Ten Investment Mistakes Your Future Self Wishes You’d Avoid

Simon Turner

Tue 27 Jan 2026 7 minutesThe most expensive investment mistakes rarely stem from ignorance. They tend to arise from behavioural biases, poorly governed decision-making, and incentives that distort investors’ judgement over time. History shows that even professional investors, armed with the best data, experience, and market access, repeatedly make the same predictable errors.

With a view to avoiding those mistakes to the benefit of your future self, here’s a checklist of the most common ways intelligent people lose money in financial markets...

1. Chasing Past Performance Instead of Understanding Cycles

The temptation to allocate more capital to recent winners is one of the most common mistakes investors make. It’s easy to understand why. Performance attracts flows, flows reinforce narratives, and narratives create social proof.

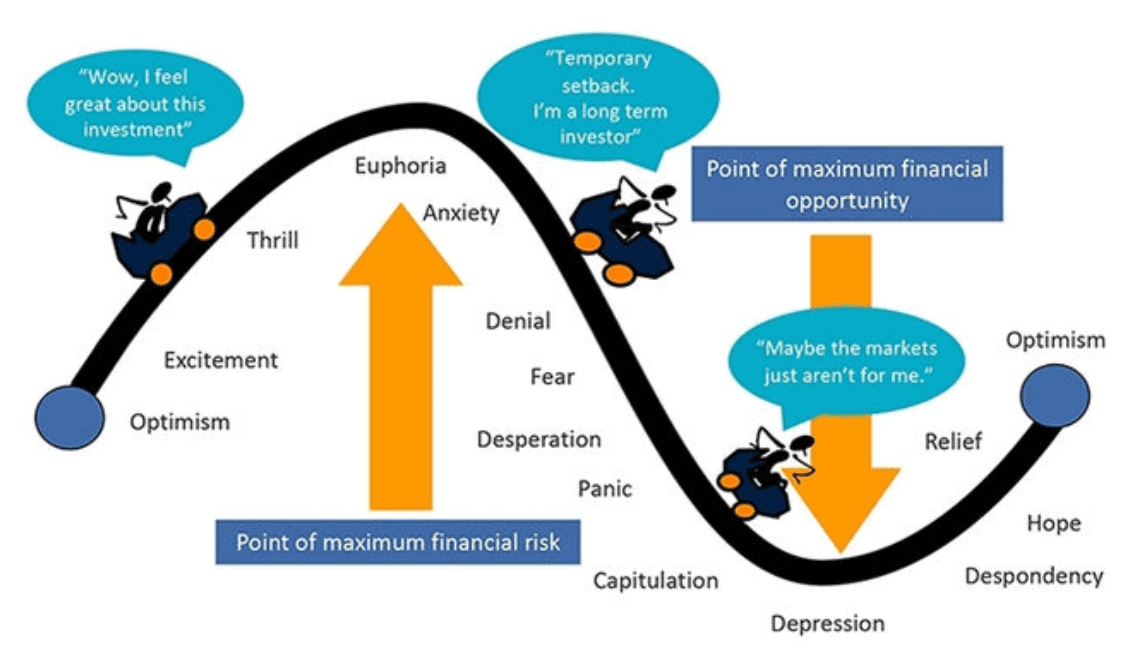

We’ve all ridden the dangerous rollercoaster of emotions below to our detriment.

Seasoned investors know markets are cyclical by nature, and excess returns tend to mean-revert precisely when investors’ conviction is highest. The upshot is that investors who anchor their decisions to recent returns are effectively driving using a rear-view mirror, which guides them to buy just before hot assets begin underperforming.

Let the cycle work for you rather than against you.

2. Confusing Market Timing with Risk Management

The media is full of voices proclaiming they’re experts at timing the market. The problem with trying to do this isn’t just that it’s almost impossible, but how investors often react when they inevitably fail.

