Comparison Data

1Performance

| 1 month | 3 month | 1 year | 3 year | 5 year | Since Inception | Inception Date |

|---|---|---|---|---|---|---|

| 1.86% | 17.54% | 11.08% | 17.53% | 7.76% | 8.74% | 10 Oct 2019 |

Fees

| Management Fee | Performance Fee | Morningstar Total Cost Ratio |

|---|---|---|

| 0.65% | - | 0.65% |

The Elm Responsible Investments (ELMRI) ANZ Conviction fund invests in innovative growth companies that are striving for positive change and delivering social and environmental outcomes, whilst also aiming to achieve strong returns for investors.

We invest in Australian and New Zealand listed securities, typically in mid and large cap companies that are included in the S&P/ASX 300 Index. We may also invest in securities expected to list on an Australian or New Zealand exchange within 18 months. If a security changes its listing from an Australian or New Zealand exchange to another exchange, and if the Fund already has a holding in that security, we may continue to invest in that security.

The ELMRI ANZ Conviction fund aims to outperform the S&P/ASX 300 Accumulation Index (Benchmark) on a net fees basis. We have a long-term investment horizon of 5-7 years, taking concentrated long-only positions without reference to the Benchmark. Therefore the returns of the Fund may differ significantly from the returns of the Benchmark. We are not permitted to invest in derivatives, borrow cash, or short-sell securities. We employ a fully invested strategy, with a low cash balance.

