Building a more sustainable future

Structural changes such as climate change, demographic shifts and urbanisation are creating huge demand for infrastructure, requiring trillions of dollars a year in global infrastructure investment. This presents a unique opportunity to invest in the essential assets that can help us build a more sustainable future.

Sustainable Infrastructure Fund builds a high-conviction portfolio of companies providing the infrastructure to support a sustainable and inclusive economy. Key sub-themes include environmental resilience, social infrastructure and improved connectivity.

Expertise

Brings together fundamental and sector-specific insights with expertise in artificial intelligence and data science to develop a portfolio that is designed by data, refined by research and sustainability-driven.

Supported by insights and stewardship from a dedicated sustainable investing team.

Portfolio

Proprietary thematic engine uses natural language processing over a vast data set to identify companies exposed to the sustainable infrastructure theme.

Fundamental active managers select their highest conviction ideas, investing in long-term, quality companies, supported by solid corporate governance and sustainability practices.

Excludes the worst offenders – based on revenue driven by tobacco, coal, or weapons, or norms violators.

Results

A high conviction, unconstrained portfolio of companies leading the way in delivering sustainable infrastructure.

Provided to illustrate macro trends, investment universe and investment process, this is generic information that doesn’t take any specific investor’s circumstances into account not to be construed as offer, research or investment advice. Please refer to offering documents for further details.

Provided to illustrate macro trends, investment universe and investment process, this is generic information that doesn’t take any specific investor.

To achieve a return through investing at least 80% of the Fund’s assets in equity securities of companies with exposure to the theme of sustainable infrastructure.

This product is likely to be appropriate for a consumer seeking capital growth to be used as a small allocation within a portfolio where the consumer has a high risk/return profile and needs daily access to capital. The minimum suggested holding period is 5 years.

Click here view our latest Performance details.

Before investing, obtain and review the Product Disclosure Statement of the Fund and Target Market Determination (available from https://am.jpmorgan.com/au/) to understand the various risks associated with investing in the Fund and in making any investment decision. Past performance is not a reliable indicator of future performance and investors may not get back the full amount invested. Future performance and return of capital is not guaranteed. Information is considered correct at the time of issue but no liability for errors or omissions will be accepted by JPMorgan Asset Management (Australia) Limited or its affiliates. This document is confidential and intended solely for the person to whom it is provided by the issuer. ETFs have fees that reduce their performance, indexes do not. Investors cannot directly invest in an index. The market price is generally determined using the official closing price of the Fund. Provided for reporting purposes only and should not be considered as offer, research, advice or recommendations to purchase or sell any particular security. Each individual security is calculated as a percentage of the net assets. Holdings in actively managed portfolios are subject to change from time to time. The Fund seeks to achieve its stated objectives, there is no guarantee they will be met. Dividends or returns are not guaranteed. Please refer to offering documents for details on distribution policy. Due to rounding, values may not total 100%. Top holdings, sector and country or region excludes cash. Fund holdings and performance are likely to have changed since the report date. No provider of information presented here, including index and ratings information, is liable for damages or losses of any type arising from use of their information. Information from communications with you will be recorded, monitored, collected, stored and processed consistent with our Australian Privacy Policy available at am.jpmorgan.com/au/en/asset-management/adv/privacy-policy/

Fund information, including performance calculations and other data, is provided by J.P. Morgan Asset Management (the marketing name for the asset management businesses of JPMorgan Chase & Co and its affiliates worldwide). All data is as at the document date unless indicated otherwise.

Benchmark Source: MSCI. Neither MSCI nor any other third party involved in or related to compiling, computing or creating the MSCI data (the “MSCI Parties”) makes any express or implied warranties or representations with respect to such data (or the results to be obtained by use thereof), and the MSCI Parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to such data . Without limiting any of the foregoing, in no event shall any of the MSCI Parties have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

For further information please email us at jpmorgan.funds.au@jpmorgan.com, telephone 1800 576 468 or visit our website am.jpmorgan.com/au/en/asset-management/adv.

All Rights Reserved - JPMorgan Asset Management (Australia) Limited ABN 55 143 832 080, AFSL No. 376919. The information provided here is general in nature only and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this website you should consider the appropriateness of the information having regard to your objectives, financial situation and needs. Therefore, before you decide to buy any product or keep or cancel a similar product that you already hold, it is important that you read and consider the relevant Product Disclosure Statement (PDS) and Target Market Determination, which are available to download on this website and make sure that the product is appropriate for you. Before making any decision, it is important for you to consider these matters and to seek appropriate legal, tax, and other professional advice.

The power of perspective to build stronger portfolios

We work together to identify big-picture ideas and develop the deep insights that our globally connected outlook can deliver. With over a century of investment experience, our clients trust us to manage US$2.8 trillion in assets to deliver what matters most to individuals, families, companies, and communities.

A diversified perspective builds stronger portfolios

From our unique global vantage point, we’re able to advise on the right strategy at the right time, with solutions available to match specific investment styles and preferences. We’re committed to listening first to find investment solutions that can help investors achieve their long-term goals.

7 years with J.P. Morgan / 26 years in the Industry

Sara Bellenda, executive director, is a portfolio manager within the J.P. Morgan Asset Management International Equity Group, based in London. An employee since 2017, Sara was an equity research analyst at Fidelity Management & Research covering European real estate and UK homebuilders. Sara holds a MBA in Hospitality Management from Cornell/ESSEC business school and is fluent in Italian, English and French.

15 years with J.P. Morgan 15 years in the Industry

Wei (Victor) Li, PhD, CFA, Executive Director, is Head of Equity and Alternative Beta Research and a portfolio manager in the Quantitative Beta Strategies group, based in London. Victor's primary responsibilities include the oversight of the team's research agenda, model development and portfolio management for both Alternative beta and Strategic Beta suite of products.

