Comparison Data

1Performance

| 1 month | 3 month | 1 year | 3 year | 5 year | Since Inception | Inception Date |

|---|---|---|---|---|---|---|

| -0.42% | 3.99% | 21.97% | 13.63% | 7.95% | 6.51% | 8 Aug 2012 |

Fees

| Management Fee | Performance Fee | Morningstar Total Cost Ratio |

|---|---|---|

| 1.03% | 0.01% | 1.51% |

Cor Capital is focussed on a single registered managed investment scheme, the Cor Capital Fund. The Fund is commonly used as an alternative asset within a broader strategic asset allocation or as a standalone absolute return investment. Tailored mandate solutions can also be managed for larger clients.

The investment objective of the Fund is to maximise the total return (income plus growth) above the consumer price inflation (change in CPI) over rolling 3-year periods without generating a negative return over any 12-month period.

Differentiated investment alternatives are difficult to find but when discovered, can improve the alignment of portfolios with investor goals, whether that be with regard to the timing of their commitments, or their more or less conservative nature.

The Cor Capital Fund therefore seeks to protect and grow real wealth with less risk of capital draw down, filling the void between cash deposits and longer-term or less-liquid investments such as stocks or real-estate.

In order to compound returns with improved odds of success over periods shorter than those used for traditional strategic asset allocation, a specially designed approach is required. Rather than betting on the accuracy of specific forecasts or predictions, we invest across a carefully selected range of asset classes, capitalising on time-tested behavioural, mathematical and market principles to achieve incremental returns in excess of the average constituent, particularly during periods of heightened market volatility.

Asset class returns, in our opinion, are largely driven by changes in expectations of economic growth and inflation. That said, economic and market outcomes are uncertain; changes to expectations are unpredictable for practical investment purposes. Surprises are common and have an underappreciated influence on long-term asset class returns.

However economic and market outcomes are not arbitrary; while very different in nature and critically consequential to investor wealth, the range of possible scenarios is limited.

Because the behavioural responses of general market participants to each outcome are somewhat predictable, real positive medium-term returns can be achieved by doing the following:

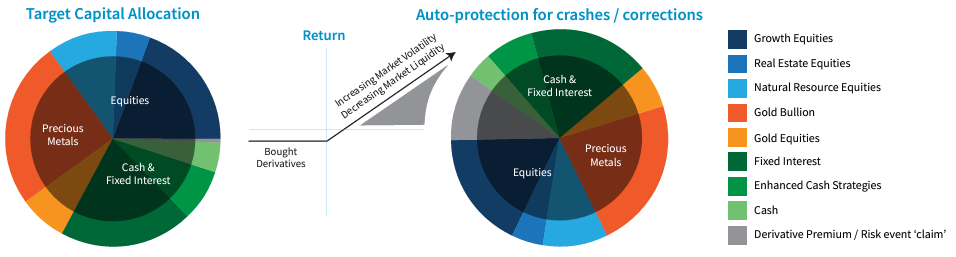

- Diversifying broadly across the main growth and inflation risks (assumption: every asset class has its day)

- Rebalancing risk regularly (assumption: making contrarian adjustments adds to returns)

Similar ‘permanent portfolio’ approaches have been employed for decades in the United States and Cor Capital has operated an Australian-based version of the strategy since 2012. Designed as a more robust alternative to generating positive medium-term returns, Cor Capital has enhanced the general approach for Australian investors including:

- Adding selective asymmetry to certain asset classes

- Focussing on volatility capture throughout the portfolio

- Optimising for friction costs

- 100% systematic / rule-based implementation

The Cor Capital Fund portfolio is constructed in line with our Investment Philosophy of i) diversifying broadly across the main growth and inflation risks (every asset class has its day) and ii) rebalancing risk regularly (making contrarian adjustments adds to returns).

Highly intuitive and robust to origin or regime, it involves matching asset classes to highly consequential but opposing economic and market forces. For example: aggressive monetary policy, unintended policy consequences, carry bubble, carry crash, real economic growth.

We believe this macro-level design and ongoing management process increases the likelihood of portfolio growth across a broad range of environments, whether evolving slowly or explosive in nature.

