The Fund is an unlisted managed investment scheme offering you the opportunity to gain a direct exposure(s) to specific loans secured by mortgages over real property assets.

From time to time, Pillarview will provide you with the opportunity to invest in Approved Investment Proposal(s) (AIP).

The details of each AIP will be outlined in a Supplementary Information Memorandum (SIM).

As the investor, you have ultimate control over which AIP(s) you invest your money in.

When Member’s funds are not contributed towards Approved Investment Proposal(s), these funds are held within the Cash Account (CA). In the event that funds held within the Cash Account earn interest, such interest will be distributed to Members on a quarterly basis.

The purpose of the specific loan that underlies an AIP may include property investment, property development or other uses.

It is intended that the majority of loans will be secured by either a registered first mortgage or second mortgage. The loan to valuation ratio will be disclosed in the SIM.

The property security underpinning an AIP will typically be located in the metropolitan region of Australia’s mainland capital cities and major regional centres.

The SIM for the specific AIP will clearly detail what the purpose of the underlying loan is and where the property security underpinning the loan is located.

Types of Security

An AIP will generally be secured against either a registered first mortgage or second mortgage over the relevant Borrower’s property. In some instances other forms of security will be taken.

Term of Investment

Each AIP will have its own specific investment term which will be clearly detailed in the relevant SIM. As a guide, the term for most AIPs will be between 6 months and 2 years.

Withdrawals from an AIP before the term expiry are not permitted. However, subject to approval by Pillarview (at its absolute discretion), a transfer of Loan Units may be permitted. Such a transfer may be subject to an administration fee.

Withdrawals from the CA (Cash Units) may be made at any time without any withdrawal fee being charged. A five business day notice period applies to withdrawals of Cash Units. A Member’s entitlement on withdrawal will be calculated in accordance with the Constitution.

Click here to see our Active Transactions.

Guy Hewartson is a Director of Pillarview Invest Pty Ltd. Guy has been involved in the property finance industry since 1994. He spent 11 years at NAB, where he undertook numerous management roles in the bank including a role as a credit manager with a joint approval limit to $50,000,000.

Guy has been involved in the origination and mortgage management of private debt since 2005.

Over this period Guy has been in constant contact with the property development and financing process through a varying degree of market conditions including the Global Financial Crisis. This experience assists him in assessing all risks associated with a proposed loan, including the character of the borrower, the appeal and viability of the project, the state of the market and any other potential risk to a successful project.

Our Brisbane and Sydney-based leadership team have forged loyal relationships giving PillarView the ability to finance a wide range of projects including townhouses, high-rise residential and hotel developments, as well as specialised projects in the childcare, resources and consumer industries.

To learn more about each of our team’s individual achievements, please see below.

Guy holds a Bachelor of Arts with a major in Economics and has over 25 years’ experience in property finance. Guy joined the National Australia Bank straight from university in 1994 and spent 11 years at NAB, mainly in Brisbane focusing on the local property market. During this time Guy also worked in Sydney for a period in the National Australia Bank’s corporate credit area.

Ben has expertise in property finance amassed from arranging construction finance and commercial finance for some of NSW’s leading property developers and investors since 1993. Having previously worked for major banks and brokerage firms, Ben has extensive finance experience across all property asset classes and understands the key issues required to successfully close property transactions from senior debt to structured finance and equity. Ben is active in managing other stakeholder relationships and strategy of the business.

Josh completed his Bachelor degree in 2008 at the University of Auckland, majoring in Statistics and Psychology. After working for two years as a Risk Analyst at Southern Cross Healthcare (New Zealand’s largest health insurer), Josh spent the next three years travelling and working in the hospitality and marine industries, before settling in Brisbane. Josh has worked alongside Ben and Guy since 2014, constantly maintaining his strong interest in property development and investment. With a naturally analytical mindset, Josh is a trusted and valuable advisory to all transactions.

.

