Comparison Data

1Performance

| 1 month | 3 month | 1 year | 3 year | 5 year | Since Inception | Inception Date |

|---|---|---|---|---|---|---|

| 6.99% | -2.18% | 6.98% | - | - | 10.35% | 15 Dec 2022 |

Fees

| Management Fee | Performance Fee | Morningstar Total Cost Ratio |

|---|---|---|

| 0.85% | - | 0.85% |

The Sintra Global Fund is a wholesale unregistered managed investment scheme under a unit trust structure. The Fund primarily invests in Australian and International listed equities.

It typically holds 20-30 stocks however, depending on market conditions, has the ability to hold up to 100% cash. In addition, may from time to time use derivative instruments for the purpose of risk management.

Over the long-term, equities provide capital appreciation with share price gains ultimately driven by earnings growth. Investment returns can be further enhanced by superior management teams.

At Sintra Capital we will only invest when our advanced internal stock scoring system, exceeds a minimum threshold. Capital preservation is always a priority when considering potential investments. As such, when opportunities are scarce the portfolio will hold additional cash and derivative overlays will be considered.

The Fund operates under a flexible mandate that is style, sector, country, size and benchmark agnostic, providing the ability to capture greater value over the entire investment cycle.

The principal objective of the Fund is to grow investor wealth over the long-term while maintaining a capital preservation focus by investing in a portfolio of Australian and International securities which satisfy key selection criteria as determined by the Investment Manager.

Stock Selection

At Sintra we seek to identify companies with an enhanced combination of:

- Attractive Valuation

- Industry Structure

- Strong Leadership

- Superior Earnings Growth

Each of these items is scored out of 100 with emphasis placed on company leadership, reflecting our conviction that strong management is a defining element of a successful business. Our analysis is supported by in-depth fundamental research, extensive company meetings, independent consultants and industry experts. For inclusion in the portfolio a weighted average

minimum score is required.

To appropriately balance risk and return, stock risk (which is determined by assessing liquidity and volatility), is considered when determining maximum portfolio weightings.

Therefore, stocks with a lower risk factor will be allocated a higher portfolio weight and vice versa. The individual stock scores are then incorporated as a measure of relative conviction. The Fund will aim to not have more than 10% of the Portfolio in any one position.

Click here to view our Fund Performance.

Sintra Capital was established in 2022 as a Melbourne based boutique funds management business. Co-founders and portfolio managers Joshua Kitchen and Tony Sutton have a combined 45+ years of equity market experience with proven long-term track records of consistently strong investment performance.

Joshua began his career at Bankers Trust as an Institutional Sales Trader.

In 1999 he joined K2 Asset Management as its first employee. K2 was the pre-eminent Australian Hedge Fund that had over AU$1.0bn of FUM at its peak, offering absolute return strategies for retail, wholesale and institutional investors across domestic and international markets.

Joshua spent 23 years at K2 where he gained significant investment management experience in his role as senior portfolio manager within the Australian, Small Cap and Global funds. His core competencies are in Australian and International equities with an absolute return focus.

Joshua holds a Bachelor of Commerce and a Graduate Diploma of Applied Finance and Investment.

Industry experience: 25 years

Tony commenced his investment career in 2000 at Goldman Sachs JB Were within the sell-side equities research team as a quantitative analyst.

In 2006, Tony joined Global Wealth Allocation Ltd (GWA), a UK based funds management company, initially as head of research and then managing director Asia Pacific. He was jointly responsible for AUM growth from start-up to US$6bn. In 2010, his responsibilities at GWA were expanded to include lead portfolio manager for the global equity high conviction fund within affiliate company API Capital.

In 2016, he joined K2 Asset Management as a Portfolio Manager and subsequently as Head of International Equities within the K2 Select, Global and Asian funds.

Tony graduated from Melbourne University with a Bachelor of Commerce (Hons) in 1999.

Industry experience: 22 years

Click here to view our current and past Monthly Reports and Reserach Notes.

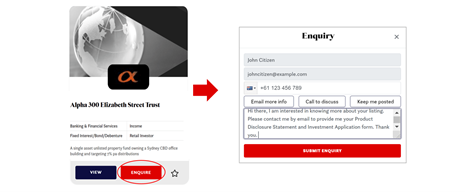

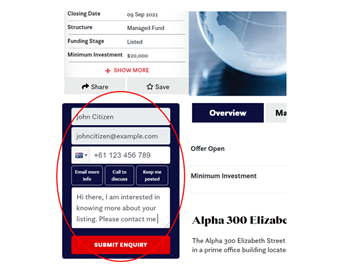

If you have joined Investment Markets (which is free) and verified your email address, you can send an email directly to us either by: -

- Selecting “Enquire” when viewing the card relating to the listing, OR

- By completing the enquiry form on the left-hand side when viewing the detail of a listing

We will respond using your preferred communication method (i.e., email or phone).

Statutory Statement

This offer of scheme interests is available to wholesale clients only. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

1 For use in Australia: © 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its affiliates or content providers; (2) may not be copied, adapted or distributed; (3) is not warranted to be accurate, complete or timely and 4) has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), subsidiary of Morningstar. Neither Morningstar nor its content providers are responsible for any damages arising from the use and distribution of this information. Past performance is no guarantee of future results.

Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at http://www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar's publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar's full research reports are the source of any Morningstar Ratings and are available from Morningstar or your advisor. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a financial advisor. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.