The Kind of Portfolio You Can Sleep Through a Market Crash With

Simon Turner

Sun 1 Feb 2026 7 minutesThere’s a particular kind of calm that comes from watching your portfolio during a violent market sell-off and feeling nothing. No urge to act. No creeping sense that something is broken. Just the knowledge that what you own was designed to survive moments like this.

That calm isn’t accidental. It’s engineered well in advance of extreme market events. It’s core to the sleep-well portfolio…

The Challenge is Close to Home

The pursuit of superior, all-weather investment returns usually begins with good intentions. But then complexity creeps in, conviction hardens, narratives replace structure. And somewhere along the way, portfolio fragility starts affecting sleep quality.

The irony is that the portfolios most conducive to long-term success are often the ones that seem boring.

Consider the simplest possible portfolio. Broad global equity exposure via a few best-in-class managed funds. A defensive allocation to high-quality bond ETFs. Periodic rebalancing. Minimal turnover. Low fees. This lazy structure has been quietly outperforming the majority of active approaches after costs for generations.

What is often missed is why these simple portfolios work.

It’s because simplicity removes the conditions under which investors tend to sabotage themselves. When there is nothing to tweak, nothing to trade, and nothing to explain to oneself, investors don’t have the opportunities to trip themselves up.

Behaviour rather than intelligence is what most reliably separates solid portfolios from fragile ones. The problem isn’t that most investors don’t know enough. It’s that they know too much, and apply it at exactly the wrong moments.

‘The greatest enemy of the equity investor is himself.’ ~ Jack Bogle, Vanguard’s founder

So simplicity is the goal.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Enter the Sleep-Well Portfolio

A portfolio genuinely designed to support sleeping well tends to share three underlying traits:

a) Its risks are visible rather than concealed inside complex structures;

b) Its sources of return are diversified across different economic conditions rather than clustered around a single narrative; and c) Its rules are decided in advance, when emotions are calm, rather than rewritten during moments of stress.Designing a sleep-well portfolio starts not with markets, but with investors.

