Investment Highlights

The Rixon Credit Opportunities Fund offers a sophisticated private credit strategy focused on secured lending to Australian SMEs. Targeting non-dilutionary debt funding of up to $20 million, the Fund operates via two primary lending pillars:

- First-ranking security over high-quality cash flows and intangible assets; and

- Second-ranking positions collateralised by substantial tangible assets

This ungeared vehicle provides true diversification by strictly excluding residential property and development exposure.

Rixon prioritises cash-generative borrowers, avoiding equity-like instruments such as warrants or hybrids to maintain a pure credit focus.

Designed for a three-to-five-year horizon, the Fund aims to deliver meaningful quarterly cash yields and capital appreciation, with a net Target Return of 10.0% + RBA Cash Rate.

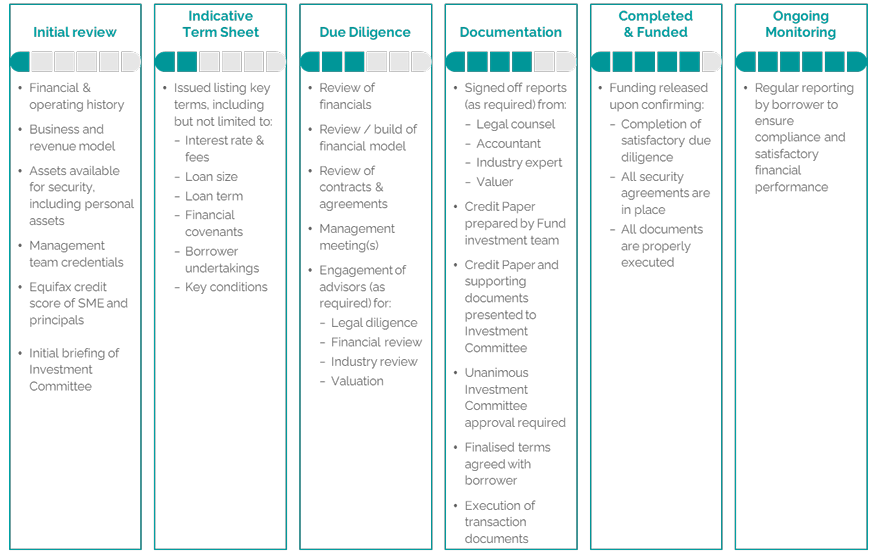

All loan investments undergo rigorous due diligence and requires unanimous Investment Committee approval, ensuring a disciplined approach to generating attractive risk-adjusted returns within the Australian and New Zealand mid-market landscape.

Investment Strategy

The Rixon Credit Opportunities Fund is focused on secured lending to Australian SMEs seeking non-dilutionary debt funding of up to $20m and offering attractive credit characteristics.

The strategy has two lending pillars:

- First ranking secured lending to borrowers demonstrating high quality cashflows and valuable intangible assets

- Second ranking secured lending to borrowers demonstrating substantial tangible asset security

The Rixon Credit Opportunities Fund strategy is focused on generating an attractive risk-adjusted return via meaningful quarterly cash yield and capital appreciation.

First ranking security

Priority position on underlying borrower balance sheet when secured over high quality cashflows or valuable intangible assets

Tangible asset collateral

Where second ranking secured, investor capital is collateralised over recoverable real assets (e.g. receivables, equipment)

Quarterly Cash Interest

Cashflow generative borrowers

No direct property exposure

Offers investors true diversification from property debt and equity

No equity warrants or options

Focus on lending to borrowers who offer attractive credit characteristics

Leverage

The Fund will be ungeared and will not utilise debt in seeking to achieve the Target Return.

The Fund will deploy capital by way of secured credit instruments across both cash flow-based and asset-backed lending, focused on senior ranking security.

The Fund intends to avoid investments that are equity like, such as hybrids and convertible notes, or offer equity inducements (e.g. listed and unlisted equity warrants, or options) and intends to not lend to parties who are unable to pay cash interest.

The Fund is designed for investors who wish to have exposure to private credit and who are looking for returns in excess of the RBA Cash Rate + 10% per annum (net of fees and costs) over the medium term. This is expected to be achieved through a combination of income and capital. Given the expected illiquidity of the Fund’s assets, the Fund is likely to be most suited for investors who have an investment horizon of three to five years.

Investments are intended to be sourced from Rixon’s wide network of contacts and will be added to the Fund’s portfolio if, in Rixon’s view, they provide the appropriate risk-return profile for the Fund. New investments are subject to due diligence, documented review, and unanimous approval by the Investment Committee.

