Inside the Global Liquidity Machine: Why Money Supply Keeps Expanding

Simon Turner

Mon 2 Feb 2026 7 minutesYou may have heard the term ‘rising money supply’ being bandied around as a key driver of global markets of late. It’s no exaggeration. If anything, most investors aren’t as aware of this market driver as they should be.

When global money supply is rising fast, as it has been in recent years, asset prices tend to levitate in ways that confuse investors who are only watching fundamental factors such as earnings, GDP, or valuation ratios.

Rising money supply is effectively a global wall of money that makes bank and market financing easier, while forcing cash further up the risk curve into anything which offers a plausible return.

What is Money Supply?

First, a brief definition of money supply.

Global money supply is the total stock of liquid monetary assets worldwide, including physical currency, bank deposits, and near-money instruments, issued by central banks and commercial banks.

It represents the purchasing power available across the global economy for transactions, savings, and financial investment.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

How Does Money Supply Rise or Fall?

Global money supply expands or contracts primarily through central bank policy and banking system behaviour. It increases when central banks lower interest rates, conduct asset purchases, or provide liquidity, encouraging banks to create more credit. Governments can also boost it through deficit spending financed by borrowing.

Conversely, money supply tightens when rates rise, balance sheets shrink, or lending standards tighten. Central banks reduce liquidity to contain inflation, cool asset bubbles, or stabilise currencies.

In short, money supply changes often reflect central banks attempts to balance growth, achieve price and financial stability, and improve confidence across interconnected global markets.

