Super vs Non-Super: A Decision Tree for Asset Location

Sara Allen

Thu 5 Feb 2026 9 minutesThere are plenty of advantages to using superannuation to build wealth, such as the tax-advantaged environment, but that doesn’t always mean it should be your first port of investment call.

There are a range of factors you should consider before deciding to use superannuation for certain types of assets, or to transfer extra cash, an inheritance or savings.

Taking the time to answer these and think through your options will help you work out where is the right place to house your assets, in your superannuation or in an external investment structure.

To start with, you’ll want to consider the ‘What’ – what is the asset you are investing in and what might be restrictions around where you hold it, before you consider other factors like ‘When’ you might want to access the asset, or ‘Why and Where’ super or non-super might be best for the asset.

The ‘What’: Your Asset

Your superannuation has restrictions on the types of assets you can hold in it.

While you may have some more flexibility on asset options in a self-managed superannuation fund compared with a retail superannuation fund, any assets must be solely for providing retirement benefits rather than providing a present-day benefit to you.

Investments like direct equities, bonds and managed funds can be held in your superannuation.

Depending on the superannuation option you are invested in, you may be able to select which equities, bonds or managed funds you are invested in (ie purchase within the fund). Those using a self-managed superannuation fund (SMSF) may be able to transfer their externally purchased investments, including inherited direct shares, into the fund structure. This will depend on the Trust Deed for your SMSF.

Investments like property and collectibles are more complicated.

You cannot transfer these into a retail superannuation fund. When it comes to SMSFs, there are specific restrictions to meet. The asset must be for the sole purpose of providing retirement benefits, you must hold it/purchase it/sell it at arms’ length and the assets must be insured in the name of the SMSF.

What this means is that your primary residence cannot be transferred into your SMSF, unless you have moved out and rent it to tenants through a market agreement. Your holiday house also doesn’t meet these requirements.

On the other hand, you can have business or commercial premises in your SMSF – but you need to ensure your business pays your SMSF market-valued rent on those premises.

Personally owned collectibles like artworks, cars, antiques wine or jewellery also can’t be transferred into your SMSF unless you have arranged for these to be stored in professional facilities. It has been independently valued, and you have insurance on these. You cannot be using these or displaying these personally.

If you specifically want to own assets like property or collectibles as part of your SMSF for the diversification benefits they may offer, then take the time to understand what is allowable and the process for purchasing and managing these in your SMSF.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The ‘When’: How you might use or need the Asset

When you invest, you are hoping to improve your financial future – but that doesn’t necessarily mean you want to wait for retirement.

Consider, for instance, you have inherited cash. You want to invest it and the decision is whether to use superannuation or an investment vehicle outside of superannuation.

The questions you should consider are:

1. What is my specific goal for this money?

Do you want to use it for specific purchases now or in the future, like property, or do you need it to generate additional income for you, or are you comfortable with the money being invested specifically for retirement?

You may also want to consider whether you want to ‘split’ the money to serve dual goals or allow you an emergency fund buffer.

Knowing your goal is a good way to assess whether you invest in super or not.

Having a goal like property might still leave superannuation open as an option if you are planning to take advantage of the First Home Super Saver Scheme but remember you can only contribute up to $15,000 in any one financial year and up to a maximum of $50,000 across all years.

2. Is there a specific asset or use I intend for the inheritance?

If you plan to invest your inheritance in an asset like property or collectibles (and you have an SMSF), you’ll need to consider what these assets will be used for. If you place them in super, you cannot gain personal use out of them at the present time (unless as a business premise that you rent under a commercial arrangement from your SMSF). If you want to enjoy these assets after retirement, there are set criteria for transferring them out of superannuation to personally use them and it will count as a drawdown.

3. How quickly might I need to access this money?

If you think you might (or will) need access to the money before you retire, then superannuation is not the right place to move your investment. Once you invest in superannuation, you can only access your funds after reaching preservation age or under specific conditions, such as compassionate grounds or terminal illness.

Having a timeframe in mind will also help you determine what type of structure outside of superannuation will best suit you.

For example, if you want to access your money in a few years, you may be best considering ETFs or a high-interest rate savings account compared to, say, a fund with illiquid assets or a selection of higher risk assets.

