Investment Strategy

The Quest Australian Equities Concentrated Portfolio is managed according to our proven investment process. Our objective is to deliver returns ahead of the S&P/ASX 300. This goal has been achieved.

Stock numbers are limited to 35 with an average of 30 stocks held. We believe a concentrated portfolio of stocks researched by our investment process will optimise investor outcomes. A Quest portfolio will be more volatile than the average Australian equity fund with the potential to deliver larger absolute gains or losses. There is no limit on the ability to hold cash.

Since inception in 2005, the portfolio return, before fees, is 11.7% pa* as at 30 September 2023. Over the same period the ASX 300 Accumulation Index has delivered an annualised return of 7.3% pa. Our Quest portfolio has consistently beaten the benchmark over time.

Investment Profile

The Quest Australian Equities Concentrated Portfolio is a Separately Managed Account (SMA), actively managed by Quest Asset Partners Pty Limited. Our objective is to outperform the S&P/ASX300 Accumulation Index. The SMA structure allows the investor to retain beneficial ownership of the portfolio while maximising transactional and tax visibility.

WHOLESALE INVESTORS

New wholesale investors should contact Quest directly.

Existing wholesale investors please contact Quest.

RETAIL INVESTORS

For retail investors, please contact your Financial Adviser.

Click here for the latest performance details.

This information is intended as indicative and general information rather than advice. Quest Asset Partners holds an AFS Wholesale Licence. Quest’s products are not directly available to, and may not be appropriate for, retail investors. Retail clients may invest via a retail platform and should seek advice from their financial adviser before doing so. The information has been prepared without taking account of any individual’s objectives, financial situation or needs. The portfolio returns quoted above represent the return achieved if invested in the Quest portfolio on the JBWere platform since inception (February 2005). Individual returns will differ for investors that invest on different platforms, made an initial investment after this inception date or where additional investments, redemptions or any SPP investments have been made. Past performance provides no guide to future performance. Neither Quest Asset Partners Pty Limited nor any member of Quest guarantees the performance of Quest funds, the repayment of capital or any particular return. Please contact Quest for further information.

Quest Asset Partners was formed in 2004 to create an independent boutique Australian equities manager that was motivated by performance and not by size. The firm manages in excess of AUD$2 billion for institutional, wholesale and wealth management clients. Quest is 100% privately owned by the investment team who have built a long standing and sophisticated 3 Stage investment process that dictates stock decisions and shapes portfolio construction. All staff are co-invested in the portfolios alongside clients. Quest has a long-standing track record with a recognised skill in analysing and investing, particularly in small and mid-cap stocks. The business adheres to strict compliance guidelines and embeds an understanding of sustainability into the investment process.

The Quest team believe they have a number of competitive advantages:

- Independently owned;

- A long track record of 18 years;

- Lack of staff turnover in the investment team thereby retaining intellectual property;

- In depth research that pinpoints the key drivers of performance and determines our target price. We believe accurate business assessment requires a combination of skills and that stock research is a mix of both art and science;

- A strong understanding of the business value chain;

- A process that continually reviews the quality ranking and valuation assumptions for each business;

- Access and capacity to interview senior management of investee companies and competitors;

- Willingness to undertake travel to differentiate business knowledge including finding similar business models in other markets;

- A nimble team that undertakes detailed peer review of business valuations; and

- A bespoke valuation template that allows sensitivity analysis.

Joint founding partner of Quest Asset Partners, establishing the business with Chris Cahill in 2004. Michael is a founding Director and Portfolio Manager at Quest Asset Partners. Michael has more than three decades of funds management experience as an analyst, portfolio manager and team leader. He has built his career analysing companies and identifying the factors that affect their profitability. This has been fundamental to his success in delivering consistent returns for investors. Previously, Michael was Director of Australian Equities at AMP Capital where he worked for 14 years. During that time, Michael managed both large and small cap portfolios including established Australia’s second small cap investment team in 1993.

Michael has a Commerce Degree from the University of NSW, majoring in Finance and post graduate qualifications from Finsia.

Joint founding partner of Quest Asset Partners, establishing the business with Michael Evans in 2004. Chris is a founding Director and Portfolio Manager at Quest Asset Partners. Chris has over 35 years of experience in funds management and stock broking. Chris spent 9 years until 2004 at AMP Capital managing mainly mid cap and small cap portfolios. Previously, Chris was an Institutional stockbroker with Burdett Buckeridge and Young for 5 years and Kleinwort Hattersley Noall Limited also for 5 years. Prior to that, Chris worked as a Chartered Accountant after completing a Commerce degree at the University of NSW. Chris is a member of the Institute of Chartered Accountants.

Troy is a Director and Portfolio Manager at Quest Asset Partners. He has over 25 years’ experience in Australian investment markets, being particularly active in mid and small cap industrials, technology stocks and the healthcare sector. Troy joined Quest in 2007 and was formerly a Director in Equity Capital Markets at UBS and prior to that ABN AMRO Rothschild. He also advised listed companies on transactions and investor relations as Director at Channel Financial Communication.