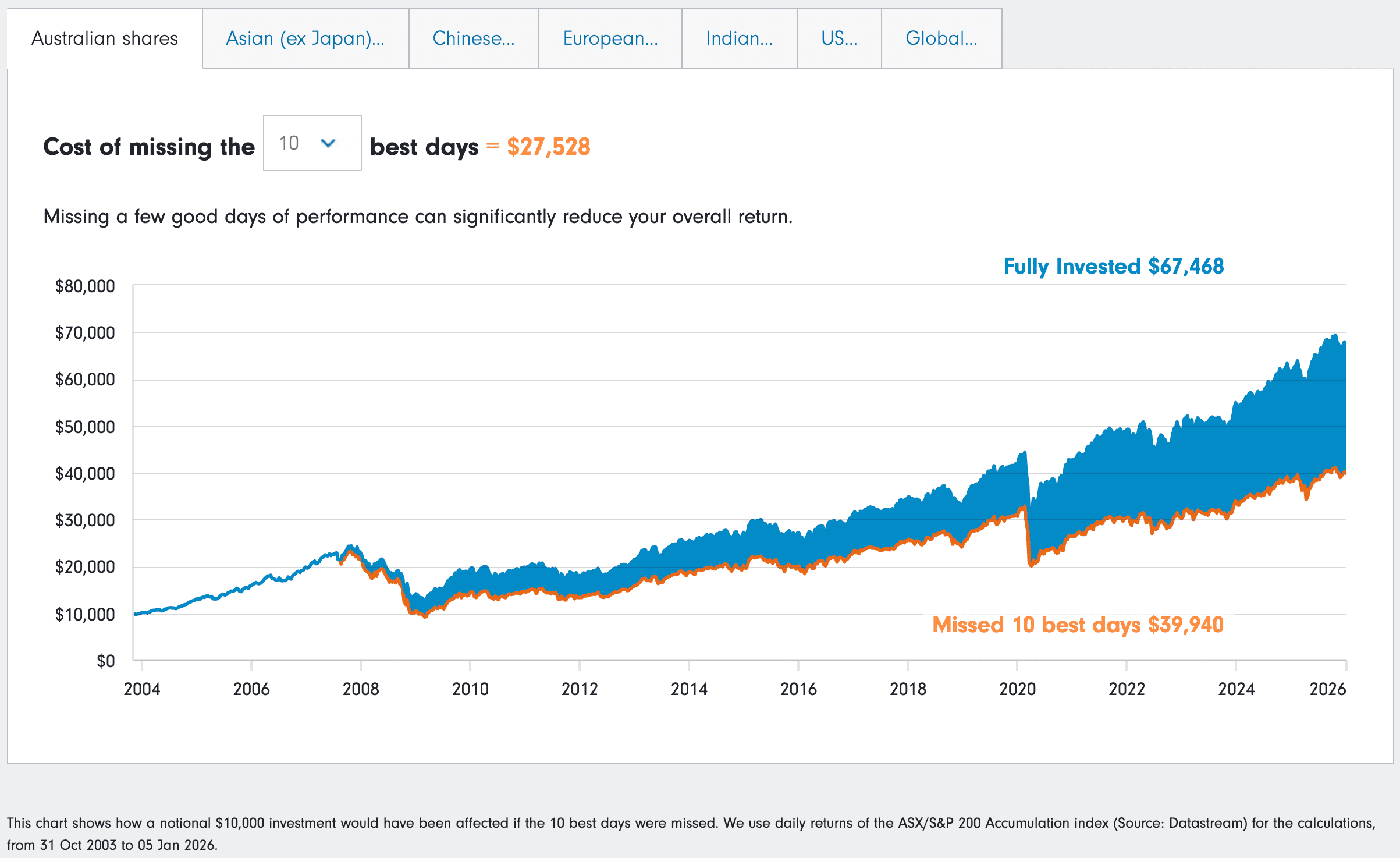

The largest market rebounds typically occur during periods of maximum uncertainty, when most investors are least willing to be exposed. So investors who mistime the market often miss out on those rebounds to the detriment of their long-term performance.

Check out how costly missing the best ten days of market performance is over twenty years:

It’s no understatement that missing a few of the market’s strongest days can permanently impair the benefits of long-term compounding. The important takeaway is that staying invested is an active decision to accept uncertainty in exchange for participating in the market’s upside.

