Comparison Data

1Performance

| 1 month | 3 month | 1 year | 3 year | 5 year | Since Inception | Inception Date |

|---|---|---|---|---|---|---|

| 3.38% | 9.38% | 11.05% | 21.35% | 12.39% | 12.29% | 2 May 1994 |

Fees

| Management Fee | Performance Fee | Morningstar Total Cost Ratio |

|---|---|---|

| 1.35% | - | 1.35% |

The Pengana Axiom International Ethical Fund invests in companies that are dynamically growing and changing for the better, more rapidly than generally expected and where the positive changes are not yet reflected in expectations or valuation.

The Global Equity Strategy seeks dynamic growth by concentrating its investments in global developed markets, and may also invest in companies located in emerging markets.

The investment manager is Axiom Investors, a Connecticut-based global equity fund manager formed in 1998 with over US$ 19 billion in assets under Management.

For up-to-date fund statistics please find the latest monthly report here

Investment Approach

Axiom invests in companies that are:

- dynamically growing;

- changing for the better, more rapidly than generally expected;

- undervalued, such that the positive change is not yet reflected in the share price.

Axiom identifies forward looking positive changes, accelerations, and inflections in a business’s key operations, which it believes will lead to subsequent improvements in reported financial results or earnings projections over the next 12-36 months. Axiom believes that the most attractive companies will have positive fundamental changes occurring in their earnings growth, creating natural compounding performance tailwinds, and an attractive valuation providing both upside potential and risk control benefits.

Investment Process

Axiom has developed a repeatable and transparent 4 step investment process:

- Idea generation

- Fundamental Research

- Portfolio Construction

- Monitoring

Axiom does not use screens or quantitative tools at the start of the research process but rather focuses on collecting and assessing operational data in order to identify significant gaps between their research and consensus expectations. The investment thesis and the relevant supporting data is translated into a consistent risk and return rating for each security that incorporates about two dozen fundamental elements. This analysis includes:

- Macroeconomic analysis – to the extent that such factors may be impactful to underlying earnings. Macroeconomic considerations will not be the primary driver of a portfolio decision, but rather will serve as a headwind or tailwind to our bottom-up investment thesis.

- Environmental, Social and Governance (ESG) analysis – all relevant and material ESG considerations are systematically evaluated and expressed within Axiom's ratings worksheet which is prepared for every portfolio owned security. ESG has been incorporated since inception of the firm in 1998.

The portfolio management team constructs the portfolio from diversified sources of alpha, informed by the proprietary ratings framework which is applied to each security in the portfolio. The objective of the portfolio construction stage is to build high active share portfolios with high upside participation and downside protection.

Indicative Strategic Asset Allocation

The Fund's investment manager aims to manage the Fund within the following guidelines:

- Typically 45 to 75 holdings

- No more than 6%, or 1.5x the index, in a single position

- No more than 40% in a single sector (45% in IT)

- No more than 30% in a single country (0.5 to 1.5x the Index in the US)

- No more than 25% in emerging markets

The Fund can invest in securities that are not part of the Index.

Top Holdings can be viewed here

Latest Fund performance can be viewed here

Pengana is committed to responsible investing for the Fund and seeks to avoid investing in businesses that are, in its opinion, currently involved in activities that are unnecessarily harmful to people, animals or the environment. These activities include:

- Alcohol

- Adult content

- Animal cruelty

- Fossil fuels (coal, coal seam gas, oil)

- Gambling

- Genetically modified organisms (GMO)

- Human rights abuses and exploitation

- Mining

- Nuclear

- Old growth forest logging

- Securities from issuers on UN sanctions list

- Tobacco

- Uranium mining

- Weapons

The Fund utilises a negative screening process which seeks to avoid investment in companies that derive operating revenues from direct and material business involvement in these sectors.

Consideration of ESG issues raised by prospective and existing investments are investigated within the investment research process and integrated into the assessment of the investment’s return potential and risk. ESG analysis forms a part of the team’s holistic assessment of all key stock drivers as part of the investment philosophy and process, Labour standards are considered but not systematically taken into account in the selection, retention or realisation of investments.

