Comparison Data

1Performance

| 1 month | 3 month | 1 year | 3 year | 5 year | Since Inception | Inception Date |

|---|---|---|---|---|---|---|

| -1.62% | -0.22% | -34.15% | -13.82% | -5.69% | -5.7% | 6 July 2021 |

Fees

| Management Fee | Performance Fee | Morningstar Total Cost Ratio |

|---|---|---|

| 0.82% | - | 0.82% |

The RAM Diversified Property Fund (“RDPF”) is an open-ended unlisted property fund that aims to provide investors with a long term secure income yield with exposure to strong underlying growth fundamentals.

| Investment Strategy |

Direct Property - Acquire existing occupied direct property assets within our target sectors that exhibit long term secure income and occupied by proven operators.

|

| Location | Metropolitan and larger regional hubs in Australia |

| Target Investment Size | Individual direct assets $15M – 150M Fund Size – Targeting $750M |

| Target Equity Returns | Circa 8.00-10.00%+ net IRR p.a. after management fees and expenses, before tax. Includes annual income distributions of 5.0% |

| Senior Debt Leverage | Targeted gearing of 50% LVR (max 60%) |

| Term | Open-ended with quarterly liquidity facility |

To learn more about the RAM Diversified Property Fund, click here.

Properties

5

portfolio valuation

$471 million

Occupancy

100%

WALE

4.3 years

-

Burwood NSW

- Canberra ACT

- Perth WA

- Bowen Hills QLD

- Brisbane CBD QLD

-

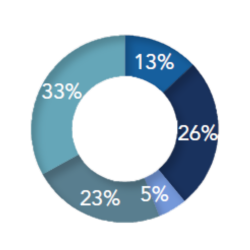

Government / Government Backed

- Corporate / Professional Services

- Publically Listed

- Higher Education

- Healthcare

- WALE: 4.15 yrs

- Occupancy: 100%

- Site Area: 1,563 sqm

- NLA: 16,301 sqm

- Key Tenants: Federal Government, Federation University, Medhealth

- WALE: 5.3 yrs

- Occupancy: 100%

- Site Area: 5,611 sqm

- NLA: 16,679 sqm

- Key Tenants: Commonwealth of Australia (Dept. of Defence), Air Services Australia

- WALE: 6.1 yrs

- Occupancy: 100%*

- Site Area: 9,302 sqm

- NLA: 12,427 sqm

- Key Tenants: 20% Fuji Xerox

- WALE: 7.9 yrs

- Occupancy: 100%

- Site Area: 5,957 sqm

- NLA: 1,871 sqm

- Key Tenants: Modern Medical Clinics, Clinipath Pathology

- WALE: 1.8 yrs

- Occupancy: 100%

- Site Area: 1,785 sqm

- NLA: 6,401 sqm

- Key Tenants: NSW Government

1. Target Income Payable Quarterly

2. Target long term capital growth

*Investment returns are not guaranteed. Actual returns may differ from target returns for a range of factors including investment performance, taxation and indirect costs. Equity Trustees Limited (“Equity Trustees”) (ABN 46 004 031 298), AFSL 240975, is the Responsible Entity for the RAM Australia Diversified Property Fund. Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT). The Investment Manager for the Fund is Real Asset Management Pty (ACN 162 123 408, AFSL No. 484263. This material has been prepared by Real Asset Management Pty to provide you with general information only. In preparing this material, we did not take into account the investment objectives, financial situation or particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Neither Real Asset Management Pty, Equity Trustees nor any of its related parties, their employees or directors, provide and warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. Past performance should not be taken as an indicator of future performance. You should obtain a copy of the IM before making a decision about whether to invest in this product.

RAM was founded in 2010 and has a pan-Asia presence of 5 offices in Sydney, Melbourne, Brisbane, Shanghai and Hong Kong. RAM provides more than 15 investment strategies and has a team of over 100 finance professionals managing in excess of A$4.3bn in assets.

We provide a global set of investment solutions through our group companies licensed by the Australian Securities and Investment Commission of Australia (AFSL 484263), and the Securities & Futures Commission of Hong Kong (CE BGL803).

All numbers as of 31st December 2023, unless otherwise indicated.

Matthew has over 26 years of experience in Global Real Estate markets across real estate development, investment and funds management disciplines.

Prior to joining the Real Asset Management team as Head of Real Estate, Matthew was a Global Director and Head of Funds Management at QIC Global Real Estate, with responsibilities for Australian and United States capital transactions, wholesale funds and client mandates. As part of the leadership team at QIC Global Real Estate, Matthew oversaw all of the group’s direct and unlisted investment activities and established QIC’s offshore capabilities in the United States. During his 19 years at QIC, Matthew was part of both the development and asset management teams and capital transactions prior to leading the funds management group. Prior to joining QIC, Matthew worked for Lend Lease Development in various development roles in Australia.

Matthew holds degrees in Commerce, majoring in Finance, and Information Technology, majoring in Statistics and Applied Mathematics from Bond University, achieved through a Vice Chancellor’s scholarship

Relevant Documents

You should read the PDS, TMD (if applicable) or any Investment Memorandum (or other offer documents) related to this product before making an investment decision. These documents (if available) can be found at https://ramgroup.com/, or if this is a "wholesale investor only" investment, can be viewed by contacting the Product Issuer identified on the aforementioned website.

Statutory Statement

This offer of scheme interests is available to wholesale clients only. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

1 For use in Australia: © 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its affiliates or content providers; (2) may not be copied, adapted or distributed; (3) is not warranted to be accurate, complete or timely and 4) has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), subsidiary of Morningstar. Neither Morningstar nor its content providers are responsible for any damages arising from the use and distribution of this information. Past performance is no guarantee of future results.

Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at http://www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar's publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar's full research reports are the source of any Morningstar Ratings and are available from Morningstar or your advisor. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a financial advisor. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.