Comparison Data

1Performance

| 1 month | 3 month | 1 year | 3 year | 5 year | Since Inception | Inception Date |

|---|---|---|---|---|---|---|

| 0.93% | 4.8% | 17.21% | 11.61% | 13.1% | 12.93% | 26 Apr 2017 |

Fees

| Management Fee | Performance Fee | Morningstar Total Cost Ratio |

|---|---|---|

| 0.95% | 0.09% | 1.04% |

The Chester High Conviction Fund, managed by Chester Asset Management and distributed by Copia Investment Partners, is a high-conviction Australian equities fund designed for investors seeking superior long-term performance through a focused, research-driven approach. Established in 2017, Chester Asset Management is a boutique investment manager specialising in Australian listed companies within the S&P/ASX 300 Index.

The Fund seeks to exploit market inefficiencies by identifying companies with sustainable earnings and strong free cash flow or dividend growth potential — always anchored by valuation discipline to ensure a margin of safety. The portfolio typically holds 25 to 40 carefully selected stocks, enabling deep insight and conviction in every investment. The Fund is highly index-unaware, meaning it prioritises opportunity over benchmark weighting, allowing greater flexibility to pursue performance across varying market conditions.

Chester believes that a focused and active approach to Australian equities, combined with disciplined risk management, can deliver superior returns over time. The Fund aims to outperform the S&P/ASX 300 Accumulation Index by 5% per annum (before fees) over a rolling three-year period. Investments are selected through a combination of thematic insights and quantitative screening, ensuring each company fits within the team’s high-conviction investment framework.

The strategy is supported by Chester’s environmental, social, and governance (ESG) framework, which is integrated into the investment process to assess long-term risks and opportunities. While ESG considerations are not the sole driver of portfolio construction, companies that fail to meet the Fund’s governance or sustainability standards may be excluded from its investable universe.

Investors in the Chester High Conviction Fund gain access to:

-

A boutique investment team whose interests are aligned with investors — the portfolio managers invest meaningfully alongside clients.

-

An actively managed, concentrated portfolio that reflects the team’s best ideas rather than broad market exposure.

-

Proven investment expertise, with a track record of navigating multiple market cycles successfully.

-

Diversified exposure within the Australian equities universe, balancing conviction with disciplined risk controls.

Designed for investors with a medium- to long-term horizon (five years or more), the Fund offers the potential for strong risk-adjusted returns through a blend of focused stock selection and disciplined portfolio management.

Chester Asset Management was founded to help investors protect and then grow generational wealth. Formed in 2017, Chester is a dedicated high conviction equity fund manager led by Portfolio Manager Rob Tucker.

The company was named after Rob’s grandfather, Chester Raymond Tucker, who introduced Rob to investing with a parcel of shares for his 18th birthday. The Chester name represents a life-long commitment to staying curious, a deep passion for investing and building generational wealth.

Rob founded Chester Asset Management in 2017. Prior to Chester, Rob spent 7 years at SG Hiscock and was most recently the portfolio manager of the SGH Australia Plus product, a 25-40 stock Australian Equity portfolio with a mid cap bias, that was run in the same manner as the Chester High Conviction Fund. Rob was also the Co-Portfolio Manager for the SGH20 unit trust and key mandates from 2010 until November 2014 when he became the primary portfolio manager from November 2014 until his departure. Responsibilities included: portfolio construction and management, stock selection, macroeconomic analysis, research and marketing.

Prior to joining SG Hiscock in 2010 Rob was Investment Director for Halbis Capital Management (formerly HSBC Asset Management) where he worked for 9 years as Portfolio Manager of the Australian Country Fund (2005-2010), Head of Research for Asia Pacific (2005-2007), and Portfolio Manager of the Asian Freestyle Fund (2008-2009). 5 of these years (2005-2010) were based in Hong Kong where he managed a large pool of money for a wide array of institutional clients. During his 5 years running the HSBC Australian Country Fund, the Fund delivered 4.3% outperformance per annum.

Between 2001 and 2005 as well as Co Managing the Australian Active Fund from 2003 – 2005 Rob was also Australian Equities Analyst across: Healthcare, Building Materials, Energy, Transport, Media, Retail, Food and Beverages sectors.

Rob also previously spent time as an Analyst at Merrill Lynch.

Anthony co-founded Chester Asset Management in 2017 after departing SG Hiscock where he was the senior analyst for the SGH Australia Plus and SGH20 team. Anthony performed detailed company research and industry analysis, portfolio management assistance, client reporting, ESG analyses, proxy voting, quant filtering and database management. Anthony was also the primary dealer of the team.

