Comparison Data

1Performance

| 1 month | 3 month | 1 year | 3 year | 5 year | Since Inception | Inception Date |

|---|---|---|---|---|---|---|

| -0.44% | -1.02% | 3.85% | - | - | 4.74% | 29 Sept 2023 |

Fees

| Management Fee | Performance Fee | Morningstar Total Cost Ratio |

|---|---|---|

| 0.58% | - | 0.58% |

The Fund offers a sophisticated investment vehicle tailored for those prioritising capital stability and consistent income through the Australian fixed interest market.

By focusing on investment-grade, AUD-denominated securities—including government and corporate bonds alongside secured asset-backed instruments—the strategy ensures a high-quality portfolio with predominantly senior rankings. It is specifically curated for investors with a medium to long-term horizon who possess a low tolerance for volatility but seek returns exceeding the Benchmark Index.

Through the active management of both duration and credit exposure, the Fund pursues a dual mandate of capital preservation and yield enhancement. This disciplined approach provides a diversified exposure across key sectors such as banking and insurance, delivering reliable quarterly distributions while maintaining a robust defensive profile. Ultimately, the Fund serves as a prudent solution for those requiring steady performance and rigorous risk oversight within the domestic debt landscape.

Fund Objective

The Fund aims to provide investors with capital stability, income and returns (after fees) in excess of the Benchmark Index over three-year rolling periods through investment in a portfolio of Investment grade rated Australian fixed interest securities that include government and corporate bonds, mortgage-backed securities, asset-backed securities, cash and enhanced cash instruments.

Designed for investors:

- Seeking fixed rate debt exposure

- With a medium to long term investment horizon (> 3 years)

- With a low tolerance for capital volatility

- Comfortable with a quarterly income stream

The Fund invests in AUD denominated investment grade rated fixed income securities, predominantly with senior rankings.

Investors can expect exposure to a diversified pool of assets within key debt issuer categories of government, corporate, bank, insurance, and (secured) Asset-backed Security (ABS), in fixed and floating rate forms.

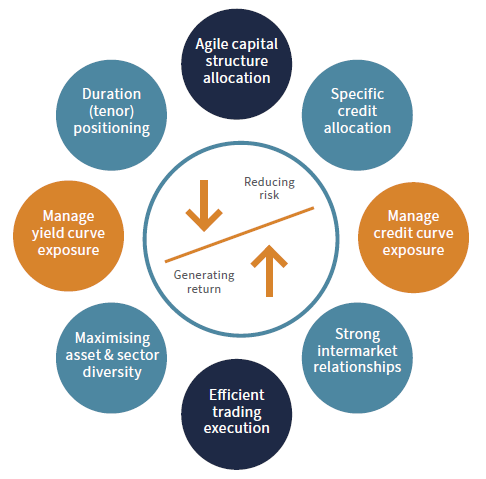

The Fund actively implements both duration and credit exposure investment strategies, aiming to provide investors with:

- Capital preservation through a prudent selection process and maximisation of exposure diversity

- Total Return in excess of the Benchmark Index, net of fees; over three-year rolling periods and

- Quarterly income distributions.

MST Australian Bond Fund ‘Superior’ by SQM Research*

* The SQM rating contained is issued by SQM Research Pty Ltd ABN 93 122 592 036. SQM Research is an investment research firm that undertakes research on investment products exclusively for its wholesale clients, utilising a proprietary review and star rating system. The SQM Research star rating system is of a general nature and does not take into account the particular circumstances or needs of any specific person. The rating may be subject to change at any time. Only licensed financial advisers may use the SQM Research star rating system in determining whether an investment is appropriate to a person’s particular circumstances or needs. You should read the product disclosure statement and consult a licensed financial adviser before making an investment decision in relation to this investment product. SQM Research receives a fee from the Fund Manager for the research and rating of the managed investment scheme. For full Disclaimer, please visit: https://sqmresearch.com.au/funds/disclaimer.php

*BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”)

Equity Trustees Limited (“Equity Trustees”) (ABN 46 004 031 298), AFSL 240975, is the Responsible Entity for the MST Australian Bond Fund (“the Fund”). Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT). This publication has been prepared by MST Financial Services Pty Ltd (ABN 54 617 475 180) (“MST”) to provide you with general information only. In preparing this information, we did not take into account the investment objectives, financial situation or particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Neither MST, Equity Trustees nor any of its related parties, their employees or directors, provide and warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. Past performance should not be taken as an indicator of future performance. You should obtain a copy of the Product Disclosure Statement before making a decision about whether to invest in this product. The Fund’s Target Market Determination and Product Disclosure Statement are available on Equity Trustees Website. A Target Market Determination is a document which is required to be made available from 5 October 2021. It describes who this financial product is likely to be appropriate for (i.e. the target market), and any conditions around how the product can be distributed to investors. It also describes the events or circumstances where the Target Market Determination for this financial product may need target market), and any conditions around how the product can be distributed to investors. It also describes the events or circumstances where the Target Market Determination for this financial product may need to be reviewed.

