The Fund offers units in different Classes of Units, which differ in their investment opportunities, targeted returns and risk profiles. The five Classes of Units offered under this PDS are the:

- Gyrostat Absolute Return Income Equity Class or Class A Units

- Gyrostat Leveraged Absolute Return Income Equity Class or Class B Units

- Gyrostat Risk Managed Australian Equity Class or Class C Units

- Gyrostat Risk Managed Hong Kong Equity Class or Class D Units

- Gyrostat Risk Managed Global Equity Class or Class E Units

Each Class has differing risk-return characteristics, but all Classes are based on the ‘dynamic hedging’ risk-managed approach with protection always in place. Each class is backed by a Class-specific pool of assets and liabilities held on a segregated basis.

We offer two absolute return funds, non-correlated with the stock market.

Class A is our flagship fund. Blue chip shares with protection for retiree income. This is specifically designed to address sequencing risk with a downside tail always in place for gains on large market falls.

Class B is a leveraged version, with a focus on greater returns with less risk protection.

We also offer three index funds, Gyrostat Risk Managed Australian (Class C), Hong Kong (Class D), and Global (Class E) designed to outperform their specific benchmark index over rolling 12 months by avoiding large losses through the complete investment cycle.

- Distinctive thinking: Absolute returns and income with protection always in place (dynamic hedging).

- Non-correlated returns in rising and falling markets.

- Regular quarterly income class A BBSW3M + 3% (currently 6.6% pa; class B BBSW3M +6% (currently 9.6% pa).

- Dynamic hedging risk management: Protection always in place adjusted with market moves (not set and forget).

- Daily liquidity and no locks ins.

- Track record of returns increasing with market volatility (‘changing’ markets since Jan 2022).

- Class A Units: Designed to increase in value on major Australian market falls (downside protection always in place) with regular income through the complete investment cycle Low correlation to the Australian market.

- Class B Units: Designed to produce higher income (compared to an investment in the Class A Units) through the complete investment cycle (downside protection always in place) In contrast to the Class A Units, Class B Units may not necessarily gain from major market falls Low correlation to the Australian market.

- Class C Units: Designed to outperform the Morningstar® Australia Index™ over rolling 12 months whilst mitigating against major losses on large Australian market falls (downside protection always in place).

- Class D Units: Designed to outperform the Morningstar® Hong Kong Index™ over rolling 12 months whilst mitigating against major losses on large Hong Kong market falls (downside protection always in place).

- Class E Units: Designed to outperform the Morningstar® Global Markets Index™ over rolling 12 months whilst mitigating against major losses on large global equity market falls (downside protection always in place).

Hurdle Rate

- Class A Units: BBSW 90 plus 3% p.a.

- Class B Units: BBSW 90 plus 6% p.a.

- Class C Units: Morningstar® Australia Index™

- Class D Units: Morningstar® Hong Kong Index™

- Class E Units: Morningstar® Global Markets Index™

Minimum Initial Investment

- Classes A, B and C Units: $5,000 AUD

- Class D Units: $50,000 HKD or the USD equivalent amount or the AUD equivalent amount, if accepted by the Responsible Entity

- Class E Units: $5,000 USD or the AUD equivalent amount, if accepted by the Responsible Entity

- 1.1% p.a. of the NAV (denominated in AUD) for the Class A Units

- 1.4% p.a. of the NAV (denominated in AUD) for the Class B Units

- 1.1% p.a. of the NAV (denominated in AUD) for the Class C Units

- 1.1% p.a. of the NAV (denominated in HKD) for the Class D Units

- 1.1% p.a. of the NAV (denominated in USD) for the Class E Units

15% of the increase in the Net Asset Value of the Relevant Class of Units (denominated in the relevant currency of the Class) above the Hurdle Rate of the Relevant Class of Units calculated and accrued daily, payable quarterly, subject to the High Watermark of the Relevant Class of Units.

For the Class D Units and the Class E Units, the performance fee (calculated in HKD in the case of the Class D Units and USD in the case of the Class E Units) is converted into AUD (at the prevailing spot rate of exchange obtained by the Administrator) and is invoiced and paid in AUD.

The above performance fees are inclusive of GST and net of RITC.

In today's turbulent financial market, managing investment risk is crucial for ensuring long-term success for equity-managed funds. One of the most effective ways to manage risk is dynamic hedging, which involves adjusting the protection positions of a portfolio in real time based on market changes. This strategy is used by sophisticated fund managers with the systems to continuously monitor market conditions and know how to adjust their portfolios accordingly.