He was previously a member of the quantitative research team in Multi-Asset Solutions, focusing on quantitative asset allocation, systematic and factor-based investment strategies. Prior to joining the firm in 2010, Victor completed a PhD in Signal Processing at Imperial College London, where he was also employed as a research assistant. Victor additionally has an MSc with Distinction in Communications Engineering from the University of Manchester, a BEng in Information Engineering from the Beijing Institute of Technology, and is a CFA charterholder.

8 years with J.P. Morgan / 24 years in the Industry

Fred Barasi, managing director, is an analyst within the J.P. Morgan Asset Management International Equity Group, based in London. An employee since 2017, Fred was previously with Moody's Investor Services, where he was a credit analyst. Fred obtained a MA in Mathematics from the University of Cambridge and earned a MSc. in operation research from the London School of Economics and Political Science. He is a CFA charterholder.

Click here view our latest Fund Factsheet.

Click here to view our latest Fund Commentary.

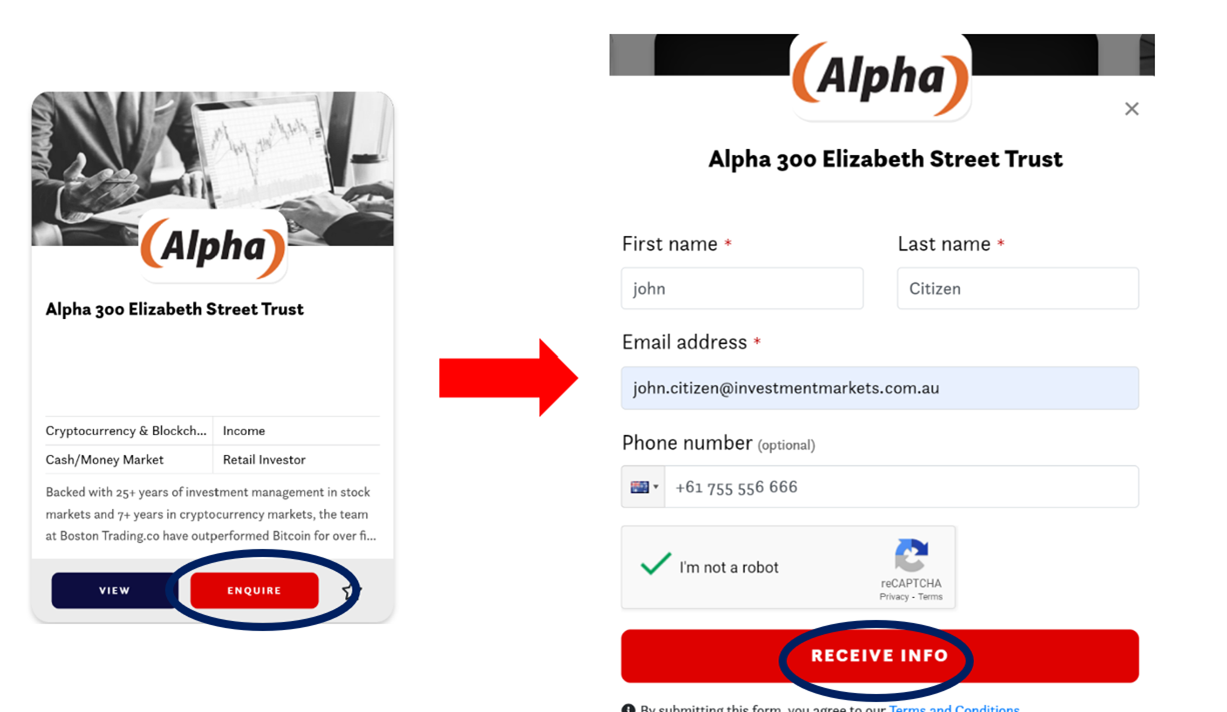

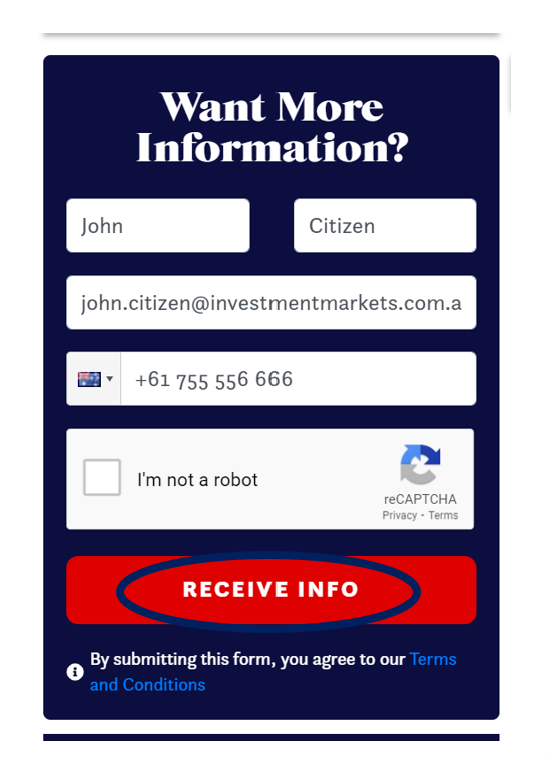

• By clicking the enquire button on the card view

Or

• By selecting “Receive Info” when viewing the listing

We will respond using your preferred communication method (i.e., email or phone).

Statutory Statement

The issuer of this product is identified at the top of this page. The PDS and target market determination for the product are available in the Documents section of this listing. Prospective investors should consider the PDS before deciding to acquire the product. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.