Comparison Data

1Performance

| 1 month | 3 month | 1 year | 3 year | 5 year | Since Inception | Inception Date |

|---|---|---|---|---|---|---|

| 0.54% | 1.65% | 7.26% | 7.15% | 6.71% | 6.49% | 26 Mar 2018 |

Fees

| Management Fee | Performance Fee | Morningstar Total Cost Ratio |

|---|---|---|

| 0.77% | - | 0.77% |

Investment Highlights

By providing capital to borrowers, Skyring’s clients generate long-term income streams for their portfolios that are backed by high quality, first mortgage’s secured against investment-grade properties and businesses within Australia.

The Skyring Fixed Income Fund's current distribution rate is 6.55%p.a.^. (after fees).

The Skyring Fixed Income Fund is an investment option offering the following key features:

- Aims to provide investors with regular income via monthly distributions

- Aims to provide investors with quarterly withdrawal offers, subject to a minimum investment term

- Offers investment exposure to loans secured by a registered first mortgage

- Access to online investor portal from investment reporting and transactions

- All monies invested into the Fund is used exclusively to purchase Secured Notes issued by Skyring Capital Pty Ltd

Benefits

Benefits of investing in the Fund include:

- Regular income via monthly Distributions;

- Skyring Capital has a conservative lending policy aimed at reducing the risk of capital loss;

- Diversification across property and industry sectors in the underlying assets; and

- Benefiting from the expertise and experience of our Board and the management of Skyring Capital.

How does the Skyring Fixed Income Fund work?

The Fund seeks to raise funds from the issue of Units to investors for the purpose of acquiring secured notes (Notes) issued by Skyring Capital Pty Ltd (Skyring Capital). Skyring Capital will use these funds primarily to provide loans for a wide range of purposes including property acquisition or development, construction, and business growth and acquisition, across Australia. Skyring Capital was established to conduct a lending business using funds raised from the issue of Notes to the Fund.

If you have $1,000-$100,000 or more to invest, consider attractive monthly returns with the Skyring Fixed Income Fund.

The Skyring Fixed Income Fund currently offers a return of 6.55%p.a.^ paid monthly.

As always, the Skyring Fixed Income Fund is convenient and flexible. You’ll receive distributions paid monthly and you can apply to withdraw your funds on a quarterly basis.

Here’s why so many existing investors, high-net worth clients, and retirees are choosing the Skyring Fixed Income Fund:

Historical Performance

The Fund’s previous monthly Distribution Rate (%PA) for November 2025 was 8.05%p.a.^ (including 1.5% p.a. percent bonus rate)

(For more detailed information on our performance history, request a copy of the Fund’s Product Disclosure Statement, where you will also receive our latest Investor Update).

Monthly Distributions

Monthly distributions are made within five Business Days after the last day of each month. There have been no missed distributions since inception. Distribution reinvestment available.

Start With As Little As $1,000-$100,000+

All you need is a minimum of $1,000 to get started. Our current average investment is $100,000.

No Entry Or Exit Fees

We won’t charge you to join us. And we won’t charge you to withdraw your funds.

Suitable For Many Types Of Investors

The Skyring Fixed Income Fund is suitable for SMSFs, Individuals, Companies, and Trusts. Please note, we only accept investors from Australia.

You Can “Test” Fund Performance

Unlike other investments that require significant capital, you can test the Skyring Fixed Income Fund with as little as $1,000. Minimum three-month investment period to qualify for quarterly withdrawal offers#.

You can apply Online in Less Than 10 Minutes

#Withdrawal rights are subject to liquidity and may be delayed or suspended.

The Fund seeks to raise funds from the issue of Units to investors for the purpose of acquiring secured notes (Notes) issued by Skyring Capital Pty Ltd (Skyring Capital). Skyring Capital will use these funds to provide loans for a wide range of purposes including property acquisition or development, construction, and business growth and acquisition, across Australia. Skyring Capital has been established for the purpose of conducting a lending business using funds raised from the issue of Notes to the Fund.