Some of the key benefits of using dynamic hedging are:

- Real-time risk management: Dynamic hedging allows fund managers to respond quickly to market changes and adjust their portfolio in real-time to minimise potential losses and maximise returns.

- Improved returns: By continuously monitoring market conditions and adjusting the hedge ratios accordingly, dynamic hedging can help equity-managed funds achieve better returns. This is because the hedge ratios are adjusted to minimize the potential impact of market risks on the portfolio.

- Increased transparency: Dynamic hedging provides fund managers with greater insight into the risks and returns of their portfolios. This increased transparency allows fund managers to make informed decisions and adjust their portfolios, leading to better investment outcomes.

- Better risk-reward balance: Dynamic hedging enables fund managers to better balance their risk and reward. By adjusting the hedge ratios, fund managers can minimise potential losses while maximising returns, leading to a better risk-reward balance for their portfolio.

Gyrostat uses dynamic hedging to manage the trade-off between returns, income, and protection levels (risk). Our approach has focused on a pre-defined quarterly ‘hard’ risk parameter, and then to maximise returns and income within that constraint. A secondary consideration is the source of returns, in particular the level of correlation with the market. From established finance theory adding non-correlated assets is of significant value to the overall portfolio, so the Gyrostat approach has been to generate returns in rising and falling markets, which increase with volatility.

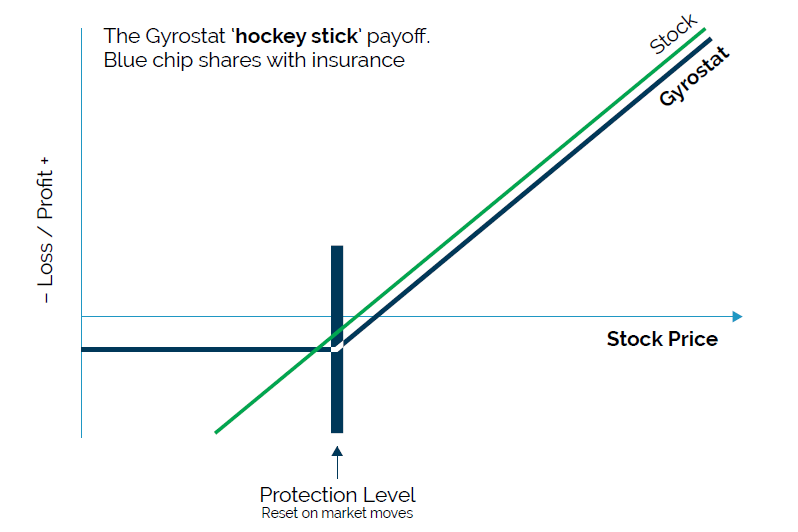

Superimpose a 'hockey stick' payoff at all times on a share price chart, moving the protection level on market moves.

- Buy and hold blue chip shares with protection on the Stock Exchange

- Set the amount of protection to always participate in the upside with minimal capital at risk

- Re-set the protection level on market moves - if the share price rises increase the protection level, on falls reduce the protection level

For more information please contact Michael Baker or James Duck of Wayfarer Investment Partners on 0439 276 484 or email Michael Baker - michael@wayfarerpartners.com.au

The responsible entity for the Gyrostat Risk Managed Equity Fund (ARSN 651 853 799) (Fund) is One Managed Investment Funds Limited ACN 117 400 987 AFSL 297042 (OMIFL). The investment manager for the Fund is Gyrostat Capital Management Advisers Pty Ltd (ACN 168 737 246), a duly authorised representative of Gyrostat Capital Management Pty Ltd (ACN 138 219 002) (AFSL 452917) (GCM).

The information provided in this document was not prepared by OMIFL but prepared by other parties. All of the commentary, statements of opinion and recommendations contain general advice only. This information does not take into account your investment objectives, particular needs or financial situation. You should seek independent financial advice.

The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds or an offer to buy or sell any financial product. Accordingly, reliance should not be placed on this document as the basis for making an investment, financial or other decision.

Past performance is not a reliable indicator of future performance. Performance comparisons are provided purely for information purposes only and should not be relied upon. The information included in this document may include information that is predictive in character which may be affected by inaccurate assumptions or by known or unknown risks and uncertainties and may differ materially from results ultimately achieved.

