Comparison Data

1Performance

| 1 month | 3 month | 1 year | 3 year | 5 year | Since Inception | Inception Date |

|---|---|---|---|---|---|---|

| 1.56% | 4.4% | 4.72% | 8.65% | 10.15% | 9.8% | 31 May 2018 |

Fees

| Management Fee | Performance Fee | Morningstar Total Cost Ratio |

|---|---|---|

| 0.78% | - | 0.78% |

The Airlie Australian Share Fund provides an opportunity to access a highly experienced investment team with a proven track record of prudent, common-sense investing.

The fund will hold a concentrated basket of between 15-35 quality Australian listed companies – Airlie's best ideas. Maximum cash holding of 10% with an aim to be fully invested. The partnership between Airlie and Magellan offers Airlie’s experience in Australian equities with Magellan’s considerable expertise in operating and distributing retail funds for Australian investors.

The Fund is a registered managed investment scheme. The Fund has been admitted to trading status on the Securities Exchange under the Securities Exchange Rules (ASX: AASF).

An investment in the Fund may suit investors who are seeking a medium to long-term investment exposure to Australian equities.

The Fund primarily invests in the securities of Australian listed companies but will also have some exposure to cash and cash equivalents.

The Fund may also use exchange-traded derivatives, in a limited manner, for risk management purposes.

Asset classes and allocation ranges

The Fund’s assets are typically invested within the following asset allocation ranges:

| Asset Class | Investment Range |

| Australian listed securities | 90% - 100% |

| Cash and cash equivalents | 0% - 10% |

Significant Features

The Fund’s primary investment objective is to provide long-term capital growth and regular income through investment in Australian equities.

The Fund offers investors the opportunity to invest in a specialised and focused Australian equities fund. The Investment Manager’s broad investment philosophy is to build portfolios using a bottom-up investment approach with a belief that active management can produce significant wealth accumulation relative to passive management. The Investment Manager assesses companies in the investment universe on four key criteria: financial strength, quality of the management team, quality of the business and valuation.

Significant Benefits

Investing in the Fund offers investors a range of benefits, including:

- access to the Investment Manager’s investment expertise and a professionally managed Australian equities portfolio;

- access to a concentrated portfolio of attractive Australian listed companies; and

- participation in any capital appreciation and income distributions of the Fund.

