The Trivesta Protected Yield Fund (TPYF) presents a compelling opportunity for wholesale investors seeking stable income and capital preservation through secured notes issued to Trivesta Investment for foreign exchange trading.

This strategy targets a reliable 10 per cent per annum return, net of fees, delivered through fixed monthly distributions. TPYF offers significant investor control with no lock-up periods and monthly redemption options. Furthermore, capital risk is protected by Trivesta’s use of Subordinated Units for the first ten per cent of any capital loss.

The Fund’s success is underpinned by rigorous risk management, a focus on highly liquid assets, and the combined expertise of its management.

The Trivesta Protected Yield Fund offers reliable returns without sacrificing flexibility.

It offers a targeted 10% p.a. return (net of fees),* delivered through fixed monthly distributions—making it an attractive solution for wholesale investors seeking stable income and capital preservation. With no lock-up periods, monthly redemption, and capital risk protected by Trivesta, TPYF is designed to give you control of your money and peace of mind.

Backed by a rigorous investment process and a strong regulatory foundation, the Fund focuses on delivering predictable outcomes in an unpredictable world.

Benefits of investing in the Fund include:

- monthly distributions;

- no minimum investment term;

- Subordinated Units protect investors for the first 10% of any capital loss by the Fund; and

- experience and expertise of our and Trivesta Investment’s key management and Investment Committee.

*Returns Not Guaranteed, Subject To Risks Outlined In Information Memorandum

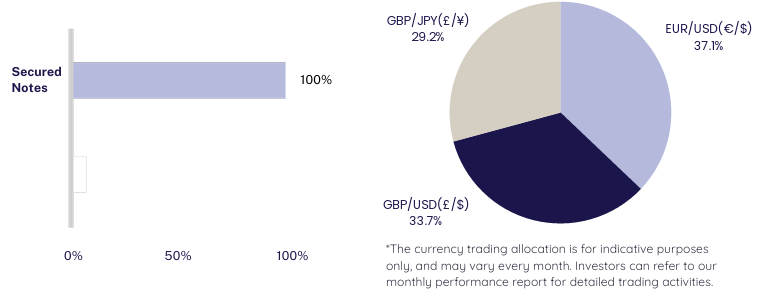

The Fund allocates 100% of its committed capital to secured notes issued by Trivesta Investment. Trivesta Investment then utilises the proceeds to engage in foreign exchange trading activities, aiming to generate high returns to meet its obligations under the issued notes, including interest payments and principal redemption. This strategy seeks to enhance returns while controlling downside risks through position management, a focus on high-liquidity currency pairs, and a combination of technical and fundamental analysis.

TPYF Asset Allocation Trivesta Investment Exposure Breakdown

Risk Management Trading Framework

There is no minimum investment term and your investment continues until it is redeemed.

The Fund offers redemptions on the 7th day and 21st day of each calendar month (and if these days are not Business Days, Units will be redeemed on the next immediate Business Day), and the redemption date will depend on when you submit a redemption request.

The distribution rate for an investment in Units (Distribution Rate) is 10% p.a., for every 12 months for which the investment is maintained starting from the date distributions commence accruing on such Units (Distribution Commencement Date).

In relation to each investor, the Distribution Rate will be paid via a monthly distribution of 0.5% of the amount invested in Units, with an additional distribution of 2% of your investment amount in months 6 and 12.

Where an investor stays for more than 12 months from their Distribution Commencement Date, the Distribution Rate resets and the Distribution Rate applying at that time (which will be based on the interest rate applying on Notes issued at the time) will apply for the second investment year (and this process will repeat for each year the investor remains invested in those Units).

The Distribution Rate is an estimate and is not guaranteed.

The payment of distributions is dependent upon Trivesta Investment making interest payments in accordance with the terms of the Notes.

Trivesta Group is a trusted leader in financial services, providing financial services related to managing the Fund, including access to select alternative investment opportunities to meet the unique needs of our clients. Based in Sydney, we operate across Asia-Pacific, supporting thousands of clients worldwide.

Trivesta Funds Pty Ltd (AR No. 1274820) is a corporate authorised representative of Trivesta Capital Ltd (AFSL 320497 | ACN 126 975 282), licensed to provide financial services related to our fund operations.

The Trivesta Protected Yield Fund (Fund) is offered exclusively to wholesale investors, providing specific investment opportunities designed to generate regular income through monthly distributions. The Fund seeks to achieve this objective by investing in secured notes issued by Trivesta Investment Pty Ltd, which are backed by a first-ranking security interest over the assets and undertaking of Trivesta Investment.

Trivesta Investment is a private entity established in 2024, focused on identifying and executing investment strategies in fixed income–linked and private market opportunities. Its principal activity involves deploying capital raised through wholesale note issuances into internally managed trading strategies, including FX and Commodities.

Trivesta Investment leverages market research and in-house expertise to pursue risk-adjusted returns, with a particular focus on strategies designed to support its structured yield obligations.

Trivesta Investment does not offer financial advice or deal directly with retail clients. Trivesta Investment provides its services to wholesale clients only.

Trivesta Investment promotes the Fund to prospective investors and has been appointed as an authorised representative of Trivesta Capital to enable Trivesta Investment to perform this activity.

Click here to see the latest updates.

The minimum initial investment is AUD 500,000, with increments requiring a minimum of AUD 100,000.

Trivesta Funds outlines all applicable fees in the Information Memorandum (IM). Fees typically include management fees and performance based fees tied to the fund’s performance.

Trivesta Funds provides regular reports and updates on fund performance. You may also receivemaccess to an online portal for real time tracking of your investment.

Withdrawal terms and conditions are set out in the Fund’s Information Memorandum. Redemptions are subject to minimum notice requirements and other conditions, including timing and processing rules. Investors should refer to the Information Memorandum for full details before making a redemption request.

Statutory Statement

This offer of scheme interests is available to wholesale clients only. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.