3. Underestimating the Long-Term Drag of Fees

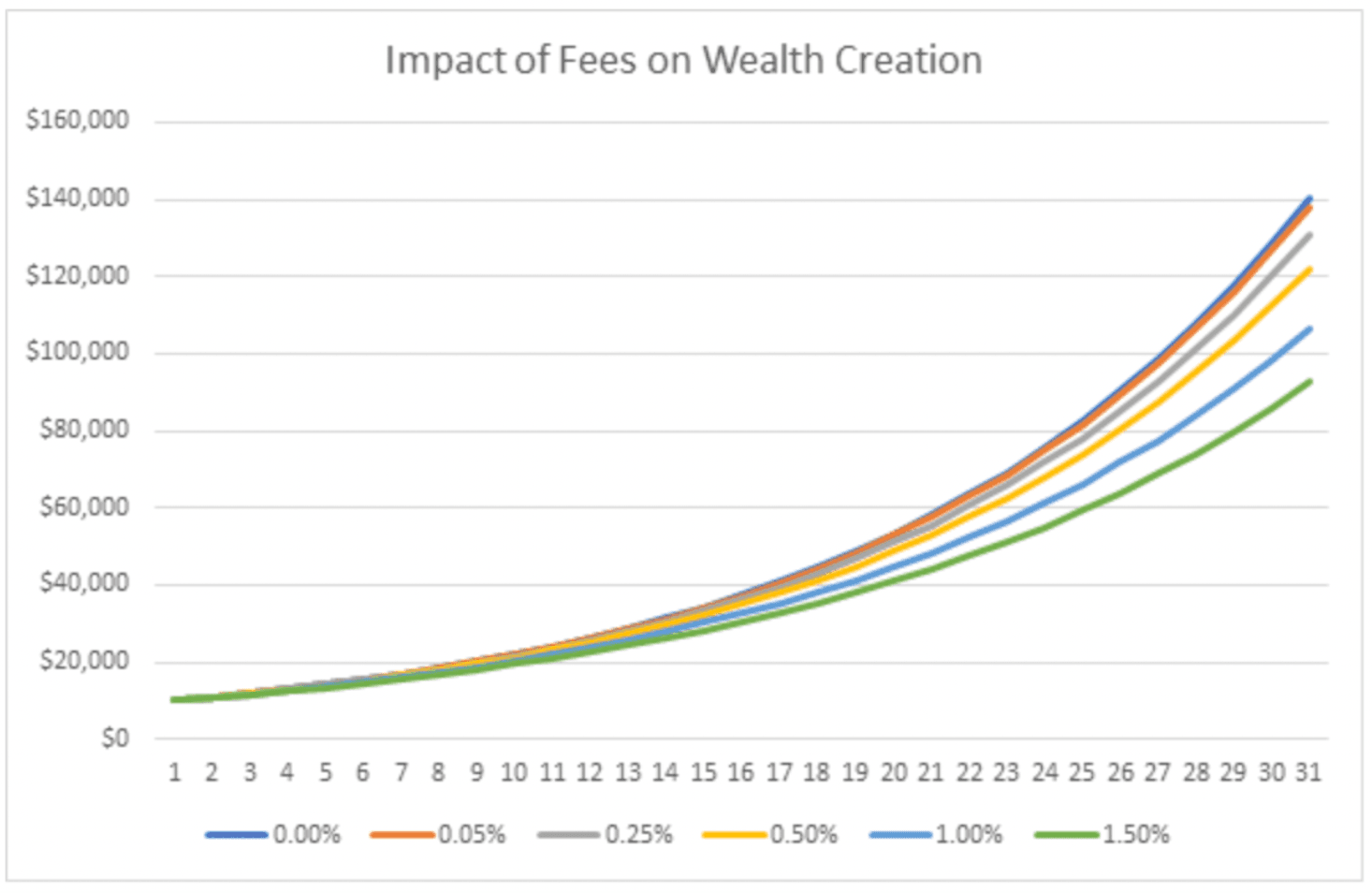

Fees are among the few variables investors can control, yet they remain chronically underestimated.

A seemingly modest difference in annual costs compounds into a substantial transfer of wealth over decades.

The impact of fees is most damaging in low-return environments, precisely when investors can least afford it.

The good news is there are now plenty of low-cost ETFs available, as well as managed funds charging competitive fees. Make sure you focus on fees during your fund and ETF search.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

4. Mistaking Concentration for Conviction

Concentration often feels like investors are expressing their confidence, but it can also represent a failure of imagination.