At SG Hiscock Anthony led a material enhancement in the company analysis capabilities of the team including: research, modelling, stock selection and idea generation. During that time Anthony’s research coverage expanded from Energy and Utilities to include: Infrastructure/ Transport, Agriculture/ Consumer Staples, Resources (base metals, precious metals and bulks), Building Materials, Financials, Construction and REITS, Chemicals, Paper and Packaging and Gaming.

Prior to this role Anthony was an Associate Director at Core Energy Group, providing consulting services (in depth research and insights) to over 10 of Australia’s largest fund managers on ASX listed energy and utility companies and energy market dynamics. During that time Anthony also completed a number of client engagements for industry participants including assistance with M&A projects.

Anthony has also previously worked as an Assistant Manager in Audit and Advisory at KPMG.

Luke joined Chester Asset Management in February 2018 having spent the previous 6+ years working at SG Hiscock & Company. As an investment analyst Luke worked on the SGH Australia Plus and SGH20 funds at SG Hiscock and assumed primary company research coverage across the consumer, industrials, telecommunications, media and IT sectors during his tenure. In addition to his work on ASX listed companies Luke worked closely with Rob Tucker researching listed Asian companies in support of the SGH Australia Plus strategy that selectively invested across the region.

Prior to joining SG Hiscock in 2011 Luke spent 5 years working in Melbourne with Perennial Investment Partners supporting the various Perennial investment boutiques. During his time with Perennial Luke successfully completed the CFA program and gained this accreditation.

Luke joined Chester having previously enjoyed a successful working relationship with Rob Tucker and Anthony Kavanagh.

Luke Dalgleish joined Chester Asset Management in March 2024. Prior to joining Chester, Luke spent 3 years as an Equity Research Associate at J.P. Morgan, specialising in the Telecommunications, Energy, and Utilities sectors. Before his role at J.P. Morgan, Luke spent 3 years at Telstra Corporation as Retail, Commercial & Strategy Analyst, where he optimised distribution strategies, conducted financial modelling and scenario analyses, and managed capital expenditure for store modernisation programs.

Tom Beard joined Chester Asset Management in February 2024. Prior to joining Chester, Tom served as an Equity Analyst at Taylor Collison for 3 years, covering investment opportunities within the ASX listed small and micro caps space with a particular focus on the Industrials sector. Tom played a key role constructing comprehensive financial models and actively engaging with company management teams. Tom also spent a year as a Research Analyst at Modern Investor, where he contributed to building valuation models across various sectors and authored research articles aimed at retail investors.

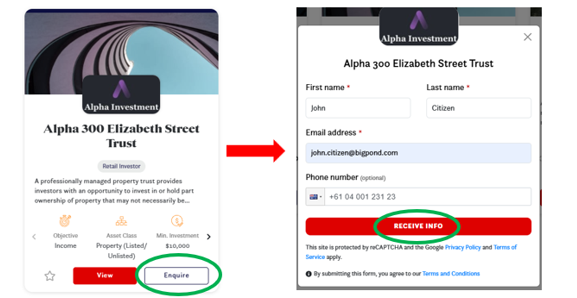

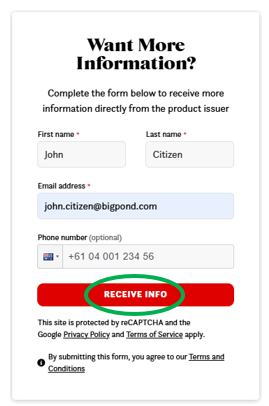

- By clicking the enquire button on the card view

Or

- By selecting “Receive Info” when viewing the listing

We will respond using your preferred communication method (i.e., email or phone).

Tags

Published by Copia Investment Partners Ltd

FIXED INTERESTINVESTOR EDUCATION

SHARESINVESTOR EDUCATION

INVESTMENT THEMESSHARES

Published by Copia Investment Partners Ltd

Statutory Statement

The issuer of this product is identified at the top of this page. The PDS and target market determination for the product are available in the Documents section of this listing. Prospective investors should consider the PDS before deciding to acquire the product. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

1 For use in Australia: © 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its affiliates or content providers; (2) may not be copied, adapted or distributed; (3) is not warranted to be accurate, complete or timely and 4) has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), subsidiary of Morningstar. Neither Morningstar nor its content providers are responsible for any damages arising from the use and distribution of this information. Past performance is no guarantee of future results.

Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at http://www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar's publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar's full research reports are the source of any Morningstar Ratings and are available from Morningstar or your advisor. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a financial advisor. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.