|

TARGET RETURNS PER ANNUM

|

Class A – Cash Rate + 4.5% (plus Class B receives 50% of any income in excess of Target) * net of fees |

FEES |

1.0% (plus 50% of any income in excess of Target) |

|

MAXIMUM WEIGHTED AVERAGE LVR

|

Class A - 65% |

MINIMUM INVESTMENT |

$100,000 |

|

LOAN TERMS |

6 - 36 Months |

DISTRIBUTIONS & REPORTING | Quarterly in arrears |

Reliable Returns

A competitive targeted return paid quarterly in arrears, offers a compelling investment opportunity relative to risk.

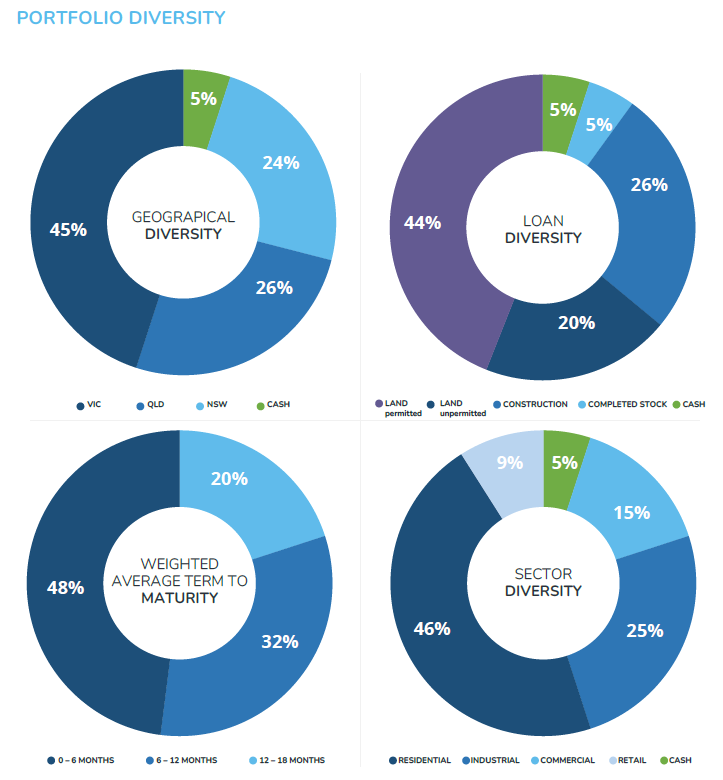

Diversified Risk

Investments are combined and distributed over a variety of investments that are professionally managed, ensuring risk diversification.

Secured Property Investment

A property only debt fund, with all investments secured by first registered mortgages.

Lending Experts

All investments are managed by a professional team of experts with experience in real estate, property development, investment, financing and funds management, construction and commercial law.

Passive Investment

After the initial investment, there is no need to consider each individual investment made by the pooled fund.

Co-Investment

Directors and/or other members of the Supra Capital Group will co-invest in each of Class A and Class B of the Fund alongside other investors (with the co-investments weighted towards Class B of the Fund), giving comfort of alignment of interests between all Classes of investors and the Supra Capital Group.

Risk Adjusted Returns

Investors may select from classes aligning risk appetite with target returns.

The investment objective of the Fund is to:

- Preserve capital; and

- Achieve the target returns for each Class of the Fund.

The investment strategy of the Fund is to generate income returns for Investors by acquiring units in SPVs which make Loans to borrowers for the purchase, refinancing, investment or development of real estate in Australia. Loans will be secured by first-ranking registered mortgages and may also be secured by general security agreements. Generally, Loan terms will be for 6-36 months, with a particular focus on Loans for assets along the eastern seaboard including suburban and major regional locations.

Class A and Class B Investors will invest in the same Loans. However, each Class will have different rights, obligations and restrictions, as described in this IM.

Upon maturity of the Loans, the SPVs are expected to be repaid capital (which is then repaid to the Fund), and interest is intended to be distributed to Investors on a quarterly basis (subject to availability).

Class B Units are subordinated to the Class A Units in respect of interest distributions and capital repayments.

The SPVs will make Loans only to such borrowers and in such circumstances that meet its investment selection criteria. Investors’ subscription money is ‘pooled’ and invested collectively into the Fund.