Australian investors are especially prone to this challenge, with most portfolios heavily skewed toward the domestic resources and banking sectors.

The issue is that investors underestimate the benefits of diversification, in particular the reduction in their portfolios’ likely exposure to large losses. For many, this only becomes apparent in the midst of a major drawdown.

Diversification isn’t just about owning more assets. It’s about reducing your exposure to the same underlying economic drivers. True diversification protects investors’ portfolios from macro and market shifts, not just volatility.

5. Allowing Emotion to Override Process

One of the hardest mistakes to overcome is preventing your emotions from driving your investment decisions.

This issue affects all of us as markets invariably provoke intense emotional responses from investors. Fear surges during selloffs and euphoria arises during rallies. These are structural features of investing, and they lead to investors being more comfortable buying risk when it feels safe and abandoning it when it’s most attractively priced.

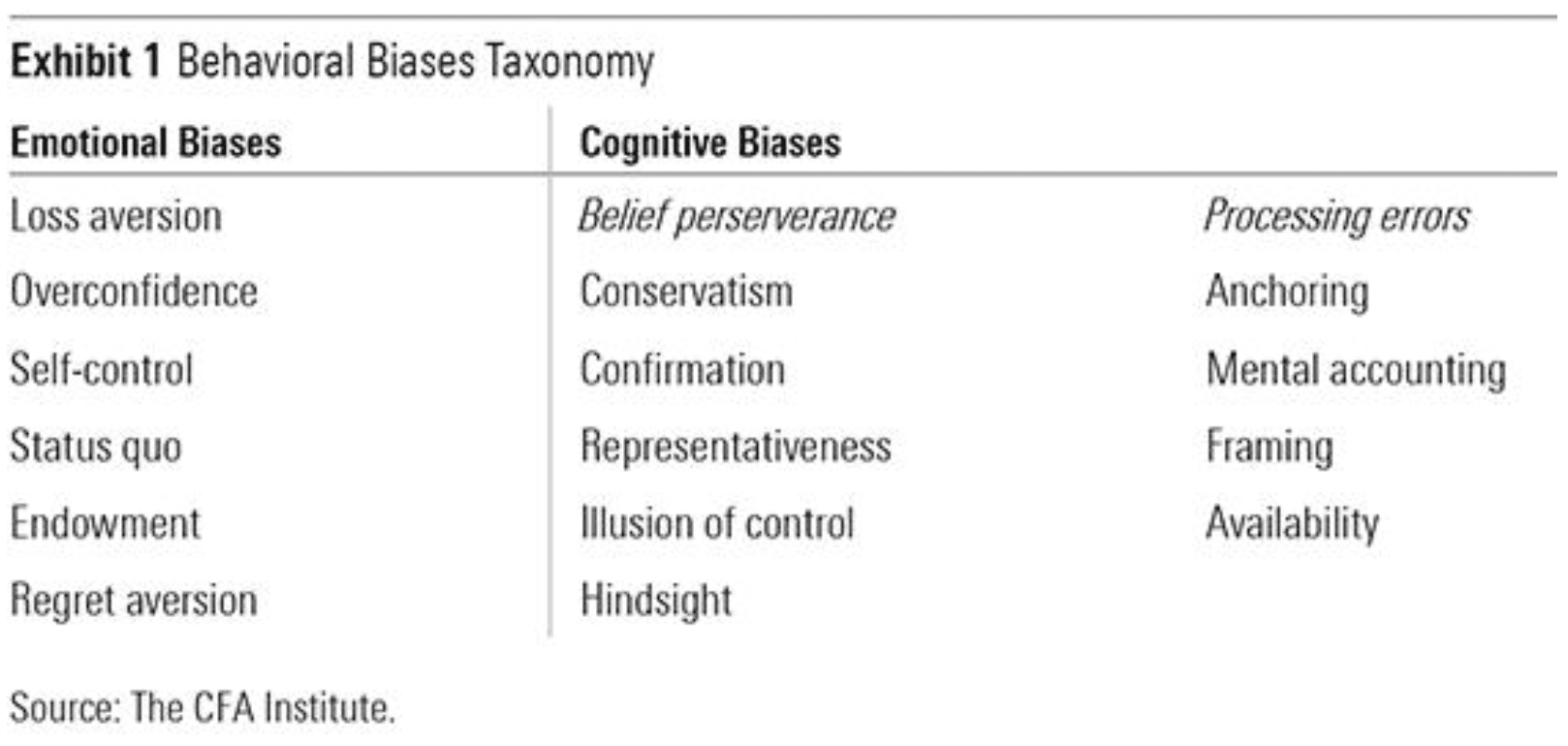

There are plenty of emotional biases conspiring to make this happen without investors’ awareness. Loss aversion, overconfidence, regret aversion, the list goes on.

