Comparison Data

1Performance

| 1 month | 3 month | 1 year | 3 year | 5 year | Since Inception | Inception Date |

|---|---|---|---|---|---|---|

| -1.39% | 2.02% | 5.36% | 8.93% | 9.52% | 10.43% | 18 Feb 2014 |

Fees

| Management Fee | Performance Fee | Morningstar Total Cost Ratio |

|---|---|---|

| 1.25% | - | 1.25% |

Claremont Global Fund (hedged)(ASX:CGHE) is an actively managed equity fund seeking to generate absolute returns of 8-12% per annum over 5-7 years by investing in a concentrated portfolio of high-quality, undervalued global companies.

The fund aims to outperform its benchmark by employing a fundamental, bottom-up investment approach.

Unlike its unhedged counterpart, CGHE aims to mitigate currency fluctuations through the use of derivatives, providing investors with exposure to international equity markets without the added currency risk.

As an Active Exchange Traded Managed Fund (ETMF), it offers the transparency and trading flexibility of an ETF combined with the active management expertise of a traditional fund.

- Cash weighting – maximum 10% of the gross asset value of the Fund.

- Single stock weighting – maximum 10% of the gross asset value of the Fund.

The Fund may be suitable for investors seeking to have an exposure to international equity markets outside Australia and the currencies of those international equity markets.

Recommended investment time frame

The minimum suggested time frame for investment in the Fund is 5 to 7 years.

Applying and withdrawing from the Fund

Investors can buy and sell Units in the Fund by either:

- Securities Exchange: Transacting on the Securities Exchange via a broker and using your HIN;

- Unit Registry: By sending a completed Application Form and associated identification documents to the Fund’s Unit Registry along with payment for the purchase of units or by completing an online application form, available from the Claremont Global website. Investors can exit the Fund by sending a withdrawal request to the Unit Registry for processing; or

- IDPS: Investors can also invest in the Fund through an IDPS operator.

An Active ETMF is actively managed by a fund manager. Active ETMFs operate in a similar way to traditional managed funds but have the benefit of transparent, live intra-day pricing and T+2 settlement.

Active ETMFs allow simplicity in investing as you invest simply through the ASX with lower minimum investment amounts compared to traditional unlisted managed funds. Investors also have the benefit of seeing live trading prices, a full disclosure of the portfolio on a quarterly basis and the ability to buy and sell intraday on the ASX.

Click here to view our latest Performance details.

Claremont Global is a boutique fund manager located in Sydney, Australia. We run a high conviction, fundamental strategy and only invest in international equities. Our evidence based and rigorous bottom-up approach allows us to identify the world’s best companies. If these businesses satisfy our specific criteria and strict valuation methodology the team will consider to invest in them for the long term.

Claremont Funds Management is a single strategy investment manager of the Fund.

Claremont Funds Management has an investment team of four investment professionals who, as at 30 June 2024, collectively manage over $1.4 billion of funds.

Bob is a seasoned investor in global markets and has been refining his quality growth process for more than 29 years.

Zimbabwean born, Bob has lived and worked in Africa, the UK and Australia. He started his career with Anglo American and Fleming Martin in Africa, before joining Seilern Investment Management in London in 2002 as a Portfolio Manager and Head of Research.

He joined the strategy in 2012 as Senior Research Analyst and in 2017 was appointed Head of Claremont Global and co-Portfolio Manager.

Bob leads Claremont with an egalitarian approach, empowering the team to individually play to their strengths within a highly collaborative environment.

He holds a BA in Politics and Economics from the University of West Australia and is a CFA Charterholder.

Adam has more than 25 years’ experience in financial markets, having previously worked as an analyst and Portfolio Manager with UBS’s Fundamental Investment Group and at a London-based, absolute return fund. In the earlier stages of his career, Adam worked in investment banking at Credit Suisse First Boston, and at UBS in Sydney and London, advising on mergers and acquisitions, and capital raisings.

Adam joined Claremont Global in 2017, as co-Portfolio Manager with Bob Desmond.

He has a Bachelor of Commerce, majoring in Finance (Honours) from The University of Melbourne.

Chris is Mexican born and has more than 14 years’ experience in equity research. He joined Evans & Partners in 2011 as Investment Analyst where he covered Australian equities.

Chris joined Claremont Global in 2018.

He holds a Bachelor of Finance from La Trobe University and a Master of Applied Finance from Monash University.

Luke joined the Claremont Global team in 2017 and has more than 6 years’ experience investing in global markets.

He has completed a Bachelor of Engineering (Honours) majoring in Civil Engineering and a Bachelor of Commerce majoring in Finance from Monash University. He is a CFA Charterholder.

Click here to view our ASX Announcements.

Click here to view our latest Reports.

Click here to view our latest Insights.