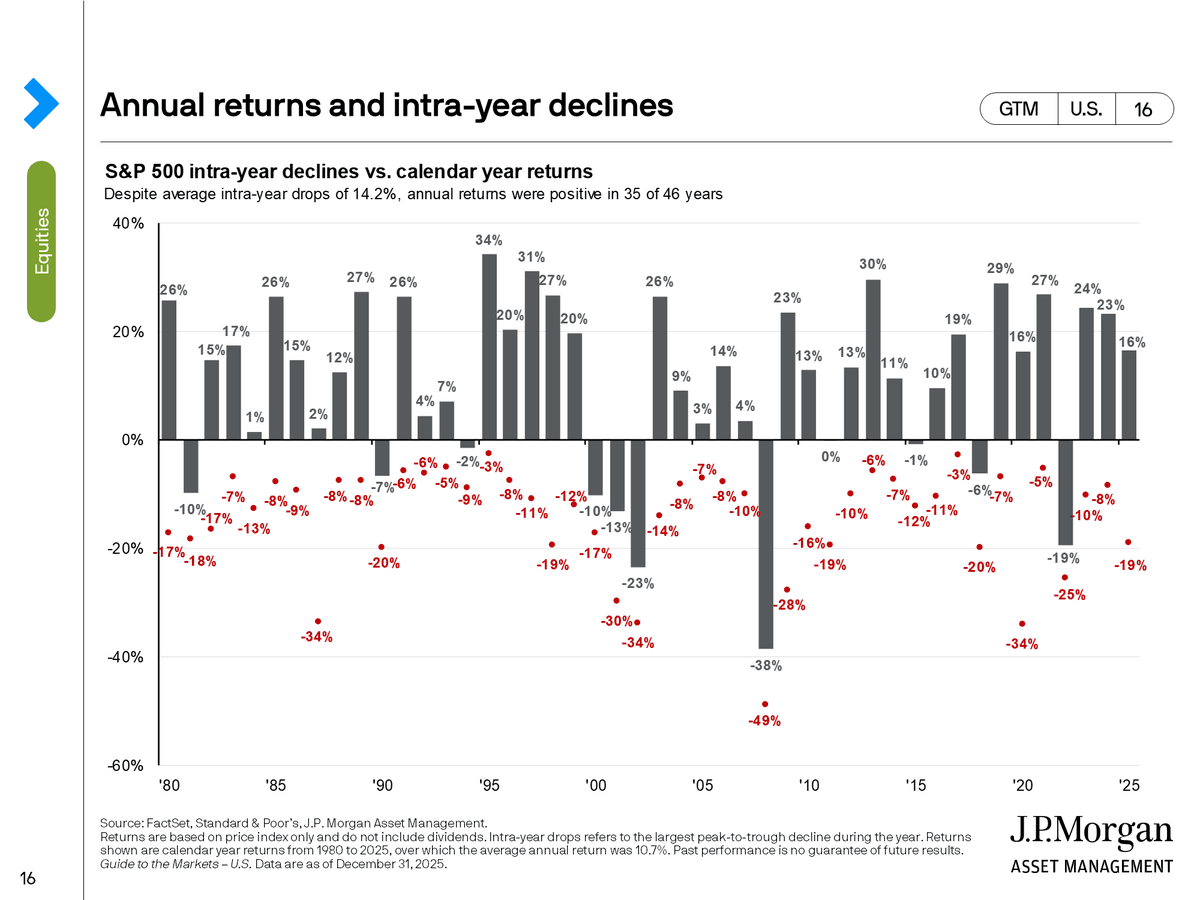

An investor’s time horizon and risk tolerance define how much volatility they can endure without feeling compelled to act. Numerous studies show that investors overestimate their tolerance for drawdowns when markets are rising and underestimate how uncomfortable losses feel in real time. Remember: volatility is a normal part of the investment journey.

On that note, check out the S&P 500 intra-year decline data below.

Once a realistic asset allocation plan is established, diversification becomes the central design challenge. Effective diversification enables investors to build resilient portfolios with enhanced risk-adjusted returns.

