Beginning 2026 With A Bang

Garreth Innes

Fri 13 Feb 2026 7 minutesThis time of the year is always interesting due to the preponderance of investment outlooks that are penned in early-to-mid December. These publications wax lyrical on a variety of topics du jour but are often most useful in informing investors exactly where consensus expectations and biases lie across various asset classes. These publications are also slowly coming to grips with the new world order in geopolitics and how a seemingly structured 6-month view of the world can get blasted to smithereens in a few hours.

January 2026 was a case in point. President Trump was a very busy boy - his new year began with a literal bang in Venezuela, followed up by further overtures towards Greenland, culminating in his Davos address where the relief was palpable when we stated he wouldn’t be taking the slab of ice ‘by force’. Shortly after this, he threatened the Iranian leadership over its violent crackdown on civilian protests while stationing US military assets in the region. All of these developments had large impacts on commodity prices, with oil trading in a wide range through the month. It was gold, however, that shone brightest, with the sheer level of uncertainty supercharging the ultimate boss of safe-haven trades. Last month we commented on the lackluster AUD performance in December compared with metals prices and growing interest rate differentials – January provided the catchup with the AUD stretching its neck above USD0.70 and gaining 4.4% over the month.

Economically, Trump was also very active with a proposed 10% cap on credit card interest rates smacking US banks and fintech co’s, while attempts to increase the affordability of homes also moved market segments (a ban on institutional ownership of single-family homes as well as directing the Federal mortgage agencies to purchase up to $200bn of mortgage assets). The US Department of Justice subpoenaed Federal Reserve Chairman Jerome Powell, threatening a criminal indictment over his handling of the redevelopment of the Fed’s head office, further fraying the fractious relationship between these entities and catalysing uncomfortable questions about the independence of the Fed heading into 2027 – further boosting gold’s credentials.

I am not sure that even collectively, these Outlook pieces picked 25% of such events taking place in 2026!

After everything that was thrown at them during the month, government bond yields were really rather tame. US 2-year yields increased slightly after the Fed held rates at 3.75%, and 10-year yields only climbed by 0.07% to 4.24%, respecting the upper band of the narrow range of the last few months, although the low’s do seem to be climbing month on month. Policy-sensitive 3-year Australian government yields rose by 0.12% on account of continued strong domestic economic data – this month served up another elevated monthly CPI print, whilst the unemployment rate dropped to just 4.1%.

The combination of elevated inflation, a subdued unemployment rate, credit growth lifting towards 10% YoY is making it harder for the RBA (and us) to find reasons not to hike – the collective pulse is too strong. The question is not if but when. The key point we would make is that close to 2 interest rate hikes were already priced into the market coming into January 2026, and we still think it is unlikely the RBA will be able to do much more than this without risking consumer confidence and labour market gains of 2025.

Longer-term bonds were better behaved, resulting in curve flattening of 0.05%. There were further ructions in the Japanese government bond market on account of a snap election called by new PM Takaichi as well as promises of unfunded tax cuts, heaping more pressure onto long-end Japanese Government Bonds. The Yen also continued weakening, although speculation of US intervention (to prop up the Yen) caused something of a circuit-breaker offering some temporary respite.

In other news post month-end, Kevin Warsh has been nominated as the next Federal Reserve Chairman. He has historically been guilty of overestimating inflation and critical of so-called ‘mission creep’ at the Fed and as such, may be less likely than his predecessors to support balance sheet expansion (or quantitative easing). More recently, he has been supportive of rate cuts – probably why he got the job! The initial move has accordingly been a bit of curve steepening in the US.

