Passively managed investment solutions for those who are happy to receive indexed returns whilst paying lower fees. These portfolios hold only Australian or International shares or ASX listed Bonds, and do not feature Tactical Asset Allocation, meaning they are always fully invested and are not ‘de-risked’ at any time. This can mean higher levels of volatility compared with Tactical portfolios.

The three portfolios are:

- Global Leaders

- Australian Leaders, and

- Government Bond Ladder

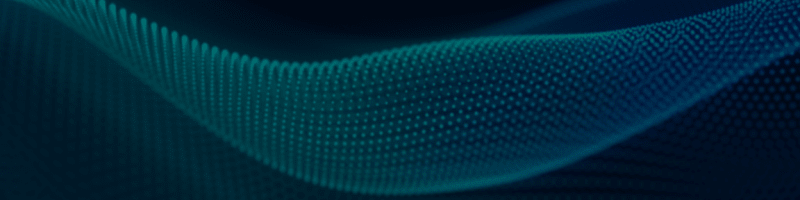

A portfolio of the largest global shares by market capitalisation (the number of holdings can be customised by you: between 15 and 75).

- Investment objective: To provide a return before fees approximating the S&P Global 100 Index in Australian dollars. Measured over a five-year rolling average.

- Investment strategy: The model provides exposure to a portfolio of the largest global equities by market capitalisation. The model will generally hold the 40 (by default) largest shares listed in developed markets.

- Ideal for those who wish to manage their own asset allocation and want to include a lower-cost Global Equities exposure.

- Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options.

- Minimum investment: $10,000 (platform dependent).

- Benchmark is the S&P Global 100 Index in AUD.

- During periods when small companies outperform larger ones the portfolio may underperform, and vice versa.

- Portfolio is unhedged so investors are exposed to AUD movements.

- Our investment management fee is 0.17% of your account balance per annum.

- Target allocations are shown in the following pie chart.

Figures shown are long-term targets

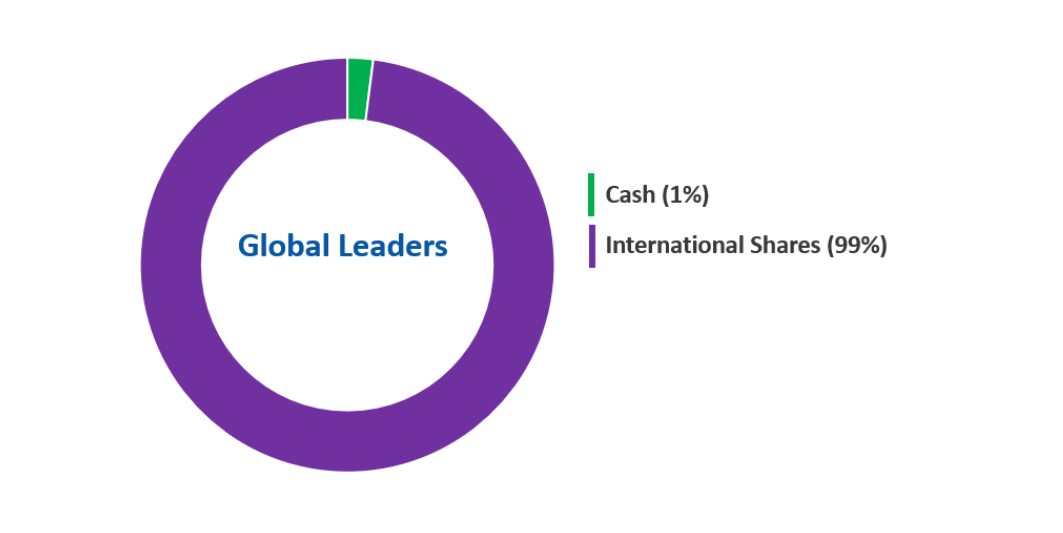

A portfolio of the largest ASX listed companies' shares (the number of holdings can be customised by you: between 15 and 75).