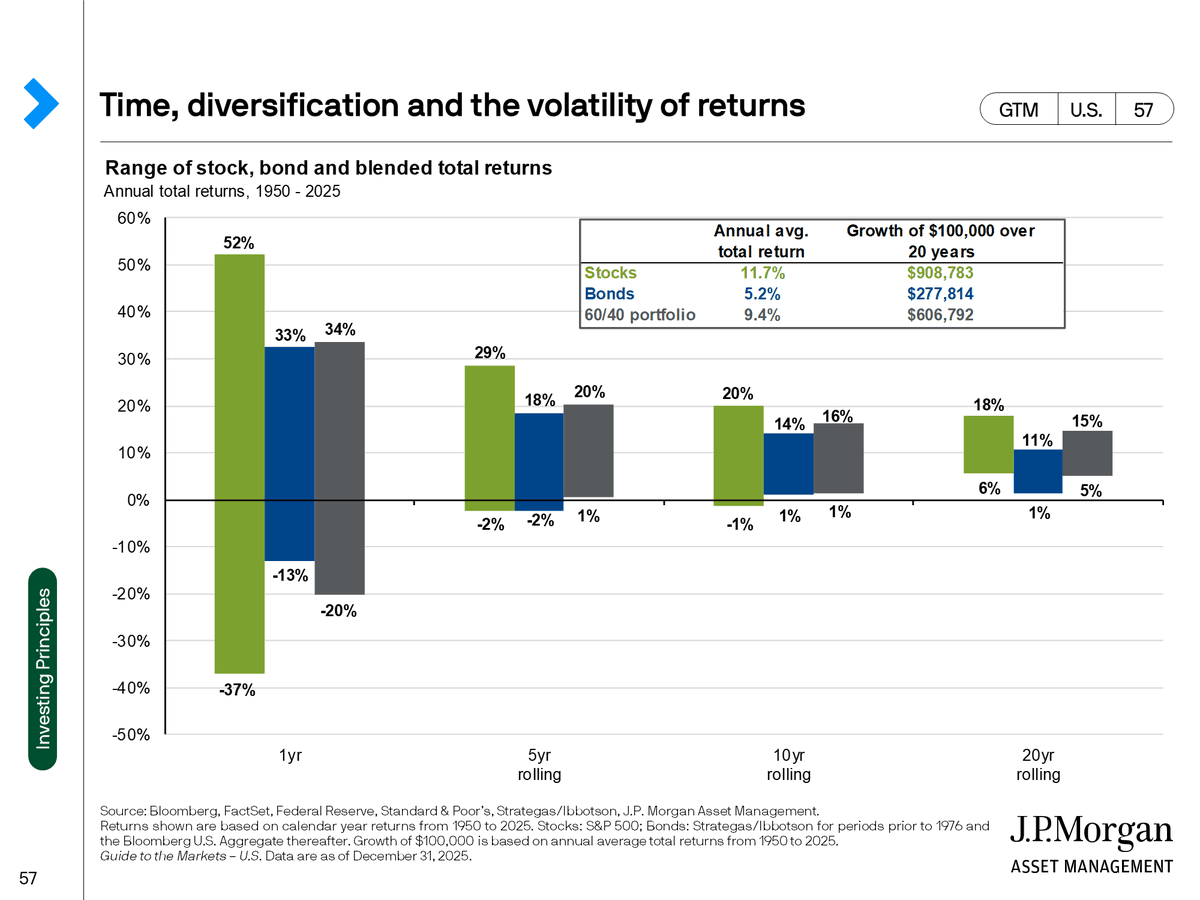

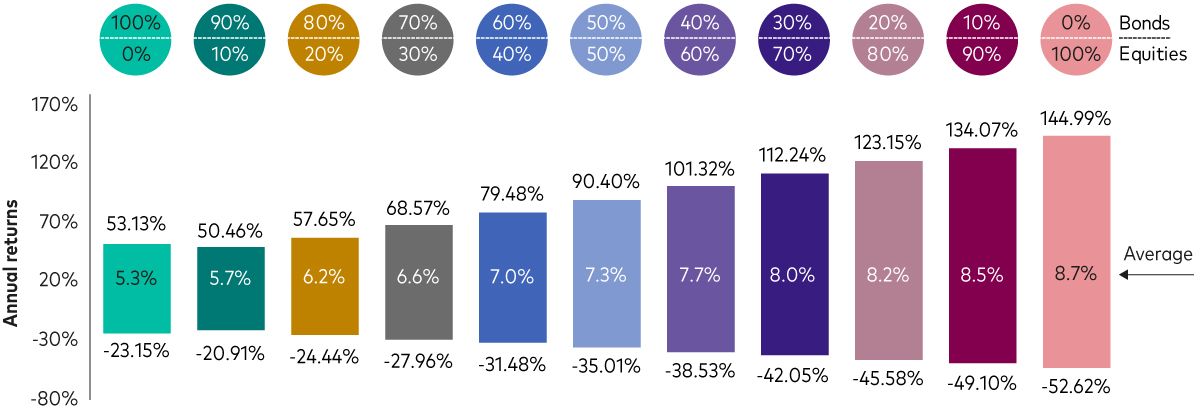

As shown below, the range of returns on the simple 60/40 portfolio has always been positive over rolling five-, ten- and twenty-year periods.

So diversification is effectively insurance against not being able to predict the future (and no one can).

