Comparison Data

1Performance

| 1 month | 3 month | 1 year | 3 year | 5 year | Since Inception | Inception Date |

|---|---|---|---|---|---|---|

| 3.36% | 17.18% | 15.93% | 17.32% | 12.18% | 10.94% | 2 Mar 2020 |

Fees

| Management Fee | Performance Fee | Morningstar Total Cost Ratio |

|---|---|---|

| 0.7% | 0.01% | 0.71% |

The Pengana High Conviction Property Securities Fund believes each security has an underlying or intrinsic value and that securities become mispriced at times relative to their value and each other, and seeks to exploit such market inefficiencies by employing an active, value-based investment style to capture the underlying cashflows generated from real estate assets and/or real estate businesses.

We believe that responsible investing is important to generate long-term sustainable returns. Incorporating ESG factors alongside financial measures provides a complete view of the risk/return characteristics of our property investments.

All positions are high conviction and assessed on a risk-reward basis, resulting in a concentrated portfolio of 10-20 securities.

The Fund invests principally in listed (or soon to be listed) Australian property securities. The Fund may also invest up to 10% of its assets in listed (or soon-to-be listed) International property securities.

The Fund is focused on:

Capital Security

Transparent NTA valuations are easily verified.

Income Yield

A-REITs have reliable income derived from assets with long term leases.

Sustainable Growth

Rental growth indexed to CPI. A concentrated portfolio enables investment in best-positioned assets and sectors at any point in time.

Liquidity

Daily priced A-REITs with market capitalisation > $50m.

It may also invest in the shares of property developers and other companies associated with the property sector.

The Fund’s investment objective is to obtain returns greater than the S&P/ASX 300 A-REIT (AUD) TR Index (‘Index’) over rolling 3-year periods after fees.

Investment Approach

The investment process identifies mispriced securities through a high conviction and Environment, Social and Governance (‘ESG’) focused approach. The concentrated portfolio enables investment in the best-positioned assets and sectors at any point in time.

Investment Process

The Pengana High Conviction Property Securities Fund believes each security has an underlying or intrinsic value and that securities become mispriced at times relative to their value and to each other Such mispricing is due to irrational market behaviour driven by investor sentiment towards certain types of securities or sub-sectors of the property market

The Fund seeks to exploit such market inefficiencies by employing an active, value-based investment style to capture the underlying cashflows generated from real estate assets and/or real estate businesses. As a result, we adopt a bottom-up investment approach with thematic overlays to benefit from cyclical and structural changes whilst focusing on analysing the quality and potential cash flow for each security.

The team believes that responsible investing is important to generate long-term sustainable returns. Incorporating ESG factors alongside financial measures provides a complete view of the risk/return characteristics of our property investments. ESG issues vary amongst asset type, life cycle phase, corporate structure and other company-specific characteristics. Our approach is qualitative in that we engage with each company to understand the relevant issues and rank them in terms of E, S and G.

ESG factors are integrated into our fundamental research process and are designed to manage risk. This means our valuation process and ranking model takes into account both financial and ESG factors.

Incorporating ESG factors does not significantly reduce the investable universe as most Australian real estate companies rank well across the ESG matrix with high NABERS (National Australian Built Environment Rating System) ratings and good corporate governance relative to global peers.

Indicative Strategic Asset Allocation

Pengana aims to manage the Fund within the following guidelines:

- 70%-100% of Australian listed property securities

- 0%-10% International listed property securities

- 0%-20% cash and cash equivalents

- Maximum position size in Index securities 20%

- Maximum position size in non-index securities 5%

- Maximum number of securities 20

- Minimum market capitalisation A$50 million

The investment team will endeavour to work within the above guidelines – however, these should be viewed as objectives only and not absolute limits.

Latest Fund performance can be viewed here

Founded in 2003 and headquartered in Sydney, with offices in Melbourne, Brisbane, and Perth, Pengana currently manages over AUD$4 billion across a range of international and Australian strategies.

We hunt for the world’s leading investment teams in order to bring our investors unique, differentiated, and smart investment products.

Our unique business model also delivers centralised support from our corporate team, so our fund managers can focus on what they do best – managing portfolios.