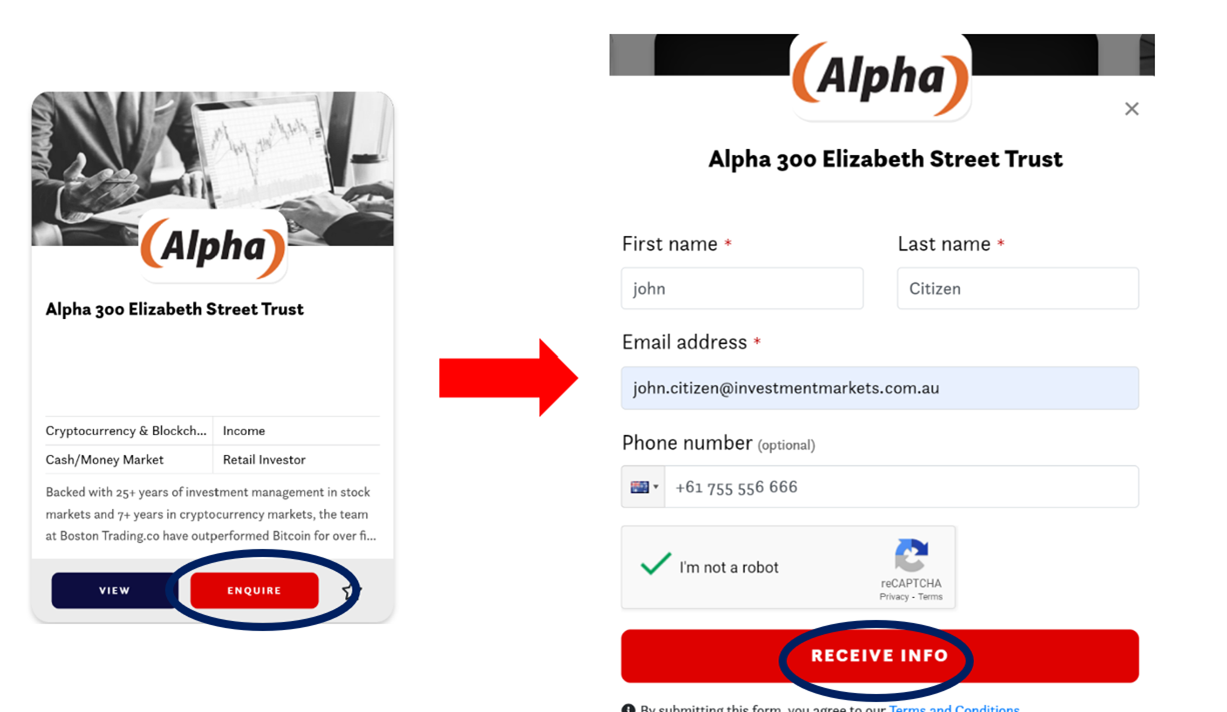

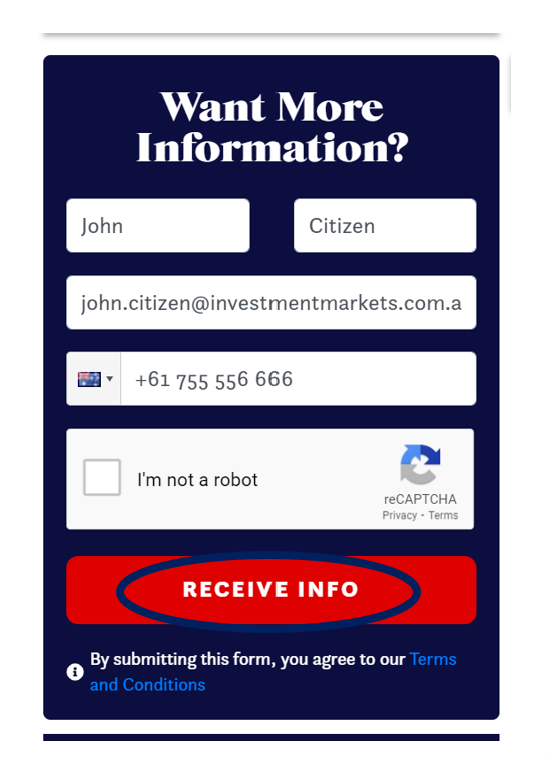

• By clicking the enquire button on the card view

Or

• By selecting “Receive Info” when viewing the listing

We will respond using your preferred communication method (i.e., email or phone).

Statutory Statement

This offer of scheme interests is available to wholesale clients only. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.