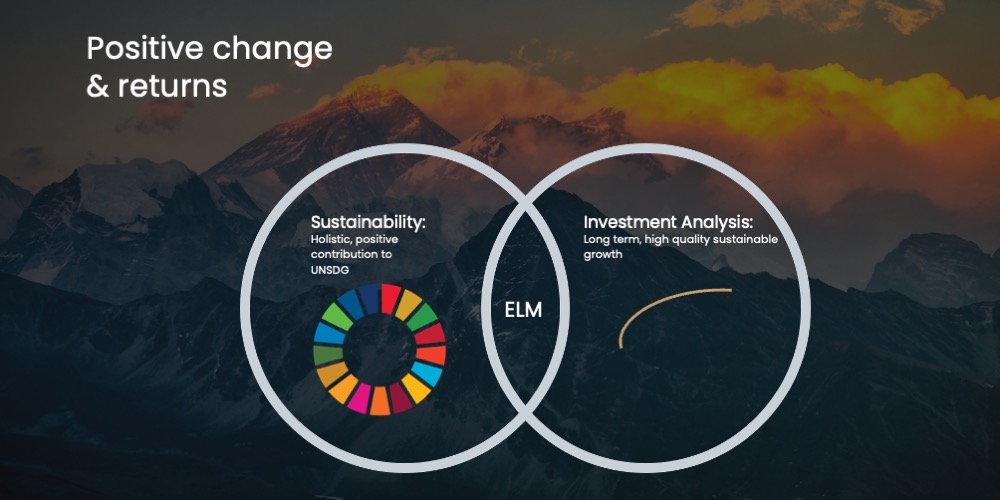

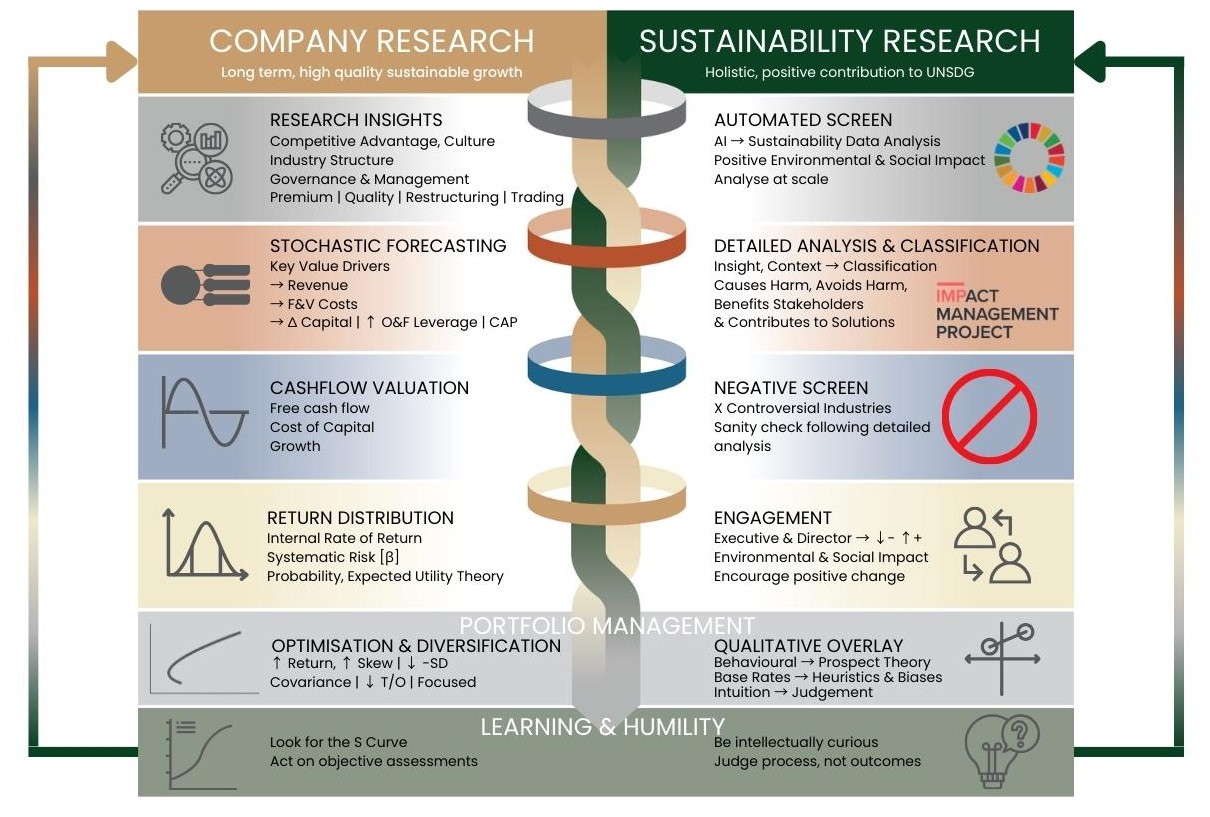

Our strategy is to identify stocks following ELMRI’s proprietary Investment and Sustainability Frameworks. The Investment Framework is focused on identifying high-quality companies with compelling investment return prospects. The Sustainability Framework is guided by the United Nations Sustainable Development Goals (UN SDGs) and focuses on identifying companies that make a positive contribution to the environment, society and all other stakeholders.

By following these frameworks, we believe we can construct a portfolio that targets strong returns for clients whilst also investing in companies that facilitate the transition to a more sustainable future.

We incorporate fundamental research, behavioural finance and empirical evidence into our investment process to build a concentrated portfolio (typically 10–30) of high-quality local companies underappreciated by the broader market: companies we believe are the most likely to deliver strong long-term returns.

Our Investment Framework (outlined below) helps us identify such companies, and construct a portfolio that is best placed to outperform the Benchmark.

- We first identify high-quality companies by focusing on their operational performance, with a particular focus on management and culture, industry structure and sustainable long-term competitive advantages.

- We then analyse a company’s financial performance by looking primarily at return on capital, free cash-flow generation and growth. The financial performance is an output of the operational performance, and helps us compare the operational quality of each company in our universe.

- Once a company is deemed high quality, we draw a road-map for how further shareholder value could be created and realised by the market. We look to various valuation methodologies including DCF, EV/EBITDA, EV/Sales, P/E (at both stock and industry levels), but an explanation of how a re-rating could occur is more important than the absolute valuation. We call this the Value Opportunity.

We only invest if we can identify and articulate the Value Opportunity.

- We still incorporate Environmental, Social and Governance (ESG) factors into our Investment Framework as we believe that companies that have leading ESG policies (governance in particular) are more likely to create value for shareholders.

- We refer to data and studies to guide our research efforts and help evolve our process.

- We maintain a long-term investment horizon, behave like business owners and manage a concentrated portfolio of companies. We are not stock traders.

Our multi-step Sustainability Research Framework helps us identify the most impactful companies.

In order to narrow the vast universe of publicly listed companies to only the most impactful ones, we start with an AI Powered Screen.

With automation, we lose context… so to delve deeper, our Analysts are guided by the results from the AI powered screen to conduct further analysis. The analysis is based on the Impact Management Project’s (“IMP”), considering the impact achieved across five dimensions: What, Who, How Much, Contribution, and Risk.

After considering the five dimensions, we can then classify each company along a spectrum of impact: Causing Harm, Act to Avoid Harm, Benefit Stakeholders, Contribute to Solutions.

We target approximately 10–30 positions, with no reference to the Benchmark.

Although we seek to diversify across sectors and geographies, our priority is to invest in our highest conviction ideas, which may mean that we have a concentrated exposure to some industries and no or low exposure to others.

Each individual position size ranges typically from 1–20% of the portfolio value. Our largest position is typically 15–20% of the portfolio value, but the investment will need to have numerous and deep sustainable long-term competitive advantages, backed by strong and improving financial results, a strong management team and culture, and a clear, low risk and significant Value Opportunity on offer.