- Investment objective: This is a passive strategy designed to provide a before fees return in line with the S&P/ASX 20 Accumulation Index over rolling five year periods.

- Investment strategy: The model provides exposure to a portfolio of the 25 (by default) largest companies on the ASX.

- Ideal for those who wish to manage their own asset allocation and want to include a lower cost Australian Equities exposure

- Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options

- Minimum investment: $10,000 (platform dependent)

- Benchmark is the ASX20 Index

- Our investment management fee is 0.17% of your account balance per annum

- Target allocations are shown in the following pie chart

Figures shown are long-term targets

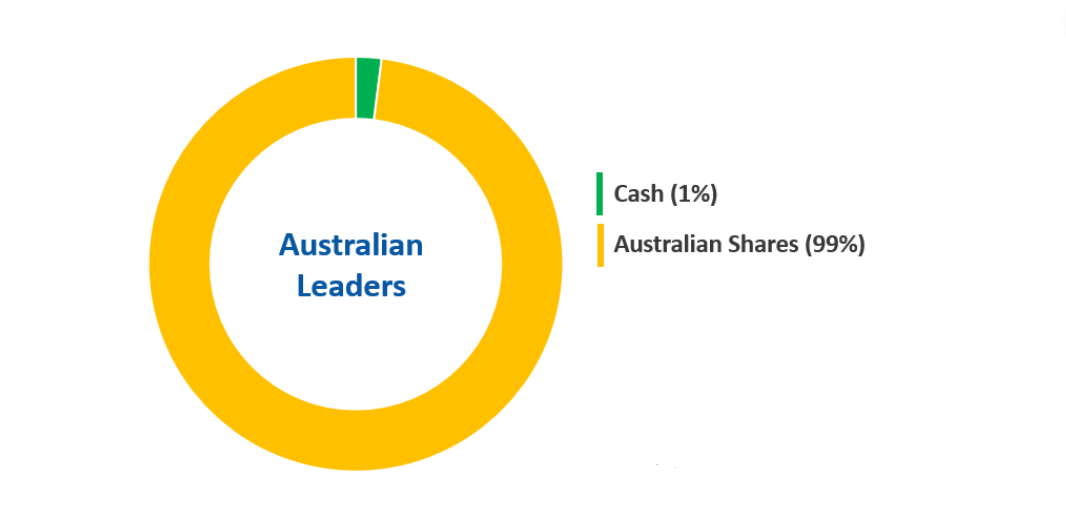

A portfolio of Australian Commonwealth Government Bonds listed on the ASX.

- Investment objective: Passively managed portfolio creating a bond ladder using ten to 15 ASX listed Australian Commonwealth Government Bonds of various maturities.

- Investment Strategy: The overall portfolio is constructed to target an average weighted maturity similar to the Bloomberg AusBond Treasury 0+Yr Index. Bonds are usually held to maturity and target minimal trading

- Ideal for those who wish to manage their own asset allocation and want to include a lower cost Bond exposure

- Minimum Investment is $20,000

- Benchmark is the Bloomberg AusBond Treasury Index

- Our investment management fee is 0 to 0.11% of your account balance per annum

- Target allocations are shown in the following pie chart

Figures shown are long-term targets

Click here to view our latest Performance Results.

Nucleus Wealth is an Australian investment fund that started in 2016. Nucleus Wealth offers significant points of difference in the way the fund invests for potential investors/clients, with the aim of providing a transparent and easy-to-understand investment solution.

Every client of Nucleus Wealth has their own bespoke portfolio of shares, bonds and cash held on a third-party platform called Praemium in a Separately Managed Account (you will sometimes see this called an SMA). More information on Praemium and Separately Managed Accounts below.

Because the client has their own individual portfolio, they can individually tailor the account using over 30 different ethical and portfolio tailoring options- from this, Nucleus Wealth can offer free investment advice on an appropriate portfolio for the client’s needs.