The Notes carry a variable coupon rate determined by us and notified to Skyring Capital from time to time, with the coupon amount calculated daily and payable monthly in arrears. Notes are secured by a first ranking security interest over the assets of Skyring Capital.

The Fund invests in secured redeemable notes issued by Skyring Capital. Here are some of Skyring Capital’s strict investment requirements:

Please note: All loans and securities are managed by Skyring Capital, a related body corporate of Skyring Asset Management Limited. Skyring Fixed Income Fund has a first ranking general security interest over Skyring Capital’s assets. Read the PDS, and TMD for more detail.

Distribution Rate to Investors

The current Distribution Rate to investors is 6.55%p.a.^.

The distribution rate for Units is variable and is equal to the coupon rate payable by Skyring Capital less our management fee (and less extraordinary Fund expenses, if any are incurred). The distribution rate will change from time to time as the coupon rate on Notes is a variable rate.

The Distribution Rate is not a guaranteed return to investors and an investment in the Fund is subject to investment risk, including the loss of capital invested. The actual Distribution rate may be higher or lower, depending upon if extraordinary Fund expenses are incurred or if the non-discounted coupon rate is payable by Skyring Capital, and the payment of Distributions is dependent upon Skyring Capital making coupon payments in accordance with its obligations.

Distribution Reinvestments

The Distribution Reinvestment Plan (DRP) is a convenient way for you to increase your holding of Units in the Fund, by allowing you to automatically reinvest all or part of your monthly Distributions in additional Units, without incurring any fees or other transaction costs. If you wish to participate in the DRP, select the DRP election in the Application Form or at any other time by completing the Reinvestment Instruction Form available from Skyring.

The Fund is a non-liquid managed investment scheme. Investors may make a withdrawal requests each quarter providing that you have held Units for 3 months prior to the date of the Withdrawal Offer.

Click here for our latest Performance Details.

To invest in this Offer, investors should obtain and read a copy of the Product Disclosure Statement (PDS), and Target Market Determination (TMD) before making an investment decision.

Complete the Application Form located at the rear of the Product Disclosure Statement or complete an online application via our website. The Skyring Fixed Income Fund is open to Australian residents only. This includes Self-Managed Super Funds, Individuals, Companies, and Trusts.

Units in this offer will only be issued in response to an application form that was included in, or accompanied by, the relevant PDS and TMD documents.

Important Information

By reading this web page or downloading these documents, you agree that this information is of a general nature only and has not taken into account your particular circumstances. You should consider whether the strategies and investments are suitable for you or seek personal advice from a licensed financial planner before making an investment decision. Unless specifically stated, the repayment of capital or the forecast performance of this investment is not guaranteed.

By reading this web page or downloading these documents, you agree to the terms and conditions. You should consider whether the investment is suitable for you, or seek personal advice from a licensed financial planner, before making an investment decision. Printed Product Disclosure Statements for this product are available from Skyring Asset Management Limited (Skyring). Call us on 1300 73 72 74 or request one from your Financial Advisor.

We reserve the right to vary this Closing Date without prior notice and may close the Offer early, extend the Offer, withdraw the Offer or accept late applications. You are encouraged to submit your Application Form as soon as possible.

Investment may only be made by completing the application form attached to the Product Disclosure Statement. Skyring Asset Management Limited ACN 156 533 041 holds Australian Financial Services License (AFSL) 422902. SKYRING has registered the Skyring Fixed Income Fund ARSN 622 775 464 with the Australian Securities and Investments Commission (ASIC).

Consumer Advisory Note

SKYRING ASSET MANAGEMENT LIMITED ACN 156 533 041 AFSL 422902 is the issuer and manager of the SKYRING FIXED INCOME FUND ARSN 622 775 464.

It is important for you to consider the Product Disclosure Statement for the Fund in deciding whether to invest, or to continue to invest, in the Fund. You can read the PDS and TMD on our website or request a copy by contacting the Skyring offices on 1300 73 72 74.

Returns on our investments are variable and paid monthly in arrears. Past performance is not a reliable indicator of future performance. The rates of return from the Fund are not guaranteed and are determined by the future revenue of the Fund and may be lower than expected. An investment in the Fund is not a bank deposit and is subject to investment risk, including the loss of capital invested.

