportunity to review the supplementary IM and decide whether to proceed or not. Should an investor elect not to proceed, they can keep their deposit in the Fund for a future opportunity or retrieve their deposit, in addition to accrued interest.

It is anticipated that the first asset originating from the Fund will be acquired within 3-6 months. Up to 2 additional assets may be acquired in this 12 month period. Total Establishment Phase is therefore 3 - 12 months.

Post Establishment Phase / asset acquisition (i.e. transfer of 100% of an investor’s funds) the investment should be considered illiquid with an investment timeframe of a minimum 5 years.

If an investor wishes to exit prior to the Fund’s five year anniversary, they can make their units available for sale to other unit holders within the Fund or external investors. This can be led by the individual or AGEM can assist in facilitating this by offering units to our investor base. Whilst we are able to help facilitate this option, there is no guarantee a suitable unit sale will occur. We are always happy to discuss your personal circumstances and will do our best to tailor a strategy to suit your needs.

Possibly, but it’s not likely. The Fund’s acquisition mandate has a specific focus and this will be the basis for the targeting and selection of assets. In any event, should an identified asset not meet all core fundamentals, but is still considered worthy of acquisition, investors will have the ability to review and consider prior to their full investment being transferred.

As with most property investments, risks include items such as interest rates, vacancy periods, tenant default and potential changes in economic conditions. Risks can impact both proposed distributions and an investor’s capital. Further information is provided in the Considerations & Risk section of this IM. Investors are strongly encouraged to seek their own independent financial advice before making any investment decisions.

During the Establishment Phase, investor deposits will be held in an interest bearing account. Once a target acquisition has been placed under offer, a supplementary IM will be provided and should investors wish to proceed, their deposit (in addition to the balance of the total investment amount) will be transferred to a dedicated Unit Trust that will own the underlying asset.

Any subsequent assets to be acquired will be done so via a separate Unit Trust, which an investor can choose to participate in, or not, at the time of acquisition.

Variations in interest rate assumptions can have a significant impact (positive or negative) on forecast returns. Whilst we continually monitor the macro-economic environment, we are not economists and use the average of Australia’s four major banks’ short-medium term forecast as the base for assumptions in our financial models. These are regularly reviewed and adjusted.

Interested investors should review the complete IM and seek their own independent financial advice.

To proceed, investors will complete the Registration of Interest Form and provide the investment deposit. Please contact Adrian Fiore or Jan Radu who can assist with next steps.

| Adrian Fiore | Jan Radu |

| MANAGING DIRECTOR | BUSINESS OPERATIONS MANAGER |

| adrian@agem.com.au | admin@agem.com.au |

Statutory Statement

This offer of scheme interests is available to wholesale clients only. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.