The smallest positions are typically 1–2% of the portfolio value and are usually a way for us to learn more about a given opportunity before we take a more meaningful position, or exit the position.

Alternatively if a company exhibits only a few favourable attributes and also elevated risk, we may choose to invest at the low-end of the weight spectrum. There are other investments that fall between the typical maximum and minimum levels.

Renewable Energy, Employment & Education, Software & Services, Biotechnology, Medical Devices, Digital Wallets, Health Technology, Property & Social Infrastructure, Housing & Sustainable Building Products

This note has been prepared by ELM Responsible Investments (‘ELMRI’) ABN 70 607 177 711 AFSL 520428, for Australian wholesale clients for the purposes of section 761G of the Corporations Act 2001 (Cth).

The information is not intended for general distribution or publication and must be retained in a confidential manner. Information contained herein consists of confidential proprietary information constituting the sole property of ELMRI and its investment activities; its use is restricted accordingly.

This note is for general informational purposes only and does not purport to be comprehensive or to give advice. The views expressed are the views of the writer at the time of preparation and presenting and all forecasts, assumptions, opinions, data and other information are not warranted as to accuracy or completeness and are subject to change without notice. This is not an offer document and does not constitute an offer or invitation of investment recommendation to distribute or purchase securities, shares, units or other interests to enter into an investment agreement. No person should rely on the content and/or act on the basis of any material contained in this note. Any potential investor should consider their own circumstances and seek professional advice.

ELMRI funds, its directors, employees, representatives and associates may have an interest in the named securities.

Past performance is for illustrative purposes only and is not indicative of future performance.

ELM Responsible Investments founder Jai Mirchandani is responsible for our investment research and portfolio management. Previously at JCP Investment Partners, for nine years Jai was a Portfolio Manager and Senior Research Analyst overseeing the JCP Benchmark Insensitive Australian Equities Strategy, and responsible for stock research across various industries.

Prior to JCP, Jai was an investment banker in London, and has experience trading and structuring equity and derivative strategies in Melbourne.

He holds Bachelor of Commerce and Bachelor of Science degrees, with a Major in Biochemistry from The University of Melbourne, and a postgraduate degree in MSc Accounting and Finance from The London School of Economics.

Some Text Here

Brian Johnson is an Investment Adviser to ELM Responsible Investments.

He has over 25-years’ investment and financial markets experience at Goldman Sachs (Tokyo, New York, London, Melbourne and Sydney), Iress, CBA, Westpac, First Sentier.

Brian has qualifications from Pace University, UNSW and AICD.

Michael Fitzsimmons is an Investment Adviser to ELM Responsible Investments, with a particular focus on investment process and quantitative modelling.

He has over 30-years’ industry experience, and was one of the founders of JCP Investment Partners, working with Jai managing the JCP Benchmark Insensitive Australian Equities Strategy.

Michael has qualifications from La Trobe University and FINSIA.

Click here for our latest June 2023 Quarterly Report.

