Comparison Data

1Performance

| 1 month | 3 month | 1 year | 3 year | 5 year | Since Inception | Inception Date |

|---|---|---|---|---|---|---|

| 2.89% | 7.27% | 14.16% | 14.09% | 13.9% | 11.17% | 30 June 2017 |

Fees

| Management Fee | Performance Fee | Morningstar Total Cost Ratio |

|---|---|---|

| 1.25% | - | 1.25% |

The Centennial Level 18 Fund is a Australian equity fund designed to provide investors with consistent long-term capital growth. The Fund has a flexible investment mandate that typically invests in a portfolio of 30 – 45 companies within the domestic small cap universe. Capital protection is a key performance outcome for the Fund.

Investment Philosophy

- Manage the Fund as if it were your own money

- Investment principals account for approximately 20% of the invested capital

- Fund size has been deliberately managed – performance focused

Objectives

- Aim to achieve returns of 13% to 15% per annum before fees

- Since inception in 2012 gross returns have been 15.3% per annum

- Avoid major capital drawdowns

Flexible Mandate

- Benchmark unaware

- Stocks are selected on an individual basis

- The Fund has a heavy but not exclusive concentration of small capitalisation stocks

- The portfolio structure avoids stock concentration - typically, the Fund holds 30-40 long positions, 0-10 short positions and a small amount of cash

- No financial gearing

The objective of the Fund is to deliver investors consistent capital growth over time and to preserve capital. The Fund aims to achieve this objective by investing in a portfolio of listed Australian companies.

The Fund seeks to achieve its growth objective by identifying investment opportunities through a combination of research-driven “top-down” macro themes and “bottom-up” fundamental research. As part of the bottom-up research the Fund will seek to identify opportunities in companies that are not well researched by the market. These opportunities are generally found in companies with small to mid-size market capitalisations. The Fund will seek to maintain diversified portfolio exposures so as to spread the investment risk.

Earnings Growth

- The portfolio seeks to own investments that are forecast to deliver above average earnings growth

- The Fund specifically targets investment exposure with estimated earnings growth over a two-year time horizon

Valuation

- Key valuation inputs include earnings trajectory two years into the future, the return on equity and industry specific factors

- Portfolio construction is based on acquiring positions that are discounted when compared to long-term intrinsic value

Strong Balance Sheet

- We look for a a debt free balance sheet with available cash is a material benefit for growing small cap companies and is the best indication a company has and will continue to fund its own organic growth without the need for debt or fresh equity

Management

- The investment process screens for high quality management – including expertise, consistency of strategy, allocation of capital and shareholder consideration

- Once the investment case is established, we look for a catalyst to re-rate the stock. A company can remain cheap or expensive for extended periods

- Common catalysts include earnings changes, asset purchases or sales, changes in management, government regulation or altering macro-economic conditions

- Identifying a catalyst both for a stock buy or sell is critical to maximising the risk adjusted returns for the Fund

Centennial Asset Management is a Sydney based privately owned boutique investment management company.

Centennial Asset Management was established to provide compelling risk reward investment opportunities to sophisticated wholesale and institutional investors with a focus on capital preservation.

Matthew worked as a portfolio manager/CIO at Wilson Asset Management for 13 years between 1998 and 2011, helping to build the business and excellent long-term investment track record, achieving 18% p.a. over the period.

Prior to joining Wilsons’, Matthew worked as a finance journalist at the Sydney Morning Herald between the years 1994 and 1998, and in 1997 was made business editor.

Matthew holds a Bachelor of Law and Economics from Macquarie University, Sydney and a Graduate Diploma in Applied Finance FINSIA.

Gary worked at Consolidated Press Holdings (“CPH”) and Ellerston Capital for 10 years between 2001 and 2011.

Gary joined CPH as part of its investment team managing a portfolio of listed and private investments which grew over several years to become the foundation for Ellerston Capital. Ellerston Capital managed the public equity and managed fund investments for the Packer family as well as third party investors and grew to in excess of $4bn of funds under management.

Prior to joining CPH, Gary worked at Citigroup in its investment banking business in both Sydney and New York.

Gary holds a Bachelor of Economics from the University of Sydney, a Graduate Diploma in Applied Finance from FINSIA and is a member of the Chartered Accountants Australia and New Zealand.

Michael is a senior member of the investment and management team at Centennial Asset Management. Michael worked at Merrill Lynch as a Healthcare Analyst for 10 years between 2000 and 2010.

Most recently, he was employed at Morgan Stanley within the Institutional Equities team with responsibility for establishing and growing the Emerging Companies business.

He has more than 22 years’ experience working in the Australian equities market.

This data has been prepared by Centennial Asset Management ACN 605 827 745 & AFSL No. 515887 for Wholesale Clients only as an indicative record of the performance of an investment in the Level 18 Fund.

Centennial Asset Management does not guarantee the performance of the Level 18 Fund or the return of any investor's capital in the Level 18 Fund. This is historical information, and does not imply any indication of future performance, recommendation or advice. Past performance is not a reliable indicator of future performance. Any investment needs to be made in accordance with and after reading any relevant offer document.

Matthew Kidman recently recorded the following interview where he talks about the Level 18 Funds mandate and outlook for the market.

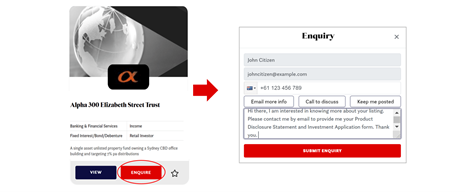

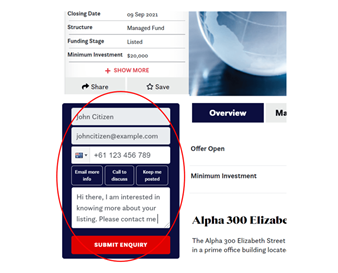

If you have joined Investment Markets (which is free) and verified your email address, you can send an email directly to us either by: -

- Selecting “Enquire” when viewing the card relating to the listing, OR

- By completing the enquiry form on the left-hand side when viewing the detail of a listing

We will respond using your preferred communication method (i.e., email or phone).

Statutory Statement

This offer of scheme interests is available to wholesale clients only. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

1 For use in Australia: © 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its affiliates or content providers; (2) may not be copied, adapted or distributed; (3) is not warranted to be accurate, complete or timely and 4) has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), subsidiary of Morningstar. Neither Morningstar nor its content providers are responsible for any damages arising from the use and distribution of this information. Past performance is no guarantee of future results.

Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at http://www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar's publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar's full research reports are the source of any Morningstar Ratings and are available from Morningstar or your advisor. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a financial advisor. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.