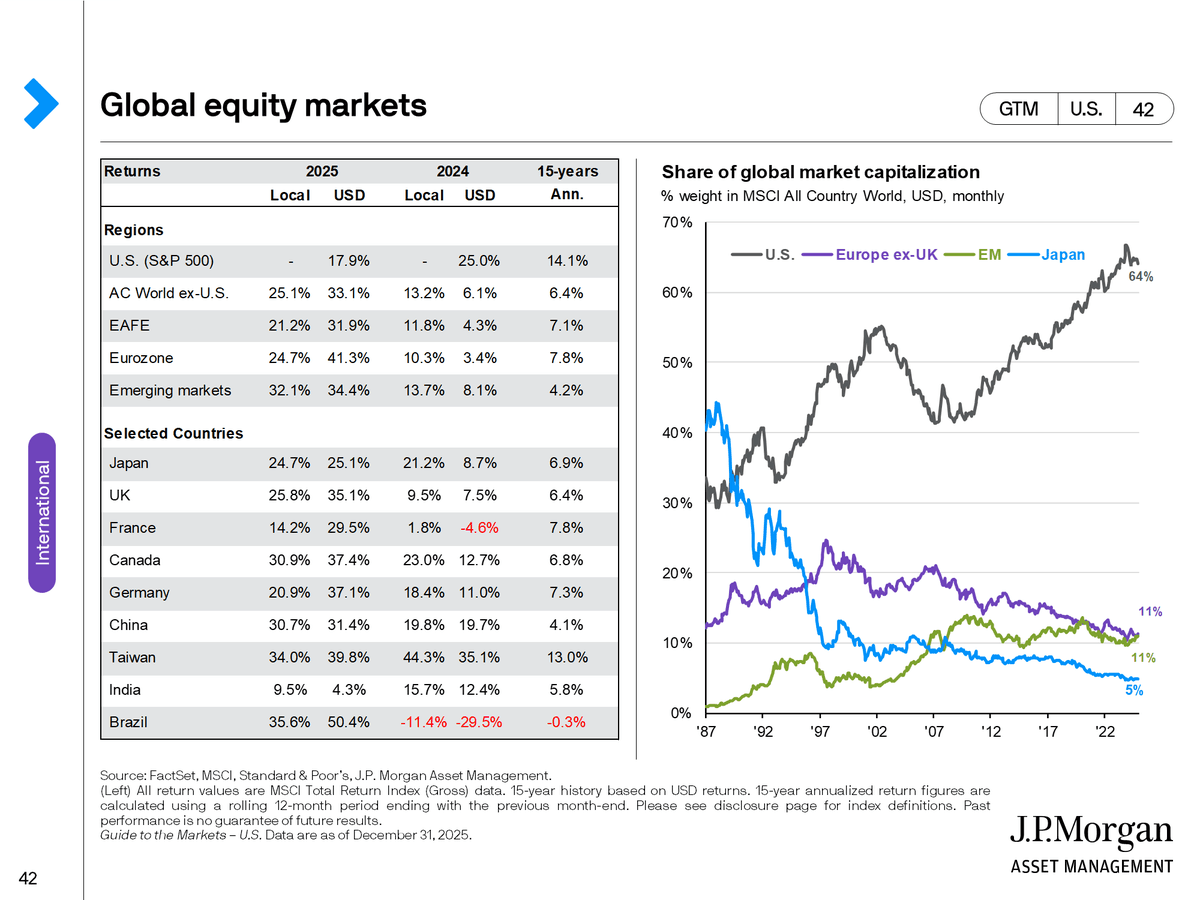

Many investors assume that holding a single global equity ETF delivers broad diversification benefits. These days, that’s questionable. U.S. equities now represent a massive 64% of global market cap, with an unusually large share of that exposure concentrated in the Magnificent Seven.

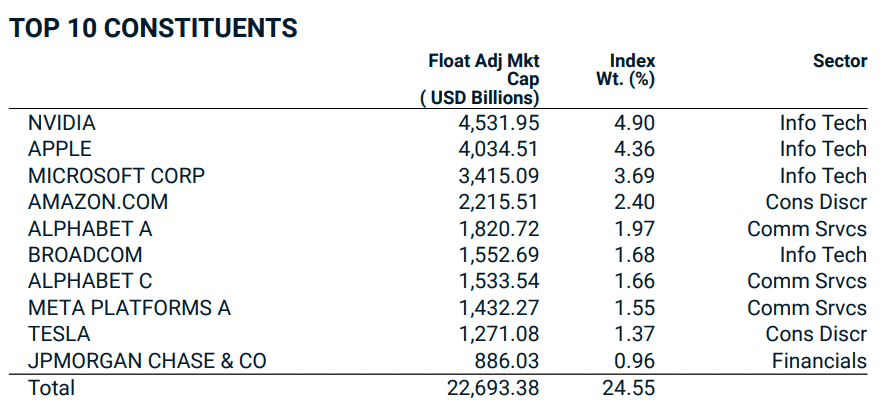

The top ten constituents of the MSCI World Index illustrate this point. They’re all American companies and account for a quarter of the index’s total weight.

This is concentration disguised as breadth. And it means that many portfolios which appear diversified on paper are, in fact, highly sensitive to a narrow set of outcomes, particularly the continuation of strong U.S. economic growth, the success of big tech’s capex gamble on AI, and favourable S&P 500 sentiment.

