This is a “Master Fund – Sub Fund” arrangement where investment in this Master Fund is your gateway to participation in a series of exclusive Brightlands property opportunities carried in project-specific Sub Funds. The reason for the separation is investor protection.

Each Sub Fund quarantines investor money subscribed to a project and ensures that financial exposure is limited to that specific project as well as facilitates transparent accounting for profits earned.

In addition to this IM, you will be presented with a project-specific Supplementary Statement and the two are to be read as one document constituting an investment offer.

Following entry to the Master Fund you will authorise that your investment money be applied to a Sub Fund carrying the project of your choice and this will determine the size and timing of your returns.

The Trust will provide funds as equity or loans funds to selected property projects. It will look for strong returns and where loaned, financing rates charged will vary depending on the profile of the project and security offered.

What is being offered?

A series of Redeemable Preference Units in the Trust, each tied to a project-specific Sub Fund.

What are Redeemable Preference Units?

Redeemable Preference Units are a class of units carrying specific rights relating to priority payment of returns and return of capital.

Minimum investment

The minimum investment amount will be determined by project requirements and will be advised in Sub Fund Supplementary Statements Rate of Return The rate of return will be specified in Supplementary Statements.

Minimum Investment Period

The minimum investment period will be determined by the strategy associated with undertaking a project and will be specified in Supplementary Statements.

Redemption of Units

This is an illiquid investment. Exit is at the end of the minimum period.

The benefits to investors include:

- exposure to Australian real estate assets

- the ability to participate with smaller investment amounts

- leverage off Brightlands’ expertise, capability and track record

The Investment Committee recognises its fiduciary duty to act in the best interests of unitholders and ensure Fund resources are deployed to maximise unitholder value.

Starting with an initial borrowed investment of $5,000 in 2013, Edward has now completed twenty-two property projects with another five in progress and has built a significant property portfolio. These projects include the purchase and sale of the Katoomba Golf Club and adjoining 48 townhouse lots, a 67 room co-living project opposite Randwick racecourse and 70 bed accommodation offering in Muswellbrook.

Edward is also the founder and major investor of Belong Technology a leading technology platform for co-living, build2rent and affordable housing as well as the co-founder and major investor of Brightlands Retreat.

Additional Highlights:

- 2 x Olympian in the Modern Pentathlon (London 2012, Tokyo 2020)

- Winner of the World’s Longest Horse Race (Mongol Derby, 2017)

- Summited Aconcagua the highest mountain in the Southern Hemisphere (2016)

- Completed a 5-week 1,000km horse ride from Braidwood to Melbourne as an ambassador for the Black Dog Institute (2012)

- NSW Real Estate Agent License

- Bachelor of Commerce (Finance & Economics)- Sydney University

- Master of Commerce – Sydney University

Michael has over 35 years of diverse international real estate development, funds management, finance, and investment experience.

He has sourced, analysed, undertaken due diligence, managed closings, financed, undertaken planning and development for office, industrial, residential, and retail assets in Australia, China, India, Japan, Malaysia, South Korea, Indonesia, US, UK, Spain, France, Germany, and Russia.

Michael’s skills include:

Analysis, underwriting, and research skills were honed with Jones Lang LaSalle, Citibank (Sydney and London), London and Edinburgh Trust (LET, Hong Kong), Consolo Limited, Redwood (Japan and Singapore) and LaSalle Investment Management (LIM, Singapore).

Property Finance and Capital Structuring with Citibank in Australia for residential, commercial and mixed use development as well as land subdivision, in the United Kingdom where he financed a number of residential developments and office investments primarily in London and at LET, Consolo, Allianz and Redwood with financings for residential in Hong Kong, Noosa, industrial development and

investments in Moscow and Sydney, office and mixed use investments in Tokyo, Osaka, Jakarta, Singapore, Germany and Turkey.

Funds Management and Capital Raising experience commenced with Citibank in the UK where he launched 3 funds focused on residential refurbishment and development in London, office development in London, a diversified investment vehicle in Spain and established Citibank Real Estate Investment Management in Europe involving equity more than US$300 million.

In Australia A$350 million was raised in a fully underwritten Listed Property Trust for Allianz to invest in Europe and Turkey where he was the designated Fund Manager.

Raised US$250 million from institutional investors for property investments in Moscow and Tokyo for the Redwood Group.

Property Asset Management, Planning and Development Management with LET in Hong Kong he managed office developments in Hong Kong, Singapore, Jakarta and Bangkok and a retail scheme in Malaysia. He has also developed residential property in London and Sydney, land subdivision in Noosa, Dicky Beach, Melbourne, Sydney, and Brisbane (Australia), industrial development and planning in Sydney, Moscow, India, China, and South Korea.

This section has intentionally been left blank.

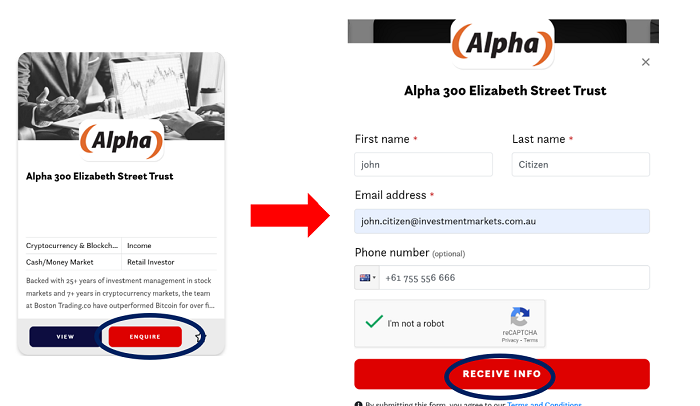

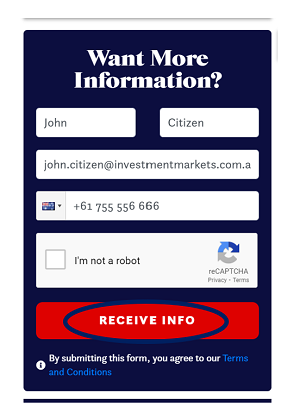

- By clicking the enquire button on the card view

Or

- By selecting “Receive Info” when viewing the listing

We will respond using your preferred communication method (i.e., email or phone).

Statutory Statement

This offer of scheme interests is available to wholesale clients only. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.