Comparison Data

1Performance

| 1 month | 3 month | 1 year | 3 year | 5 year | Since Inception | Inception Date |

|---|---|---|---|---|---|---|

| 7.51% | 4.93% | 3.85% | 2.44% | 9.54% | 10.69% | 1 July 2018 |

Fees

| Management Fee | Performance Fee | Morningstar Total Cost Ratio |

|---|---|---|

| 1.25% | 0.15% | 1.4% |

The Spatium Small Companies Fund is:

- an actively traded Fund, turning over the portfolio, on average, every 30-45 days; an Australian long-only product, investing in listed companies within the top 300 only;

- holding a majority of the portfolio’s positions within the 101-300 listed companies (the Small Ordinaries portion);

- invested in, on average, 25 to 40 positions on an equal weighted basis; and

- does not use gearing or leverage.

Objectives

Outperform

Outperform the benchmark over the long term by 5-6% p.a¹.

1Target returns of 5-6% p.a. above the ASX Small Ordinaries index benchmark is a target only and not a forecast. Target returns are not guaranteed to occur. Past performance is not necessarily indicative of future performance.

Majority Invested

Be majority invested at all times; on average holding <3% in cash.

Income Distribution

A focus on gains, with the intention of paying an annual distribution.

DAILY

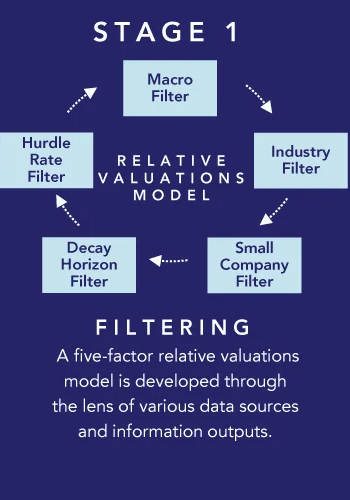

Sector and industry agnostic, our investment strategy aims to identify undervalued equities through a methodical and agile approach, allowing Spatium Capital to focus on equities it believes will appreciate in the short term.

The Fund applies a systematic investment strategy, designed to identify undervalued equities listed on the ASX300 through processes that focus on robust filters.

The investment objective of the Fund is to generate capital gains by investing predominantly in listed Australian equity securities with an aim to exceed the return achieved by the S&P/ASX Small Ordinaries Index, over the long-term. At times the Fund may invest in international equities, and it may use futures and options, however the Investment Manager does not presently seek to engage in these investments.

Investment Approach

The Fund:

- invests in listed Australian equity securities (whilst the Trust Deed permits the purchase of international equities, the Investment Manager does not presently seek to engage in these investments);

- does not generally borrow and in the event of borrowing only intends to borrow for short term purposes such as funding redemptions; and

- intends not to, although may use futures and options.

As making informed investment decisions has become increasingly difficult and time consuming, Spatium Capital's investment philosophy asserts that listed companies are susceptible to being momentarily oversold or undervalued due to herd mentality and market psychology.

Put simply, we believe that with the influx of passive products (ETF's), major institutions occasionally requiring immediate access to capital and with the wider markets more frequently moving in herds, equities are prone to being sold-off hastily. This phenomenon has become particularly noticeable over the last 8 years of building and launching the investment strategy.

We consider this point to be a momentary mispricing which through our investment approach outlined below, we seek to identify these equities at their opportune moment to benefit from their appreciation.

Nicholas Quinn from Spatium Capital is back on Talk Ya Book to discuss the rapidly developing ESG investing landscape, the recent extreme commodity inflation, and three of his favourite stocks picks.

In this week’s episode of Talk Ya Book we’re joined by Nick Quinn from Spatium Capital. Spatium’s Small Companies Fund (SSCF) was founded in 2018 by long-term associates Nick and Jesse. The fund seeks to be actively moving between 25-40 positions across the ASX300, with their core focus surrounding companies that they believe have been oversold due to market inefficiencies. Tune in to hear Nick and I discuss global markets, the future of monetary policy and a few stocks currently on his radar.

