- Convenience-plus shopping centre with strong 96% occupancy

- Target net annual distribution of 6.07%

- Target Internal Rate of Return 11.35-12% after the first 7 years

- ASX listed anchor tenants Woolworths, Big W and Dan Murphy’s – all on long leases

- Strong WALE (by area) of 9.17 years

- The centre is located just 2.4km from Adelaide's CBD on a highly exposed corner allotment. The centre offers convenient parking and is well-served by public transport

- Construction completion in June 2015 with corresponding depreciation benefits of ~60%

- Large 4.4Ha land holding that offers development opportunities (one development application has already been lodged). Future development may result in additional returns to investors and is not relied upon in our current forecasts

|

Gross Asset Value |

$85,000,000 |

|

Classification |

Sub-regional Centre |

|

Net Lettable Area |

17,160sqm |

| WALE (By Area) | 9.17 Years |

| Major Tenants | Woolworths, Big W and Dan Murphy’s |

| Mini Major Tenants | Tony & Mark's and Direct Chemist Outlet |

| Speciality Tenants | 40 Specialties |

| Car Parking | 680 Vehicles |

| Centre MAT | $118 Million p.a. |

| Foot Traffic | 2.2M People p.a. |

FRP’s Asset Growth Strategy for Brickworks Marketplace is designed to increase the internal rate of return and maximise long-term capital value.

FRP will focus on strategic planning, active asset management, enhancing asset quality and prudent capital management to drive consistent fund performance and optimise growth opportunities.

The growth strategy for the Brickworks Marketplace will focus on:

- Proactive and aggressive leasing

- Tenant remixing to stay up-to-date with retail trends and customer preferences.

- Positive rental increase and percentage rent

- Reduce operating expenses through in-house property management

- Maximise solar energy to reduce operating outgoings and generate additional profit

With decades of experience across fund management, real estate, finance, acquisitions and property management, FRP provides quality investment opportunities through commercial property funds. We access, manage, develop and invest in non-discretionary and convenience retail assets that provide high cash flow yields, for medium to long-term holding.

We leave no stone unturned when it comes to acquiring, managing and developing commercial property and have grown our portfolio to over $250 Million in the past 8 years. With a focus on local and neighbourhood shopping centres, we manage 7 properties nationwide and have offices in Adelaide, Sydney and Perth.

Additionally, we currently have a $145M development pipeline which includes a neighbourhood shopping centre, 2 x childcare centres, large format retail and a medical centre.

Our commitment to our investors is to provide quality passive commercial property investment funds that deliver strong and secure income growth. We strive to maximise value across our portfolio through strategic asset acquisitions, development potential, proactive property management and effective capital management so that we can deliver superior returns.

The information has been prepared by FRP Capital as a general guide. It does not constitute an offer for sale, or solicitation for the purchase of securities, financial products or other investments. Investment returns are not guaranteed. Actual returns may differ from target returns for a range of factors including investment performance, taxation and indirect costs. It should not be relied upon to determine or to make decisions about the investment objectives financial situation or individual needs of any person. FRP Capital recommend investors seek professional advice before making a decision to invest. FRP Capital and its related entities does not make any representations nor give any warranties that the information contained within is or will remain accurate or complete at all times and they disclaim all liability for harm, loss, costs, or damage which arises in connection with the use or reliance on the information.

FRP Capital Pty Ltd ACN 643 942 116; Authorised representative of Commercial & Legal Securities Pty Ltd ACN 645 981 344, holder of AFSL License #538004

The FRP Capital team together possess decades of experience across investments funds, real estate, accounting, finance, acquisitions and property management. The experienced team is committed to delivering strong income and capital growth returns to their investors.

As one of the Directors at FRP, Ben leads the property acquisitions team, focusing on developing and executing FRP’s business plan.

Providing strong, and clear, leadership both internally and externally, Ben is always cultivating a culture of innovation for the organisation.

Ben continually sources quality investment opportunities by building key stakeholder relationships and long-lasting networks within the property sector.

With abundant finance and property experience, Adrian is also a Director at FRP.

Core to his role is building and maintaining relationships with key stakeholders, investors and industry networks. Also heading up the Capital raising division; Adrian’s direct approach, and open, and honest, communication style has been the source of his success over the years.

Through his considerable impact, FRP has successfully settled all projects entered into, which has built FRP’s strong reputation within the industry.

Of the Directors, Ross is responsible for managing the overall operation and resources of FRP Capital.

As the main point of communication between the board of directors and corporate operations, Ross has exceptional abilities in making strategic decisions.

With years of experience working across treasury and finance for the Commonwealth Government and high-net wealth individuals, he has successfully established property investment strategies over time and has built his own formula for success, which he now brings to FRP Capital and our entire client base.

Anthony brings with him a wealth of experience to his role as head of Investment Management and Acquisitions.

