Comparison Data

1Performance

| 1 month | 3 month | 1 year | 3 year | 5 year | Since Inception | Inception Date |

|---|---|---|---|---|---|---|

| -0.68% | -1.07% | -3.65% | -11.14% | -3.01% | -2.56% | 21 Sept 2020 |

Fees

| Management Fee | Performance Fee | Morningstar Total Cost Ratio |

|---|---|---|

| 0.8% | 0.36% | 1.16% |

The fund is open to accept applications from Monday 24th July to Friday 18th August (4 weeks).

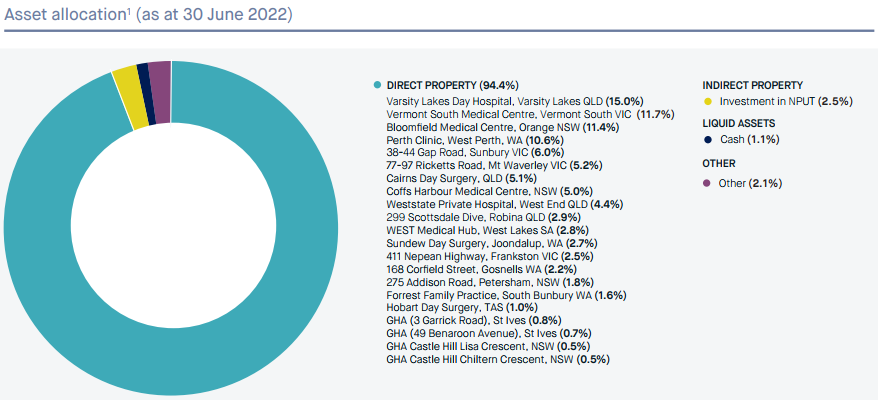

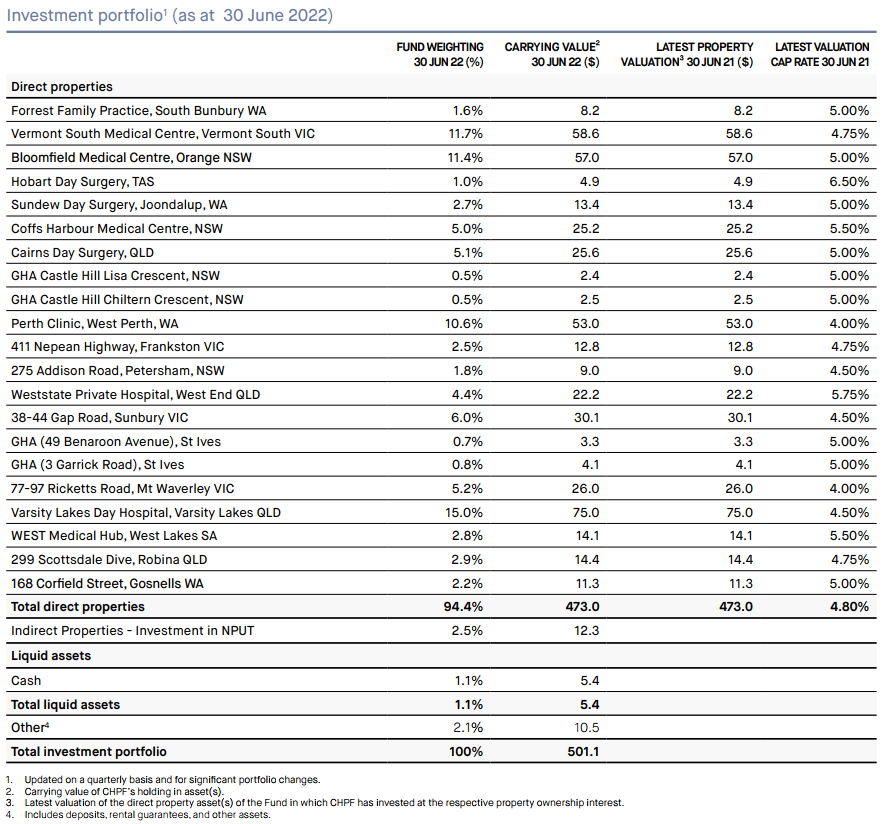

The Centuria Healthcare Property Fund (Fund) aims to provide monthly tax-effective income and long-term capital growth by investing in the healthcare sector underpinned by long term leases to a range of reputable healthcare operators.

The Fund invests across a range of healthcare properties, providing diversification by property type, healthcare sector, geographic location and tenancy mix. The Fund’s strategy is to own healthcare properties that have stable earnings profile with long-term leases to reputable healthcare operators. To assist with liquidity and returns, the Fund also holds cash, cash-like products and listed healthcare real estate investment trusts.

The Fund is a multi-asset, open-ended unlisted property fund investing in healthcare property\ both directly and indirectly (through other Centuria unlisted healthcare property funds), A-REITs, cash and cash-like products.

The Fund’s strategy is to:

Invest in a quality portfolio of strategically located Australian healthcare properties;

- Diversify the portfolio by location, property type, tenant and healthcare use;

- Own properties that have a stable earnings profile, with rental income underpinned by long-term leases with reputable healthcare operators;

- Adhere to a prudent capital structure and capital management strategy, with target look-through Gearing between 35% to 49%;

- Pursue acquisition, divestment and investment opportunities, utilising Centuria healthcare sector relationships and expertise; and

- Continue to assess Development opportunities, and where appropriate, undertake developments to increase the potential of the portfolio.