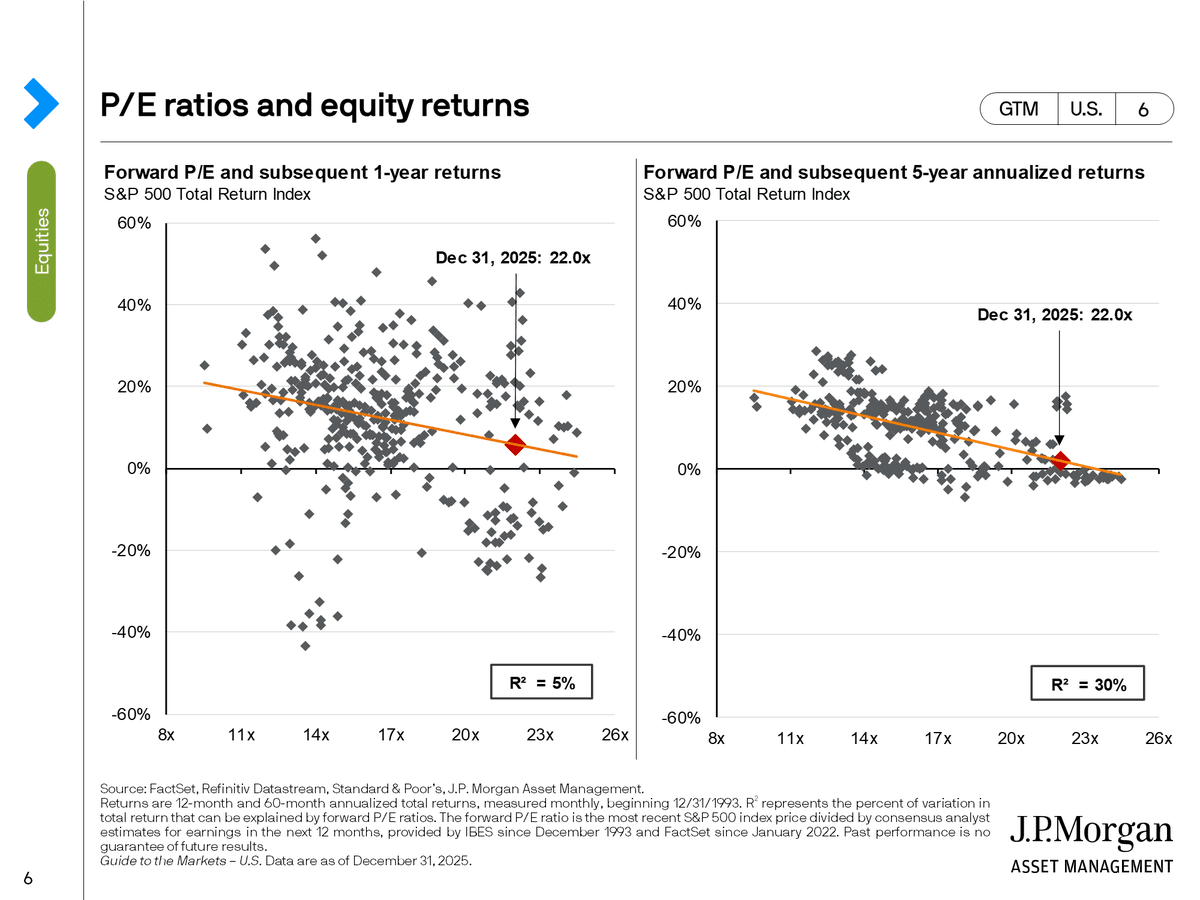

U.S. valuations alone should give investors pause for thought about this. The historical data shows at the market’s current P/E of 22x, the following five-year returns have been 0% or less.

A portfolio designed for sleep doesn’t ignore this reality. It addresses it structurally. By separating U.S. equities from other global markets, and treating emerging markets as a distinct return driver, investors are better able to diversify across different economic environments, inflation backdrops, and policy regimes. This helps avoid betting implicitly on a single outcome, and improves a portfolio’s longer term resilience.

The goal of the sleep-well strategy isn’t to maximise returns during the best years. It’s to remain invested and sleeping well through the worst ones.

The same principles apply beyond equities.

Bonds exist in a portfolio to provide stability when risk assets falter. Yet many investors undermine this role by reaching for yield through lower-quality credit or by shortening duration when inflation fears dominate headlines. However, historical evidence suggests this is precisely when bonds are most valuable as insurance.

During major equity drawdowns over the past four decades, high-quality government bonds have repeatedly delivered powerful diversification benefits, while sacrificing surprisingly little in long-term returns.

Some investors may also want to include defensive assets such as inflation-linked bonds, gold, or real assets in their sleep-well portfolios. Their role is to protect against adverse outcomes such as unexpected inflation, currency debasement, or financial stress.

Gold, for example, has historically exhibited low long-term correlation with equities and bonds, particularly during periods of monetary instability.

The key is intentionality. Every asset in a sleep-well portfolio earns its place by contributing to diversification across economic outcomes, not by chasing recent performance.

