Australian Unity has established the Fund to generate long-term capital growth from providing strategic investment capital to address the key issues of Australia’s ageing population, rise of chronic and communicable disease, disability, mental health, and wellbeing, as well as seeking to address the shortage of social and medical infrastructure.

In doing so, the non-financial objective of the Fund is to enhance the real well-being of Australians via investment in preventative and remedial healthcare and health-associated businesses and assets.

The Fund seeks to achieve its objectives through investing in both public and privately held investments across a strategic set of asset classes being publicly traded equities, venture capital, private equity, social infrastructure, medical and health-related real estate and aged care.

The Australian Unity Future of Healthcare Fund comprises a stapled security of either Ordinary Units, Class A units or Wholesale Units in two managed investment schemes: Australian Unity Future of Healthcare Fund No. 1 for passive investments and Australian Unity Future of Healthcare Fund No. 2 for active investments (collectively, the ‘Fund’).

The primary objective is to generate long-term capital growth from providing strategic capital investment to address key issues of an ageing population, rise of chronic disease, disability, mental health and wellbeing and shortage of social and medical infrastructure in Australia.

The non-financial purpose is to enhance the well-being of Australians via investment in preventative and remedial healthcare services and health-associated businesses and assets.

The Fund leverages Australian Unity’s internal capability along with its strategic network in the identification of investment opportunities across the healthcare sector. The Fund’s strategic asset allocation (SAA) ranges are as follows:

The investment strategy for each of these asset classes is set out in Section 3 of the Information Memorandum.

Click here to view our current performance.

Investment philosophy

The Fund’s portfolio management team will create, structure, invest, actively manage, grow, realise and exit healthcare investment opportunities largely inaccessible to individual Australian investors to create and capture value, and generate growth returns.

The Fund focuses on investing into public and private markets, as well as real estate investments, which seek to add new technology, products, services or capacity to the healthcare system.

We strive to the be the market leader in healthcare investing and, through our efforts, to enhance the wellbeing of Australians by addressing the key issues of ageing population, rise of chronic disease, disability, mental health, and the shortage of social and medical infrastructure via our investments in preventative and remedial healthcare and health-associated businesses and assets.

We see the thematic of Australia’s ageing demographics combined with rising health care needs and costs as a long-term fundamental trend. Combining our heritage and mindset with this backdrop, we seek to apply the capital of the Fund in strategic investments with a long-term perspective to value. Our long-term mindset also means that the Fund may hold investments for a longer period than a venture capital or private equity investor, or a traditional portfolio manager investing in listed equities.

We view the investments that the Fund makes and the overall portfolio being a natural hedge for investors against the rising costs of healthcare and insurance as well addressing many of the challenges that will become increasingly prevalent in an ageing population including rise of chronic disease. Given the objectives of the Fund, the types of investments it makes and its long-term outlook, the returns of the Fund will primarily represent capital growth orientation rather than income.

We believe that ESG issues can have a direct impact on the risk and consequently value of our investments. ESG assessment is an integral part of our investment process and enhances our knowledge and understanding of a company’s management, culture and business strategy. This enables us to make better informed investment management decisions of behalf of our clients.

Our core beliefs that relate to how we will invest and strategically add value through the lifecycle of an investment are summarised below:

- Consideration of the risk and return attributes of the investment compared to the objectives of the Fund;

- Consideration of how the opportunity fits within its industry and the various elements of the industry structure, how the business model and attributes of the opportunity fit with the strategic purpose of the Fund;

- Review of key management expertise and track record where relevant;

- Acquisition strategy and competitive advantage;

- Consideration of growth prospects as well as downside scenarios;

- Review of key environmental, social and governance factors; and

- Consideration of the exit strategy.

Summary of the investment process

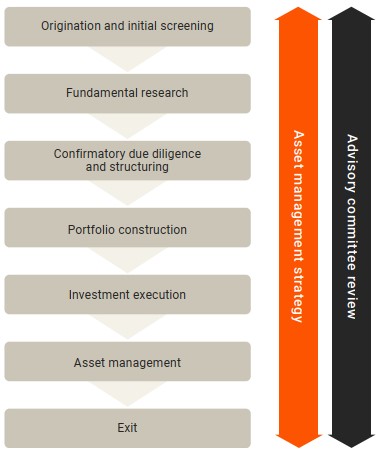

Investments may be sourced by the Portfolio Manager, from the Advisory Committee or the broader Australian Unity Group given its reach across property, health insurance, retirement living, and our broker, consulting and advisor networks. Once a potential opportunity is sourced, these prospective investments are subject to rigorous vetting through our investment process which includes:

