The Fund offers investment in Loans, secured by first registered Mortgages over legal interests in real property in Australia. Each Loan we approve is separate from other Loans in the Fund. Mortgages are registered in the name of RMBL as Responsible Entity for the Fund being the mortgagee or lender.

Each Investor contributes their investment to one or more Loans after we have received your consent.

As the Fund is not a “pooled fund”, your entitlement to income or capital is based only on your investment in a specific Loan and you have no right to the income or capital of other Loans within the Fund. Once you invest into a Loan, you have no right to withdraw from a Loan.

Prior to investing in the Fund, you should seek advice from a financial adviser about whether the Fund meets your objectives, needs and circumstances.

Over 60 years of Investment Solutions

With over 60 years of proven experience, RMBL has over $1.8 billion in Funds Management and currently has the support over 4,000 investors to whom we maintain our commitment to excellence and high professional service.

No fees to investors

NO FEES are charged by us to Investors. All fees received by us are received from the Borrower under the Loan Facility.

Competitive Rate of Return

Subject to payment by the Borrower, we pursue the most competitive rate of return on a regular basis (usually monthly), allowing our clients to reinvest their interest if they wish.

Control over your investment

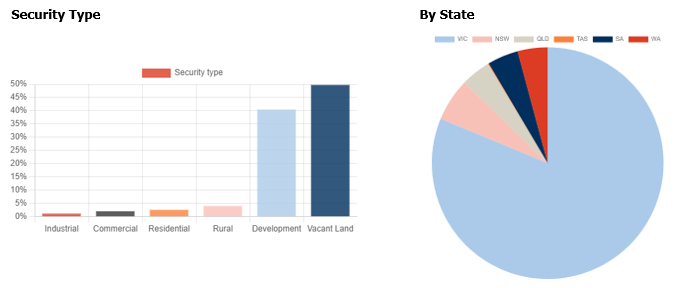

Our clients can consent to a Loan in which they like to invest, allowing full control of their investment decision. Clients may also decide which types of Security Property or Loans they wish to invest in, as well as spreading their funds across.

Highly qualified and experienced Professionals

Our qualified professionals have an extensive knowledge and in depth understanding on Development Loans in this industry. Along with strong and long-standing relationships with Borrowers, this places us in an excellent position to respond quickly and effectively to any issues that arise before they impact on Investors’ funds.

Bespoke Service

We pride ourselves on providing a personal service to our Investors and Borrowers. Getting to know our clients who place their trust in us to invest their fund, is a responsibility which we handle with the outmost professionalism. Our dedicated team is always accessible to you whether that is in person, over the phone, via email or mail.

RMBL's select first mortgage fund offers a simple, streamlined way for investors to gain exposure to quality properties and developments through first mortgage debt.

Our investors enjoy complete control over their investments, directing their investments to their chosen loan/s within the Fund. This flexibility extends from a minimum investment of $10,000 up to multi-million dollar sums.

Click here for an example of the opportunities of RMBL loans for information purposes only and should not be construed as being invitations to invest into these loans.

RMBL commenced its journey in the 1960s originating from the law firm of Macpherson Kelley where four of the founding partners, George Robertson, Frank Monotti, Colin Barlow & Ron Lambert which created the acronym for our current business name, RMBL.

Our founders identified a niche within the investment arena matching clients seeking Investment with others who had active projects requiring funding and this was the genesis of the original solicitor’s mortgage fund.

Our vision is to be Australia’s most trusted and leading niche specialist in Mortgage Investment services.

Today we operate under the stringent regulatory guidelines prescribed by the Australian Securities and Investments Commission (ASIC) and maintain an Australian Financial Services License (AFSL).

Dawn has extensive experience in the finance and investment sector. Having been with RMBL for over 20 years and in her role as Funds Manager for the past 17 years, Dawn is a very familiar face and voice to many of our investors.

Dawn works across the Fund supporting both operations and investor relations. Dawn holds a Diploma of Mortgage Lending and Diploma of Financial Services.

As RMBL’s Chief Investment Officer, Cassim leads the Investment team and is responsible for developing strong, long-term relationships with wholesale and high net worth investors, as well as supporting and expanding relationships with existing RMBL investors.

Before joining RMBL, Cassim acquired more than 20 years’ experience in financial services across 2 continents having held senior roles in private banking and private wealth businesses in Australia and South Africa. He has gained invaluable experiences in both real estate financing and Investing.

With a career spanning more than 18 years in the superannuation sector, Scott’s expertise encompasses pivotal domains such as key account management, relationship management, strategic business development and education.

Scott’s versatile skill set has expanded in recent years to encompass investment analysis, strategic investment planning and investment management, with a particular focus on property as an asset class.

Scott holds tertiary qualifications in Business Management (LaTrobe University) and Education (Australian Catholic University), and is a Certified Agents Representative, licensed to buy and sell real estate in Victoria.

Wayne has over 17 years of Financial Services experience, specialising in Superannuation and Group Life Insurance.

He is a strong operational leader with a passion for building client relationships and delivering exceptional service outcomes to clients.

Notably, Wayne brings extensive experience leading business transformations and a focus on continuously improving the way we operate to make it easy for our clients to do business with us.

Click here to view our Better Futures Blog.

For further information, please contact us at team@rmbl.com.au

Statutory Statement

The issuer of this product is identified at the top of this page. The PDS and target market determination for the product are available in the Documents section of this listing. Prospective investors should consider the PDS before deciding to acquire the product. An investment in the product is not a bank deposit and investors risk losing some or all of their money. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets(Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.