The Spatium Small Companies Fund (Fund) is an unregistered managed investment scheme in the form of an Australian unit trust. The Fund is only available to investors that are wholesale clients as defined in s761G of the Corporations Act 2001 (Cth). M&Q Capital Pty Ltd is the investment manager of the Fund (Investment Manager). The Investment Manager is a corporate authorised representative (001279779) of True Oak Investments Ltd ACN 002 558 956 AFSL 238184. The Investment Manager's authority under its Corporate Authorised Representative Agreement with True Oak Investments Ltd is limited to general advice regarding the Fund only. True Oak Investments Ltd ACN 002 558 956 is the trustee of the Fund and the issuer of its Information Memorandum. Withdrawal rights are subject to available liquidity and may be delayed or suspended. The contents of this document are not intended as financial product advice and have been prepared without taking into account your personal circumstances, investment objectives or particular needs. You should read the Information Memorandum for the Fund in full to consider whether an investment is appropriate for you. Neither the Investment Manager nor True Oak Investments Ltd guarantee the repayment of capital, the performance of any investment or the rate of return for the Fund. Past performance is not necessarily indicative of future performance. An investment in the Fund is not a bank deposit. We strongly suggest that you seek your own professional financial or legal advice prior to any investment decisions.

Spatium Capital is an independently owned, boutique funds management firm.

Founded by Nick Quinn and Jesse Moors, Spatium specialises in identifying mispriced listed equities.

We believe that there is growth in an environment where equities are increasingly oversold or undervalued for short periods. By applying a clinical and disciplined investment process, we hope to capture these short-term mispricing’s for the benefit of the Fund.

As a Firm we have three key beliefs:

- Put your money where your mouth is: all liquid assets owned by the Founders are invested in the Firm & Fund;

- Do our own research: in an industry with numerous research offerings, Spatium is a DIY operator, relying on our robust filters and a clinical investment approach; and

- Preserve performance: funds managed by Spatium are limited in total FUM to ensure that investments can be entered and exited with agility.

In doing so, we believe this prioritises the performance returned to investors.

As making informed investment decisions has become increasingly difficult and time consuming, Spatium Capital's investment philosophy asserts that listed companies are susceptible to being momentarily oversold or undervalued due to herd mentality and market psychology.

Put simply, we believe that with the influx of passive products (i.e. ETF's), major institutions occasionally requiring immediate access to capital and with the wider markets more frequently moving in herds due to increased market participants, equities are prone to being sold-off hastily. This phenomenon has become particularly noticeable over the last 8 years of building and launching the investment strategy.

We consider this point to be a momentary mispricing which through our investment approach, we seek to identify these equities at their opportune moment to benefit from their appreciation.

Co-founder and Director of Spatium Capital, Nick has an affinity for physics and mathematics whose principles have influenced the creation of the Fund’s investment strategy.

In his capacity as Director, Nick’s responsibilities are predominantly focused on trading and portfolio construction, whilst supporting Jesse on numerous client engagement and firm-related tasks. He has shared responsibility for the investment management decision process with Jesse.

Prior to Spatium Capital, Nick led a team of software developers for a mining manufacturer, before moving to transfer pricing and international debt with one of the Big 4 consulting firms.

In his free time, Nicholas can be found riding his motorbike, reading all things finance, representing his local hockey club and walking his beloved labrador Bentley.

Qualifications: Bachelor of Commerce (Finance & Economics), University of Melbourne.

Co-founder and Director of Spatium Capital, Jesse is fascinated by the mental shortcuts that drive people to solve problems and make decisions, which supported the launch of the Firm.

In his capacity as Director, Jesse’s responsibilities are predominantly focused on distribution and market research, whilst supporting Nick on the portfolio construction and R&D-related duties. He has shared responsibility for the investment management decision process with Nick.

Prior to Spatium Capital, Jesse worked in restructuring and corporate finance with a US-listed consulting firm, before transitioning to business development and market penetration strategies with an international professional membership body.

When not cycling, Jesse enjoys travelling with his wife, reading various genres of non-fiction and playing with his dog Joli.

Qualifications: Bachelor of Arts, University of Melbourne and Master of International Business, Melbourne Business School.

For our latest AusBiz videos, please click on the below:

Click here to read our current Newsletter.

If you have joined Investment Markets (which is free) and verified your email address, you can send an email directly to us either by: -

- Selecting “Enquire” when viewing the card relating to the listing, OR

- By completing the enquiry form on the left-hand side when viewing the detail of a listing

We will respond using your preferred communication method (i.e., email or phone).

Tags

Published by True Oak Investments Limited (Issuer) & Spatium Capital (Investment Manager)

Published by True Oak Investments Limited (Issuer) & Spatium Capital (Investment Manager)

Statutory Statement

This offer of scheme interests is available to wholesale clients only. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

1 For use in Australia: © 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its affiliates or content providers; (2) may not be copied, adapted or distributed; (3) is not warranted to be accurate, complete or timely and 4) has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), subsidiary of Morningstar. Neither Morningstar nor its content providers are responsible for any damages arising from the use and distribution of this information. Past performance is no guarantee of future results.

Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at http://www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar's publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar's full research reports are the source of any Morningstar Ratings and are available from Morningstar or your advisor. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a financial advisor. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.