Understanding how these biases derail your success is a game-changer if you’re aiming to avoid making costly mistakes looking forward. It’s time to look in the mirror.

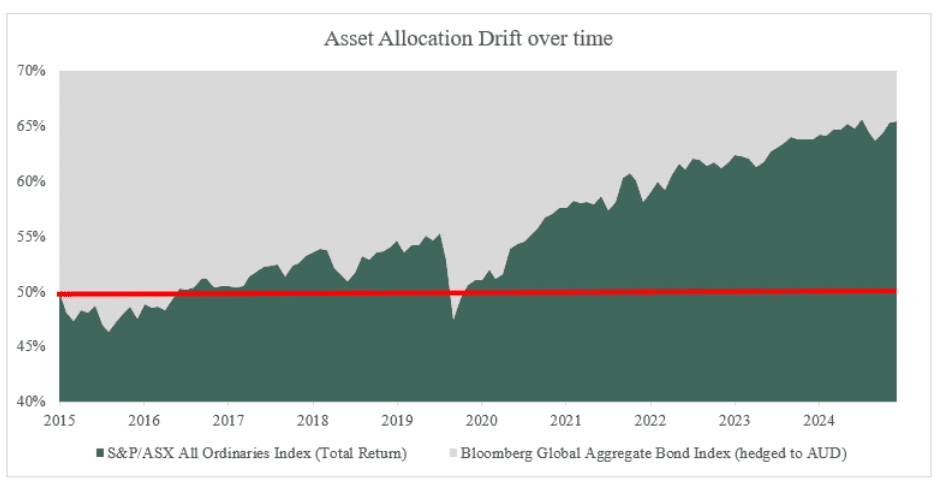

6. Neglecting Portfolio Drift

Plenty of investors make the mistake of viewing asset allocation as a set-and-forget-forever decision.

However, over time, outperforming assets grow to dominate portfolios, which increases portfolio risk and vulnerability. So a portfolio that began as balanced can become aggressively skewed simply through inertia.

Rebalancing is uncomfortable for most investors because it requires trimming winners, but it’s one of the few disciplined ways investors can systematically sell high and buy low. It’s a powerful way of ensuring your portfolio’s resilience remains in focus.

