Comparison Data

1Performance

| 1 month | 3 month | 1 year | 3 year | 5 year | Since Inception | Inception Date |

|---|---|---|---|---|---|---|

| 0.85% | 5.17% | 16.16% | 15.33% | 15.89% | 12.55% | 26 Aug 2014 |

Fees

| Management Fee | Performance Fee | Morningstar Total Cost Ratio |

|---|---|---|

| 0.99% | - | 0.99% |

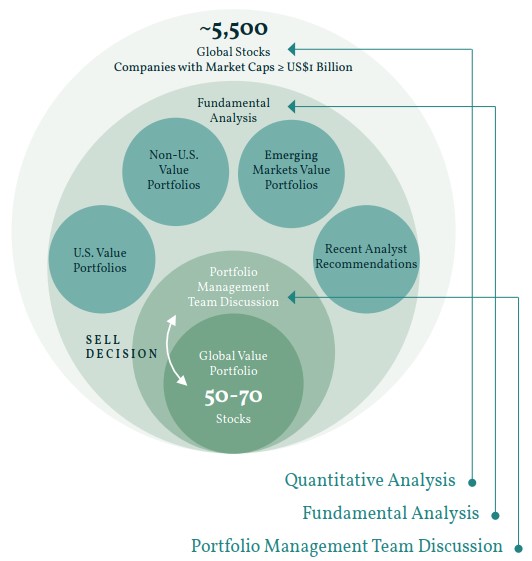

The Barrow Hanley Global Share Fund aims to provide investors with long-term capital growth through investment in quality global shares. It is managed by a team with deep experience in investing through multiple market cycles.

The consistent, repeatable investment process identifies companies across the globe and the market cap spectrum to exploit inefficiencies. This results in a well-diversified, high active share portfolio that provides asymmetrical returns by participating in up markets while protecting in down markets.

The Fund aims to provide investors with long-term capital growth through investment in quality global shares and to outperform the MSCI World Net Total Return Index (AUD) (before fees and taxes) over rolling three-year periods.

Barrow Hanley strives to achieve the Fund's investment objectives by adopting a value-oriented, bottom-up investment process focused on in-depth fundamental research to identify companies that trade below their intrinsic value for reasons that they can identify, believe are temporary and have a clearly identified path to achieving fair value.

Barrow Hanley aims to select the most attractive securities to construct a well diversified, high active share portfolio that provides asymmetrical returns by participating in up markets while protecting in down markets.

The portfolio will exhibit a clear value bias and seek characteristics such as:

- price/earnings ratios below the market,

- price/book ratios below the market,

- enterprise value/free cash flow ratios below the market and

- dividend yields above the market.

The Fund will primarily invest in companies incorporated in developed markets and may hold up to 20% of the portfolio in companies incorporated in emerging markets.

The portfolio has no direct tobacco stock exposure.

The currency exposure in the Fund is unhedged.

| Assets | Range % |

| Global Shares | 95 - 100% |

| Cash | 0 - 5% |

Click here for our latest Pricing and Performance

Perpetual Investment Management Limited has appointed specialist investment manager Barrow, Hanley, Mewhinney & Strauss, LLC (‘Barrow Hanley’) to manage the Barrow Hanley Global Share Fund.

Barrow Hanley is a diversified investment management firm offering value-focused investment strategies spanning global equities and fixed income. Barrow Hanley enjoys a boutique culture with a singular focus to assist clients in meeting their investment objectives.

Barrow Hanley strives to achieve the Fund’s investment objectives by adopting a value-oriented, bottom-up investment process focused on in-depth fundamental research to identify companies that trade below their intrinsic value for reasons that they can identify, believe are temporary and have a clearly identified path to achieving fair value.

Brad Kinkelaar joined Barrow Hanley in 2017. He previously served as an equity portfolio manager and head of dividend strategies at Pacific Investment Management Company (PIMCO).

During his investment career, Brad Kinkelaar served as a managing director and equity portfolio manager at Thornburg Investment Management and as an equity analyst at State Farm Insurance Companies.

Brad Kinkelaar earned a BS in Management and Marketing from Eastern Illinois University, where he graduated cum laude. He received an MBA in Finance from the Kellogg School of Management at Northwestern University.

Cory Martin joined Barrow Hanley in 1999. During his tenure at Barrow Hanley, he has been instrumental in the creation, development, and implementation of our Non-U.S. Value, Global Value, and Emerging Markets Equity strategies.

In 2017, Mr. Martin was named Barrow Hanley’s Executive Director and in 2019 he was named Chief Executive Officer and is responsible for the day-to-day management of the firm.

Prior to joining Barrow Hanley, Cory Martin served as a vice president at Templeton Investment Counsel, Inc. in Fort Lauderdale, Florida.

His career in the investment management industry includes serving as an institutional investment consultant at LCG Associates, Inc.

Mr. Martin is a member of the CFA Society in Dallas-Fort Worth . He graduated from Baylor University.

David Ganucheau joined Barrow Hanley in 2004 from Clover Partners, LP, where he served on the management team for several funds, including a financial sector fund.

Prior to his tenure at Clover Partners, Mr. Ganucheau served as securities analyst at GSB Investment Management, where he began career in the investment management industry.

Mr. Ganucheau graduated from Southern Methodist University with a BBA in Accounting and is a CFA charterholder.

TJ Carter joined Barrow Hanley in 2014 from Kingstown Capital Management, where he served as an analyst.

His prior experience includes analyst positions at Outpoint Capital Management and Highland Capital Management. TJ Carter began his career at Deloitte & Touche, LLP. He received a BSBA from the University of Arkansas and an MBA from Columbia Business School.

Click here to view our latest fund profile.

All investments carry risk. While it is not possible to identify every risk relevant to your investment, we have provided details of the risks that may affect your investment in the relevant product disclosure statement (PDS) or offer document.

Click here to view our continuous disclosure and PDS.

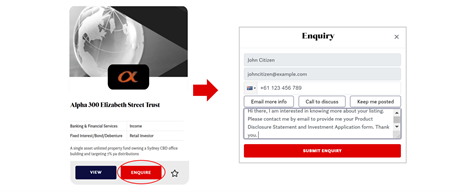

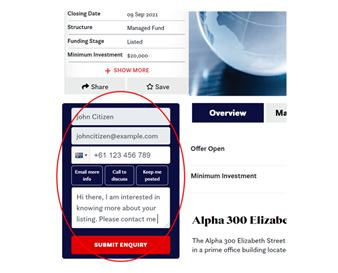

If you have joined Investment Markets (which is free) and verified your email address, you can send an email directly to us either by: -

- Selecting “Enquire” when viewing the card relating to the listing, OR

- By completing the enquiry form on the left-hand side when viewing the detail of a listing

We will respond using your preferred communication method (i.e., email or phone).

Statutory Statement

The issuer of this product is identified at the top of this page. The PDS and target market determination for the product are available in the Documents section of this listing. Prospective investors should consider the PDS before deciding to acquire the product. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

1 For use in Australia: © 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its affiliates or content providers; (2) may not be copied, adapted or distributed; (3) is not warranted to be accurate, complete or timely and 4) has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), subsidiary of Morningstar. Neither Morningstar nor its content providers are responsible for any damages arising from the use and distribution of this information. Past performance is no guarantee of future results.

Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at http://www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar's publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar's full research reports are the source of any Morningstar Ratings and are available from Morningstar or your advisor. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a financial advisor. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.