Troy originally qualified and practised as a Veterinary Surgeon and earned an MBA in 1995.

This portfolio is available for investment via HUB24, JBWere, Macquarie, Mason Stevens and MyNorth platforms.

WHOLESALE INVESTORS

New wholesale investors should contact Quest directly.

For existing wholesale investors please contact Quest.

RETAIL INVESTORS

For retail investors, please contact your Financial Adviser.

Click here for the September 2023 Monthly Report.

Click here for the September 2023 Quarterly Report.

Click here to view our latest News & Articles.

Quest Asset Partners Pty Ltd holds a wholesale Australian Financial Services Licence from ASIC (AFSL Licence No. 279207).

As the holder of a wholesale AFSL licence, those who satisfy ASIC’s ‘Sophisticated’ or ‘Professional’ Investor requirements can come directly to Quest. Both the Quest Ex20 Trust and Quest Long Short Trust have an external Responsible Entity and are accessible for ‘Retail’ investors via Equity Trustees.

- QuestLong Short PDS from Equity Trustees: Link to Quest LongShort PDS

- QuestX20 PDS from Equity Trustees: Link to Quest X20 PDS

Quest SMA portfolios are available on investment platforms including Macquarie, JBWere, Mason Stevens, MyNorth, Netwealth, HUB24 and Xplore Wealth. Retail investors can access the SMA portfolios via their financial adviser.

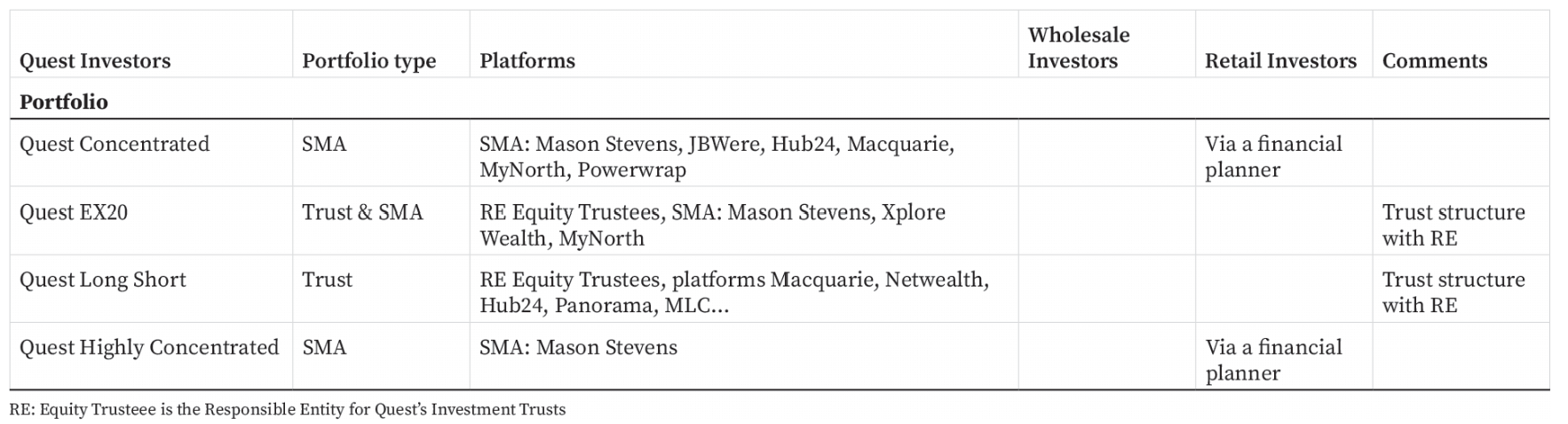

Quest provides four Australian equity portfolios run by various members of the experienced team. All Quest portfolios utilise the long standing Quest investment philosophy of combining business quality and value disciplines. To satisfy ASIC requirements, some portfolios are available directly from Quest whilst others are accessed via financial planners, investment platforms and/or the Responsible Entity of our investment trusts.

The following table provides a table of accessibility.

Institutional Investors sign an Individually Managed Account (IMA) agreement directly with Quest which can be tailored to suit specific needs. Quest uses Link Fund Services (LFS) for back-office functions and Institutions elect the custodian. Please contact Quest for more information.

Quest Portfolios have ratings from various independent manager researchers, such as JANA, Willis Towers Watson, Lonsec and Zenith.

The current Lonsec ratings are (as at November 2022):

- Quest Concentrated - Recommended / 4 Stars

- Quest Ex20 - Recommended / 4 Stars

- Quest Long Short - Recommended / 4 Stars

Financial advisers can email quest@questap.com.au for the Lonsec and Zenith reports.

This depends on the product. The Trusts pay annual distributions. The SMA’s reinvest all income and realised gains. A client can redeem all or part of their investment at any time. Redemptions are usually settled in 2 days.

