The Fund offers investors an opportunity to invest in Australian real estate backed mortgaged, a highly experienced investment team and a differentiated value proposition by way of our specialist and tailored credit/risk framework.

Fund Highlights –

- Target returns of 10.00% (net of fees)

- Quarterly distributions (paid in arrears)

- 12-month lock-up period, followed by 45-day notice period for redemption

- $500,000 minimum investment (or otherwise agreed)

The Fund aims to provide Unitholders with regular income (with asset-backed security) secured against Australian real estate.

Private loans will generally be provided to SMEs, investors and entrepreneurs for business or investment use with an aim of providing investors with an attractive quarterly distribution that meets the Investment Manager’s strict criteria.

The Investment Manager will be responsible for selecting loans that are suitable for each underlying SME, investor or entrepreneur using the Investment Manager’s internal credit policy (Credit Policy) and by reference to defined parameters.

Tyalla Capital's Private Credit strategy provides fund investors access to the SME & Private Investor market, a highly differentiated offering compared to the crowded developer & construction lending segment.

Tyalla Capital demonstrates a conservative risk management approach, backed by quality Australian real estate.

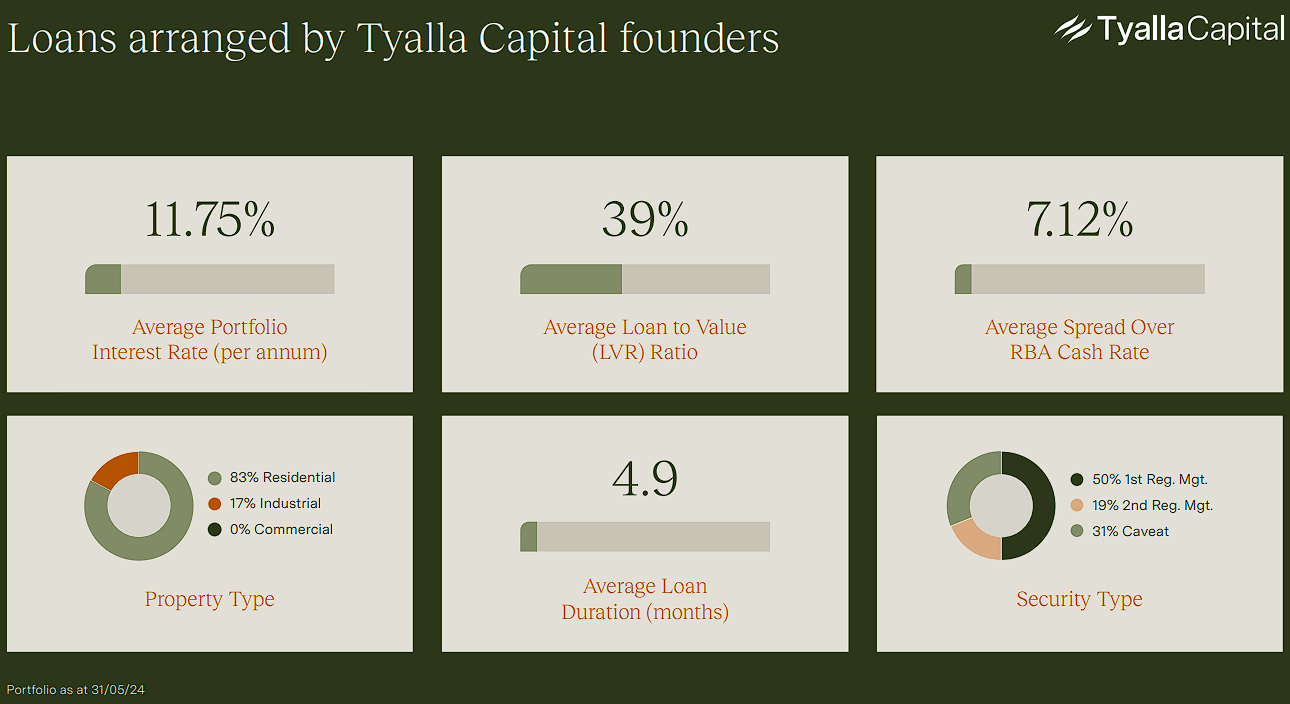

Our key risk metric, the Loan to Value Ratio (LVR) is based on real assets with real valuation today. Whilst we are interested in the future value of an asset, we mitigate risk by anchoring to the value today.

Our deal flow is sourced from a proprietary network of professional contacts ensuring deals are negotiated without competitive tension, generating attractive rates to our investors.

Our comprehensive risk and credit analysis evaluates the borrower’s bona fides and financial strength in tandem with the transaction.

Very strong deal pipeline, with significant diversity of property asset class and geography.

We conduct our own property value analysis, in addition to using independent valuers for each transaction assessing current market value which includes a detailed risk profile of the asset.

