The Fund’s objective is to provide an attractive risk-adjusted return in excess of the Benchmark over a rolling 5-7 -year period that is hedged for foreign currency exposure.

The Fund’s objective is to provide an attractive risk-adjusted return in excess of the Benchmark over a rolling 5-7 -year period.

YMAX aims to generate attractive quarterly income and reduce the volatility of portfolio returns by implementing an equity income investment strategy over a portfolio of the 20 largest blue-chip shares listed on the ASX. YMAX does not aim to track an index.

UMAX aims to generate attractive quarterly income and reduce the volatility of portfolio returns by implementing an equity income investment strategy over a portfolio of stocks comprising the S&P 500 Index. UMAX does not aim to track an index.

Tribeca Global Natural Resources (TGF) provides investors with exposure to an active long short investment strategy that seeks to profit from the inherent volatility in the Natural Resources Sector.

An ASX listed investment company that holds positions across both public and private markets, covering a range of industries and stages of development. The investment strategy targets innovative companies that display a sustainable competitive advantage and strong management teams. The Fund also aims to provide a steady, fully franked dividend stream.

Ryder Capital Limited (RYD), an ASX-listed company, is a boutique fund manager pursuing a high conviction, value driven investment strategy specialising in small-cap Australian equities.

Excelsior Capital Limited, (‘ASX:ECL’ or ‘Excelsior’) (previously known as CMI Limited), is a Listed Investment Company (LIC) that has been listed on the Australian Stock Exchange since 1993. Its investment strategy is quite dynamic, focusing on a mix of acquisitions, direct investments, and managed investment schemes aimed at achieving high compound returns with capital stability , low volatility at minimal correlation to risk assets such as equities and bonds.

Carlton Investments Limited (CIN) is a long established investment company listed on the Australian Securities Exchange. It is the investment strategy of the Carlton Investments Group to invest in established, well managed Australian listed entities that are anticipated to provide attractive levels of sustainable income and also long term capital growth.

The Fund employs a passive investment strategy that aims to provide investors with the performance of the S&P/ASX Bank Bill Index (before fees and expenses). The Fund offers the ability to achieve capital preservation and regular income with a diversified portfolio of high quality short-term money market instruments. The Fund is truly liquid and only holds investments in instruments that can be sold on a same day basis.

The Fund uses a passive investment strategy aimed to provide investors with performance, before fees and expenses, that is broadly aligned with, and which may exceed, the performance of an index comprised of Australian bank bills.

Using Allan Gray’s contrarian investment strategy, the Fund seeks to provide a long-term return that exceeds the S&P/ASX 300 Accumulation Index (Benchmark).

The Fund's investment strategy is to primarily invest in property development projects that take into account ESG considerations where it would be a benefit to the final revenue and value of the Fund.

The Fund offers investors access to BCUC’s investment strategy and a diverse portfolio of loans secured by 1st and/or 2nd mortgages against premium Australian real estate. (For Wholesale Investors Only)

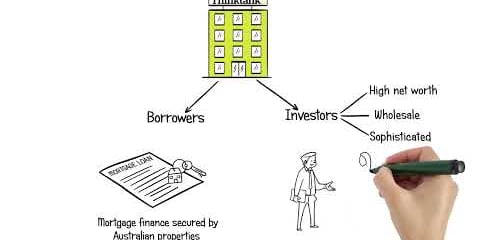

Thinktank Income Trust offers investors first mortgage exposure to domestic, established commercial and residential property (for Wholesale Investors only)