Nucleus Wealth predominantly operates online. Regularly updated blogs, reports, podcasts and articles are available on the company’s website, as well as calling and email services. The Nucleus Wealth client onboarding portal not only details every share and bond in the client’s portfolio, but more importantly why they are in the portfolio. While clients are welcome for an in-person visit at the Nucleus Wealth office, the company’s hope is that the unparalleled transparency and online investment support is enough to give clients all of the information needed to make investment choices.

Damien has a wealth of experience across international equities (Schroders), asset allocation (Wilson HTM) and he helped create one of Australia’s largest independent research firm, Aegis Equities. He lectured for over a decade at the Securities Institute, Finsia and Kaplan and spent many of those years as the external Chair for the subject of Industrial Equity Analysis.

Damien runs the investment side of Nucleus Wealth, selecting stocks suggested by analysts and implementing the asset allocation.

Damien started Nucleus Wealth after 20+ years in financial markets. He wanted to come up with an investment solution for ordinary investors that delivers the same types of personalised investment portfolios high net worth investors use.

David runs a prominent investment blog, co-authored of The Great Crash of 2008 with Ross Garnaut, was the editor of the second Garnaut Climate Change Review and was former editor-in-chief of The Diplomat magazine.

For years, Damien and David discussed the potential to create an investment firm to invest in the themes that both had pursued independently, and by 2016 platform fees had reduced low enough that the strategy could be invested in without the investment platforms making more than the investors!

David is the Asset Allocation strategist, his main role being to drive debate and decisions on whether to own cash, bonds, Australian stocks or International stocks.

Shelley runs the non-investment side of Nucleus Wealth, including sales, marketing, administration, compliance and technology.

Shelley is a CFA® charterholder and holds a Bachelor of Commerce (Finance and Econometrics). She has over a 15 years experience working in financial services. She built the multi-asset class dealing capability at AustralianSuper, has dealt across global equity, derivative, currency, and bond markets, and performed small capitalisation Australian equity analysis.

Leith is the chief economist and so a natural fit for our Asset Allocation team – converse in the themes of the portfolio and with an in-depth knowledge of the Australian economy and its drivers. He specialises in the Australian economy and for over a decade worked at the Australian Treasury, the Victorian Treasury and Goldman Sachs.

Radek came to Nucleus Wealth via Mainstreet, and Radek has over 20 years experience in a wide range of analyst/quant roles across a number of stockbroking/research houses that include BZW, Abn Amro, BBY, and Aegis and CBA Equities research. Radek spends most of his time trawling through stocks looking for value traps and problems.

Click here for the latest Global Leaders updates.

Click here for the latest Australian Leaders updates.

Click here for the latest Goverment Bond Ladder updates.

Click here to view Nucleus Wealth's FAQs.

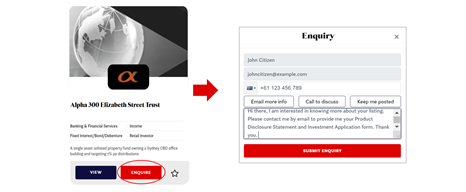

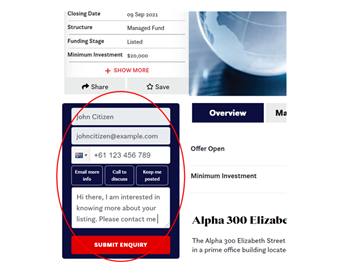

If you have joined Investment Markets (which is free) and verified your email address, you can send an email directly to us either by: -

- Selecting “Enquire” when viewing the card relating to the listing, OR

- By completing the enquiry form on the left hand side when viewing the detail of a listing

We will respond using your preferred communication method (i.e. email or phone).

Tags

Statutory Statement

The issuer of this product is identified at the top of this page. The PDS and target market determination for the product are available in the Documents section of this listing. Prospective investors should consider the PDS before deciding to acquire the product. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.