It has never been easier to get a professional money manager in your corner. Invest alongside Market Matters with three portfolios available for direct investment.

Built on a historically strong track-record of past returns, while targeting significantly less volatility than the ASX200, the portfolios are based on Market Matters existing members-only portfolios (Growth, Income and Emerging Companies), and provide a unique active management approach, together with an unprecedented level of clarity.

Performance is key for every portfolio regardless of risk profile, and through the Open Invest Platform, investors can always see the underlying positions, quantity, purchase price, P&L and more.

Whether our portfolios complement your existing approach or provide the ‘active management’ solution you’ve been looking for, we’re confident we can add significant value while delivering total transparency.

The portfolios are managed by James Gerrish, Portfolio Manager at Shaw and Partners and primary contributor to Market Matters, while our team offers 100+ years of combined market experience.

About the Active Growth portfolio

Market Matters most popular portfolio targeting large cap Australian shares in the ASX 200. The portfolio is high conviction in nature, showcasing our best 20-30 positions in the large cap space. It’s actively managed, far removed from some ‘set and forget’ portfolios. We overlay our broader macro economic views with extensively researched company positions, with performance at its core. Returns will be achieved through a combination of capital appreciation and income with an overall objective of outperformance of the S&P/ASX 200 Accumulation Index over 5 years but with lower volatility.

Ideal for: Appeals to a wide-range of investors; the portfolio can be used as a single investment solution or as part of a wider strategy depending on an individual's particular circumstances and goals.

Performance: click here

About the Active Income portfolio

Combines Australian large cap listed equities with a value focus together with other asx listed income securities, including hybrid securities and other listed income funds. The portfolio is designed primarily for investors looking for lower volatility and consistent returns — together with a higher income ceiling — something that the portfolio has exceeded since inception.

Ideal for: Designed for investors with a more conservative mindset, looking for income and consistent returns, while still seeking an active management approach to navigate choppy waters if/when they arrive.

Performance: click here

About the Emerging Companies Portfolio

A newer portfolio, identifying small & mid capitalisation emerging stocks (ex-100) that show strong underlying growth characteristics. This is a higher risk portfolio and investors should expect greater volatility. Returns will primarily be achieved through capital appreciation rather than income with an overall objective of outperformance of the S&P/ASX Small Ordinaries Index over 5 years.

Ideal for: Investors looking to add on to their existing investor portfolios; investors seeking an actively managed portfolio of Australia’s smaller, growth-oriented companies; those willing to accept a greater level of volatility in the search for stronger returns in the long term.

Performance: click here

The best of both worlds

Market Matters Invest combines the best parts of a managed fund with a direct investment. It provides you with control and direct ownership, whilst still offering convenience, flexibility and diversification, to help manage your investment risk.

An active management approach

We don’t believe in ‘set and forget’ portfolios. Every position and decision is extensively researched, valued and revalued over time. We’re not afraid to make buy and sell decisions, with performance constantly monitored. Our active approach has paid dividends in a time of rapid change and shifting markets.

Your own professionally managed portfolio

Once you open an account you will have access to a range of investment options and the ability to obtain your own personal portfolio that is professionally managed by the team at Market Matters.

It’s easy to get started

You can open your account online in minutes, and our relatively low minimum investable amount ensures that our portfolios are more accessible than others.

Stay informed and up-to-date

Investors have 24/7 online access to view and monitor investments, track performance and more. Market Matters monthly investor reports are also extensive, explaining every decision with detail, clarity and transparency.

Reports

You can generate several reports on your portfolio covering portfolio performance, transactions, fees and tax. The Administrator will also send you an Annual Tax Statement to assist you (and your accountant) in preparing your annual tax return.

When you open an Account in the Market Matters Invest service (“the Service”), you obtain your own personal investment portfolio that is professionally managed for you by the team at Market Matters in accordance with the objectives of the investments you have chosen.

You are able to view your portfolio via your Investor Portal and app. You will also receive regular updates and information from the team at Market Matters, explaining the rationale for their investment decisions and their reflections on investment markets and other relevant topics; all to help keep you informed about the status of your portfolio.