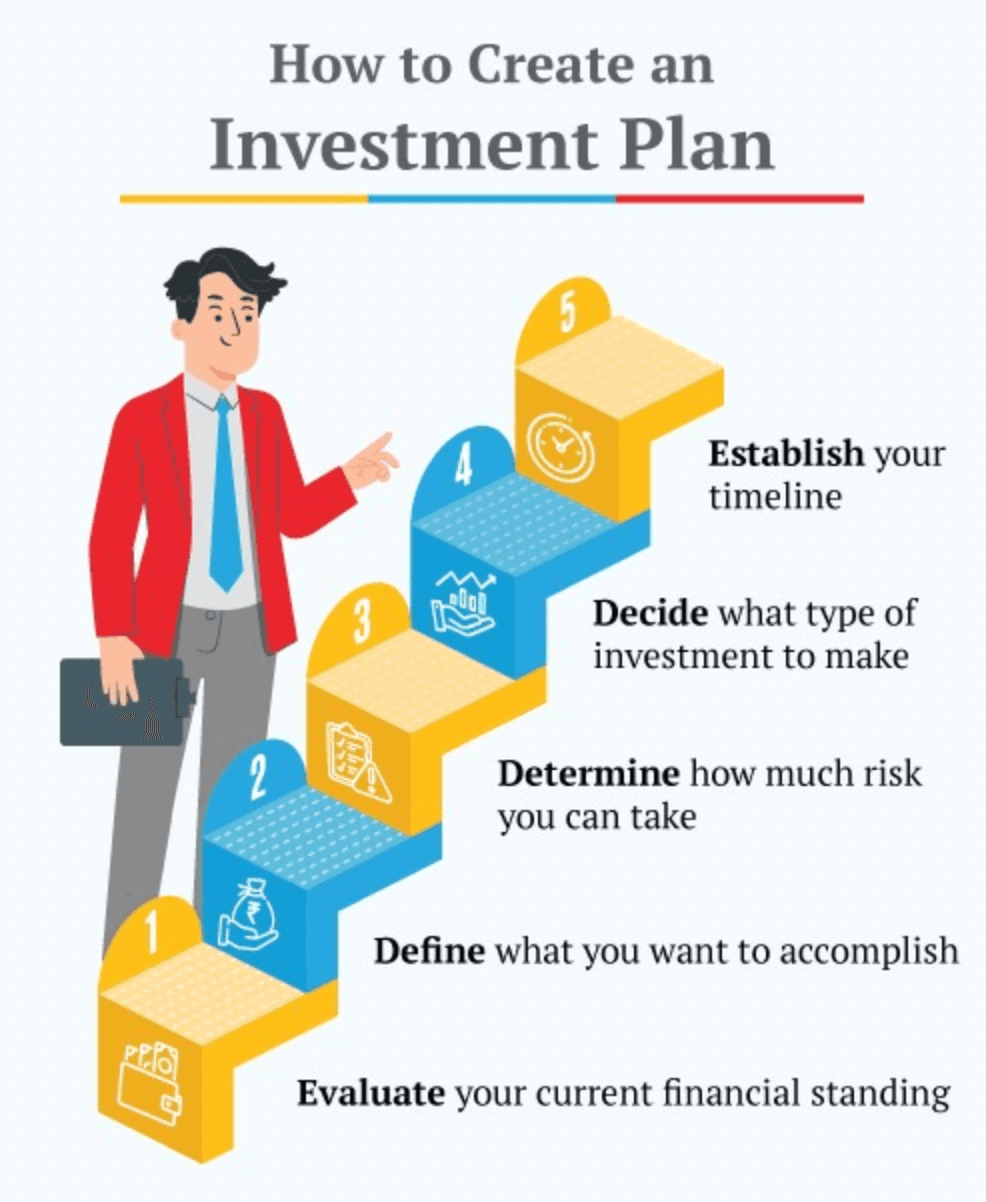

7. Investing Without Clearly Defined Objectives

If you’ve ever invested without a clear goal, you’ll know how easy it is to veer off-course.

Capital without purpose tends to drift toward the constant noise of markets, as without explicit goals, investors struggle to evaluate risk, time horizon, or success.

Retirement income, capital preservation, intergenerational transfer, and real return objectives all demand different portfolios.

Establishing an appropriate investment plan requires asking yourself a few simple questions:

Whilst it’s easy to create an investment plan, few investors do. Yet it’s a game-changer. Strategy should follow purpose, not product availability or market narratives.