Whilst all care has been taken in preparation of this document, neither OMIFL nor the Investment Manager give any representation or warranty as to the reliability, completeness or accuracy of the information contained in this document. Neither OMIFL nor the Investment Manager accepts liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information.

You should obtain and carefully consider the Product Disclosure Statement (PDS) and Target Market Determination (TMD) for the Fund before making any decision about whether to acquire, or continue to hold, an interest in the Fund. Applications for units in the Fund can only be made pursuant to the application form relevant to the Fund. A copy of the PDS (dated 20 October 2022), TMD and relevant application form may be obtained from:-

https://www.gyrostat.com.au/application-forms or https://www.oneinvestment.com.au/qyrostat

OMIFL, as responsible entity of the Fund, has appointed Gyrostat Capital Management Advisers Pty Ltd as the investment manager of the Fund The Investment Manager is a wholly-owned subsidiary, and corporate authorised representative (ASIC number 001283051) of GCM.

GCM acted as the investment manager of the Fund from November 2010 until 1 March 2021. Following a corporate reorganisation of the business of GCM, the Investment Manager was appointed the investment manager of the Fund from 1 March 2021.

GCM is a privately-owned, specialist boutique income equities business established in November 2010 by Craig Racine, who currently is the Managing Director and Chief Investment Officer of the Investment Manager.

Craig Racine is the Managing Director and Chief Investment Officer of the Investment Manager.

Prior to establishing the Fund, Craig’s senior management experience had mainly been in Hong Kong It included appointments as Executive Director at The Asian Infrastructure Trust (Hong Kong) with lead investors being International Finance Corporation, Asian Development Bank, Soros Funds Management, Frank Russell Investments, and AMP Capital.

During that period, he held board positions in multi-national companies in China (China Unicom), India, Indonesia, Philippines, and Pakistan Craig was also a Managing Director and Head of Sector Research at ING Barings (Asia) and Peregrine Investment Bank.

Craig holds the following qualifications: Bachelor of Commerce, Bachelor of Laws, Masters of Applied Finance, and Post Graduate Diploma (International Finance).

Qualifications: BCom, LLB, MAppFin, PGDip (Int Fin)

Leo is also an experienced investor within the options market and has extensive experience in investment banking and private equity.

He has over 29 years of industry experience and has previously worked as a regional analyst in equity research with ING Barings Securities Asia, and in the investment deal team with Asian Infrastructure Fund Advisers, as well as a strategic planning specialist with Motorola Asia Pacific.

He is particularly skilled in business analysis, financial modelling, and operational management.

Qualifications: BEng, MSc

Peter has an extensive and diverse experience in treasury, financial and management accounting, strategy and business planning, company management, business development, project finance, and debt financing.

He led the treasury function for a major Australian corporation. Previously he has held senior executive positions in companies located in Indonesia, Russia, Poland and Saudi Arabia.

Qualifications: CPA, B.BUS, MBA

Click here to view our latest news.

Click here for the latest fund updates.

Please contact Michael Baker or James Duck of Wayfarer Investment Partners on 0439 276 484 or email Michael Baker - michael@wayfarerpartners.com.au

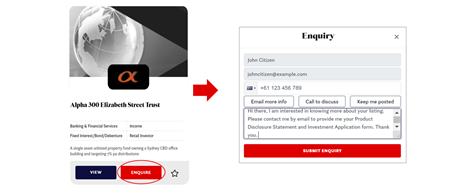

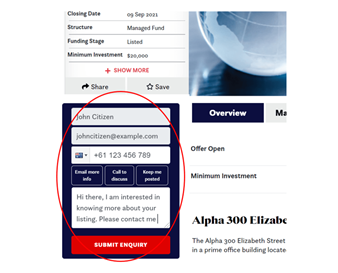

If you have joined Investment Markets (which is free) and verified your email address, you can send an email directly to us either by: -

- Selecting “Enquire” when viewing the card relating to the listing, OR

- By completing the enquiry form on the left-hand side when viewing the detail of a listing

We will respond using your preferred communication method (i.e., email or phone).

Tags

Published by Gyrostat Capital Management Advisers Pty Ltd

Published by Gyrostat Capital Management Advisers Pty Ltd

Statutory Statement

The issuer of this product is identified at the top of this page. The PDS and target market determination for the product are available in the Documents section of this listing. Prospective investors should consider the PDS before deciding to acquire the product. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.