The value of the units in the SPVs will be made referable to all Units issued within the Fund for the purposes of calculating the requisite income returns to be paid to Investors holding Units.

The Trustee will make Loans only to such borrowers and in such circumstances that meet its investment selection criteria. All proposed loans will go through a thorough risk assessment and due diligence process. The Fund offers Investors indirect investment in a pool of Loans which are all secured by first mortgages over Australian real properties.

*As at 31st December 2025

Click here for sample transactions.

The information contained on this website is directed to, and provided for use by, Australian residents. All information provided as part of this website is intended to be general in nature and provided for information purposes only. It has been prepared without taking into account your personal circumstances, objectives, financial situation or needs and should not be relied on in connection with making an investment decision. If you intend to act or rely on any information contained on this website, you should independently verify and assess the accuracy and completeness of the information and obtain professional advice regarding its suitability for your personal circumstances. Any transactions listed on this Website are only included as illustrative of the types of transactions in which Supra Capital is or has been involved. They are not intended to be reflective of any overall investment performance. Past performance is not an indicator of future returns. To the maximum extent permitted by law, in no event shall we be liable for any loss, damage or expense which may be suffered due to your use of our website and/or the information or materials contained on it, or as a result of the inaccessibility of this website and/or the fact that certain information or materials contained on it are incorrect, incomplete or not up-to- date.

Supra Capital is an experienced real estate debt manager. To guide investment focus and outcomes, high-grade risk management, governance and operating platforms are utilised.

The company has a solid heritage, originating as CGA Bryson and subsequently the Bryson Group, which has specialised in property development, investment and funds management since the 1990s, over time constructing an impressive portfolio of projects and leading to the foundation of Supra Capital.

The directors and credit committee members have not only considerable combined experience in property development and investment, financing and funds management, and commercial law, but also a long-established working relationship. Their expertise, insight and collaborative approach are extended to member investors of Supra Capital to take advantage of select investment opportunities for mutual benefit.

Supra Capital Ltd holds AFSL number 305570. SCL is the intermediary for the Trustee and is responsible for offering to arrange for the issue, variation or disposal of interests in the Fund on behalf of the Trustee.

Michael was a partner of PwC for 24 years, including 4 years as Chairman of the Australian firm. He was also a member of PwC’s Global Board.

Whilst Michael was practising, he was widely recognised as one of Australia’s top tax advisors. Michael is a non-executive director of Marshall White. His former directorships include Melbourne Cricket Club (where he was President from 2019-2023), Scotch College, Lauriston Girls’ School, The Royal Melbourne Tennis Club, Breast Cancer Network Australia, Financial Crimes Consulting Ltd, MyProsperity Ltd and Janus Ltd.

Adriana is a qualified lawyer with 25 years’ experience in the financial services, property and legal sectors. That experience includes over 15 years operating mortgage and property development funds and as Partner of a large national law firm, specialising in property development and financing.

Adriana is a member of the UDIA Victoria Finance & Investment Committee, Fellow of the Australian Institute of Company Directors, Fellow of the Financial Services Institute of Australia and member of the Law Institute of Victoria. She is the Chair of MS Plus and was formerly Deputy Chair of VincentCare Victoria and VincentCare Community Housing.

Following more than 20 years’ practising commercial law, Andrew held non-executive positions for a range of private companies and not-for profit organisations, including directorship at CGA Bryson. He is currently commissioner of the Australian Football League (having retired as a chairman and president of the Hawthorn Football Club in 2016).

Andrew has been involved in various entrepreneurial activities including establishing a renewable energy business, which he later sold to an ASX Top 20 company and developing a ground-breaking real-estate app.

Peter has an extensive legal career with nearly 40 years practising in the areas of banking law, commercial law and mergers and acquisitions where he is recognised in “Best Lawyers 2023 and Best Lawyers 2025”. He currently consults to Thomson Geer Lawyers, where he was formerly chairman of the Board of Partners. Peter’s clients include nonbank financiers, private and public companies, family firms and high net worth individuals.

Peter is a non executive director of Jellis Craig Real Estate and the chair of RTN Law. Peter is a past director and vice president of the Hawthorn Football Club and was also the past chairman of the Centre for Eye Research Australia Limited, the Eye Research Australia Foundation, the Ansell Foundation and the Xavier College Foundation.

Click here for latest news.

Statutory Statement

This offer of scheme interests is available to wholesale clients only. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.