Asset class returns are driven by changes to expected future outcomes

|

Asset Class |

Favourable Environment | Unfavourable Environment |

|

Equities |

Strong economic growth Increasing confidence Falling discount rate |

Strongly increasing inflation Outright deflation Low confidence/High anxiety |

|

Fixed Interest |

Moderate growth |

Strongly increasing inflation |

|

Cash |

Tight credit environment |

Strong Inflation |

|

Precious Metals |

Rising inflation rates Outright Deflation Falling investor confidence Low real interest rates |

Rising confidence |

- Defensive first – Cash, Bonds and Precious Metals (AUD) combine to underscore capital preservation and purchasing power

- Growth via diversified equity exposure improves risk adjusted returns and outperformance relative to market index

- Risk Insurance via bought derivatives portfolio adds to defensive / long volatility characteristics (e.g. stock index put options, gold call options, USD call options)

- Non-correlation is more reliable between broad asset classes (e.g. gold bullion / equities) than specific exposures (e.g. US defensive / growth stocks), enabling more efficient return from active re-balancing and volatility capture

Click here to view our latest Performance details.

Established in 2012, we are an independent investment management firm based in Melbourne, Australia. Our firm is 100% privately owned, the majority by staff.

We specialise in managing and further developing our proven multi-asset investment strategy via the Cor Capital Fund. The genesis of our business was in response to the need for an uncomplicated but robust and liquid absolute return investment alternative in the post-GFC environment.

To that end, we invest across equities, fixed interest, precious metals, and cash markets, systematically combining asset classes (unconventionally) into a growth solution that minimises medium-term drawdowns.

Why Cor Capital:

- Straightforward investment philosophy

- Defensive focus

- Alternative return sources

- Disciplined, rules-based approach

- Experienced team

- Proven track record

- Strong alignment of interests with investors

Our name ‘Cor’ is the Latin word for heart. It reflects the value we place on authenticity and underscores the importance of the capital we manage on behalf of our investors.

Davin established Cor Capital in 2012 to focus solely on the management of the Cor Capital Fund. Prior to Cor Capital, from 2006 to 2011 he served as a Director in the Wealth Management division of UBS Australia.

He has 20+ years’ experience in stockbroking (UBS and Citigroup) and funds management (Merlyn Asset Management) serving institutional and private clients on both a discretionary and advisory basis.

Davin has undergraduate and post-graduate qualifications in finance and is a Fellow of the Financial Services Institute of Australasia.

He is the Portfolio Manager of the Cor Capital Fund with overall responsibility for the investment strategy and its implementation.

Tom joined Cor Capital in 2012. He was previously a Managing Director and Asia Pacific Head of Credit Suisse HOLT (2001-2010), leading teams based in multiple markets and advising institutional investment managers and hedge funds on global stock selection.

Prior to joining Credit Suisse, Tom was Managing Director of HOLT Value Associates Global Securities. He also held a variety of positions over 13 years at Merrill Lynch.

Tom holds a bachelor’s degree in economics and finance, and attained adviser and principal-officer accreditations across key developed markets in Australasia, Europe and North America.

Mark joined Cor Capital in 2023 and has 25+ years’ industry experience.

Prior to joining Cor Capital, Mark was a Key Account Manager at Ellerston Capital with responsibility for growing adviser relationships and identifying business development opportunities.

Mark previously spent 3 years at MLC Life Insurance assisting with its transition in ownership from NAB-owned MLC to Nippon Life. Previous roles have included National Key Account Manager at NAB Wealth / MLC and Director, Business Development, at UBS Global Asset Management.

Mark began his career as a financial adviser and has completed a Diploma of Financial Planning.

Matt joined Cor Capital in 2016 to manage the operating business’s IT and finance functions.

He has previously worked in the UK on regulatory risk, finance and IT development projects. His roles have varied from Financial Controller, Project Manager to Data and Risk Analyst. Throughout his 20+ year career, Matt has worked for Royal Bank of Scotland, ANZ, NAB, Liberty Syndicates Insurance and KPMG among many others.

Matt acquired a Bachelor of Commerce degree and Chartered Accountant designation in the 1990s. He has also recently acquired a Diploma in IT and is a Prince2 Project Management Practitioner.

Click here to view our latest Monthly Report & Fact Sheet.

Click here to view our latest News & Media.

If you require any further information, please click here.

Statutory Statement

The issuer of this product is identified at the top of this page. The PDS and target market determination for the product are available in the Documents section of this listing. Prospective investors should consider the PDS before deciding to acquire the product. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

1 For use in Australia: © 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its affiliates or content providers; (2) may not be copied, adapted or distributed; (3) is not warranted to be accurate, complete or timely and 4) has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), subsidiary of Morningstar. Neither Morningstar nor its content providers are responsible for any damages arising from the use and distribution of this information. Past performance is no guarantee of future results.

Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at http://www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar's publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar's full research reports are the source of any Morningstar Ratings and are available from Morningstar or your advisor. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a financial advisor. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.