Clearing Up a Common Misconception

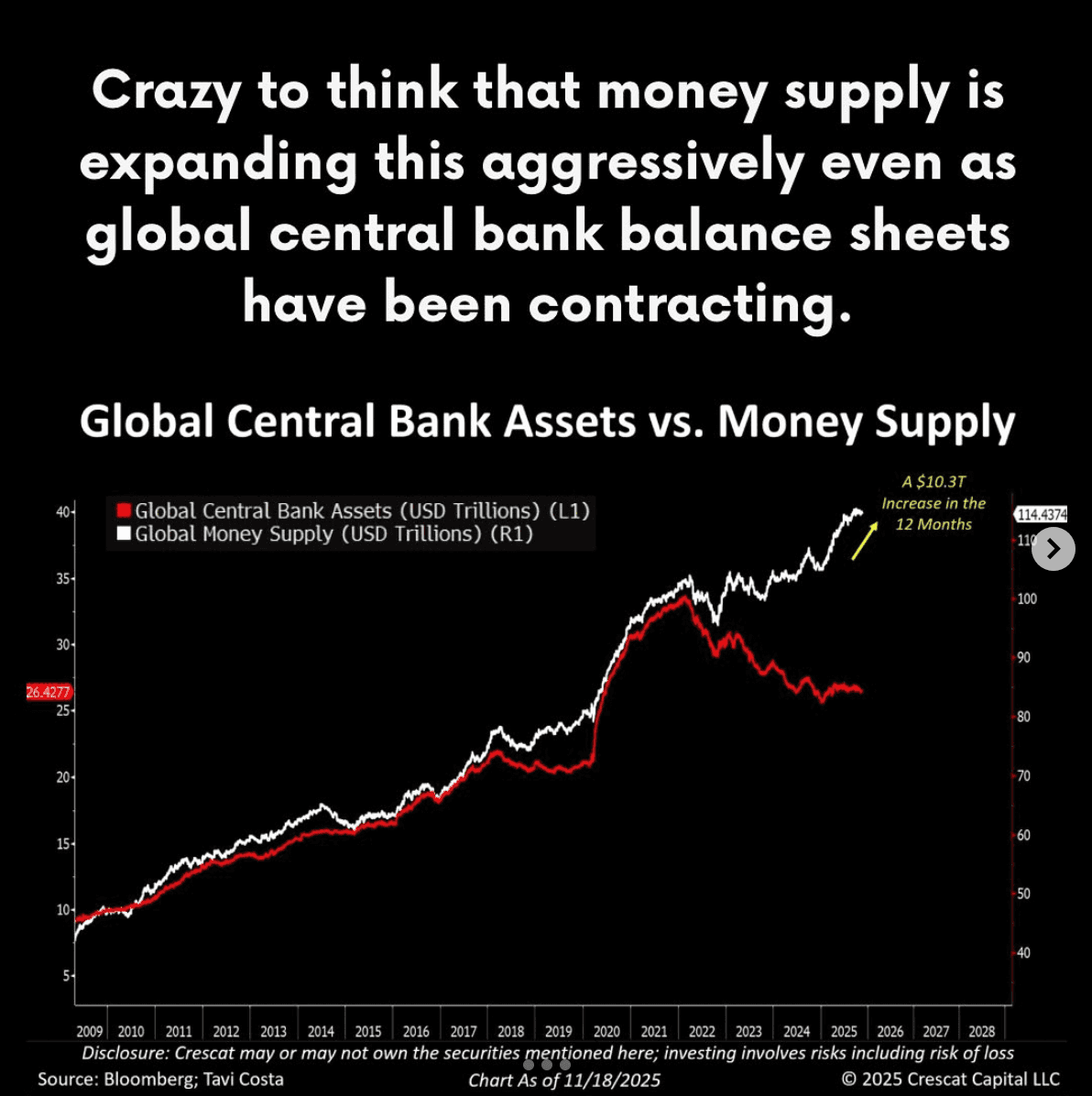

To clear up is a common misconception, central banks can shrink their balance sheets while global money supply is still rising. They’re related, but not identical, forces.

Fed Chair Powell, for example, has highlight that since June 2022 the Fed has reduced its balance sheet by $US2.2 trillion, falling from 35% of nominal GDP to under 22%, while still maintaining rate control. That’s quantitative tightening. Yet broad U.S. money supply has expanded at the same time because commercial bank lending has grown, while the U.S. government is running large deficits financed through the banking system and bond markets.

Reflecting this trend globally, global money supply has been rising while central bank assets have been falling, as shown below.

The key takeaway is that money supply matters more to investors than central bank assets, although central banks are often the main players who raise money supply (e.g. after the pandemic).

Money Supply is Rising All Around the World

So what are the trends at play across the major currency blocs that dominate global liquidity?