Pengana’s premium investment products employ active strategies with non-benchmark mandates, giving our investment teams the freedom to invest in their best ideas.

With independent investment teams in Chicago, Connecticut, New Jersey, United Kingdom, Israel, Melbourne, and Sydney, our range of independently managed investment strategies provides a well-blended and uncorrelated level of diversification.

Each strategy is run by a separate investment team with unique skills relevant to their investment class. Our focus and track record is to provide investors with long-term returns, adjusted for risk minimisation.

Pengana Capital is a wholly owned subsidiary of Pengana Capital Group.

Amy has over 20 years of property funds management experience.

Prior to joining Pengana she worked at Charter Hall/Folkestone for 6 years, managing a high conviction AREIT strategy. This team won several industry awards including Financial Standards Property Fund Manager of the Year 2019, Money Management/Lonsec Australian Property Securities Fund Manager of the Year 2018, and Financial Standards Property Fund Manager of the Year 2017.

Amy has held several senior positions including head of property securities at IAG and portfolio manager at Deutsche Asset Management and Perpetual Funds Management. She began her career as a quantitative analyst at Legal & General in 1994.

Amy holds a bachelor and honours degree in Economics from the University of New England and University of California Davis.

Jade has over 17 years property funds management and corporate finance.

Prior to joining Pengana, Jade was a senior member of Macquarie Bank’s real estate corporate advisory team in London and Sydney.

She has also acted as assistant portfolio manager of IAG’s property securities fund, working alongside portfolio manager Amy Pham.

Sam has over 5 years of property and finance experience and has passed Levels 1 & 2 of the Chartered Financial Analyst program.

Prior to joining Pengana, Sam worked in the Research team at Charter Hall and was responsible for cross-sector quantitative and thematic research, transaction and funds management support, as well as performance reporting for the fund manager’s largest investors.

Sam holds undergraduate degrees in Finance & Law from the University of Adelaide.

The latest monthly report is available here

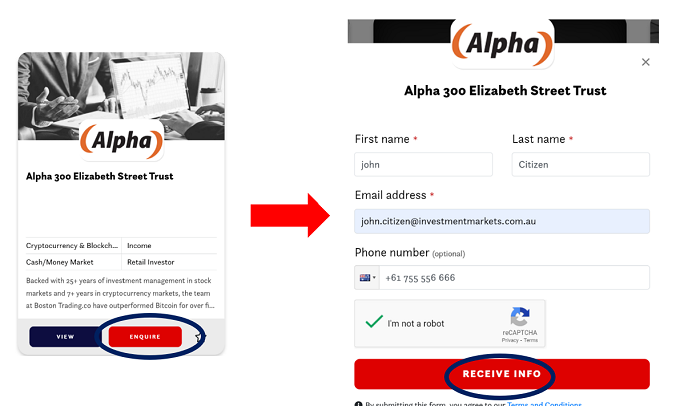

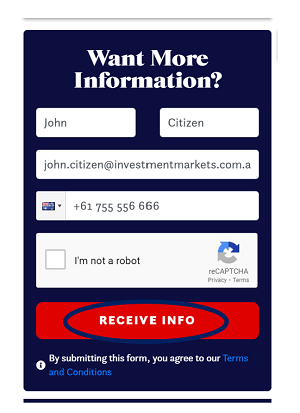

- By clicking the enquire button on the card view

Or

- By selecting “Receive Info” when viewing the listing

We will respond using your preferred communication method (i.e., email or phone).

Tags

Published by Pengana Capital Limited

FIXED INTEREST

SHARESINVESTOR EDUCATION

Published by Pengana Capital Limited

Statutory Statement

The issuer of this product is identified at the top of this page. The PDS and target market determination for the product are available in the Documents section of this listing. Prospective investors should consider the PDS before deciding to acquire the product. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

1 For use in Australia: © 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its affiliates or content providers; (2) may not be copied, adapted or distributed; (3) is not warranted to be accurate, complete or timely and 4) has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), subsidiary of Morningstar. Neither Morningstar nor its content providers are responsible for any damages arising from the use and distribution of this information. Past performance is no guarantee of future results.

Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at http://www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar's publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar's full research reports are the source of any Morningstar Ratings and are available from Morningstar or your advisor. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a financial advisor. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.