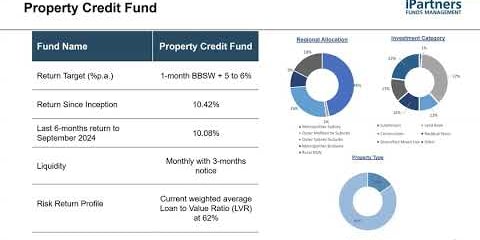

Comparison Data

1Performance

| 1 month | 3 month | 1 year | 3 year | 5 year | Since Inception | Inception Date |

|---|---|---|---|---|---|---|

| 0.8% | 2.43% | 9.97% | 10.22% | - | 9.91% | 6 Feb 2020 |

Fees

| Management Fee | Performance Fee | Morningstar Total Cost Ratio |

|---|---|---|

| 0.8% | - | 0.9% |

The iPartners Credit Investment Fund offers investors a diversified portfolio of high-yielding private credit assets, targeting a 9–10% return per annum net of fees.

The fund invests in asset-backed securities, corporate credit, and property debt, seeking high-quality investments that deliver superior risk-adjusted returns. iPartners leverages its deep expertise in structuring and executing transactions, coupled with dedicated sourcing and assessment of proprietary deal flow.

With over seven years of experience in private lending, iPartners provides wholesale investors access to institutional-grade investment opportunities across the alternative asset spectrum.

The fund prioritises investments with strong asset backing and security, offering a $10,000 minimum investment and diversified asset exposure. Liquidity is facilitated through the iPartners platform’s secondary trading functionality. The experienced investment team and co-investment model further align the fund's interests with those of its investors.

The iPartners Credit Investment Fund targets a 9 – 10% return p.a. net of fees and offers a diversified portfolio of high yielding private credit assets including asset backed securities, corporate credit and property debt.

Across the spectrum of alternative assets, the Fund seeks high quality investments that can deliver a superior risk adjusted return. It does this through:

- Utilising the deep expertise of the Fund Manager, especially in structuring and executing transactions.

- Hard work in sourcing, reviewing and assessing deals.

- Proprietary deal flow, not generally available in the market.

The iPartners Private Credit Funds (Fund) were established to offer investors exposure to a diversified portfolio of primarily private company debt instruments and cash. By leveraging the Head Portfolio Manager’s experienced team and broad network, the Fund aims to target strong, risk adjusted returns across time by creating a high quality diversified and relatively liquid portfolio.

iPartners was an early mover in private credit, being a private lender for over 7 years, with a commitment to investor access and liquidity. These features underpin the mandate of the Fund and mirror iPartners’ mantra - which is to provide wholesale investors with access to proprietary and institutional grade investment opportunities across the alternative asset’s spectrum. The Fund’s strategy is based on 6 key pillars:

- Investing where there is a strong asset backing and security, to protect the downside.

- $10,000 minimum investment and diversified asset exposure.

- Liquidity and rebalancing for the Fund and investors through the iPartners platform secondary trading functionality at regular intervals.

- A highly experienced and multidisciplinary Investment Team with deep networks, that cover every stage of the investment process.

- Portfolio managers have skin in the game, aligning with investors.

- A co-investment model granting Fund investors with priority allocations in private credit transactions.

| Asset Category | Percentage |

| Cash and Cash Equivalents | Up to 20% |

| Asset Backed Debt | Up to 80% |

| Property Debt | Up to 50% |

| Corporate Credit | Up to 50% |

| iPartners Funds | Up to 50% |

| Other Alternative Assets | Up to 10% |

| Hybrid Securities | Up to 15% |

There isn’t any strict definition of alternative investments, but we generally consider them to be investments in private markets as opposed to public markets.

Public markets include listed equities and bond issues from large corporates. They are characterised by:

- Large size: The issuer and/or the issuance are typically large in size.

- Well known issuers: Household names or familiar to financial markets.

- Liquid: The pool of demand may be deep, individual holding sizes modest, the securities have a standard format and execution of transfers is relatively easy.