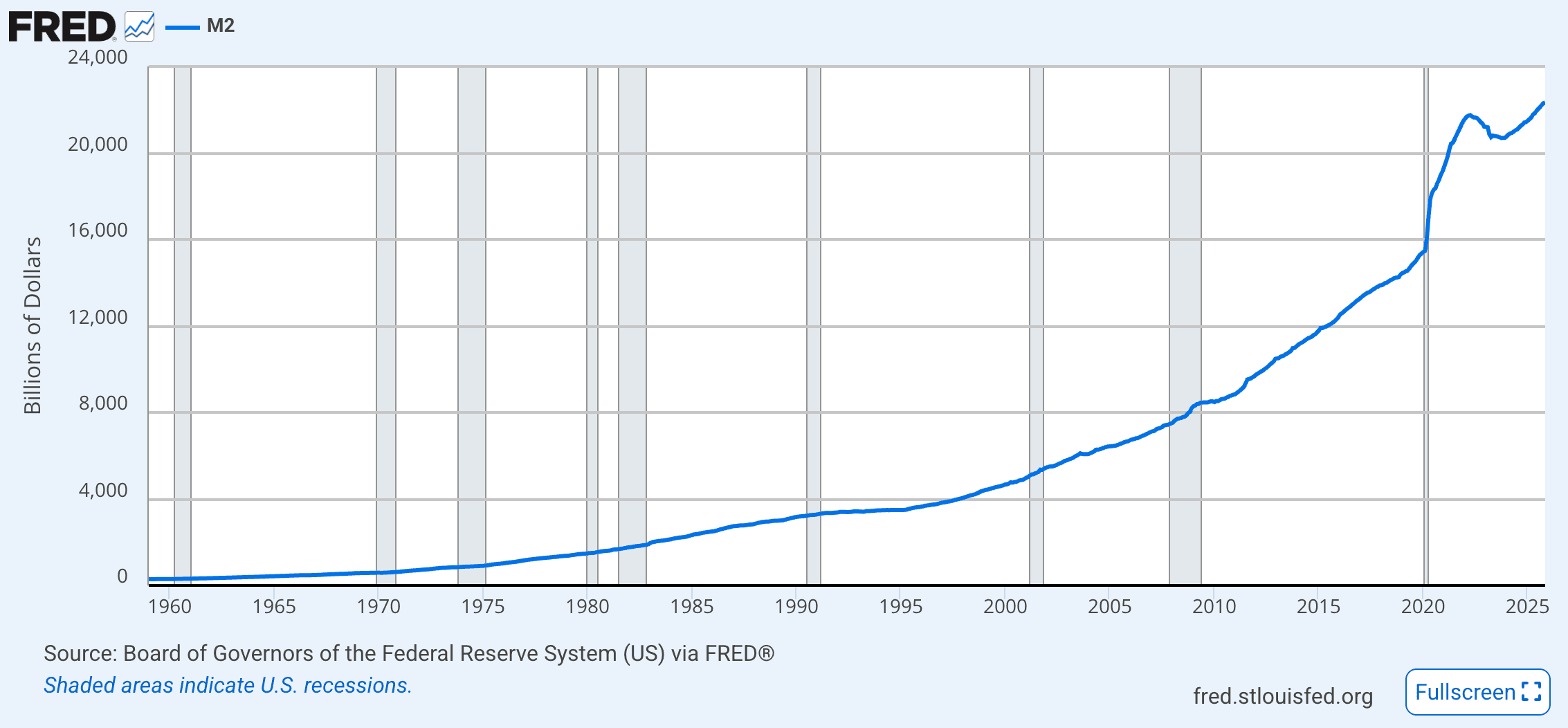

In the U.S., M2, a broad, essential measure of money supply, has been rising strongly since the pandemic, including the start of 2026. Late 2025 data showed it grew at 4.2% p.a. last year.

In the euro area, the ECB reported at end of 2025 that the annual growth rate of M3, the broadest measure of money supply, grew at 3.2% p.a.

In China, the People’s Bank of China reported M2 growth of 8.5% p.a. over the past year.

In Japan, the Bank of Japan reported M2 grew at 1.7% p.a. in 2025.

So the world’s biggest monetary engines are, on balance, expanding.

Why is Global Money Supply Rising?

Of course, the next question is why is global money supply rising like this?

There are two main reasons:

1. Policy Pragmatism.

After the pandemic-induced inflation shock, central banks tightened aggressively, but since then they’ve become more sensitive to financial stability and funding-market functioning.

So even when central banks shrink their balance sheets, the pace of change is being carefully managed with regular pauses.

On that note, Powell’s press conference in late 2025 signalled the Fed would hold the size of its balance sheet steady for a period. This wasn’t a return to emergency stimulus, but a reminder that the financial system is being engineered to avoid liquidity accidents.

2. Fiscal Gravity.

Large structural deficits in major developed economies like the U.S. is ensuring a steady flow of government bonds keeps hitting the market.

When domestic banks, pension funds, insurers, and global investors absorb that government bond issuance while credit creation continues, the broad money supply aggregates keep climbing even as central banks step back.

So in effect, the system is substituting private balance sheets for public ones, rather than the system being meaningfully deleveraged. That’s important to remember from a market risk perspective. Risk isn’t being reduced, just redistributed.

What Does the Ever Rising Wall of Money Mean Markets?

It may sound like rising money supply is an abstract force, but it has real world implications for global investment markets that all investors should be aware of:

1. Reduces the Scarcity Value of Cash.

When deposits and short-term instruments are plentiful, the marginal investor becomes more willing to accept duration risk, equity risk, and credit risk. You see it in the behaviour of spreads and in the market’s tolerance for narrative-driven assets.

The IMF’s Global Financial Stability Report captured this dynamic in 2025, noting that after a brief tightening, global financial conditions eased back to accommodative levels and asset prices rebounded strongly.

Of course, rising liquidity doesn’t guarantee positive market returns, but it provides valuable context regarding the starting conditions.

2. Supports Higher Equity Valuations.

When money supply keeps rising like this, investors often pay up for longer term cash flows.

The point isn’t that liquidity makes all equities cheap. It’s that liquidity can support risk assets valuations for longer than most value investors expect.

This is a compelling argument in favour of investing long-term in best-in-class, diversified global funds and ETFs, positioned to benefit from a risk-on environment.

3. Leads to a Repricing of Inflation Hedges & Real Assets.

Rising global money supply doesn’t automatically cause inflation, because velocity and supply constraints matter, but it does raise the value of real assets that protect purchasing power as and when inflation surprises reappear.

This is an argument in favour of investing in inflation-linked bonds, which benefit from higher inflation, and gold, which tends to behave like an insurance asset when confidence in policy and fiat purchasing power wobbles (like now).

4. Changes the Opportunity Cost of Patience.

When cash yields are attractive, investors feel less pressure to reach up the risk curve for returns.

However, when liquidity is expanding and markets are bidding up risk assets, the emotional pressure flips.

At times like this, investors’ edge often comes from having a pre-committed plan for their dry powder and rebalancing. It’s a way of staying on track when the crowd is chasing the narrative-driven momentum.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Use an Awareness of Global Money Supply to Your Advantage

When American, European, and Chinese money supply are all rising, like they are now, you should expect the liquidity tailwind to continue, which translates into a higher penalty for sitting in cash.

Against this backdrop, the optimal strategy, depending on your investment plan, may be to invest in a number of core global funds and ETFs, inflation protection via inflation-linked bond funds, and insurance assets such as gold ETFs, while maintaining a disciplined cash weighting so you can rebalance rather than chase opportunities.

Liquidity isn’t everything, but it’s an important market driver worth being aware of.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.