Since its inception, MST Financial has been committed to delivering in-depth analysis and actionable insights to help clients make informed investment decisions. In 2025, MST Financial expanded its offering by becoming an investment manager, further enhancing its reach and ability to serve a broad base of clients with tailored investment solutions.

MST Income, a division of MST Financial, provides high-quality, tailored Hybrid and Debt Securities services to Wealth Management firms and Institutional Investors, offering everything from expert insights and research to professional portfolio management with a focus on execution and implementation.

MST Financial is privately owned and not owned by any financial institution.

This is a significant point of differentiation as it enables MST Financial to transact an extensive and unrestricted range of interest rate securities and investments.

MST Financial has an Australian Financial Services Licence (issued by ASIC) and provides general financial product advice.

MST Financial maintains strict conflict of interest policies to ensure that the investment management team which manages the Fund operates independently.

Kieran joined MST in 2025 as the Head of Investment Management, Fixed Income Division. He brings more than 35 years of market experience, primarily as a fund manager responsible for investing multiple billions of dollars across a complex range of investment mandates. His deep knowledge of capital markets was developed through additional roles as a proprietary interest rate trader at a U.S. investment bank, as well as a debt originator, syndicator, and institutional (funds) client relationship manager. Kieran holds a BA in Accounting from Canberra University and is a former Chairman of the AFMA Debt Capital Markets Committee.

Garreth joined MST in 2025 as the Head of Unit Trusts – Fixed Income. He brings over 15 years of extensive experience in financial markets, including portfolio management roles with multi-asset class exposure. As Head of Fixed Income at Aberdeen Asset Management, he managed significant institutional capital across both domestic and global bond strategies, while leading a team of analysts and strategy specialists. Garreth has also served on internal and external Tactical Asset Allocation committees, and successfully launched and managed an Australian Dollar Income Bond Fund for clients of Asian private banks. He holds a Master’s degree in Finance from UNSW and is a CFA charterholder.

Megan joined MST Financial in 2025 as the Head of Individually Managed Accounts - Fixed Income. She holds a Bachelor of Science (Hons.) in Physics (Photonics) and a Diploma of Financial Services (Securitisation). Megan brings over 15 years of expertise in the Asia Pacific fixed income markets, combining portfolio management, trading, and quantitative analysis to support the MST Income Solutions division. Prior to MST Financial, Megan held the position of Portfolio Manager at FIIG Securities, helping to grow the managed account service to over 400 million funds under management.

Click here to view our latest Monthly Update.

Click here to view our latest News.

Step 1: Investors can apply to invest through the online application form, hosted by Boardroom, the registry provider for the Fund. This application process takes between 5 and 10 minutes, depending on the account type.

Step 2: After submitting your application, transfer your investment funds by BPAY or EFT to the Fund application bank account. You will receive an email from Boardroom that contains these details.

NOTE: This bank account is a trust account managed by the fund registry Boardroom. Accordingly, the account name Boardroom Pty Ltd may appear when you enter the payment details into your online banking.

Step 3: If you have any outstanding application documents such as AML documentation (drivers licence, passport or trust deed) or a wholesale investor certificate then you will need to provide these before your application can be finalised.

Step 4: Once your funds and any outstanding documentation is received, you will be issued units in the Fund, and Boardroom will send you a welcome email including a holdings statement confirming your investment. The daily cut-off is 2pm (AEDT) and funds received after this time will receive the next unit price.

Your welcome letter provides tailored instructions on how to register for an InvestorServe account.

Please refer to a generic version of these instructions below:

-

Issuer: MST Financial

-

Holding Type: Unit Trust

-

Reference Number: This is your unit holding number, starting with a 'U'. This number was included in your first holding statement.

-

Name: The registered account name. This will depend on the entity in which you created your account. For example, it will be the trustee name if your account is a SMSF or trust. You can also find this in your first holding statement.

