Comparison Data

1Performance

| 1 month | 3 month | 1 year | 3 year | 5 year | Since Inception | Inception Date |

|---|---|---|---|---|---|---|

| 0.51% | 3.73% | 5.63% | 6.16% | 7.54% | 6.93% | 27 Mar 2012 |

Fees

| Management Fee | Performance Fee | Morningstar Total Cost Ratio |

|---|---|---|

| 1.28% | 1.48% | 2.77% |

Utilising Perpetual's proven investment process, the Fund will adopt the same disciplined investment approach as is used across Perpetual's equity funds. Our conservative bottom-up approach to stock picking is core to the investment approach for this Fund, allowing the portfolio manager to identify and select stocks for both the long and short positions of the Fund. The investment process is based on comprehensive internal company research using four filters:

- sound management;

- conservative debt levels;

- quality of business; and

- recurring earnings.

The Fund's portfolio is then created within specific investment guidelines and a risk-controlled framework. The Fund will predominantly invest in Australian shares (both long and short), cash may be used defensively to preserve capital and it can invest opportunistically (both long and short) in global shares.

Derivatives may be used in managing the Fund^.

^Refer ‘Use of derivatives’ on page 8 of the PDS for further information.

Click here for our latest Pricing and Performance.

Perpetual Limited is a diversified financial services company which has been serving Australians since 1886 when it was established as a trustee company by a group of businessmen including Sir Edmund Barton, later to be Australia’s first Prime Minister. That trustee heritage – and the culture it created around putting clients first – is what makes Perpetual unique.

Over more than 135 years we have supported clients and communities through periods of great change and volatility, continuing to evolve to provide products and services to meet the changing needs of our clients – some of which span five generations.

Today, we are an ASX-listed company (ASX:PPT) headquartered in Sydney, Australia, providing asset management, private wealth and trustee services to local and international clients. Our operations span Australia, Asia, Europe, the United Kingdom and the United States.

At Perpetual, we are, and have always been, committed to acting in the best interests of our clients and the communities we support to ensure a positive impact and help build a sustainable future. We aim to be the most trusted brand in financial services.

Anthony is the Deputy Head of Equities and Portfolio Manager - Industrial Shares, SHARE-PLUS Long-Short and co-PM of Perpetual Pure Equity Alpha.

Anthony has been with Perpetual for 10 years. Prior to joining Perpetual, he worked at Ellerston Capital for six years, where he was the Portfolio Manager for the Ellerston Capital Global Equity Management Fund for two years. Before that, he spent 4 years as an analyst working on a long/short strategy. Prior to joining Ellerston Capital, Anthony worked as an Analyst at UBS Investment Bank for 8 years.

Anthony has a Bachelor of Economics from the University of Sydney and has earned the right to use the Chartered Financial Analyst designation.

Sean Roger is the Deputy Portfolio Manager for the Perpetual Share Plus Long-Short Fund and the Perpetual Pure Equity Alpha Fund.

Sean joined Perpetual in February 2013 as a Graduate Accountant. He joined the Investments team in August 2014 as an Equities Dealer and was appointed an Equities Analyst in January 2016 where he was responsible for covering a number of stocks in the gaming and agricultural sectors.

Sean has a Bachelor of Accounting from the University of Technology, Sydney and has completed the Chartered Accountants program.

Click here to view our latest Fund Profile.

Click here to view our latest Newsletter.

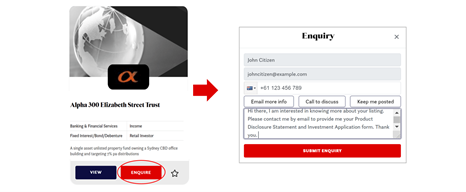

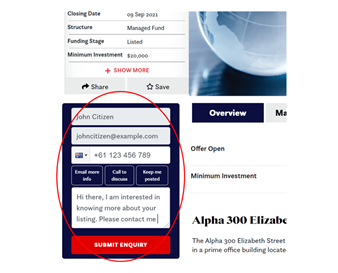

If you have joined Investment Markets (which is free) and verified your email address, you can send an email directly to us either by: -

- Selecting “Enquire” when viewing the card relating to the listing, OR

- By completing the enquiry form on the left-hand side when viewing the detail of a listing

We will respond using your preferred communication method (i.e., email or phone).

Statutory Statement

The issuer of this product is identified at the top of this page. The PDS and target market determination for the product are available in the Documents section of this listing. Prospective investors should consider the PDS before deciding to acquire the product. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

1 For use in Australia: © 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its affiliates or content providers; (2) may not be copied, adapted or distributed; (3) is not warranted to be accurate, complete or timely and 4) has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), subsidiary of Morningstar. Neither Morningstar nor its content providers are responsible for any damages arising from the use and distribution of this information. Past performance is no guarantee of future results.

Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at http://www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar's publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar's full research reports are the source of any Morningstar Ratings and are available from Morningstar or your advisor. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a financial advisor. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.