The Portfolio is a benchmark unaware global equities fund investing in quality companies listed in developed markets around the world. We target an annual return of 9% after management fees over rolling three-year periods.

Swell is a value manager, meaning we acquire each investment at a discount to its intrinsic value. Our principal objective is capital preservation thus we place greater emphasis on preventing losses than reaching for higher returns.

Our process is focused on acquiring quality companies with a durable competitive advantage and strong management team. We adopt a concentrated approach to portfolio construction, allocating meaningful weights to each holding.

We spend many months researching a business before we invest, so when we commit to it we know the company well and we’re confident in its prospects for long term growth. The scope of our research enables us to find and value opportunities the market regularly overlooks and that gives us an edge over other investors.

Our strategy is very simple and our process is very strict. We invest in outstanding companies with exceptional management and clear strategies for creating value over the long term. We hold a concentrated portfolio and reassess it often to ensure it meets our standards. Our first objective is safeguarding our investors' capital, so preventing losses is more important than reaching for higher returns and thus we prefer a more certain 12% return against a less certain 20%.

Lachlan founded Swell Asset Management in 2014, wanting to create a unique investment offering – a global portfolio with a genuine, long term focus. Prior to establishing Swell, Lachlan spent six years as a Senior Analyst with NovaPort Capital, a boutique fund manager owned by Challenger Limited. His extensive experience in the financial services industry includes legal and investment roles with The Bank of New York (London), King & Wood Mallesons and Goldman Sachs JBWere. He holds a BCom (Finance) and LLB.

Alex commenced his career with Swell in August 2015 and developed many of the technical models and quantitative screens used to manage Portfolio investments and research. Alex directs investment team research projects in addition to his responsibilities for allocated investments in the Swell Global Portfolio. He holds a BCom (Finance).

Sally joined the investment team in January 2020 and is responsible for research projects related to the Portfolio including concentrated analysis of companies being considered for inclusion. She is currently completing the CFA Institute certificate in ESG investing. While completing her studies Sally gained valuable research experience through intern positions in the UK, China and Australia. She holds an MSc (Investment and Wealth Management) and a BEc.

Eden joined the investment team in 2022 and undertakes concentrated research and analysis of Portfolio investments. Previously she worked in a range of positions at Suncorp Bank, where she was appointed a portfolio strategy analyst in the home lending division, delivering improved customer outcomes.

She holds a Bachelor of Commerce from Griffith University and completed the London School of Economics course in Advanced Corporate Finance.

Swell Global Portfolio monthly update

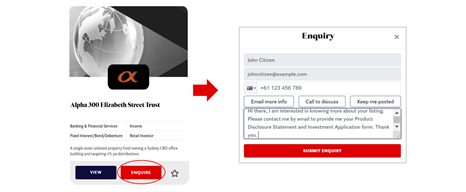

If you have joined Investment Markets (which is free) and verified your email address, you can send an email directly to us either by: -

- Selecting “Enquire” when viewing the card relating to the listing; OR

- By completing the enquiry form on the lefthand side when viewing the detail of a listing

We will respond using your preferred communication method (i.e. email or phone).

Statutory Statement

The issuer of this product is identified at the top of this page. The PDS and target market determination for the product are available in the Documents section of this listing. Prospective investors should consider the PDS before deciding to acquire the product. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.