Liquidity

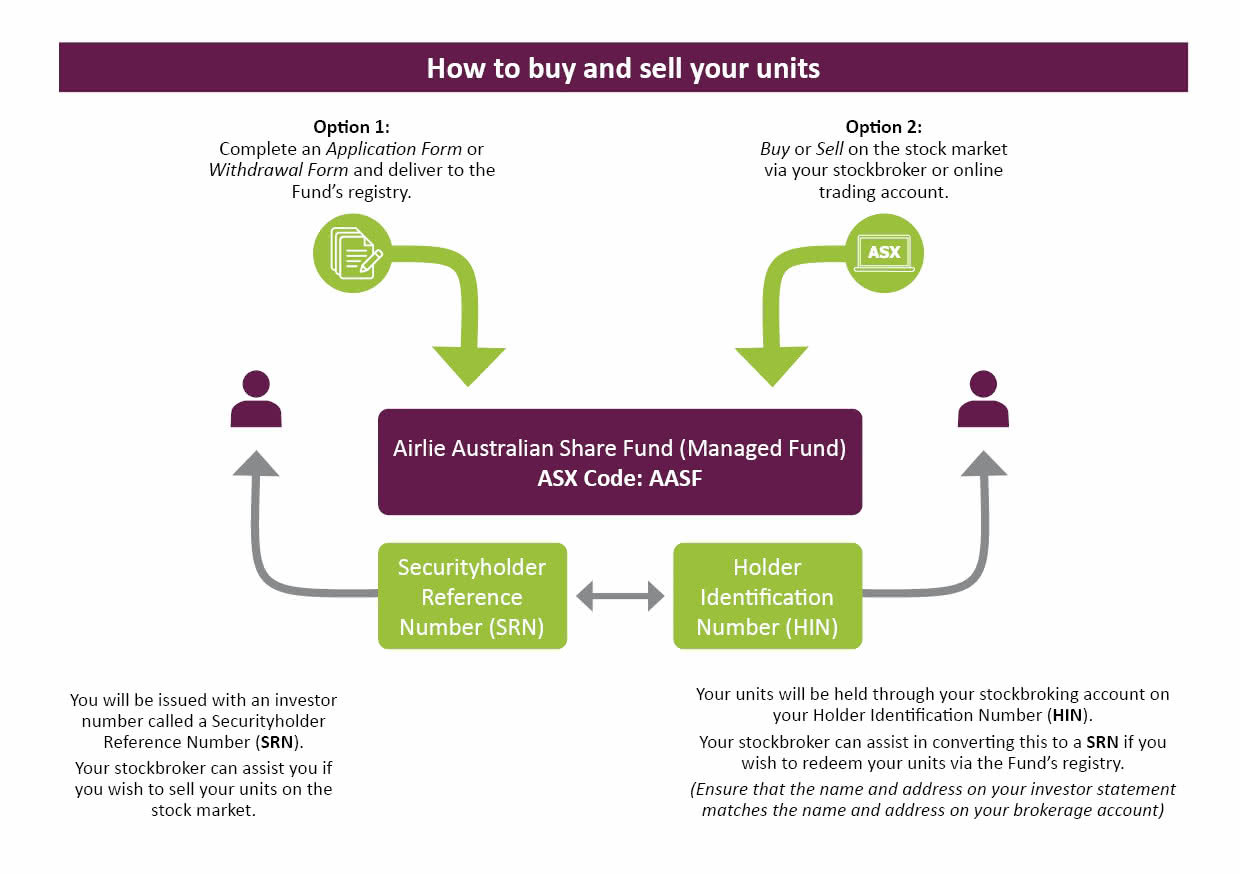

Investors can apply for or withdraw units directly with the Responsible Entity or can buy units from and sell units on the Securities Exchange (ASX) in the same way as any listed security.

Click here to view the latest performance details.

Magellan Asset Management Limited trading as Airlie Funds Management is the Responsible Entity and Investment Manager for Airlie Australian Share Fund.

As Responsible Entity, we are responsible for the overall operations of the Fund. Magellan is a wholly owned subsidiary of Magellan Financial Group Limited, which is listed on the Australian Securities Exchange (“Securities Exchange”).

Airlie is a specialist Australian equities fund manager which brings together some of Australia’s most experienced industry participants..

Airlie has an active investment style that aims to deliver attractive long-term capital growth and regular income to its investors. Founded in 2012 by industry veteran John Sevior and headquartered in Sydney, Airlie manages Australian equities for institutional and retail clients.

Magellan Asset Management ('Magellan') purchased Airlie in early 2018, providing retail investors exclusive access to Airlie's investment expertise through the Airlie Australian Share Fund (ASX: AASF) and more recently in March 2023, Airlie launched the Airlie Small Companies Fund.

Matt has over 20 years industry experience, he entered investment management in 1993 when he joined Perpetual Investments as an equities dealer. From there Matt progressed to be an equities analyst and portfolio manager.

From 2011 to 2015, Matt was Head of Equities at Perpetual. Since joining Airlie in July 2016 Matt has managed Australian share strategies for institutional clients and is a portfolio manager for the Airlie Australian Share Fund for retail clients.

Emma started her career in equity research in 2010 on the sell-side at Nomura, before joining Fidelity’s Australian investment team as an analyst.

In 2016 she joined Airlie as an investment analyst, before becoming the portfolio manager of the Airlie Australian Share Fund in 2018.

She holds a Bachelor of Commerce (Liberal Studies) from the University of Sydney.

Click here to view our latest Reports and ASX Releases

Make sense of the Australian investment landscape with timely investment updates, articles, videos and podcast interviews from Airlie's seasoned investment experts.

Click here to read the latest insights & resources.

Our portfolio managers share their expert insights as they reflect on the past year's market performance and provide their outlook for investors in the coming year. Click here to read our latest Investor Letters.

You have the choice of either buying units on the Securities Exchange (Ticker: AASF) via your stockbroker/online broker or applying directly with the Responsible Entity by sending an Application Form to our unit registry.

If you hold your investments via an investment administration platform, you should consult your financial adviser who will be able to assist you in investing in the Fund.

There are important differences between investing in the Fund through the Securities Exchange or by applying directly with the Responsible Entity, including the price you will receive. You should read the PDS before making any decision on how to invest in the Fund.