We apply a rigorous credit assessment and approval process based on 15 years experience in credit risk.

Tyalla Capital will take either a 1st Registered Mortgage, 2nd Registered Mortgage or Caveat security over Australian real estate to secure loans issued to borrowers.

Tyalla Capital has adopted a credit & risk management policy that provides our investors with significant property security to ensure funds invested are highly secure.

We will only lend to a maximum of 75% Loan to Value Ratio (LVR) to ensure there is an appropriate buffer in the unlikely event of property market weakness.

Tyalla Capital has decades of investment and credit experience, providing a strong foundation for risk management, growth and fund performance.

Highly experienced founders with 15 years of credit experience, writing over $1.65 billion in loans.

Founders and families have a long history of private lending secured against Australian real estate for business & investment purposes.

Over 45 years of investment experience including management of over $2.0 billion in institutional and family office capital across multiple asset classes in Australia and offshore.

With unprecedented growth in private credit within the Australian debt market, we see a significant opportunity which has led to the decision to source external capital to allow us to grow more rapidly and share the opportunity with our investors.

James Ostroburski OAM is an experienced banking executive & entrepreneur, with a significant interest in social responsibility and philanthropy.

Prior to founding Tyalla Capital, James spent 15 years working with some of the world’s leading private banks and lenders, as well as leading and investing in several successful start-ups across multiple sectors. This includes Kooyong Group, one of Australia’s leading specialist lenders for doctors, where James was the Founder, CEO and Managing Director between 2016 and 2023. Under his tenure, Kooyong Group provided over $1.6 billion dollars of lending, donated over $1.2 million dollars to Australian not-for-profits, and planted over 10,000 trees in partnership with Carbon Neutral Australia. James has also held leadership roles with Investec Bank, Grimsey Wealth and Credit Union Australia.

Through-out his career, James has taken on Chair, Director, Trustee and Governor roles for organisations he is passionate about – including Dancehouse Incorporated, Nexus Global Youth Summit, the Australian Chamber Orchestra, the Institute of Creative Health, the Jewish Museum of Australia, Bundanon Trust, and the Arts Centre Melbourne Foundation.

He is currently Chair of the James & Leo Ostroburski Foundation, Interim Chair of the Festival of Jewish Arts & Music, Deputy Chair of the Surgeon’s Impact Fund and Director of the Australian National Memorial Theatre Limited.

In 2021, James was awarded the Medal of the Order of Australia (OAM) in the Queen’s Birthday Honours List for distinguished services to the community through philanthropy.

James is also a pilot-in-training, having served as a civilian member of Air Academy with the Royal Australian Air Force (RAAF) for four years.

James graduated from the Victorian College of the Arts Secondary School with a dance major. He also holds a Graduate Diploma in Corporate Finance from New York University and a Diploma in Financial Planning from TMG College Australia. In 2023, he commenced a Masters of Business Administration with the London School of Economics.

Albert Peker has been a respected investment manager, analyst and advisor for over 25 years. He has a proven track record in managing public and private capital in Australian and global asset classes, achieving significant compound returns above benchmarks.

For 15 years, Albert was the Associate Director of Global Investments at the Gandel Group, a private investment group founded by Australian billionaire John Gandel. Albert established and managed the Gandel Group’s extensive investment platform, which included managing numerous active Australian equity portfolios, as well as sourcing and allocating to global managers in fixed income, credit, global equities, hedge funds and private equity. He was also an asset allocation advisor for the Gandel Charitable Foundation. Prior to working at the Gandel Group, Albert held leadership roles at HSBC Asset Management, Jardine Fleming Capital Partners and ANZ Funds Management.

Albert is also active in his community, where he applies his business acumen to help local organisations thrive. During the six years he was President of the Maccabi Victoria Basketball Club, one of the largest junior basketball clubs in the southern hemisphere, Albert helped grow the club’s memberships from 300 to over 600 players. He also undertook a strategic review to ensure the success of the club into the future.

Albert holds a Bachelor of Commerce from the University of Melbourne and a Masters of Finance from the Royal Melbourne Institute of Technology, where he also worked as a Senior Lecturer and co-authored several finance articles in peer-reviewed journals.

S.ome Text Here

Private lending is the practice of individuals, family office or private institutions providing loans to borrowers directly, without involving traditional financial institutions such as banks or credit unions at customised terms agreed to by both parties.

Private lending offers more flexibility in terms of loan approval criteria and repayment terms compared to traditional lending sources, who are more rigid with their requirements.

Private lending is an attractive alternative for borrowers who may not qualify for loans from traditional lenders due to factors such as limited or irregular income, delays in tax lodgement, timing & complex structures.

Every private debt solution is tailored to the particular scenario, because we know that no two transactions are the same.

The purpose of funds must be wholly or primarily for business and/or investment purposes.

Statutory Statement

This offer of scheme interests is available to wholesale clients only. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.