The Fund may acquire healthcare properties directly or by investing in other unlisted healthcare property funds. Please note, the Fund will only invest in other healthcare property funds managed by the Manager or a related entity. The Fund may also consider stapling the Fund with other Centuria healthcare funds.

|

|

Centuria Capital Group (ASX:CNI) is an ASX-listed specialist investment manager with a 35 year track-record of delivering a range of products and services to investors, advisers and securityholders. Centuria Capital Group has $20.2b in Assets Under Management (AUM). Our business is centred around property funds management and investment bonds.

Our business has two key areas of focus:-

- Centuria Property Funds which specialises in listed property funds (A-REITs) and unlisted property funds (including the Centuria Diversified Property Fund and Centuria Healthcare Property Fund); and

- Centuria LifeGoals Investment Bonds which deliver innovative solutions to help clients meet their investment goals.

The Managers, CPFL and Primewest, are wholly-owned subsidiaries of Centuria Capital Limited and part of Centuria, which has over $20 billion of assets under management. Centuria is highly regarded and experienced in real estate investment, managing real estate assets on behalf of retail and institutional Investors through a number of closed and open-ended funds and ASX listed A-REITs. Centuria has extensive experience in managing commercial and industrial property investments and a successful track record of delivering strong investor returns for over 20 years.

Andrew Hemming was appointed Managing Director of Centuria Healthcare in August 2013 and is responsible for the day-to-day leadership and management of Centuria Healthcare.

Prior to his appointment he was an Investment Specialist – Real Estate Funds with Folkestone Limited. Andrew has 17 years’ experience in investment markets with leading international financial institutions including HSBC, Merrill Lynch and BNP Paribas.

Andrew has received a Bachelor of Arts (Commerce) and Master of Business Administration from Macquarie University.

John joined the Centuria Board (formerly Over Fifty Group) on 10 July 2006. He was appointed as Chief Executive Officer of the Over Fifty Group in April 2008. John was also a founding director and major shareholder in boutique funds manager Century Funds Management, which was established in 1999 and acquired by Over Fifty Group in July 2006.

Prior to forming Century, John founded property funds manager Waltus Investments Australia Limited and Hanover Group Pty Limited a specialised property consultancy. Waltus was formed in 1995 and was one of the first dedicated property funds managers in Australia. Prior to 1990 John held senior positions in a number of property development and property investment companies in Australia, New Zealand and the United Kingdom.

John holds a Diploma in Urban Valuation (University of Auckland).

Jason became the Centuria Group Joint CEO in June 2019 after previously leading Centuria’s Real Estate and Funds Management business. Jason was also a founding director and major shareholder in boutique funds manager Century Funds Management, which was established in 1999 and acquired by Over Fifty Group in July 2006. He is an Executive Director of Centuria Capital Group. In his role he is responsible for providing strategic leadership and ensuring the effective operation of Centuria’s real estate portfolio and funds management operations.

Jason has extensive experience in the commercial property sector, with specialist skills in property investment and funds management. He is also a past President of the Property Funds Association (PFA), which represents the $125 billion direct property investment body in Australia and continues to serve on their national executive.

Jason holds a Bachelor of Commerce (Commercial Law) from the University of Auckland, New Zealand.

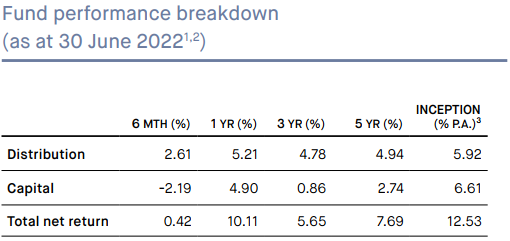

Monthly Factsheet - June 2022

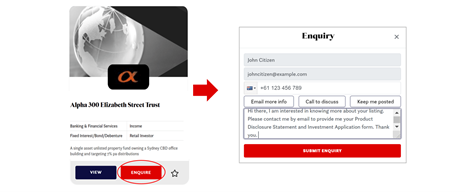

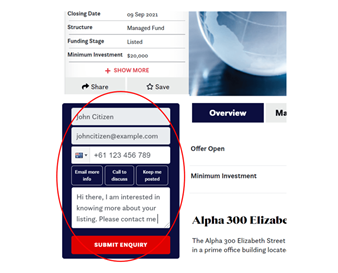

If you have joined Investment Markets (which is free) and verified your email address, you can send an email directly to us either by: -

- Selecting “Enquire” when viewing the card relating to the listing, OR

- By completing the enquiry form on the lefthand side when viewing the detail of a listing

We will respond using your preferred communication method (i.e. email or phone).

Tags

Statutory Statement

The issuer of this product is identified at the top of this page. The PDS and target market determination for the product are available in the Documents section of this listing. Prospective investors should consider the PDS before deciding to acquire the product. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

1 For use in Australia: © 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its affiliates or content providers; (2) may not be copied, adapted or distributed; (3) is not warranted to be accurate, complete or timely and 4) has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), subsidiary of Morningstar. Neither Morningstar nor its content providers are responsible for any damages arising from the use and distribution of this information. Past performance is no guarantee of future results.

Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at http://www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar's publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar's full research reports are the source of any Morningstar Ratings and are available from Morningstar or your advisor. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a financial advisor. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.