-

Postcode: This will need to match the postcode we have recorded on your account.

-

Country: Leave this blank as the system will recognise Australia as the default Country when a postcode is entered.

The Fund is structured as a managed investment scheme (MIS). As an investor in this scheme, you buy units in the scheme based on the amount you invest and the unit price on the day you invest. The value of each unit in the Fund and correspondingly the value of an investor's investment is determined daily considering the performance of the underlying assets of the Fund less the Fund management fee.

Some of the features of investing in a managed investment scheme (MIS) include:

- diversification of assets;

- professional management of the MIS; and

- access to investment opportunities that may not be available to individual investors.

This list is not exhaustive and you should consider the appropriateness of the product with regard to your objectives, financial situation and needs. Before acquiring the product you should obtain the Product Disclosure Statement and consider the offer statement before making any decision about whether to acquire the product. You should consider seeking advice from an authorised financial adviser before making an investment decision.

The Fund charges an annual investment management fee of 0.58% p.a. (inclusive of GST).

There are no application or exit fees charged by the Fund. However, there is a transaction fee known as a buy/sell spread, which amounts to 0.10% when entering and 0.10% when exiting the Fund. It is important to note that the buy/sell spread is not a fee paid to the Fund but will affect your investment return and is reflected in the application (buy) and redemption (sell) unit prices.

The purpose of this transaction fee is to cover trading expenses such as brokerage fees when investments are bought or sold in the Fund related to applications or redemptions. These fees ensure that only the investors buying or selling units incur the expenses associated with buying or selling any assets at a Fund Level.

What are distributions?

The Australian Bond Fund makes regular payments to unitholders in the form of quarterly distributions. These distributions typically consist of a combination of income from interest (generated from cash or bonds) and realised capital gains from the sale of assets held by the Fund.

How much do I receive?

The income you receive is based on the number of units you hold at the end of the distribution period, regardless of how long you have held those units. Every unit in the Fund receives the same rate of distribution. This rate of distribution is published as a cents per unit distribution rate. The total distribution you receive is calculated by multiplying the cents per unit distribution rate by the number of units held at the end of the distribution period.

How often are distributions paid?

The Fund pays distributions on a quarterly basis.

The Fund distributes income quarterly, corresponding to the quarters ending March, June, September, and December, provided there is distributable income available. Distribution payments occur in the month following a distribution date.

How can my distributions be paid to me?

Unitholders can elect to receive the distribution in the form of cash (paid to their nominated bank account) or reinvestment, which is the purchase of additional units in the fund.

Investors in the Fund can choose to have their income paid to an Australian bank account held in the name of the account holder or to have this distribution reinvested into the Fund to purchase additional units. Investors may elect to have income distributed on the initial fund application form. However, this preference can be changed up to 7 days before a distribution date.

Why is the unit price lower after the distribution?

The income and any realised capital gains that the Fund earns are reflected in the unit price; this increases the unit price over time. When a distribution is paid, this income and realised capital gains are paid to investors, and the unit price will fall by approximately the same amount as the distribution.

For example, if a fund has a unit price of $1 on 30 June and the fund declares a distribution of $0.04 per unit (4 cents per unit), unitholders invested as at 30 June will be entitled to receive the $0.04 per unit distribution. Consequently, the unit price of the fund will fall to $0.96 to account for the $0.04 per unit distribution.

How can my distributions be paid to me?

Unitholders can elect to receive the distribution in the form of cash (paid to their nominated bank account) or reinvestment, which is the purchase of additional units in the fund.

Why is my distribution different from one period to the next?

The payment cycles of the underlying securities in which a fixed-income fund invests, the overall performance of the fixed-income market, the composition of the fund's holdings, and the fund's expenses can all affect distribution payments from one period to the next.

How do I know when my Fund has paid a distribution?

At the end of each distribution period, you’ll receive a distribution statement for the Fund outlining the details and amount of the distribution you received. This statement will also notify you how we have paid this distribution based on your chosen payment method.

When can I expect to receive my annual tax statement?

For each financial year, you’ll receive an Annual Tax Statement. The timing of dispatch of this document will be made available in mid-June each year and will be available on the Fund website.

The Fund is open to withdrawals on a daily basis. It is possible to withdraw a portion of your investment, but you must maintain a minimum balance above $10,000. To initiate a withdrawal, simply complete the withdrawal form and send this form to the registry for processing (mst@boardroomlimited.com.au). You can find this form in the documents section of the this page.