Anthony is responsible for driving acquisitions for FRP and works alongside the property and asset management team on the investment strategy for each asset.

Anthony’s experience and undeniable work ethic have made him invaluable to the team. Anthony, also oversees the FRP Perth business.

ome Text Here

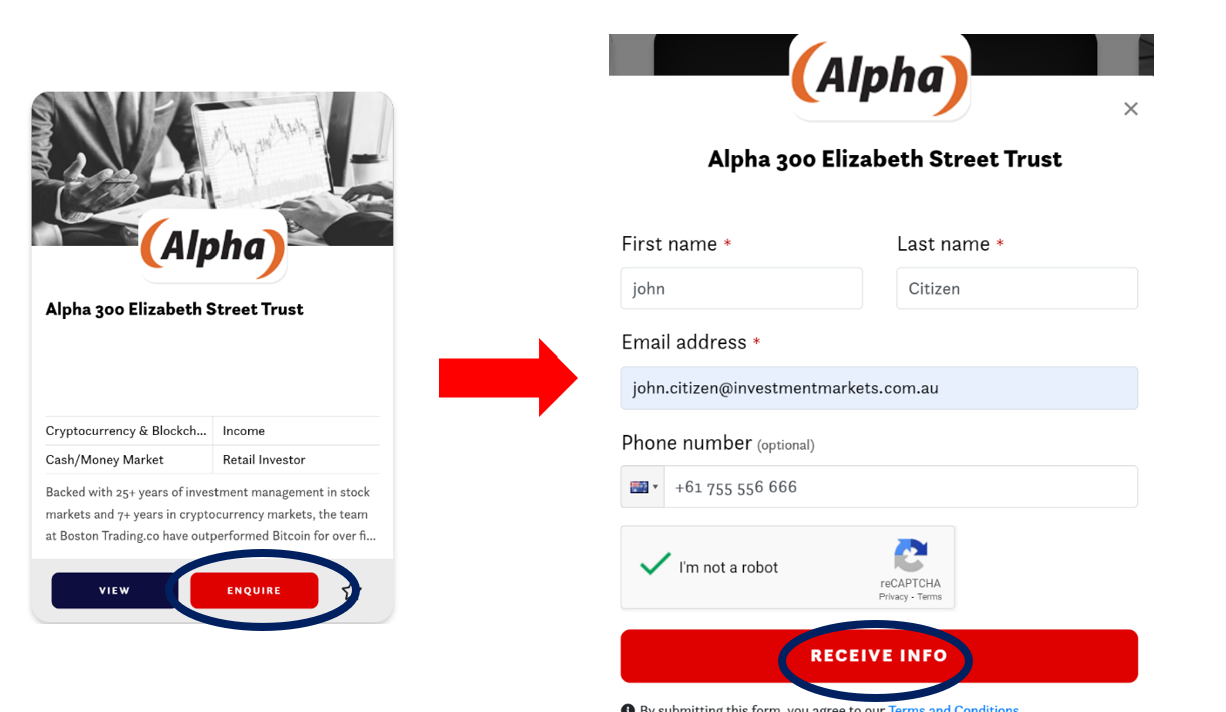

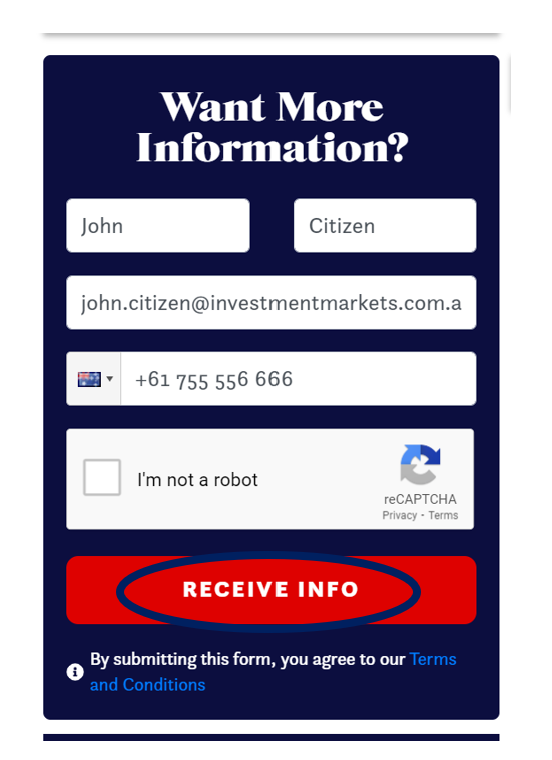

- By clicking the enquire button on the card view

Or

- By selecting “Receive Info” when viewing the listing

We will respond using your preferred communication method (i.e., email or phone).

Statutory Statement

This offer of scheme interests is available to wholesale clients only. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.