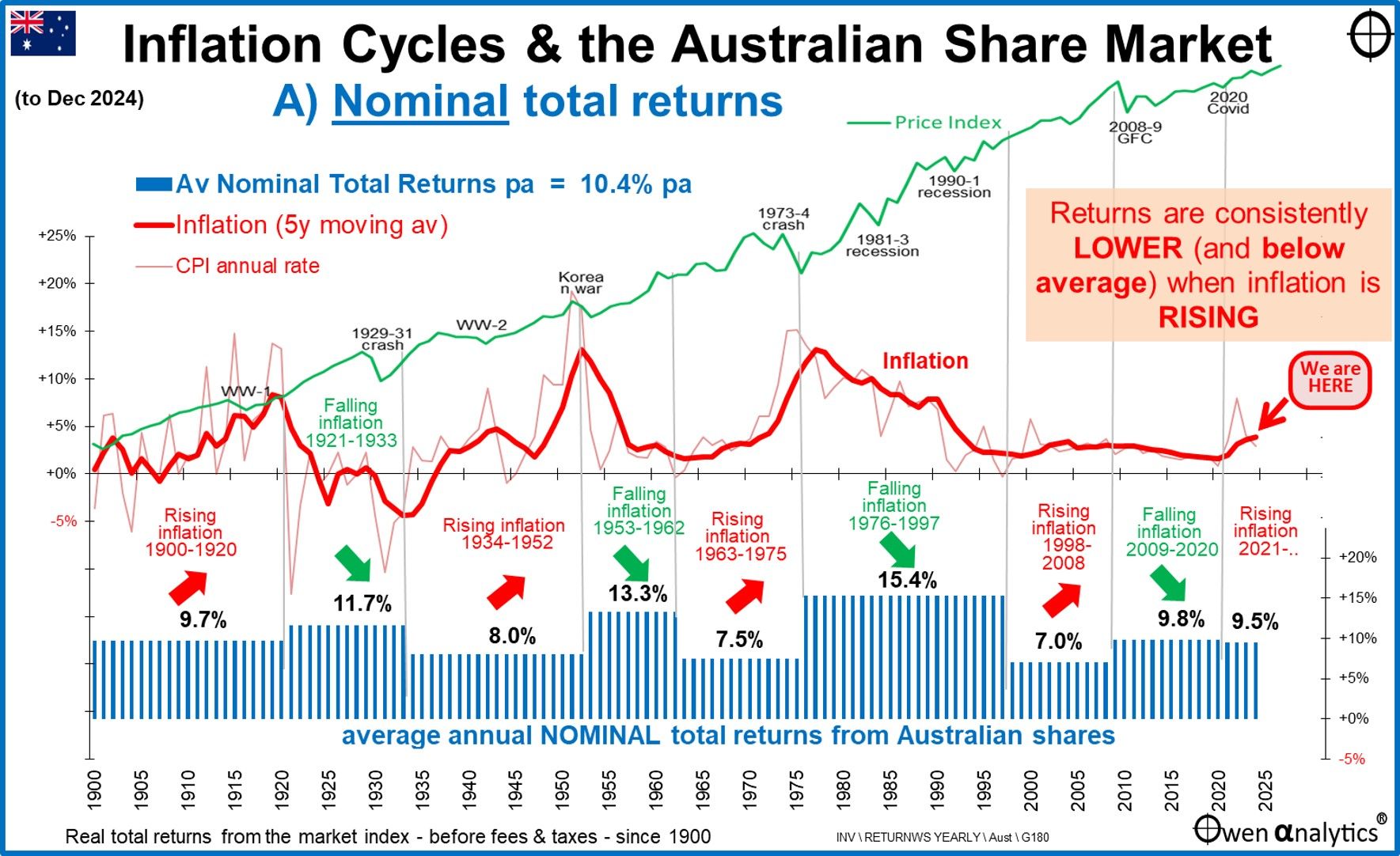

8. Ignoring Inflation as a Structural Risk

Ignoring inflation is a costly mistake that’s often hidden from investors.

Inflation has re-emerged as a major global investment theme since the pandemic. It’s not just a short-term macro variable. It’s a long-term threat to everyone’s purchasing power.

The upshot is that portfolios that ignore the impacts of inflation risk delivering disappointing real outcomes. As shown below, rising inflation tends to lead to lower nominal returns for Australian equity investors, and real returns are much lower during those periods.

So be mindful that nominal gains can mask much lower real returns after inflation and tax are accounted for. And make sure you focus on protecting your real returns from inflation (e.g. by including real assets) when you’re putting together your asset allocation plan.

9. Overestimating Skill & Underestimating Luck

Confidence is essential in investing, but overconfidence is seriously destructive.