Withdrawals will generally be paid to your nominated Bank Account within 5 Business Days.

Please be aware that there will be delays in the processing of withdrawals in the week following a distribution period. These delays will not impact the unit price received for a withdrawal, however they will increase the time in which an investor receives their withdrawal payment.

A tax statement is provided in August after the close of each financial year, which has all the information needed to complete your tax return in respect to any income received from the Fund. You will receive a tax statement for each fund you are invested in.

Investors also need to consider Capital Gains Tax (CGT) in periods they have sold or transferred their investments. The calculation of CGT from the sale or transfer of assets in the Fund will need to be calculated by a qualified accountant using information available from the statements you receive from the fund registry.

Setting up an Auto Invest plan is simple and only takes a few minutes by completing the Regular Investment Plan section through the online portal on InvestorServe. Simply navigate to the “Payment Instructions” and then “Savings Plan” section. Then follow the prompts to add or amend your Regular Investment (Savings) Plan. For new applications there is a Regular Investment Plan section in the online join form to provide the amount and bank account for the Regular Investment Plan.

Can I edit or pause my Regular Investment Plan?

Yes, they can be modified or cancelled through the online InvestorServe portal.

What happens to my Auto Invest on weekends and public holidays?

Direct Debits are processed on the 15th of each month. If this date falls on either a weekend or a public holiday, your Auto Invest transaction will be carried over to the following business day.

What is a Regular Investment Plan?

A regular investment plan allows you to commence investing in the Fund with as little as $1,000 on a monthly basis. This removes the need to manually make separate applications and investments.

To add to your investment you will need to complete an additional investment through the registries online application form. This is a fairly quick and straightforward process, however if you do have any questions please don’t hesitate to contact our registry on 02 8023 5469.

To complete your additional application please visit the online application form.

STEP 1: Beginning the form

Once you have clicked on the “Invest Now” link, please select the “Existing Investor” option, download and review the latest PDS and fill out the below details:

- Investor Number: U00XXXXX – This will be number that you received in your initial welcome email, or you can find this number on your transaction statements.

- Postcode: This is your residential postcode recorded on your investment account.

This will then auto populate, and you can proceed with your additional investment.

STEP 2: Electing your payment method and investment amount

In this step please enter in the amount you wish to invest and the method in which you wish to pay.

STEP 3: Making the payment

Once you complete this additional investment – you will receive an email outlining the application summary that includes the below (depending on your payment method).

Step 4: Confirmation

Once received and processed you will receive a transaction statement by email confirming the transaction which shows your total investment balance.

Statutory Statement

The issuer of this product is identified at the top of this page. The PDS and target market determination for the product are available in the Documents section of this listing. Prospective investors should consider the PDS before deciding to acquire the product. This product listing was vetted by and approved by the product issuer identified above before publishing. Investment Markets (Aust) Pty Ltd AFSL 527875 (IM) is not the issuer of the product.

General Disclaimer

IMPORTANT STATEMENT ABOUT YOUR USE OF THIS SITE

Information on this site is intended for Australian users only.

This site is operated by Investment Markets (Aust) Pty Ltd. (ACN 634 057 248) (IMA, we, us and our), the holder of Australian Financial Services Licence (AFSL) no. 527875. The content is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent permitted by law, neither IMA, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment products on this site and any statements made about them by their issuers are not vetted, verified or researched by IMA. The presence of an investment product on this site should not be interpreted as an implied endorsement of it by IMA. Certain content provided may constitute a summary or extract of another document such as a Product Disclosure Statement. To the extent any content is general advice, it has been prepared by IMA. Any general advice has been provided without reference to your investment objectives, financial situations or needs. For more information refer to our Financial Services Guide. To obtain advice tailored to your situation, contact a financial advisor. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement (or other offer document) before making any decision to invest. Past performance does not necessarily indicate an investment product’s future performance. The content is current as at date of initial publication and may not be current as at your date of viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

1 For use in Australia: © 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its affiliates or content providers; (2) may not be copied, adapted or distributed; (3) is not warranted to be accurate, complete or timely and 4) has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), subsidiary of Morningstar. Neither Morningstar nor its content providers are responsible for any damages arising from the use and distribution of this information. Past performance is no guarantee of future results.

Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at http://www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar's publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar's full research reports are the source of any Morningstar Ratings and are available from Morningstar or your advisor. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a financial advisor. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.