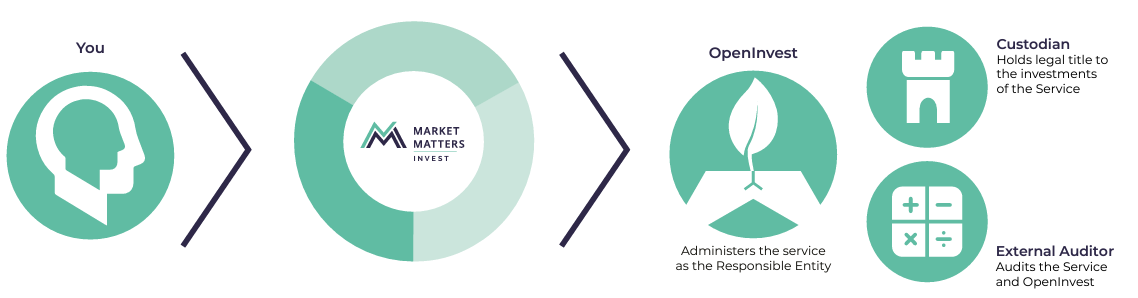

The Service is provided via the OpenInvest Portfolio Service (ARSN 628 156 052), an IDPS-like managed investment scheme registered with ASIC under the Corporations Act. The Responsible Entity of the scheme, OpenInvest Limited (referred to as “OpenInvest”, the “Responsible Entity” or the “Administrator”), operates pursuant to a strict regulatory regime overseen by ASIC, and is required by law to act in the best interests of all investors.

The diagram below shows the roles of the different parties involved in delivering a safe, compliant and professional investing solution for all investors.

Market Matters was founded in 2013 to provide independent investors with accurate, timely and professional market insight. Every day we break down the latest financial developments into simple, actionable opinion for members and investors.

The Market Matters service has evolved into a pioneering site and service. Whether it's our high-performing portfolios, dynamic company pages, insightful market commentary or expertly presented actions — Market Matters gives investors the tools and the know-how to make smarter, more informed investment decisions.

With Market Matters Invest — we go one step further, offering the wider investment community the chance to invest alongside Market Matters with our three portfolios available for direct investment.

Established in 2016, Market Matters Invest provides investors with a low-cost, easily accessible, transparent, and active investment approach — targeting superior returns by holding direct assets.

We provide an incredibly easy-to-use financial platform, while still offering in-depth data and analysis. Crucially, we invest in our own portfolios – putting real money where our mouth is. Market Matters combines data + context with opinion + action to deliver the most complete investor experience possible.

Our investment function is overseen by the Investment Committee, and we pride ourselves on delivering a unique, professionally managed solution, aligned with our active investing philosophy.

The Market Matters investment management team has over 100 years of combined investment experience, implementing a unique top-down, bottom-up approach that has delivered consistent outperformance over time. The investment team are shareholders in the business and Market Matters invests directly into each portfolio, ensuring alignment at all levels.

James Gerrish is Market Matters’ Lead Portfolio Manager, with overall responsibility for the Market Matters investment approach, security selection and portfolio construction. James has 20 years of investment experience and combines his role at Market Matters with portfolio management responsibilities at Shaw and Partners, a firm with ~$30bn of assets under management. James is the majority shareholder of Market Matters, holds a Bachelor of Management & sits on the Market Matters Investment Committee.

Harrison Watt contributes daily to the Market Matters content and is instrumental in researching stock opportunities. He specialises in Emerging Companies Research and prides himself on uncovering smaller growth opportunities for the Emerging Companies Portfolio, where he is Co-Portfolio Manager with James. Harry is also a Portfolio Manager at Shaw & Partners with a strong foundation in risk management. He holds a Bachelor of Economics from the University of Sydney and is currently completing his Chartered Financial Analyst (CFA) qualifications. Harrison is a shareholder of Market Matters.

Shawn Hickman is a macro-economic specialist with over 30 years’ experience in investing and trading having held senior investment positions at Goldman Sachs & Macquarie Bank. Shawn heads the Market Matters research effort with a particular focus on global investment trends and their influence on domestic & international equity markets. He holds a Bachelor of Applied Science, Chemical Engineering from Aston University. Shawn is a shareholder of Market Matters.

Peter White chairs the Market Matters Investment Committee, leveraging his more than 25 years’ experience as a specialist in portfolio construction and financial strategies with a focus on long-term investment planning and risk management. Peter holds a Bachelor of Business degree, a Diploma in Financial Planning and attained the industry’s highest accreditation of Certified Financial Planner (CFP). Peter is a shareholder of Market Matters.

Peter Whyntie is a recognised leader in the governance, risk management and compliance community. He is an active member of the Governance Institute of Australia and the GRC Institute and a Course Director of the Advanced Risk Management Module of the Governance Institute’s Governance Diploma. Peter holds a Bachelor of Economics from James Cook University and is a member of the Market Matters Investment Committee.

---

The Market Matters Investment process is underpinned by in-depth macroeconomic analysis and sectorial trends, fundamental security analysis and robust portfolio construction, delivering high conviction portfolios, actively managed, for strong risk-adjusted returns.

Click here to view our latest Videos.

Click here to view our latest Podcasts.

Click here to view our latest Blog.

