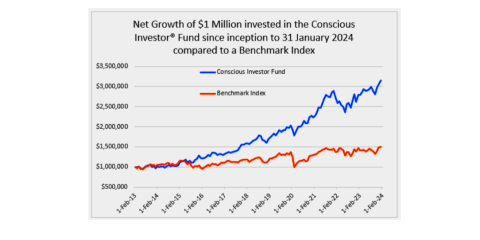

The Conscious Investor® Fund is a wholesale fund focussed on finding long-term value through investing in quality business.

Its rigorous approach is scientific and conservative.

Style

A long-term disciplined approach to investing based on a proven investment technology and a verified investment methodology.

Objective

Consistent careful long-term wealth creation, through capital growth and income.

Resources

Conscious Investor® software and the Teaminvest investment methodology form the quantitative and qualitative spine of our investment framework - https://www.teaminvest.com.au/

Investments

The Fund’s mandate is investing in ASX and Internationally listed securities.

Highlights

- Proprietary Conscious Investor® software rigorously scans the entire Australian share market plus 25 overseas markets to find quality businesses with a proven track record of stable business growth with clear prospects for this continuing

- Teaminvest methodology classifies and weighs the risks of potential investments, and assesses their ongoing economic strengths.

- Systematic methods evaluate whether the board and senior management are acting honestly, rationally and in the best interests of shareholders.

- Scientific proprietary valuation methods calculate the price to pay, with a margin of safety, to secure an attractive return based on a full evaluation of the company.

- Fixed dollar fees mean that as your investment balance increases, your fees as a percentage of your total investment declines: there are also no management fees based on funds under management.

- A success fee for performance above an absolute return hurdle: our business is aligned with your success.

Conscious investing is a unique way of bringing proven and advanced investment technology together with a verified investment process to find quality, stable investments that are likely to provide attractive returns.

Strict analysis + wisdom

Put simply, the way the Fund invests is special, involving two intertwined steps:

Conscious Investor® and the Teaminvest investment methodology work together to give a fresh approach to long-term returns through investing in quality companies.

Quality companies

The Fund primarily invests in quality Australian as well as overseas listed securities. Cash holdings would usually be minimal. The intention is to be fully invested apart from a limited amount for settlement or withdrawals. If there are insufficient quality investments at suitable prices, we may have a larger cash position while waiting for investment opportunities that meet the stringent checklist of the Fund. See the section How we invest for more details.

Patient investing

Our goal is consistent long-term wealth creation, through capital growth and payment of income over a rolling five-year time horizon. We are not active traders and will aim to hold stocks for the longer term.

Volatility

We seek investments with less volatile business behaviour. So the Fund has a focus on investments with a proven track record of stable business growth which show good prospects for this continuing. Price volatility, something altogether different from a stable business and generally a function of market factors, will always be present. We see this as bringing attractive purchase opportunities by allowing desirable companies to be bought at particularly low prices.

Diversification

There is no set minimum or maximum number of stocks. We expect that the Fund will hold around 15 to 30 investments representing approximately 90% or more of the value of the portfolio. We do not intend to compromise portfolio quality and performance potential by diversifying for the sake of diversification.

Derivatives

We do not use derivatives for investment purposes.

Borrowing

We do not borrow for investment purposes.

Click here to see our latest Performance details.

Not your typical managed fund…

The Conscious Investor Fund is based on a simple yet effective philosophy: to invest in ‘WealthWinners®’ – quality companies that have proven business track records, and a management that is hard-working, capable and honest.

How are we different?

Most funds’ mandates virtually force them to invest in the biggest companies; we only invest in the best. We aim to generate consistent long term wealth creation, through capital growth and payment of income.

We use Conscious Investor®, a proven 4th generation software technology which identifies great companies and the price that should be paid to secure an attractive return with a margin of safety.

Our profits are aligned with yours: You keep the first 6% and 80% of everything above that. We hold regular investor update briefings so you know exactly what’s happening with your money.

Who runs the Fund

The team managing and supporting the Conscious Investor® Fund consists of a unique blend of investment experience, dedicated professionalism, business knowledge and number-crunching research skills. It is a hands-on team.

The Capital Allocation Team

The members of the Capital Allocation Team represent a broad range of experience and skills in business development, hands-on business strategy and operation, business and financial analysis, and mathematical examination of large-scale company databases:

- Stephen Harrison, Chairman, is a seasoned investment professional with many years of leading financial services experience.

