To provide long-term capital growth by investing in a portfolio of life science companies where innovation plays a crucial role in improving global health and economic outcomes. This includes biotechnology, pharmaceuticals, medical devices and equipment, medical data, information technology (e-health), and robotics.

The minimum suggest investment time frame for the Fund is over 5 years.

There is a risk that investors may lose some or all of their initial investment. Higher-risk investments tend to fluctuate in the short-term but can produce higher returns over the long term. This risk grading may not accurately measure the actual level of risk of the Fund and is not an indicator of likely returns.

Designed for investors seeking a diversified portfolio of life science companies and medium to long-term capital growth and for those who can accept short-term volatility associated with equity market risk, as well as sector and stock-specific risk.

The investment strategy of the Fund is to:

- Only invest in financial assets, which may include investments in asset classes such as equities (Australian and international), pre-IPO and private investments.

- Incorporate fixed interest or convertible note type investments where appropriate.

- Reduce the correlation of the Fund to the ASX 200 by investing outside the ASX 200 and in private and pre-IPO investments that the public have difficulty accessing; and

- Where appropriate hold larger cash positions than a traditional fund would do.

The Investment Manager seeks to achieve long-term capital growth by focusing stock selection on:

- Share valuation

- Company management and industry structure

- Behavioural factors to determine investment-timing

It is intended that the investment portfolio will consist of 20 to 50 companies split between:

Mature Growth – companies that have established medical products, generate revenue and are profitable.

Typically, the Life Science is hard to disrupt or replicate and has a leading market position, e.g. CSL Limited.

Developing Growth - companies that have disruptive intellectual property in the life science space. Typically, these companies are in late-stage clinical trials or have registered or approved medical products, growing market access, and early-stage revenue.

Seed – companies that are involved in disruptive life science projects, e.g., start-ups. Typically, these are fast-growing and highly innovative companies with the potential for exponential growth from successful commercialization of their product.

Unlisted and pre-Initial Public Offering (IPO) companies – these companies will typically reside in the “Seed” and “Developing Growth” stage of their life cycle as defined above.

Merchant Funds Management Pty Ltd (ACN 154 493 277) is the Manager of the Merchant Biotech Fund, under an agreement with our Responsible Entity, CIP Licensing Limited, AFSL 471728. This publication has been prepared on behalf of and issued by Merchant Funds Management Pty Ltd (ACN 154 493 277) Corporate Authorised Representative No. 420444 of Draupner Investment Management Pty Ltd (ACN 112 894 845) AFSL No. 303566.

Merchant Funds Management Pty Ltd (Merchant), does not accept any liability for loss or damage suffered or incurred by any person however caused (including negligence) relating in any way to this Listing including, without limitation, the information contained in it, any errors or omissions however caused or any person placing any reliance on this presentation, its accuracy, completeness or reliability.

Merchant and its affiliates or any of its directors, agents, officers or employees do not make any representation or warranty, express or implied, as to or endorsement of, the accuracy or completeness of any information, statements, representations or forecasts contained in this Listing, and they do not accept any liability for any statement made in, or omitted from, this Listing. Merchant accepts no obligation to correct or update the information in this Listing.

This Listing is intended only to provide a summary and general overview of matters of interest. The Listing is not financial product advice, whether personal or general, for the purposes of Section 766B of the Corporations Act. The Listing does not involve or imply a recommendation or a statement of opinion in respect of whether to buy, sell or hold a financial product. The information in this Listing does not take into account the objectives, financial situation or needs of any person. You should not act on or rely on the contents of this Listing before first obtaining professional advice specific to your circumstances.

This Listing and contents has been made available in confidence and may not be reproduced or disclosed to third parties or made public in any way without the express written permission of the Fund or Merchant Funds Management Pty Ltd.

We are Merchant Funds Management, a boutique Perth-Based fund manager focused on driving value for our clients.

We do things a little bit differently, with a focus on making wealth creation accessible to as many Australians as possible. Managing Director Andrew Chapman is taking the expertise he has gained over 20 plus years of managing the investments of the uber-wealthy and is working to make those opportunities available to all.

Andrew has a background not just in Finance, but in Hospitality, and is also the co-owner of a number of venues in Perth. His management style is shaped by the hospitality practice of “management by walking around” - getting into the depths of an organisation and getting your hands dirty. When required, Merchant has taken an activist investment style as opportunities have presented, turning companies around for the benefit of all.

With our own money invested in both funds, Merchant Funds Management takes a great interest in the management of the companies we invest in, we’re looking for management that have had track records in their field and “skin in the game”. Management must have passion, drive and a clear strategy to achieve and deliver upon their goals. The vision and the passion driving the company is what will often catch Andrew’s eye as a potential investment opportunity.

Merchant Funds Management works hard to find emerging companies that present the best investment opportunities that, over time, we hope to assist in turning them into big name brands.

Investment Manager Andrew Chapman is known for his own successful funds management operation, Merchant Group which manages funds for a VIP client base across Australia.

Andrew has Graduate and Post Graduate qualifications in Business, Finance and Hospitality. He established Merchant Group in 2011, after spending 9 years with one of Perth’s leading private wealth managers.

During his financial career, he has traded through a number of market cycles, which have in turn shaped his views on active portfolio management and risk. Through Merchant Group he offers a specialised investment management service to a select group of high-net-worth clients, the unit holders within the Merchant Opportunities Fund and the Merchant Biotech Fund.

Away from the markets, he is passionate about the hospitality industry and is an owner of several venues in Perth. In 2014, Andrew was an integral part of the establishment of the Western Australian branch of the food rescue organisation, Oz Harvest. He still holds the Australian record for the highest amount raised by one person at a single fundraiser event, the 2019 OzHarvest CEO Cookoff, where he raised $324,000.

Reece holds a Bachelor of Business and Finance from Murdoch University, an MBA from the University of Canberra, and a Graduate Diploma in Financial Planning with Kaplan. Reece worked as a Trader in the City of London and as a Stockbroker in Perth prior to joining Merchant. During his financial career he has managed and traded his way through economic and market cycles. His long-term investment approach and care for his client’s needs and objectives is critically important to him. Through Merchant Group he offers a specialised investment management service to unitholders.

Outside of financial markets, he is passionate about his family and his community. Being the inaugural Adam Gilchrist Cricket Scholar as a teenager he is passionate about helping and giving back to young sports people from rural WA.

Monthly Newsletter

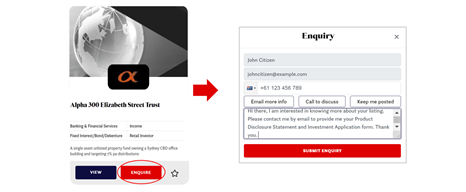

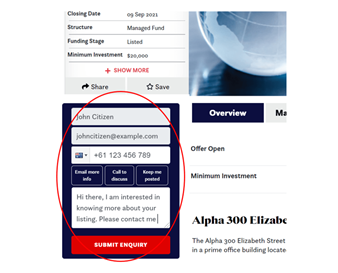

If you have joined Investment Markets (which is free) and verified your email address, you can send an email directly to us either by: -

- Selecting “Enquire” when viewing the card relating to the listing, OR

- By completing the enquiry form on the lefthand side when viewing the detail of a listing

We will respond using your preferred communication method (i.e. email or phone).

Statutory Statement

The issuer of this product is identified at the top of this page. The PDS and target market determination for the product are available in the Documents section of this listing. Prospective investors should consider the PDS before deciding to acquire the product. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.