Comparison Data

1Performance

| 1 month | 3 month | 1 year | 3 year | 5 year | Since Inception | Inception Date |

|---|---|---|---|---|---|---|

| 0.28% | 2.34% | 5.74% | 5.26% | 5.1% | 4.74% | 1 June 2018 |

Fees

| Management Fee | Performance Fee | Morningstar Total Cost Ratio |

|---|---|---|

| 0.35% | 0.19% | 0.59% |

The Fund invests across a range of geographies, sectors, strategies, and sources of returns that can be difficult for investors to access directly.

As it is focused on reducing uncertain investment outcomes, the fund can suit those seeking a smoother, more regular profile of returns, providing protection against inflation and volatility without having to sacrifice growth.

The Fund targets a pre-tax return of 5% per annum above inflation (before fees and taxes) over rolling five-year periods while minimising downside risk.

With a greater diversity of investment opportunities, the Fund is designed for investors with a little or a lot to invest.

The Fund targets a pre-tax return of 5% per annum above inflation (before fees and taxes) over rolling five-year periods while minimising downside risk.

This version of the Perpetual Diversified Real Return Fund has a performance fee.

The Fund will invest in a diversified range of asset classes. The combination of assets held by the Fund at any time are those which we believe provide the greatest probability of achieving the target return over rolling five-year periods.

Perpetual may adjust the Fund's asset allocation to respond to changing market conditions and/or to take advantage of new opportunities.

In managing the Fund to meet its investment objective, the Fund may implement a considerable amount of its exposures via derivatives and may include alternative and private market assets.

Currency is managed at the Fund level, taking into account currency exposure arising from underlying investments. Currency management is used to either hedge currency for an existing position or create exposure to a foreign currency. Net foreign currency exposure will be limited to 50% of the gross asset value of the Fund.

Investment in illiquid assets^ will be limited to 18% of the net asset value of the Fund.

^Illiquid assets are defined as assets that have no readily available secondary market and are not marketable securities. Units in unlisted funds are considered illiquid where underlying assets meet that definition.

| Assets | Range % |

| Australian shares | 0 - 50% |

| Cash | 0 - 100% |

| International shares | 0 - 50% |

| Property | 0 - 15% |

| Commodities | 0 - 15% |

| Other investments | 0 - 30% |

| Illiquid assets | 0 - 20% |

| Fixed income and credit | 0 - 100% |

Click here for our latest Pricing and Performance.

Perpetual Limited is a diversified financial services company that has been serving Australians since 1886 when it was established as a trustee company by a group of businessmen including Sir Edmund Barton, later to be Australia’s first Prime Minister. That trustee heritage – and the culture it created around putting clients first – is what makes Perpetual unique.

Over more than 135 years we have supported clients and communities through periods of great change and volatility, continuing to evolve to provide products and services to meet the changing needs of our clients – some of which span five generations.

Today, we are an ASX-listed company (ASX: PPT) headquartered in Sydney, Australia, providing asset management, private wealth, and trustee services to local and international clients. Our operations span Australia, Asia, Europe, the United Kingdom, and the United States.

At Perpetual, we are, and have always been, committed to acting in the best interests of our clients and the communities we support to ensure a positive impact and help build a sustainable future. We aim to be the most trusted brand in financial services.

Our purpose is and has always been, to create enduring prosperity.

Michael is Head of Multi Asset for Perpetual Investments. In this role, he is responsible for the suite of Multi-Asset Funds and capital markets research.

Michael joined Perpetual in June 2014 and has 18 years of finance industry experience. Prior to joining Perpetual Michael worked at JANA for 13 years, and held a number of positions across research, consulting and portfolio management, including Head of Investments, and Implemented Consulting.

Earlier in his career, Michael held a variety of positions at UBS, Morgan Stanley and Barclays Capital in both Australia and the United Kingdom.

Michael holds a Bachelor of Business (Economics and Finance) from RMIT University and is a Vincent Fairfax fellow.

Geoff Ryan is Portfolio Manager for Diversified Strategies at Perpetual Investments. In this role, he is responsible for the portfolio management of diversified funds and tactical asset allocation.

Geoff joined Perpetual Asset Management Australia in June 2018, having previously worked for five years as Investment Manager, Risk & Strategy for Commonwealth Superannuation Corporation where he developed and implemented the Fund’s dynamic asset allocation process.

Prior to this, he worked at Black Rock / Merrill Lynch, where he held various roles in the multi-asset division. Most recently he was Portfolio Manager, Balanced Funds and Portfolio Manager, Overlays as well as Strategist, Fundamental Global Macro Funds.

Geoff has a Bachelor of Economics (Honours).

Click here to view our latest fund profile.

Click here to view our latest newsletter.

Call your Perpetual Business Development Manager on 1800 062 728

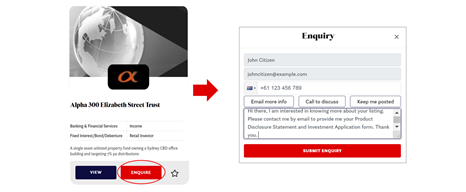

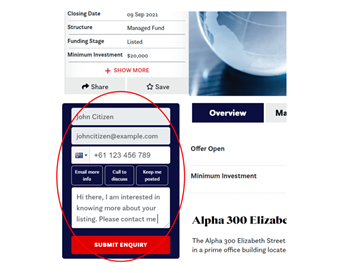

If you have joined Investment Markets (which is free) and verified your email address, you can send an email directly to us either by: -

- Selecting “Enquire” when viewing the card relating to the listing, OR

- By completing the enquiry form on the left-hand side when viewing the detail of a listing

We will respond using your preferred communication method (i.e., email or phone).

Statutory Statement

The issuer of this product is identified at the top of this page. The PDS and target market determination for the product are available in the Documents section of this listing. Prospective investors should consider the PDS before deciding to acquire the product. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

1 For use in Australia: © 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its affiliates or content providers; (2) may not be copied, adapted or distributed; (3) is not warranted to be accurate, complete or timely and 4) has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), subsidiary of Morningstar. Neither Morningstar nor its content providers are responsible for any damages arising from the use and distribution of this information. Past performance is no guarantee of future results.

Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at http://www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar's publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar's full research reports are the source of any Morningstar Ratings and are available from Morningstar or your advisor. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a financial advisor. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.