The Quest Long Short and X20 Funds have a minimum of $50,000. Please see your financial adviser to invest with Quest on Mason Stevens, Macquarie, HUB24, Netwealth, Xplore Wealth and MyNorth. The minimum investments are set by the platforms. For clients on the JBWere Multi-Asset Platform (Sophisticated Investors) the minimum investment is $250,000. Some minimums can be varied by agreement. Please contact Quest.

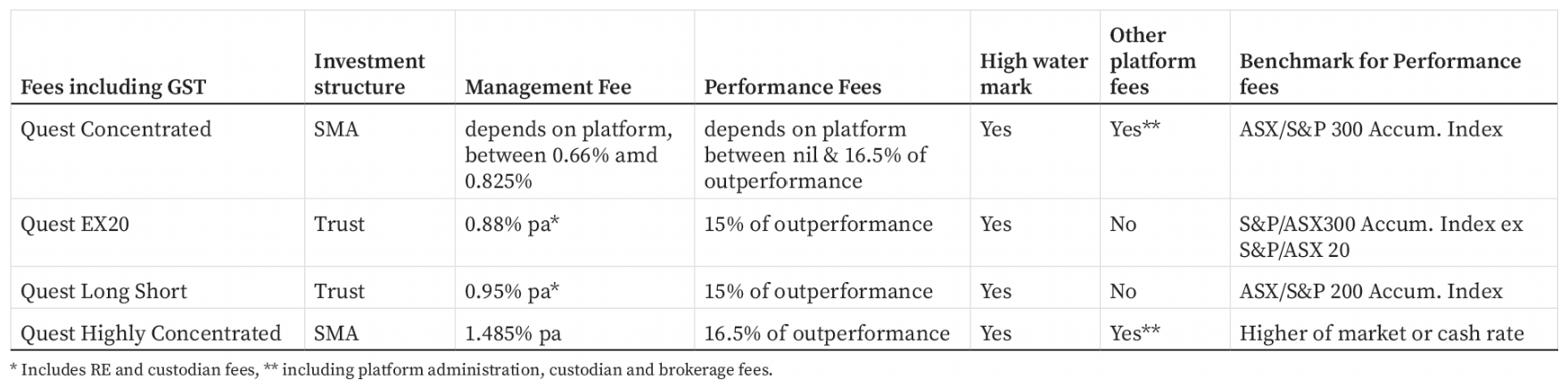

All portfolios have the objective of adding value after fees over the relevant portfolio benchmark over the medium term.

Portfolios have both Quest Investment Management fees and platform or trust fees depending on the investment structure. Please see the details in the particular PDS or platform documents.

questapQuest portfolios generally carry management fees and performance fees. Performance fees are paid when portfolios perform well. Most portfolios have performance fees on outperformance above a benchmark such as the S&P/ASX300 Accumulation Index whilst one portfolio has performance fees on returns above an absolute hurdle. All mandates with performance fees have high water marks for the benefit of clients where underperformance must be recouped before performance fees can be earnt.

Quest Directors have considerable experience managing large portfolios. Quest has chosen to remain a smaller boutique to ensure size is not an impediment to client returns. We have chosen a performance fee model to offset the smaller scale.

A central tenet of the Quest Asset Partners investment process is the assessment of business quality. We are attracted to companies that can demonstrate an ability to attain and sustain above average returns on capital employed. In our experience, companies that can maintain high returns on capital are rare and can become valuable. Consideration of Environmental, Social and Governance (“ESG”) factors are important inputs into our qualitative assessment of business quality. It may also impact our valuation of a company, reflecting our evaluation of the risks inherent in each business.

Quest philosophy is to provide ‘best ideas’ portfolios. We limit the stock numbers in each portfolio in order to maximise both the quality of holdings and the weights held in each stock. In this way we seek to maximise potential returns.

Our Concentrated mandate limits holdings to no more than 35 securities will be held in a portfolio and historically clients have held approximately 30 stocks. The Quest Ex20 has a 40 stock limit whilst the Long Short has a higher limit. A Quest portfolio will be more volatile than the relevant Australian equity index with the potential to deliver larger absolute gains or losses.

Prior to the launch of the Quest Long Short Fund in February 2020, Quest did not short sell stocks. The Quest Long Short Fund is classified as a 130/30 active extension strategy. Up to 30% of the portfolio can be shorted and reinvested in alternative long investments. In November 2022 the Long Short is 5% of Quest’s FUM, so shorting is currently a small activity at Quest.

Some Quest portfolios are available as SMA’s on various investment platforms such as Hub24 and Macquarie. Investors invest into a Separately Managed Account (SMA). This structure allows Quest clients to have their own individual portfolio that replicates a model portfolio. As a result, all clients have the same portfolio of shares. The shares are held in the name of the applicable custodian on behalf of our clients.

In contrast to pooled investment vehicles or unit trusts, investors retain individual ownership of the underlying investments managed by Quest and there is no transfer of capital gains between clients. This may allow clients to benefit from the tax advantages from discounted CGT benefits.

Only institutional mandates and the Quest Long Short allow for use of derivatives. In practice, derivatives are seldom used except to manage large client flows.

If you have any questions, please contact Quest on 02 94092333 or email quest@questap.com.au

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.