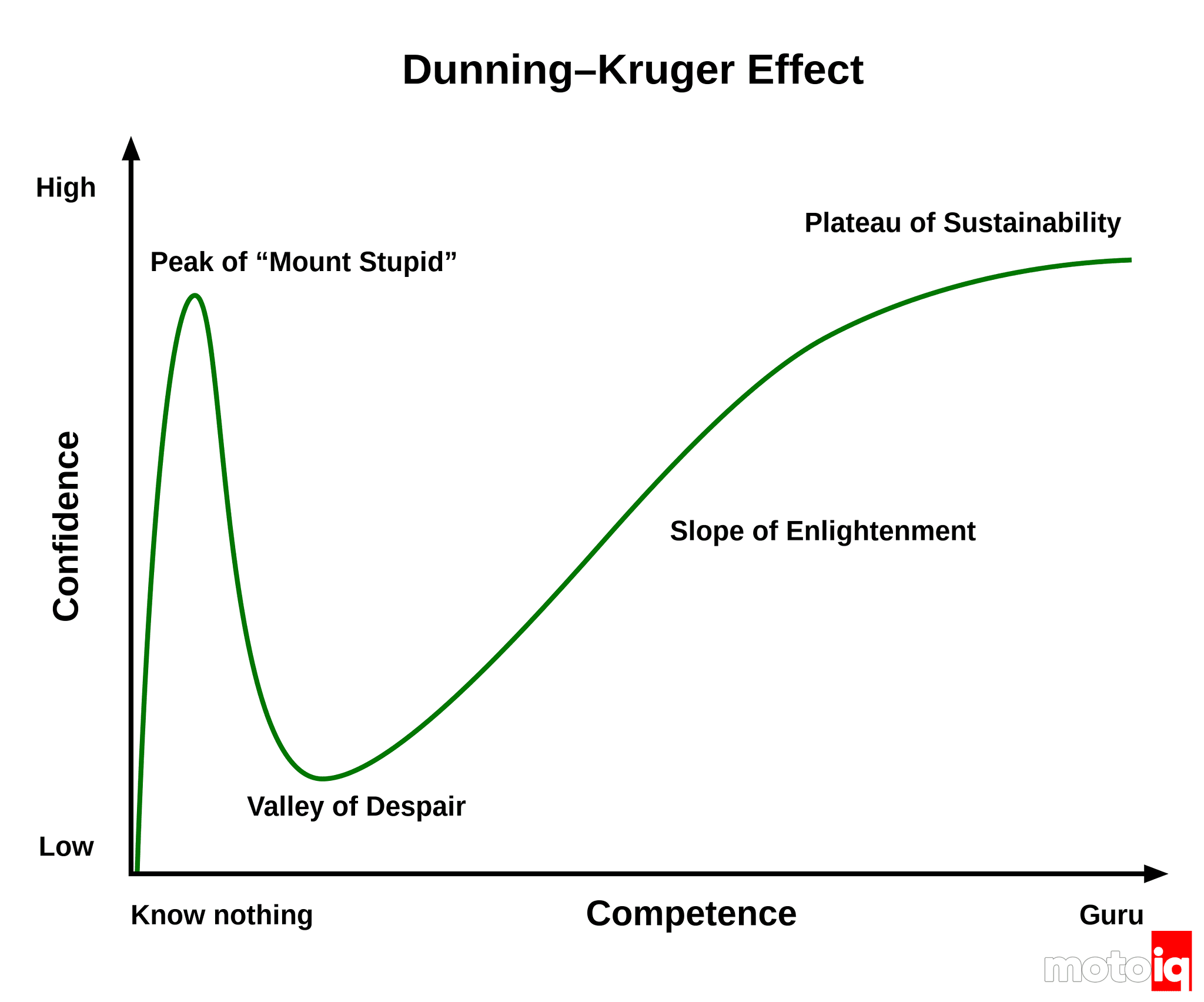

Numerous studies have shown that investors who trade more frequently and believe strongly in their own forecasting ability tend to underperform. This is the Dunning-Kruger Effect in all its glory.

Markets are complex adaptive systems, not puzzles to be solved. So humility, probabilistic thinking, and an acceptance of uncertainty are the hallmarks of durable investment success.

10. Treating Advice as Optional Rather Than Strategic

And finally, not listening to voices of wisdom is a costly mistake worth being aware of.

While not all financial advice adds value, informed external perspectives can act as a safeguard against behavioural blind spots.

The role of a good financial adviser or coach is to help investors maintain their discipline, align their strategy with their objectives, and avoid self-inflicted errors during periods of stress. For many investors, these guardrails are the difference that makes the difference.

Avoiding Mistakes is the Secret to Better Investment Outcomes

Most investment mistakes are failures of behaviour, structure, and process. Hence, successful investing is less about brilliance and more about resilience.

By designing portfolios and decision frameworks that anticipate the likelihood of the above-mentioned mistakes, investors can give themselves a far better chance of compounding their wealth over time. Your future self will thank you.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.