If you invest on the Securities Exchange there is no initial minimum investment amount.

If you invest directly with the Responsible Entity by sending us an Application Form, the minimum initial investment is A$10,000.

Additional investments can be made into an existing account at any time. No minimum applies for additional investments by BPAY. A minimum of $5,000 applies to other payment methods.

You can exit the Fund either by making a withdrawal request to the Responsible Entity using a Withdrawal Form or by selling units on the Securities Exchange (Ticker: AASF) via your stockbroker or online broker. How you enter the Fund does not affect the method by which you can exit the Fund.

There are important differences between exiting the Fund via the Securities Exchange or by withdrawing directly with the Responsible Entity, including the price you will receive. You should read the PDS or consult with your financial adviser before making any decision on how to invest in the Fund.

Your HIN or SRN can be found on the top right-hand corner of your holding statement and other shareholder communications. You will typically have a HIN if you bought your units on the Securities Exchange through a stockbroker. You will typically have an SRN if you applied for unit directly with the Responsible Entity.

A HIN is a Holder Identification Number issued by your stockbroker. It is a unique number used to link all your holdings, stocks, and shares, and not specific to just Magellan. A HIN is 11 characters long. It starts with an ‘X’ followed by 10 digits. For example X0001235898

An SRN is a Securityholder Reference Number issued by the Fund’s Unit Registry and is your unique identifier in the Fund. An SRN is 11 characters long and starts with an ‘I’ followed by 10 digits. Example: I00874500369. Your SRN will be stated on your first confirmation statement and partly masked for subsequent statements.

Yes, you may choose to automatically reinvest your distribution as additional units in the Fund regardless of how you acquired your units. If you wish to participate in the Distribution Reinvestment Plan (DRP), you can either update your election in the Unit Registry portal, available at magellan.mainstreamfs.com/login or complete the DRP Election Form located here.

The Fund charges a management and administration fee of 0.78% per annum.

Transaction costs may also apply - refer to the Product Disclosure Statement. All management costs described above are inclusive of the estimated net effect of GST.

The Responsible Entity intends that the Fund will make distributions on a half-yearly basis. The Fund may make distributions more or less frequently at the discretion of the Responsible Entity but will generally make a distribution to investors at least annually.

The Fund is an active stock portfolio that will generally comprise 15 to 35 securities at any one time. The Fund references the S&P/ASX 200 Accumulation Index for comparative performance measurement.

The Fund aims to have a cash or cash equivalents range of 0-10% but generally intends to be fully invested.

The Fund is an active, typically 25-stock, portfolio with a maximum limit of issued capital ownership of 15%. The Fund can hold a maximum of 15% of any one stock in the portfolio.

The Fund has been rated by Zenith (as at June 2022), Morningstar (as at August 2022) and Lonsec (as at September 2022). Please visit the individual research house's website to view the rating and full report.

Magellan Asset Management Limited (‘Magellan’) (AFS Licence No. 304 301) is the responsible entity, investment manager and issuer for the Fund. Magellan is responsible for the investment management of the fund via the Fund’s portfolio managers, Matt Williams and Emma Fisher, who are both employees of Magellan. Magellan is also responsible for the overall operations of the Fund including: distribution, compliance and risk management, reporting, marketing, operations and service provider management.

Magellan’s expertise in operating retail funds has enabled the retail market access to the Airlie investment team for the first time.

Tags

Published by Magellan Asset Management Limited

INFRASTRUCTUREMANAGED FUND

INVESTMENT THEMESALTERNATIVE INVESTMENTESG

TECHNOLOGYINVESTMENT THEMESINVESTOR EDUCATION

Published by Magellan Asset Management Limited

Statutory Statement

The issuer of this product is identified at the top of this page. The PDS and target market determination for the product are available in the Documents section of this listing. Prospective investors should consider the PDS before deciding to acquire the product. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

1 For use in Australia: © 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its affiliates or content providers; (2) may not be copied, adapted or distributed; (3) is not warranted to be accurate, complete or timely and 4) has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), subsidiary of Morningstar. Neither Morningstar nor its content providers are responsible for any damages arising from the use and distribution of this information. Past performance is no guarantee of future results.

Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at http://www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar's publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar's full research reports are the source of any Morningstar Ratings and are available from Morningstar or your advisor. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a financial advisor. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.