Comparison Data

1Performance

| 1 month | 3 month | 1 year | 3 year | 5 year | Since Inception | Inception Date |

|---|---|---|---|---|---|---|

| -2.97% | 1% | 3.87% | 17.04% | 7.09% | 9.73% | 12 June 2020 |

Fees

| Management Fee | Performance Fee | Morningstar Total Cost Ratio |

|---|---|---|

| 0.7% | - | 1.2% |

The Artisan Global Discovery Fund, managed by Artisan Partners and distributed by Copia Investment Partners, provides investors with access to a diversified portfolio of global companies positioned for long-term capital growth. The Fund invests in the Artisan Global Discovery Fund (UCITS) — a sub-fund of the Artisan Partners Global Funds Public Limited Company, authorised and regulated under Irish law.

Through its unique approach, the Fund identifies companies that combine franchise characteristics, such as a strong brand, low-cost production, or dominant market share, with accelerating profit cycles and attractive valuations. The Fund’s investment universe spans small- to mid-sized global companies with sustainable growth potential and a demonstrated ability to compound earnings over time.

Artisan Partners believes that profit cycles drive equity returns — and that early identification of these cycles offers a powerful source of alpha. The investment team employs a fundamental, bottom-up research process to uncover businesses across global markets that are entering or benefiting from strong phases of earnings growth.

The team’s process involves three key components:

-

Security Selection – identifying companies with durable advantages, such as proprietary assets, low-cost production, or market leadership.

-

Capital Allocation – building positions based on where each company sits within its profit cycle:

-

GardenSM: early-stage opportunities that may grow into larger positions.

-

CropSM: companies in the strongest part of their profit cycle.

-

HarvestSM: positions being trimmed as valuations peak or growth slows.

-

-

Global Insight – leveraging deep sector and regional knowledge to capture opportunities across developed and emerging markets.

The Fund’s strategy also integrates environmental, social, and governance (ESG) considerations into its decision-making, viewing responsible corporate practices as a driver of sustainable long-term returns.

Investing in the Artisan Global Discovery Fund offers:

-

Global growth exposure through a professionally managed, high-conviction equity portfolio.

-

Diversification across countries, sectors, and industries that may be difficult to achieve through direct investment.

-

Active management from an experienced global investment team with a disciplined profit-cycle framework.

-

ESG integration as part of the investment process to help manage long-term risks and opportunities.

-

Access to mid-cap innovators, balancing growth potential with proven business resilience.

The Fund aims to outperform the MSCI All Country World SMID Cap Net Index (AUD) by 2% or more per annum (after fees) over rolling five-year periods. It is designed for investors with a medium- to long-term horizon, seeking capital growth through active global equity exposure.

Jason L. White, CFA, is a managing director of Artisan Partners and a portfolio manager on the Growth team. In this role, he is the lead portfolio manager for the Artisan Global Discovery Strategy and a portfolio manager for the Artisan Global Opportunities, U.S. Mid-Cap Growth and U.S. Small-Cap Growth Strategies.

Prior to joining Artisan Partners in June 2000, Mr. White was a Lieutenant in the U.S. Navy, serving aboard the USS Lake Erie as the ship’s fire control officer. Mr. White holds a bachelor’s degree in history from the United States Naval Academy, where he graduated with distinction.

James D. Hamel, CFA, is a managing director of Artisan Partners and a portfolio manager on the Growth team. In this role, he is the lead portfolio manager for the Artisan Global Opportunities Strategy and a portfolio manager for the Artisan U.S. Mid-Cap Growth, U.S. Small-Cap Growth and Global Discovery Strategies.

Prior to joining Artisan Partners in May 1997, Mr. Hamel was a financial associate, cost analyst and operations manager of Kimberly-Clark Corporation from March 1990 through May 1997. He began his career at Carlson, Posten & Associates. Mr. Hamel holds a bachelor’s degree in finance from the University of Minnesota-Minneapolis where he was a three-time Academic All-American.

Matthew H. Kamm, CFA, is a managing director of Artisan Partners and a portfolio manager on the Growth team. In this role, he is the lead portfolio manager for the Artisan U.S. Mid-Cap Growth Strategy and a portfolio manager for the Artisan Global Opportunities, U.S. Small-Cap Growth and Global Discovery Strategies.

Prior to joining Artisan Partners in May 2003, Mr. Kamm was an associate equity research analyst at Banc of America Securities. Earlier in his career, he was a senior operations analyst for NYU Medical Center. Mr. Kamm holds a bachelor’s degree in public policy from Duke University and a master’s degree in business administration, with a specialty in finance and operations management, from New York University.

Jay C. Warner, CFA, is a portfolio manager on the Artisan Partners Growth Team. In this role, he supports the lead portfolio managers of the Artisan U.S. Mid-Cap Growth, U.S. Small-Cap Growth, Global Opportunities and Global Discovery Strategies. Mr. Warner also conducts fundamental research, primarily focusing on financial companies.

Prior to joining Artisan Partners in May 2003, Mr. Warner attended the Graduate School of Business at the University of Wisconsin-Madison and graduated from the Applied Security Analysis Program. From 1997 through 2001, Mr. Warner was a senior accountant specializing in auditing, reviewing and compiling financial statements. Mr. Warner holds a bachelor’s degree in accounting and a master’s degree in finance, investment and banking from the University of Wisconsin-Madison. Mr. Warner is a licensed Certified Public Accountant.

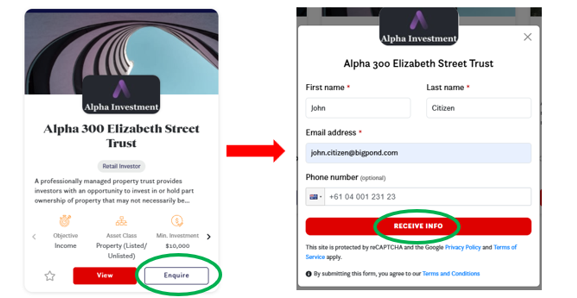

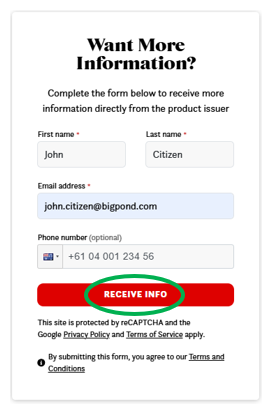

- By clicking the enquire button on the card view

Or

- By selecting “Receive Info” when viewing the listing

We will respond using your preferred communication method (i.e., email or phone).

Tags

Published by Copia Investment Partners Ltd

FIXED INTERESTINVESTOR EDUCATION

SHARESINVESTOR EDUCATION

INVESTMENT THEMESSHARES

Published by Copia Investment Partners Ltd

Statutory Statement

The issuer of this product is identified at the top of this page. The PDS and target market determination for the product are available in the Documents section of this listing. Prospective investors should consider the PDS before deciding to acquire the product. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

1 For use in Australia: © 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its affiliates or content providers; (2) may not be copied, adapted or distributed; (3) is not warranted to be accurate, complete or timely and 4) has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), subsidiary of Morningstar. Neither Morningstar nor its content providers are responsible for any damages arising from the use and distribution of this information. Past performance is no guarantee of future results.

Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at http://www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar's publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar's full research reports are the source of any Morningstar Ratings and are available from Morningstar or your advisor. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a financial advisor. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.