The Australian Unity Future of Healthcare Fund comprises a stapled security of ordinary units in two managed investment schemes; Australian Unity Future of Healthcare Fund No. 1 and Australian Unity Future of Healthcare Fund No. 2. Units in Australian Unity Future of Healthcare Fund No. 1 and Australian Unity Future of Healthcare Fund No. 2 are issued by Australian Unity Funds Management Limited, ABN 60 071 497 115, AFS Licence No. 234454 (‘AUFM’). Information provided here is general information only and current at the time of publication and does not take into account your objectives, financial situation or needs. In deciding whether to acquire, hold or dispose of the product you should obtain a copy of the Information Memorandum and seek professional financial and taxation advice. For more information, please visit australianunity.com.au or call our team on the telephone number provided above. This information is intended for recipients in Australia only.

Australian Unity has a distinguished track record in providing innovative health solutions to its customers and members dating back to 1840, being one of Australia’s oldest member owned companies. Australian Unity’s ambition is to serve and enhance the wellbeing of members, customers and the community. Our unique breadth of in-house expertise and capability creates an opportunity to be the market leader in thematic based healthcare investing.

The Fund is a key component of the Australian Unity Group; a mutual organisation with a 180 year heritag.

Victor has over 27 years of health sector expertise in both industry and financial roles. Some of Victor’s standout achievements in the healthcare sector include:

- Developed the Audallion speech processor, the first commercial noise cancelling adaptive beamformer to improve hearing reception for Cochlear implant recipients. This technology is the foundation for super directional microphones and noise cancelling headphones;

- Invented, then led the development and commercialisation of the Pelorus Tissue Processor, which is currently widely used globally today for processing of biopsies. Victor’s patented method reduced time to diagnosis and improved laboratory safety removing the need to use cancer causing xylene. This product was core to the Australian export award winning Vision Biosystems suite which was the primary target of Danaher’s takeover of Vision Systems for $700 million in 2006;

- Co-founder and director of Austral Bionics Limited, developing a bionic eye;

- A director of BronchoDx, which is developing lung cancer detection equipment;

- Led the Australian Healthcare Equities Research team at Citigroup winning the Thompson Reuters Starmine analyst award in 2017; and

- Originated QIC Global Infrastructure’s first healthcare acquisition, Nexus Hospitals. Victor joined Australian Unity from a role advising QIC Global Infrastructure on healthcare investments and before that he spent eight years at Citigroup where he led the Australian Healthcare Equities Research team. Prior to Citi he was the General Manager and Chief Operating Officer at ASX listed medical device company, Sunshine Heart. Victor also had senior roles at Ventracor, Vision Systems as well as Cochlear. Victor holds a Bachelor of Mechanical Engineering (Mechatronics) from The University of Sydney and a Graduate Certificate in Management from The University of NSW.

Damian has 19 years’ experience in investment management and research of both listed and unlisted property securities as well as direct property.

Prior to joining Australian Unity, Damian managed various property securities funds during his time at Karara Capital and 360 Capital Group. Damian also has experience in managing several A-REIT and direct property funds having concluded an extensive 12-year career at APN Property Group.

Damian graduated with a bachelor’s degree in Commerce from Monash University, has completed the FINSIA Graduate Diploma in Applied Finance and Investment and holds a Diploma in Property Investment and Finance from the Property Council of Australia.

Sam is responsible for supporting the Portfolio Manager of the Fund. Previously Sam has assisted in the management of property, fixed interest, and diversified portfolios at Australian Unity. Sam holds a bachelor’s degree in Commerce (Finance and Economics) and a Master of Applied Finance from Kaplan Professional. In 2014, Sam was admitted to the Chartered Financial Analyst Institute as a charter holder.

Relevant Documents

You should read the PDS, TMD (if applicable) or any Investment Memorandum (or other offer documents) related to this product before making an investment decision. These documents (if available) can be found at https://www.australianunity.com.au/, or if this is a "wholesale investor only" investment, can be viewed by contacting the Product Issuer identified on the aforementioned website.

Statutory Statement

This offer of scheme interests is available to wholesale clients only. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.