Rixon intends that the Fund will invest in assets that are unrated by investment rating agencies and that the Fund’s portfolio will typically have the characteristics summarised in the following table.

|

Characteristic |

Fund Constraints |

| Geographical | Focus on Australian opportunities with the ability to consider suitable opportunities in New Zealand. |

|

Loan Size |

Loans of up to $20m with the potential to undertake larger loans subject to Investment Committee approval. |

| Security | First ranking senior loans will have security against cashflows and intangible assets such as intellectual property. Second ranking loans will be secured against suitable identified and valued tangible assets, including real property, equipment, receivables, and/or inventory. |

|

Ranking concentration |

After the initial deployment phase, first ranking senior loans are intended to comprise at least 60% of Net Asset Value. |

|

Currency |

No less than 100% A$ assets. |

|

Leverage |

No leverage permitted in the Fund. |

|

Loan Concentration |

After the initial deployment phase, no single loan or borrower is intended to comprise more than 10% of Net Asset Value. However, in its initial deployment phase the Fund is likely to be concentrated on a small number of seed investments. |

|

Sector concentration |

The Fund intends to lend across a range of assets and industry sectors. However, during its initial deployment phase, the Fund may be concentrated in specific loans via a small number of seed investments. |

|

Excluded Borrowers |

The Fund will not provide loans for residential property or property development. |

Established in 2022, Rixon was founded by senior private credit and investment banking professionals with a background in deploying secured, high yield private credit.

The Rixon team has expertise in the origination, assessment, structuring, and execution of non-vanilla credit in the Australian SME and emerging corporate

market.

Rixon maintains a deep relationship with a national network of origination channels, allowing it to readily access potential borrowers across multiple sectors and geographies.

Patrick is an experienced SME credit professional and investment banker.

Prior to founding Rixon Capital, he was an Executive Director at an alternative asset manager where he led execution of their mid-market private credit strategy and broader corporate development initiatives.

Previously, Patrick was a Senior Vice President at independent M&A advisor AquAsia where he was a founding member of their SME private fund.

Patrick commenced his career at Macquarie Capital’s Technology, Media, Entertainment, and Telecommunications investment banking team in Sydney and Singapore.

He has executed over $500m in Australian SME private credit lends and $10 billion in M&A across Australia, Indonesia, South Korea, and the Philippines.

Patrick holds a Bachelor of Commerce and a Bachelor of Economics from the University of Queensland where he was awarded the International Economics Scholarship.

Daniel is a seasoned private credit professional with over 10 years of experience across funds management and corporate finance.

Prior to joining Rixon, Daniel led the growth credit strategy at Marshall Investments, a Sydney-based family office and fund manager, where he executed over $150m of senior loans to high-growth companies in Australia.

Earlier in his career, Daniel worked with Ernst & Young in both Sydney and London, specialising in M&A and debt advisory within the financial services sector.

Daniel has a Bachelor of Applied Finance degree and is a qualified Chartered Accountant.

Shrikaanth has over 11 years of experience across equity research & valuation and SME private credit.

He was most recently Associate Director at an alternative asset manager where he managed the structuring, diligence, and execution of over $100m high-yield SME private debt transactions.

Prior to this, Shrikaanth spent 5 years supporting the Deutsche Bank equity research team covering global listed equities.

Shrikaanth has a Bachelor of Commerce and is a qualified Chartered Accountant and CFA Charterholder.

Hessan holds over five years of experience in navigating both private and public markets. During this time, he has adeptly managed corporate transactions exceeding >$ 1 billion in value, providing tailored solutions to companies of varying sizes and industries.

Hessan has a Masters of Commerce degree from University of Sydney.

John-Paul has a background in financial risk management and SME advisory with experience in life insurance and public practice.

He is passionate about the role of private credit in generating reliable income and safeguarding investor capital, with an interest in how emerging technologies can enhance analysis and risk management.

John-Paul holds a Bachelor of Applied Finance from Macquarie University and is currently completing Chartered Accountant (CA) and Chartered Alternative Investment Analyst (CAIA) certifications.

Click here to view our past and current Performance and Unitholder Updates.

Tags

Published by Rixon Capital Pty Ltd

PRIVATE ASSETSALTERNATIVE INVESTMENTINVESTOR EDUCATION

PRIVATE ASSETSMANAGED FUNDINVESTOR EDUCATION

FIXED INTERESTINVESTOR EDUCATION

Published by Rixon Capital Pty Ltd

Statutory Statement

This offer of scheme interests is available to wholesale clients only. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.