In Ray Dalio’s words, ‘If you don’t own assets that do well in all environments, you don’t know what you’re missing.’

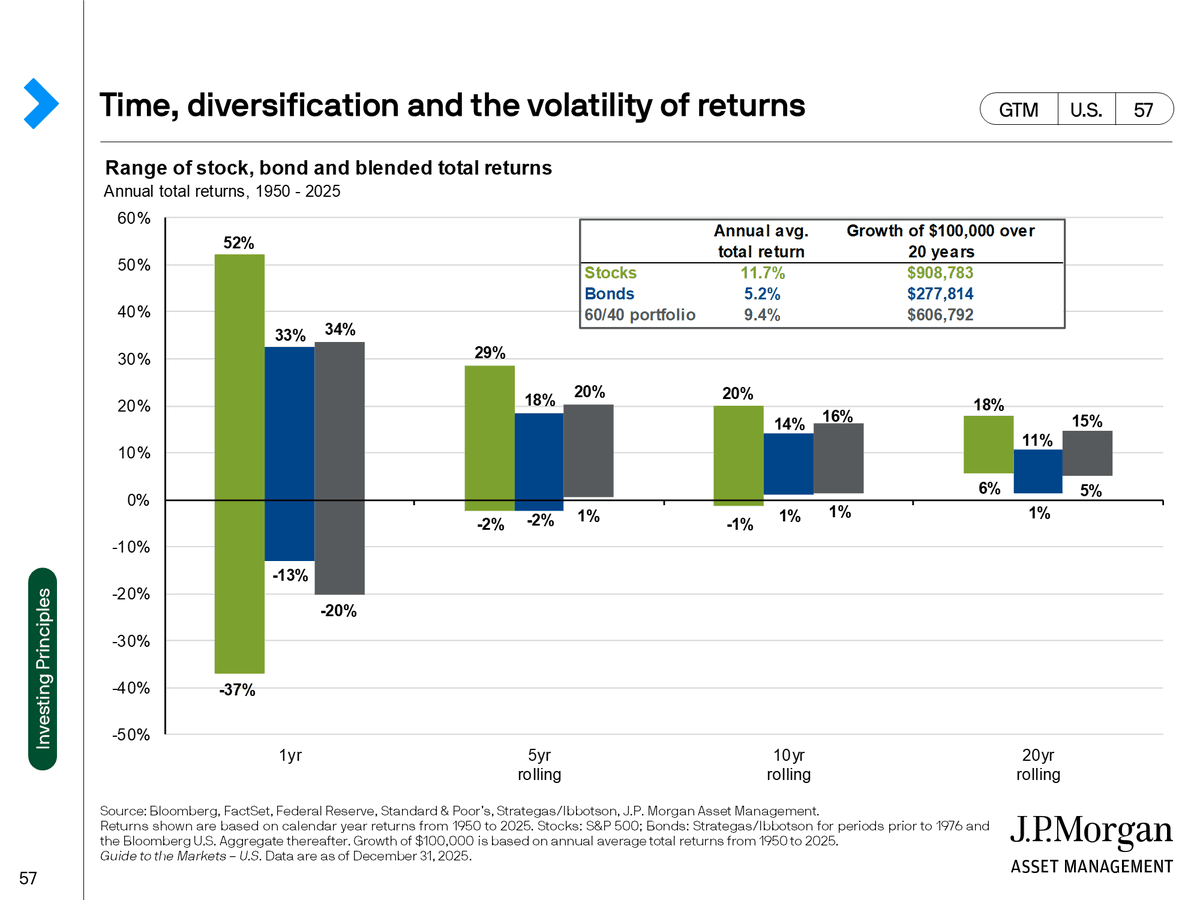

Time in the market is also important. The longer you invest, the higher the probability of earning positive returns, as shown below.

It’s fair to say that a long-term time horizon (and a strategy you can stick with) is an investing cheat code.

Currency Matters

Don’t forget currency. Intentional management of currency exposure is a core element of a robust portfolio.

In short, if you believe the Australian dollar is likely to outperform the foreign currency in which you’re investing, it’s time to hedge. Equally, if you believe the Australian dollar is more likely to be the underperformer, remaining unhedged may make more sense.

What matters most is avoiding accidental exposure to one currency, like the U.S. dollar for example. A portfolio that’s implicitly long a single foreign currency because of structural choices isn’t diversified. It’s simply exposed.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Fees Matter

A sleep-well portfolio is also focused on keeping fees low.