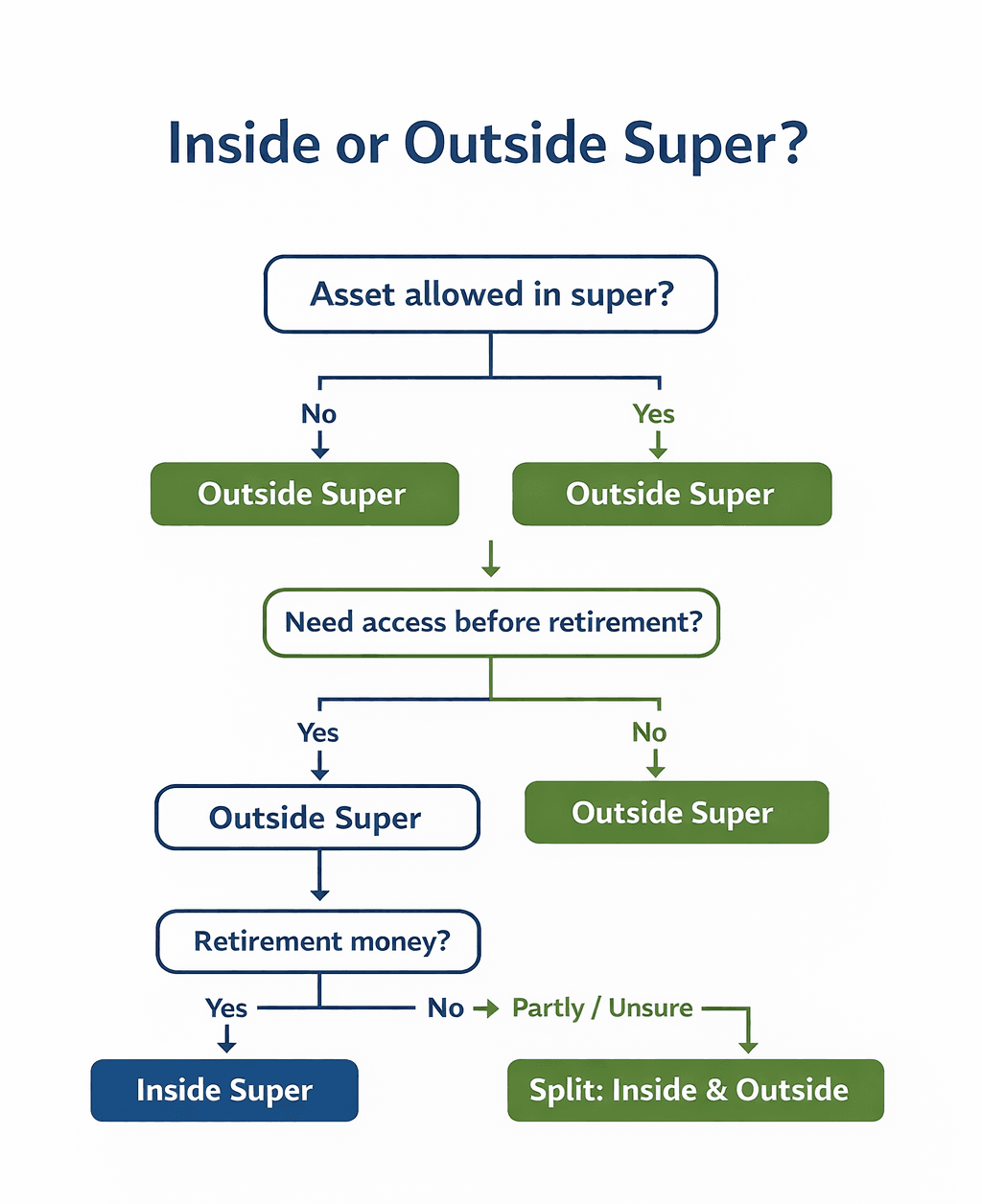

We can translate those factors into a decision tree as per below:

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

The ‘Why and Where’: Timing and Structure can change your decision

Assuming you might be happy to wait for retirement to access your investment, and your choice of asset is suited to your superannuation, the decision doesn’t necessarily stop there.

Some other things to think about are:

- Contributions Caps

There are restrictions on how much you can contribute to your superannuation each financial year on a before and after-tax basis, as well as based on your total superannuation balance. Knowing this may influence whether or not you invest via super or not. It can also affect how you invest if you do use super – you may need to split payments over a number of financial years.

You can contribute up to $30,000 in concessional (pre-tax) contributions, including Superannuation Guarantee, per financial year to your superannuation. And you may be able to carry forward concessional caps from previous years (noting lower caps in the past) under certain criteria. You can contribute up to $120,000 in non-concessional (after-tax) contributions to your superannuation noting that your total superannuation balance must be below $2 million. You may also be able to bring-forward up to $360,000 in non-concessional contributions under certain criteria.

Those aged 55 years and older may also be able to contribute up to $300,000 from the proceeds of the sale (or part sale) of their primary residence held for 10 or more years as a Downsizer Contribution.

- Your Age

If you are nearing retirement age, investing within super can be a deliberate strategy to support your retirement in a tax-advantaged environment. Being unable to access the funds is less an issue when you are reaching the point of being able to drawdown your fund, and super withdrawals have a tax-free status.

If you are younger with more time ahead, you’ll want to consider both flexibility and ability to access your funds when you need them, compared to the value of compounding returns within the superannuation environment over many years, alongside the tax environment superannuation operates in.

- Strategy Options

While those with an SMSF have more flexibility in their investment options, those in retail superannuation funds may see investment options they prefer that aren’t available in their superannuation fund (or they can’t nominate specific places to invest) and elect to invest this way instead.

- Lifestyle

Investing outside of superannuation might factor as a broader lifestyle choice. It might mean an emergency fund, or perhaps an additional income stream to supplement your chosen pre-retirement lifestyle (or fund big ticket costs, like school fees). It can also be a flexibility decision, meaning you can easily adjust your investment or sell it as you choose, an option that superannuation doesn’t provide.

Investing within super can also be a lifestyle choice. After all, superannuation offers a tax efficient environment with typically 15% tax due on contributions and earnings compared to your marginal tax rate (plus higher income earners may have an additional applicable tax).

Super vs Non-Super?

Taking the time to research and ask basic questions about your investments before choosing super or non-super structures can make a significant difference to your finances. Generally speaking, there are benefits to both super and non-super options but which one better suits you will depend on a range of circumstances.

Remember that your choice doesn’t need to be an ‘either or’ situation for certain types of assets – you can ‘split’ an inheritance, for example, or hold equities within and outside of superannuation for extra flexibility. Just make sure what you decide actually fits with your financial needs, goals and circumstances. As always, consider seeking expert advice to make sure you have the information you need at hand for your decision.

Disclaimer: This article is prepared by Sara Allen. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.