- Howard Coleman, CEO, is responsible for the development of the Teaminvest investment methodology used by the Fund.

- Dr John Price, Director of Research, is the brains behind the Conscious Investor® software used by the Fund.

- Michael Stewart is an experienced investor known for his logical and thorough research into potential investments.

Stephen has over 35 years’ experience in the financial services, funds management, private equity and accounting fields. He has held Director positions with Investec Funds Management and the Australian subsidiary of US based fund manager Sanford C. Bernstein. Prior to that he was National Director, Financial Services for BDO, Chartered Accountants.

Stephen has held directorships and consulting positions with listed and unlisted companies both in Australia and overseas. He is currently Chairman of two other Public companies, NobleOak Life Ltd, and Incentiapay Limited (ASX listed). Stephen is a founding director of Conscious Capital Limited.

Qualifications: BEc, CPA

For over 30 years Howard has started and built companies in the areas of consumer finance, education, language and mathematics in Australia, South Africa and the UK.

Howard’s extensive business background and experience means that he has the ability to hone in on the strengths and weaknesses of companies. This particularly applies to identifying their future risks, and the ability and strategies of the board and senior management to deal with them.

He has regularly presented strategic business and financial workshops with a focus on CEOs and senior management of medium sized companies.

Howard is a graduate of the Harvard Owner/President Management Program and completed the Australian Institute of Company Directors’ program for company directors. He is a director of a number of companies and has won many business awards including the prestigious Speaker of The Year Award from The Executive Connection.

Howard is a founding director of Teaminvest and of Conscious Capital.

Qualifications: BSc, OPM

John started his 40-year career as a research mathematician with positions in major universities around the world. After publishing two books and over 60 papers in peer-reviewed journals in mathematics, physics, and finance, John set a research objective to understand the best investment methods of Benjamin Graham, Warren Buffett, John Burr Williams, Peter Lynch and other leading investors.

He personally programmed, tested, and compared over 30 different stock-valuation methods in his search for the best of the best. This led to the development of Conscious Investor®, which his company has sold around the world for the past eleven years and which is now part of Teaminvest. It also provided the background and research for his acclaimed book The Conscious Investor® and the establishment of this Fund. Recently John teamed with Howard to publish To balance and help focus his number crunching, John swims in the ocean every day and practises Transcendental Meditation®.

John is a director of Teaminvest and a founding director of Conscious Capital.

Qualifications: MSc, PhD

Michael studied at the Royal Military College and the University of Queensland culminating in an MBA in economics and marketing. He credits his thirteen years in the Army with giving him a firm foundation in logical decision making for all areas of life.

From running his own company after the Army, Michael gained insight into looking at companies of all sizes from the perspective of an investor and business owner. He is an avid believer in the principles of finding the highest quality companies with the best management to invest for the long term.

Michael is known for his ‘uncommon-sense’, practical investing suggestions and thorough investigation into companies. He is very robust in following the proven philosophy and methodology of the Fund aimed at great returns while minimising risks. When discussing companies for the Fund,

Michael brings great focus through his attention on companies he already owns or would be prepared to invest in at a fair price based on future earning’s growth.

When not mulling over investment opportunities, Michael can be found on the hockey field, tennis court and enjoying time with his family.

Qualifications: BA, MBA

For over 30 years Mark has started, built and sold companies in the areas of retail, sales, marketing and loyalty programs in Australia and Asia. Mark’s company has built pro-cessing infrastructure in Hong Kong and Australia. For instance, he designed, set up and managed 26 credit-card reward programs for banks including ANZ, Westpac, HSBC Hong Kong, and GE Capital.

Currently his company processes over 4 million MasterCard accounts for programs including Coles and Harvey Norman.

This extensive background gives him a unique hands-on understanding of marketing IT-based services. When not analysing businesses, Mark can be found playing competitive tennis, trekking in Nepal or ice climbing in New Zealand.

Mark is a founding director of Teaminvest and Teaminvest Private.

Click here to view our latest Fund Updates.