Fees aren’t just a drag on returns. They increase the psychological pressure to act. When investors pay high fees for disappointing performance, they look for solutions. Low-cost portfolios remove that pressure entirely. There’s nothing to justify, and no one to fire.

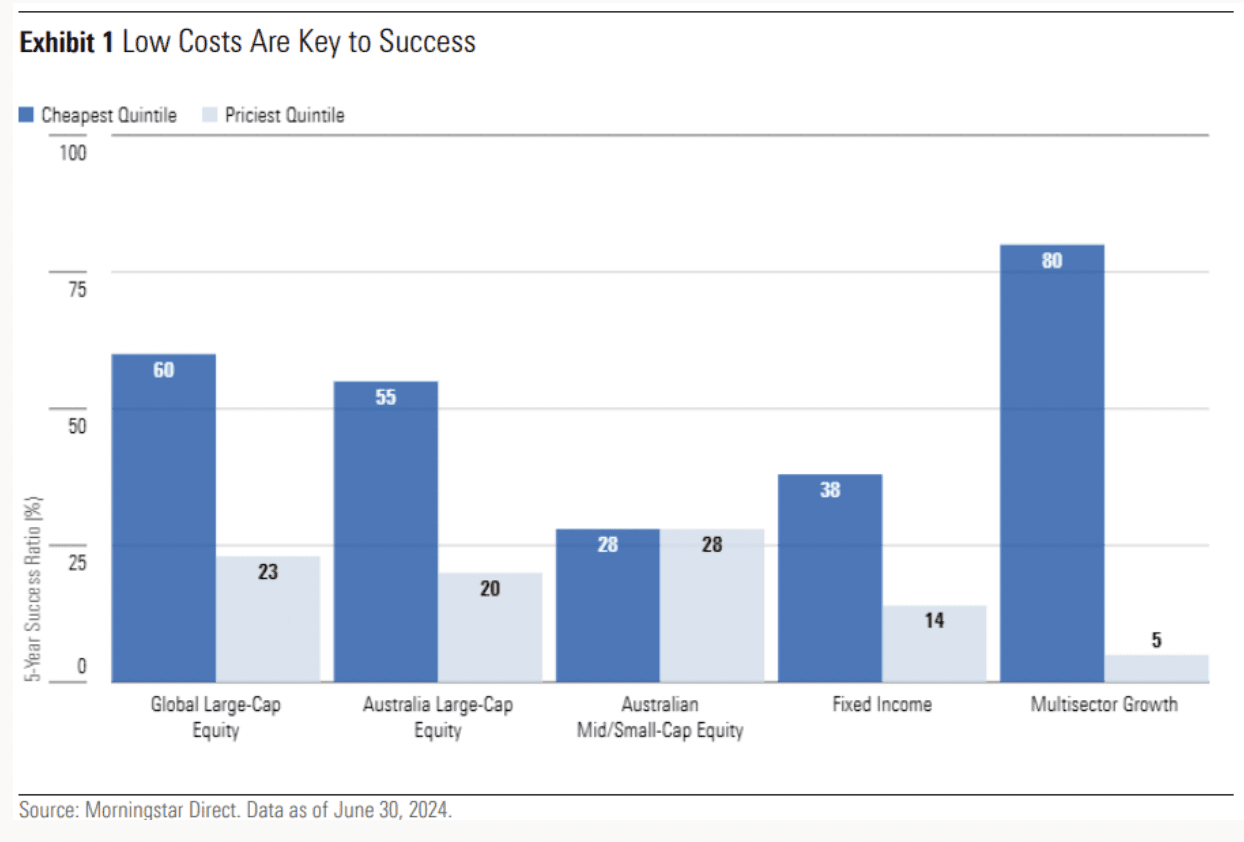

To that point, Morningstar’s research consistently shows that fees are one of the strongest predictors of future fund performance, with lower-cost funds more likely to outperform.

Remember to Rebalance

Perhaps the most underestimated element of the sleep-well portfolio is periodic rebalancing.

Rebalancing feels mechanical, but its effect is profoundly behavioural. It forces investors to sell what has gone up and buy what has gone down, without thinking too much about it.