Founded in 2003 and headquartered in Sydney, with offices in Melbourne, Brisbane, and Perth, Pengana currently manages over AUD$4 billion across a range of international and Australian strategies.

We hunt for the world’s leading investment teams in order to bring our investors unique, differentiated, and smart investment products.

Our unique business model also delivers centralised support from our corporate team, so our fund managers can focus on what they do best – managing portfolios.

Pengana’s premium investment products employ active strategies with non-benchmark mandates, giving our investment teams the freedom to invest in their best ideas.

With independent investment teams in Chicago, Connecticut, New Jersey, United Kingdom, Israel, Melbourne, and Sydney, our range of independently managed investment strategies provides a well-blended and uncorrelated level of diversification.

Each strategy is run by a separate investment team with unique skills relevant to their investment class. Our focus and track record is to provide investors with long-term returns, adjusted for risk minimisation.

Pengana Capital is a wholly owned subsidiary of Pengana Capital Group.

Managing Director/Portfolio Manager, Axiom Investors, 2002-Present

VP, Portfolio Manager, American Century, 1997-2002

Equity Research Analyst, Oppenheimer Funds, 1995-1997

M.B.A., Columbia Business School, Columbia University

B.Sc., M.D. equivalent, University of the Witwatersrand Johannesburg

CEO/Chief Investment Officer, Axiom Investors, 1998-Present

Executive VP, Portfolio Manager, Columbus Circle Investors, 1993-1998

Business Analyst, Booz Allen Hamilton, 1989-1991

Analyst, Apax Associates, 1988-1989

M.B.A., with distinction, The Wharton School, University of Pennsylvania

A.B., Molecular Biology, cum laude, Princeton University

The latest monthly report is available here

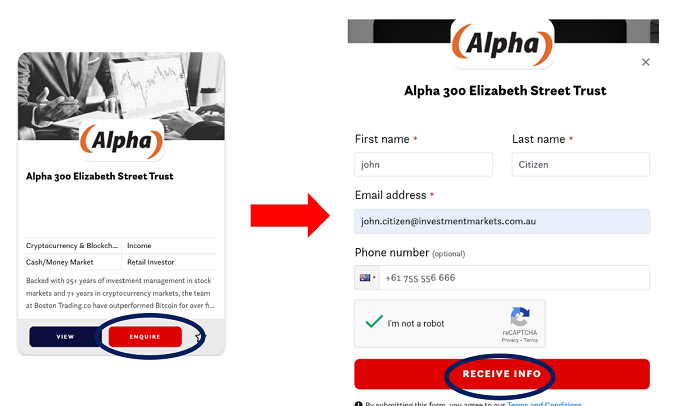

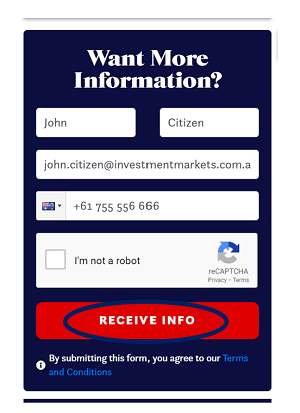

- By clicking the enquire button on the card view

Or

- By selecting “Receive Info” when viewing the listing

We will respond using your preferred communication method (i.e., email or phone).

Tags

Published by Pengana Capital Limited

FIXED INTEREST

SHARESINVESTOR EDUCATION

Published by Pengana Capital Limited

Statutory Statement

The issuer of this product is identified at the top of this page. The PDS and target market determination for the product are available in the Documents section of this listing. Prospective investors should consider the PDS before deciding to acquire the product. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

1 For use in Australia: © 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its affiliates or content providers; (2) may not be copied, adapted or distributed; (3) is not warranted to be accurate, complete or timely and 4) has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), subsidiary of Morningstar. Neither Morningstar nor its content providers are responsible for any damages arising from the use and distribution of this information. Past performance is no guarantee of future results.

Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at http://www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar's publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar's full research reports are the source of any Morningstar Ratings and are available from Morningstar or your advisor. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a financial advisor. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.