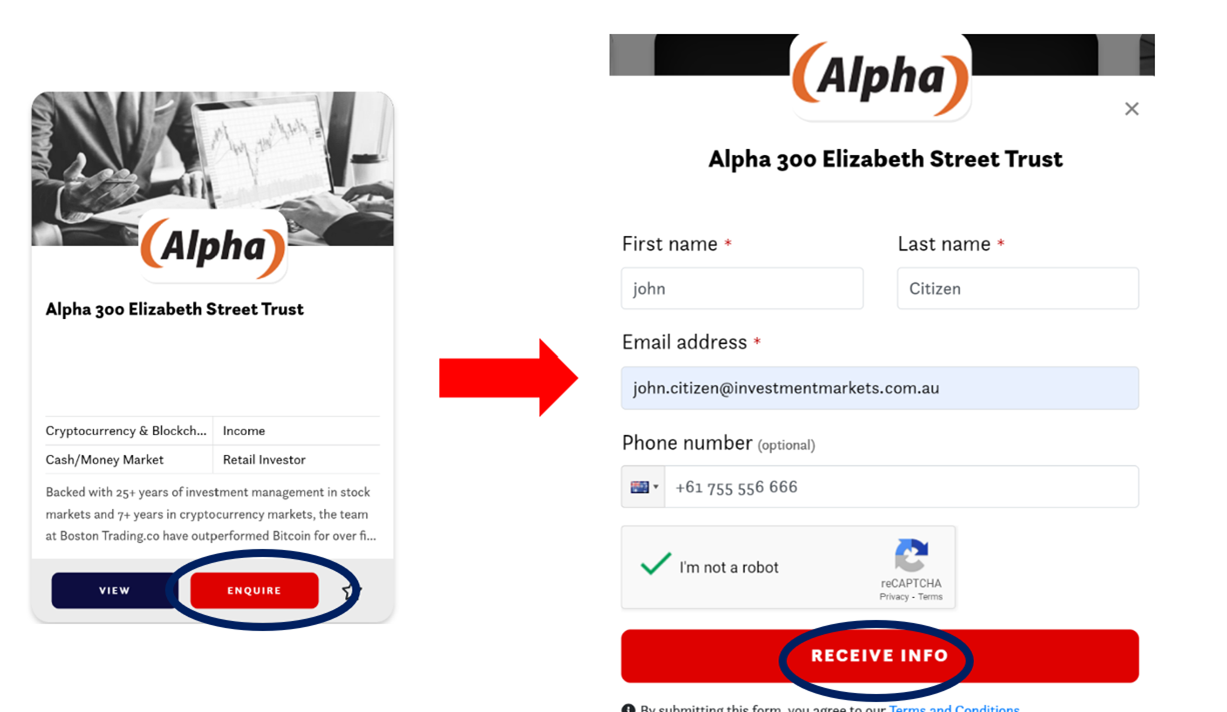

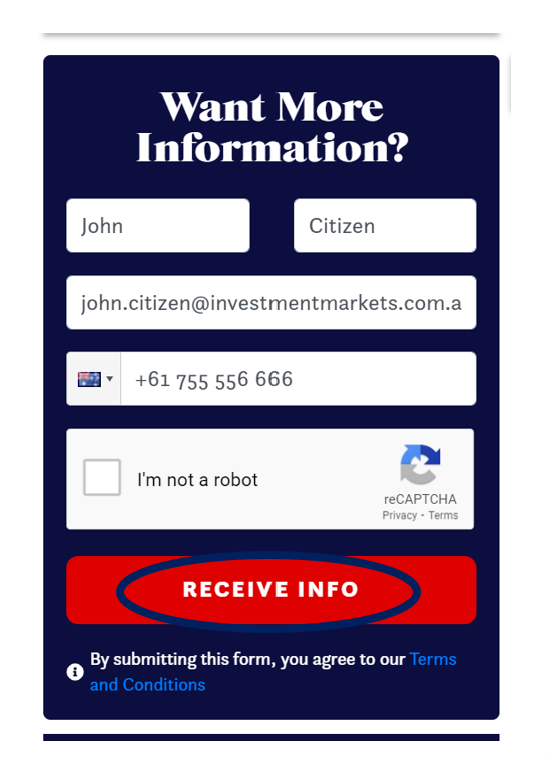

• By clicking the enquire button on the card view

Or

• By selecting “Receive Info” when viewing the listing

We will respond using your preferred communication method (i.e., email or phone).

Statutory Statement

The issuer of this product is identified at the top of this page. The PDS and target market determination for the product are available in the Documents section of this listing. Prospective investors should consider the PDS before deciding to acquire the product. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

1 For use in Australia: © 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its affiliates or content providers; (2) may not be copied, adapted or distributed; (3) is not warranted to be accurate, complete or timely and 4) has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), subsidiary of Morningstar. Neither Morningstar nor its content providers are responsible for any damages arising from the use and distribution of this information. Past performance is no guarantee of future results.

Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at http://www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar's publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar's full research reports are the source of any Morningstar Ratings and are available from Morningstar or your advisor. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a financial advisor. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.