Comparison Data

1Performance

| 1 month | 3 month | 1 year | 3 year | 5 year | Since Inception | Inception Date |

|---|---|---|---|---|---|---|

| 2.05% | 1.61% | 17.67% | 10.87% | - | 12.14% | 9 Sept 2022 |

Fees

| Management Fee | Performance Fee | Morningstar Total Cost Ratio |

|---|---|---|

| 0.6% | - | 0.6% |

The Hamilton12 Australian Shares Income Fund aims to generate long-term after-tax returns for Australian resident investors in excess of the Benchmark after fees, including an annual gross dividend yield (including franking) that exceeds the gross dividend yield of the Benchmark.

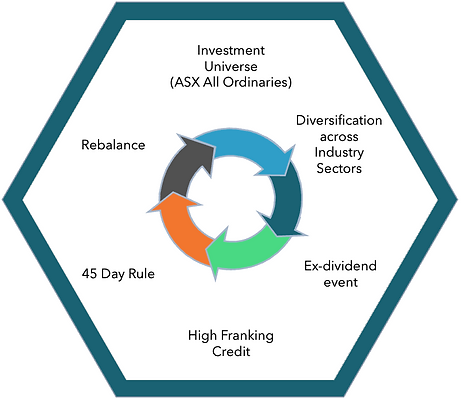

The Fund uses the same systematic, rules-based approach as the Hamilton12 Australian Diversified Yield Index that allocates the portfolio towards Securities offering high franked dividend yield and aims to mitigate risk by ensuring the Fund is diversified across industry sectors.

The investment universe is the Australian-listed securities of the All Ordinaries Index. The Fund’s Benchmark is the S&P/ASX 200 Franking Credit Adjusted Daily Total Return Index (Superannuation).

High dividend yield from companies paying franked dividends.

Optimised for Australian superannuation funds and tax-exempt investors.

Persistently outperforms the S&P/ASX200 index for no incremental risk.

The investment approach is underpinned by a focus on after-tax returns for an Australian resident investor. The portfolio is rebalanced six times per year using a rules-based approach that allocates the portfolio towards stocks offering high franked dividend yield, while maintaining diversification across industry sectors.

All portfolio stocks are drawn from the All-Ordinaries index and are projected to pay franked dividends within six months of a rebalancing date. Stock selection follows a systematic and objective analysis of analyst dividend forecasts, historical franking levels, company-specific timing of ex-dividend dates, and share prices on portfolio rebalancing dates.

As part of Hamilton12’s risk mitigation strategy, portfolio weights take account of the portfolio stocks’ relative market capitalisation and liquidity. The fund holds approximately 100 stocks, diversified across industry sectors and stocks with large market capitalisation and medium market capitalisation (stocks in the S&P/ASX 200 and stocks outside the S&P/ASX 200 but in the All Ordinaries Index).

The investment universe of the Fund is the ASX All Ordinaries Index.

The Fund uses a rules-based approach that maintains diversification across industry sectors and allocates the portfolio toward ex-dividend securities that offer high-franked dividend yield.

The portfolio rebalances six times per year.

Click here to view Hamilton12 Australian Diversified Yield Daily Index (Superannuation).

Up to date information on the performance of the Fund can be obtained from www.Hamilton12.com.

The Fund is an Australian wholesale fund which is a managed investment scheme. In a unit trust structure when you invest your money, it is pooled with other investor funds. Each unit represents an equal share in the net assets of the Fund, however no investor is entitled to any specific or part assets of the Fund. The rights of unitholders are set out in the Fund’s Constitution. The Fund was established by a Trust Deed dated 15 August 2022 which sets out the relationship between the Trustee and Unitholders. The Trustee has appointed the Investment Manager as the manager of the Fund pursuant to the Investment Management Agreement.

Fund Structure

Hamilton12 is a corporate authorised representative (AFS representative number 001298730) of K2 Asset Management Ltd.

Hamilton12 was formed in 2017 and focuses on creating systematic, rulesbased investment strategies designed to help investors achieve positive riskadjusted returns at a lower cost.

Hamilton12 offers investors a transparent and disciplined way to increase returns, minimise risk and reduce expenses on a persistent basis.

Hamilton12’s portfolio construction approach is grounded on rigorous theory, market segmentation and the impact of taxation on investment returns.

The Investment Manager believes that investors are searching for fee minimisation, tax efficiency, and above-benchmark performance. Hamilton12 seeks to provide solutions by using portfolio formation techniques grounded in theory and evidence and matched to risk constraints and return expectations of investors.

Jason’s knowledge of value-based investing, analyst earnings forecasts, and the value of dividend imputation credits forms the basis of stock selection for the Fund.

For more than 20 years, Jason has been widely recognised for his work on imputation credits. Jason has derived expected share market returns from analyst earnings forecasts; measured analyst forecast accuracy; quantified the risk-reward implications of industry sector rotation; and modelled retirement income streams.

Additionally, Jason’s work on valuation has been relied upon by companies listed on the Australian Securities Exchange, and by Australian state and federal government agencies.

Prior to co-founding Hamilton12, Jason was a director of the consulting firm Cardinal Economics & Finance. Jason’s previous experience is as a director of Frontier Economics, senior lecturer in finance at The University of Queensland Business School and equity research analyst at Credit Suisse.

Jason is also a lecturer in finance at the Ross School of Business, University of Michigan and a board member of the CFA Society Detroit.

He completed his PhD in Finance at The University of Queensland and is a CFA charter holder.

Richard’s experience in financial markets spans more than 20 years having held advisory and executive roles with banking and investment firms both domestically and abroad.

Prior to co-founding Hamilton12, Richard was a Director at the Westpac Group where his insight and experience helped its Private Bank clients make informed investment decisions.

Before joining Westpac, Richard was the Queensland State Manager for Morgan Stanley Wealth Management and was responsible for establishing its wealth management presence in Queensland following the global acquisition of Smith Barney from Citigroup.

Prior to Morgan Stanley, Richard was a Director of UBS Wealth Management, a Swiss global financial services company and the Australian General Manager for Currencies Direct, a UK based foreign exchange broker and international payment provider.

Richard holds a Bachelor of Laws and Commerce from Bond University and a Master of Business Administration (Hons) from The University of Queensland.

Click here for our latest news.

Click here to read our latest resources.

To receive a copy of our Information Memorandum, please contact us at Hamilton12.

- By clicking the enquire button on the card view

Or

- By selecting “Receive Info” when viewing the listing

We will respond using your preferred communication method (i.e., email or phone).

Tags

Statutory Statement

This offer of scheme interests is available to wholesale clients only. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

1 For use in Australia: © 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its affiliates or content providers; (2) may not be copied, adapted or distributed; (3) is not warranted to be accurate, complete or timely and 4) has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), subsidiary of Morningstar. Neither Morningstar nor its content providers are responsible for any damages arising from the use and distribution of this information. Past performance is no guarantee of future results.

Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at http://www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar's publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar's full research reports are the source of any Morningstar Ratings and are available from Morningstar or your advisor. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a financial advisor. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.