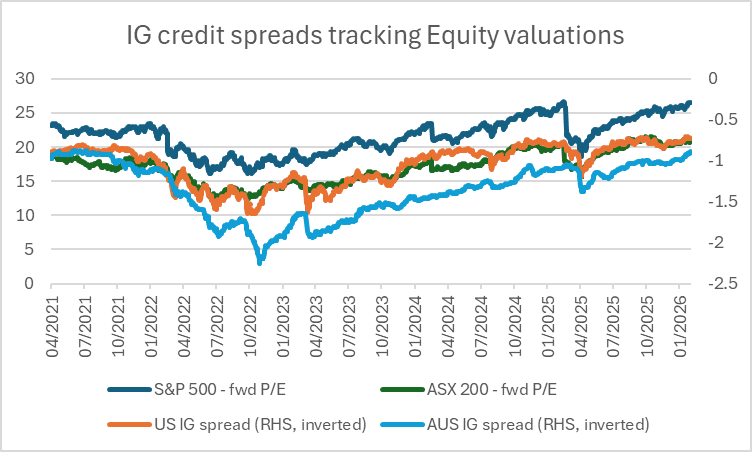

Credit markets continued to squeeze tighter in spread, with Australian corporate spreads outperforming peer Investment Grade indices in January. The headline spread tightened from 0.98% to 0.90%, while the longer-duration US index fell to a headline spread of just 0.73% at month-end. The primary market in Australia was very strong, with elevated oversubscription levels on run-of-the-mill senior unsecured bank bond deals a consistent feature of the market.

Our Outlook - for what it is worth!

At the time of writing, we now know that the RBA has hiked its cash rate to 3.85% at the February meeting. In a reversal from last month’s decision/presser, this month served up a hawkish statement (the accompanying economic projections implying a much lengthier period of above-target inflation) whilst the press conference revealed ample uncertainty over the value of these forecasts, particularly as you move further into the future. Some of the key points made by Bullock included:

A 50bps hike to the cash rate was not discussed (which would have been indicative that they were indeed worried about runaway inflation and needed to deliver some proper medicine in a hurry)

She didn’t want to rule out or rule in future moves (suggesting ‘one and done’ is a potential outcome for the time being, depending on future economic prints)

She characterised this move from the RBA as ‘an adjustment’, rather than the beginning of a new rate hiking cycle, and that the Board would be watching subsequent housing credit growth data to see the impact of this (single) hike.

The overall takeaway was the RBA didn’t want to be viewed as condoning this level of CPI, particularly after their economic forecasts have been so wrong in 2H25. After the too-slow approach to rate hikes post-Covid ’19, one can understand the psychology behind such a decision.

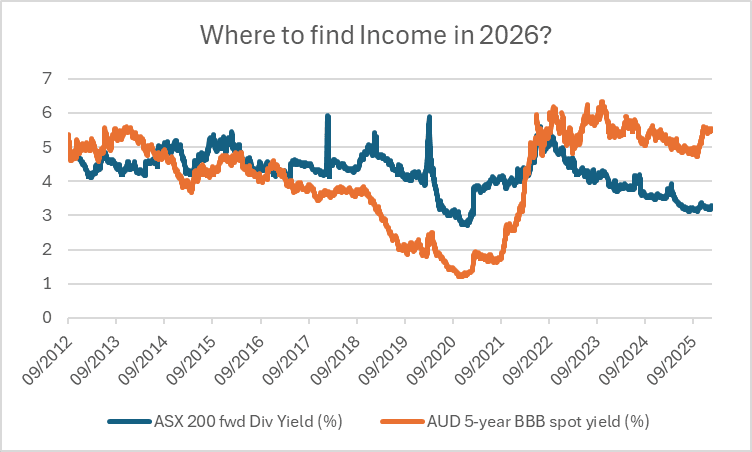

We think duration is generally unloved and offering some value at present, whilst we continue to respect the strong technical at play in credit markets. Risk assets (including credit) continue to be driven by animal spirits, however the foundations appear increasingly fragile: The K-shaped economy in the US, whereby high-income consumers are powering a greater share of economic growth and the extreme amount of margin debt funding equity holdings at present. In the meantime, Australian credit spreads offer a significant pickup to the forward dividend yield on the ASX 200 with the added bonus of downside protection via the embedded interest rate duration (i.e. the capacity for bond values to rise if yields fall):

Ultimately, we as portfolio managers can have a view and position around it but we need to be humble enough to acknowledge when we are wrong or when the backdrop moves away from our expectations, and then nimbly pivot towards the best risk-adjusted opportunities that present themselves. Easier said than done - of course - but a goal worth pursuing, particularly in a market that is facing a confluence of geopolitical, technological, environmental and demographic challenges.

Disclaimer: This article is prepared by Garreth Innes. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.