#Withdrawal rights are subject to liquidity and may be delayed or suspended.

IMPORTANT: This website (www.skyring.com.au) and all its contents have been prepared for general information only and should not be taken as legal or financial advice, and as such the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Individuals should therefore talk with their financial planner or advisor before acting on any information present in the Skyring website.

^Please note, past performance is not a reliable indicator of future performance.

Skyring provides investors an attractive regular income investment as part of a diversified investment portfolio.

As a boutique, non-bank, Australian Income Manager, we are directly accountable to you, our investors. We exist to provide a regular, reliable income solution to support your portfolio’s ongoing success.

David Mardell is the Chief Executive Officer and one of the founding directors of Skyring.

David and his sister, Cathryn Howard established Skyring Asset Management Ltd in 2011. David brings to his role over 20 years’ experience in building businesses, financial services, investment, industry leadership and management experience – expertise that he has since honed further, for the very tangible benefit of Skyring clients and associates.

David believes that at Skyring we are agile, passionate and solution focused for our clients. We challenge the usual assumptions and strive for exceptional standards whilst focusing on our agreed priorities and executing quickly and efficiently. We act with integrity and ensure compliance with regulations and demonstrate professionalism consistently.

Cathy is a Chartered Accountant and Registered Tax Agent. In addition to her roles as Managing Director of Skyring Asset Management’s Board of Directors, she has a BA in Psychology from The University of Queensland, and a Master of Professional Accounting from The University of Southern Queensland.

Cathy manages the strategic financial management of Skyring’s Funds and individual projects on investors’ behalf, and of Skyring Asset Management Limited itself.

As Managing Director, Cathy oversees the corporate direction and strategy for Skyring’s operations. This includes the acquisition and delivery of investor assets through Skyring Asset Management’s Property and Income Funds.

Cathy’s commitment to achieving Skyring’s vision for investors, partners, shareholders and stakeholders alike is demonstrated in her determination to help them grow their wealth through the Skyring Platinum Fixed Income Fund.

Peter Howard has a solid background in information technology with over 20 years’ experience across a number of roles, including senior development and project management positions in Queensland’s public sector.

Along with his leadership and IT management expertise, Peter’s ‘outside the box’ thinking adds further depth to an already impressive team. He brings a fresh perspective, and can rally people from different disciplines to overcome challenges and bring new opportunities to life.

.

Skyring Fixed Income Fund Fact Sheet January 2026

Download PDF

Online Application |

Manual Application |

|

|

| Click here to complete an Online Application | Request an Application Form to be sent to you |

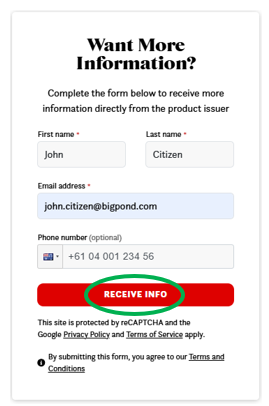

- By clicking the enquire button on the card view

Or

- By selecting “Receive Info” when viewing the listing

We will respond using your preferred communication method (i.e., email or phone).

The Skyring Fixed Income Fund is suitable for SMSFs, Individuals, Companies, and Trusts.

All you need is a minimum of $1,000 to get started.

Statutory Statement

The issuer of this product is identified at the top of this page. The PDS and target market determination for the product are available in the Documents section of this listing. Prospective investors should consider the PDS before deciding to acquire the product. An investment in the product is not a bank deposit and investors risk losing some or all of their money. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets(Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

1 For use in Australia: © 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its affiliates or content providers; (2) may not be copied, adapted or distributed; (3) is not warranted to be accurate, complete or timely and 4) has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), subsidiary of Morningstar. Neither Morningstar nor its content providers are responsible for any damages arising from the use and distribution of this information. Past performance is no guarantee of future results.

Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at http://www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar's publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar's full research reports are the source of any Morningstar Ratings and are available from Morningstar or your advisor. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a financial advisor. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.