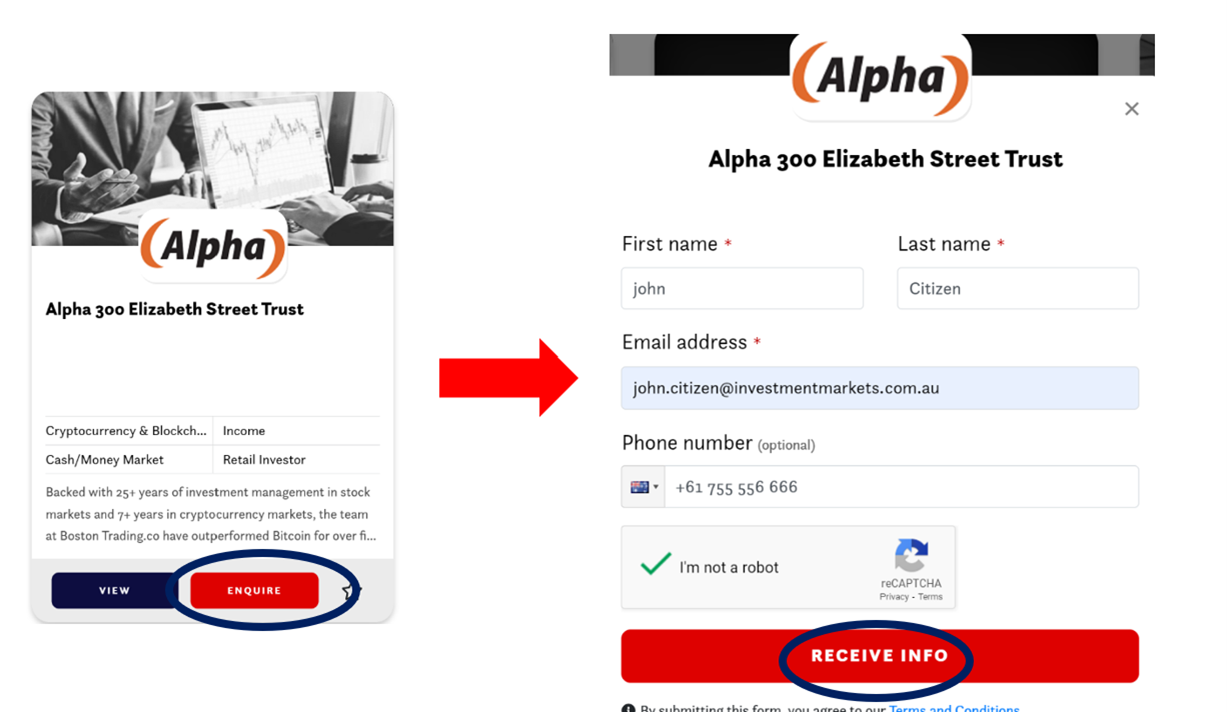

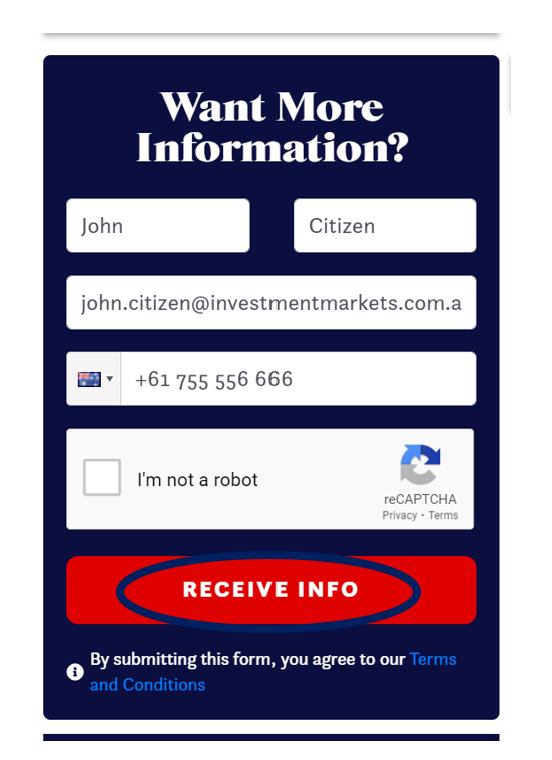

• By clicking the enquire button on the card view

Or

• By selecting “Receive Info” when viewing the listing

We will respond using your preferred communication method (i.e., email or phone).

There are many benefits to investing in sustainable companies as part or all of your overall investment strategy. They include:

- A considered investment strategy aligns your investments with your values, promoting companies and causes you believe in.

- By investing in companies developing solutions to many global challenges we face today (including climate change, inequality and biodiversity), you can provide capital and help facilitate the transition to a more sustainable future.

- Many impactful companies are also innovative companies with significant growth potential.

- Investing in sustainable companies can reduce your own reputational risks.

Sustainable investing can offer a dual advantage: financial growth and the satisfaction of positively impacting the world.

The investment team at ELMRI have decades of experience managing funds for large institutions. We apply an evidence-based portfolio construction process focused on delivering long-term returns. Furthermore, every company we consider is assessed through our intensive investment framework, and a clear pathway to shareholder value creation must be identified for us to take a position.

More broadly, research is emerging showing that sustainable investing strategies equal, and sometimes outperform, the market as a whole. For example, Morgan Stanley found that “there is no financial tradeoff in the returns of sustainable funds and traditional funds” and that “sustainable funds may offer lower market risk.”

(Source: https://www.morganstanley.com/ideas/sustainable-investing-competitive-advantages)

0.65% per annum plus GST of the Net Asset Value of the Fund, payable quarterly in arrears directly out of the Fund.

The performance fee is 25% (+ GST) of the Fund’s out-performance of the Benchmark. The benchmark is the MSCI World Accumulation Index in AUD. A high water mark applies.

Statutory Statement

This offer of scheme interests is available to wholesale clients only. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

1 For use in Australia: © 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its affiliates or content providers; (2) may not be copied, adapted or distributed; (3) is not warranted to be accurate, complete or timely and 4) has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), subsidiary of Morningstar. Neither Morningstar nor its content providers are responsible for any damages arising from the use and distribution of this information. Past performance is no guarantee of future results.

Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at http://www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar's publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar's full research reports are the source of any Morningstar Ratings and are available from Morningstar or your advisor. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a financial advisor. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.