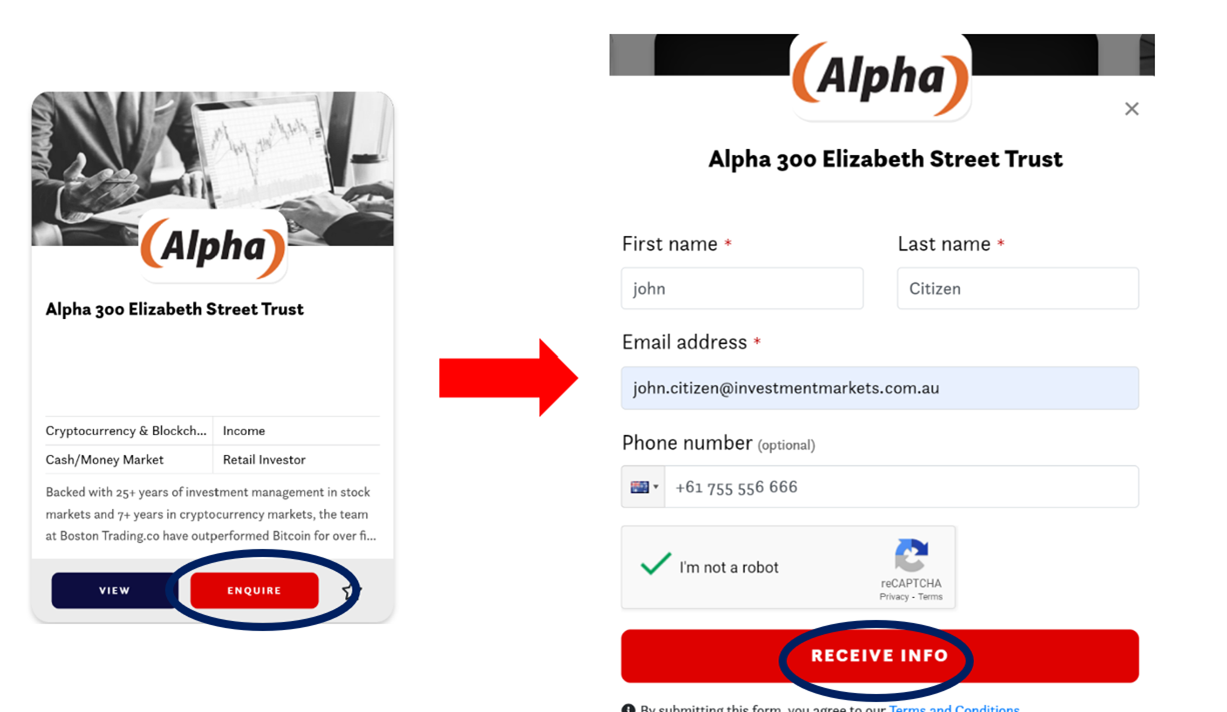

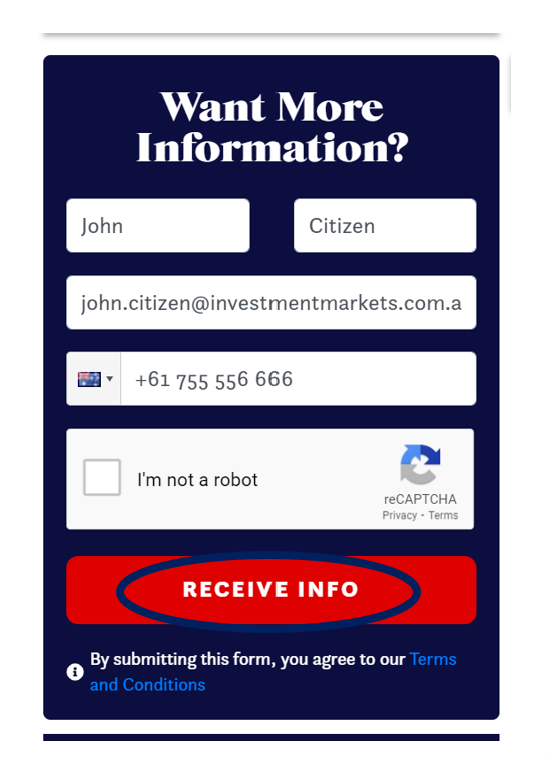

• By clicking the enquire button on the card view

Or

• By selecting “Receive Info” when viewing the listing

We will respond using your preferred communication method (i.e., email or phone).

Tags

Published by Teaminvest Pty Ltd

MANAGED FUND

MANAGED FUND

SHARESINVESTOR EDUCATION

Published by Teaminvest Pty Ltd

Statutory Statement

This offer of scheme interests is available to wholesale clients only. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.