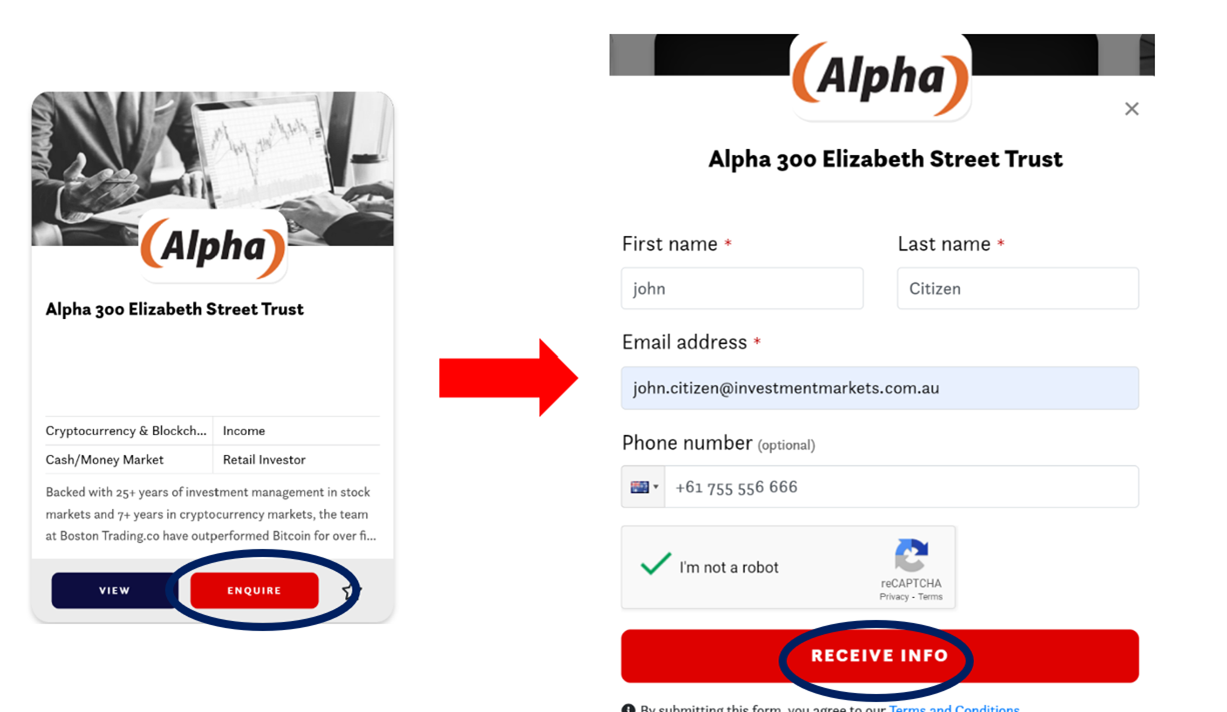

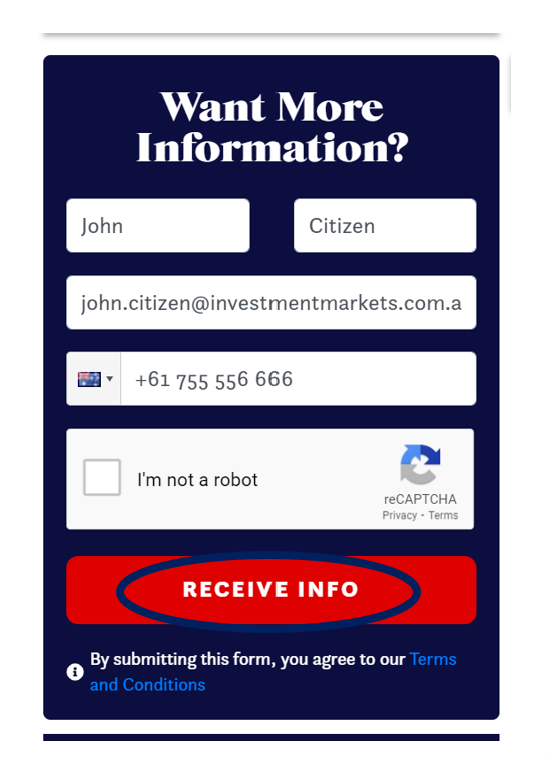

• By clicking the enquire button on the card view

Or

• By selecting “Receive Info” when viewing the listing

We will respond using your preferred communication method (i.e., email or phone).

Tags

Statutory Statement

The issuer of this product is identified at the top of this page. The PDS and target market determination for the product are available in the Documents section of this listing. Prospective investors should consider the PDS before deciding to acquire the product. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.