As a result, there is high demand for public market assets leading to higher valuations and lower yields. In the public credit market, this is evidenced by record low yields:

Investment grade → Low single digit returns

High yield → Mid-single digit returns

Private markets include private debt and private equity. They are characterised by:

- Smaller size: The issuers can be smaller and less well known.

- Illiquid: The pool of demand can be limited, the issuance may be held by a single party, and transfers to other parties may not be easy.

- Complexity: The transaction may be more complex, in a bespoke customised format with negotiated terms and a range of structural features and credit controls.

The benefits of investing in private markets include potentially higher returns for comparable risk, whilst reflecting illiquidity, complexity, and the extra work required in sourcing, assessing and structuring the transactions.

Some examples of private assets are described below:

Asset Backed Debt

Business earnings provide the primary credit support with secondary credit protection provided by security over specific assets, like a mortgage over a house. Secured assets include hard assets such as livestock and cars, and financial assets such as pools of consumer or business loans.

Property Debt

Property debt is secured over specific property including land, residential and commercial property.

Corporate Debt

These are typically unsecured loans provided to cashflow generating small to medium sized corporates.

Private Equity

Equity or equity-like investments in unlisted companies that are already operating with proven business models (i.e. not early-stage Venture Capital or Angel Investing).

iPartners Funds Management Pty Ltd is the investment manager of the Funds in accordance with an Investment Management Agreement with the Trustee and is 100% owned by iPartners. The Investment Committee approves and reviews the parameters of the Fund. The Investment Manager also oversees the management of the Funds implementing resources including:

• Lead Portfolio Manager and Portfolio Manager, part of our 1st line of defence in our risk management framework.

• Head of Operations, part of our 2nd line of defence.

• Director, Fund Accountant, part of our 3rd line of defence.

Travis is a Co-Founder and CEO of iPartners.

Through the early years of the business Travis primarily led the evolution of the iPartners private credit, private securitisations and funds management businesses, with a constant eye to the broader strategic direction and emerging opportunities.

Travis has worked in financial markets for more than 20 years, most recently as Managing Director at UBS Investment Bank, previously as a Director at Deutsche Bank and ANZ Bank. He has pioneered the evolution of alternative investments and products in Australia having priced, structured and offered assets giving investors exposure to credit, rates, equities, FX, derivatives, ETF’s, funds, property, infrastructure and agriculture. In 2023, global publisher Wiley released Travis’ book “Grow Your Wealth Faster with Alternative Assets”.

Justin has over 20 years of experience in global financial markets. He has worked in all aspects of structured finance including as in-house counsel at an investment bank, structurer and portfolio manager.

Having started his career as a graduate lawyer at UBS, Justin moved into structuring and then trading at Deutsche Bank in Sydney and Tokyo.

He moved into funds management as a portfolio manager specialising in quantitative strategies across asset classes including credit, rates, equities and property at hedge funds RF Capital, Regal Funds Management and Maven Securities

Click here to view our latest Insights.

Alternative asset investments are increasingly seen as important for portfolio diversification as they are not directly correlated to stock market fluctuations. While the inclusion of alternative asset classes is critical to building out a portfolio to help reduce risk, and potentially boost return, investors should customise their portfolio to meet their appetite for risk and yield. iPartners philosophy is to offer access to alternative asset investments with a strong alignment of interests. Investors invest with a pool of institutional investment managers, who have a strong track record of performance across multiple asset classes that previously have been difficult for direct investors to access on a small scale.

iPartners provides wholesale investors direct access to a diversified range of institutional grade alternative assets across infrastructure, property, private equity and private debt.

Investors can sell their investments to other investors on the platform if they need to sell prior to the call date.

Statutory Statement

This offer of scheme interests is available to wholesale clients only. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

1 For use in Australia: © 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its affiliates or content providers; (2) may not be copied, adapted or distributed; (3) is not warranted to be accurate, complete or timely and 4) has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), subsidiary of Morningstar. Neither Morningstar nor its content providers are responsible for any damages arising from the use and distribution of this information. Past performance is no guarantee of future results.

Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at http://www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar's publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar's full research reports are the source of any Morningstar Ratings and are available from Morningstar or your advisor. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a financial advisor. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.