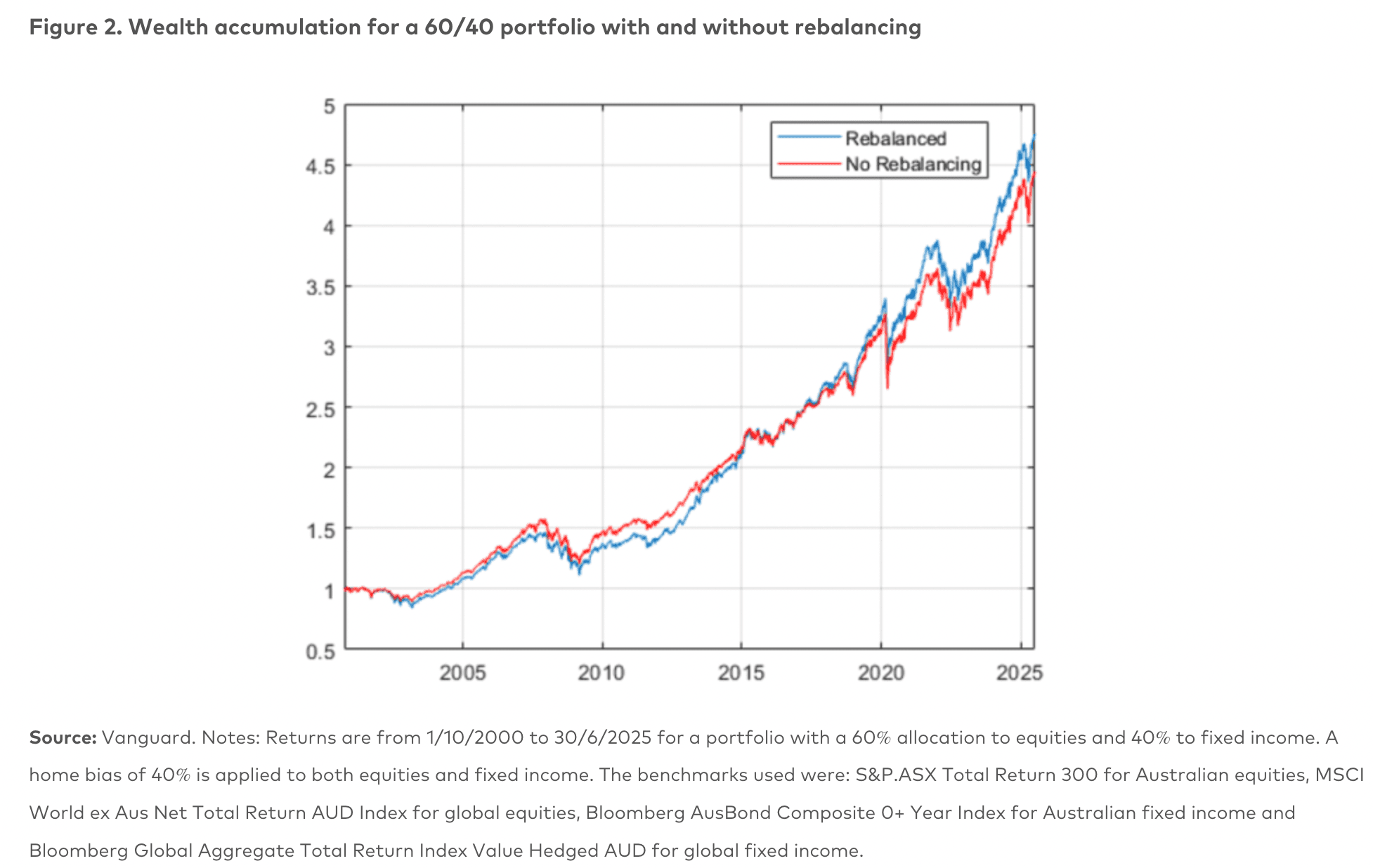

Vanguard’s analysis shows that disciplined rebalancing can add 0.3% p.a. in risk-adjusted returns over time. Not through brilliance, but through consistency.

An annual rebalance is enough for most sleep-focused portfolios.

Stand Back & Let Your Portfolio Thrive

None of this is particularly exciting. That’s the point. A sleep-well portfolio doesn’t rely on being exactly right about the next twelve months. It relies on being reasonably aligned with the next twenty years.

Patience is an essential input into and outcome of this strategy. After all, when a portfolio itself does most of the work, investors are free to step aside and relax while it compounds quietly in the background. For most investors, that may be the most compelling return of all.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.